8.1 Economic Growth and economic cycle

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

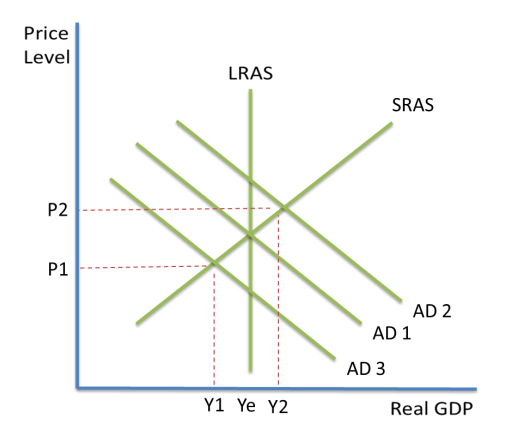

Short-run growth

is the percentage increase in a country’s real GDP and it is usually measured annually. It is caused by an increase in AD.

Long-run economic growth

occurs when the productive capacity of the economy is increasing and it refers to the trend rate of growth of real national output in an economy over time. It is caused by an increase in AS.

The potential output of an economy is what the economy could produce if resources were fully employed

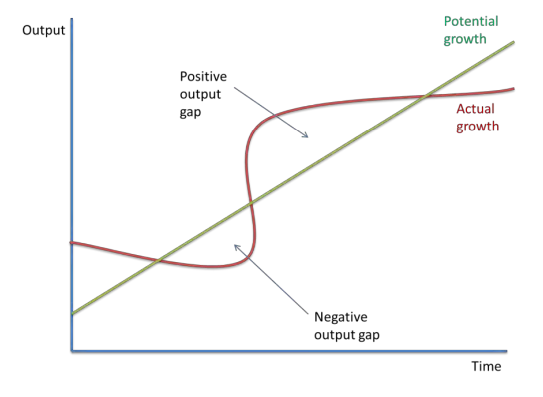

Positive and negative output gaps

An output gap occurs when there is a difference between the actual level of output and the potential level of output. It is measured as a percentage of national output.

Negative output gap

occurs when the actual level of output is less than the potential level of output. This puts downward pressure on inflation. It usually means there is the unemployment of resources in an economy, so labour and capital are not used to their full productive potential. This means there is a lot of spare capacity in the economy.

the level of actual real output in the economy is lower than the trend output level.

Positive output gap

occurs when the actual level of output is greater than the potential level of output.

It could be due to resources being used beyond the normal capacity, such as if labour works overtime. If productivity is growing, the output gap becomes positive. It puts upwards pressure on inflation.

Countries, such as China and India, which have high rates of inflation due to fast and increasing demand, are associated with positive output gaps

the level of actual real output in the economy is greater than the trend output level.

Output gap

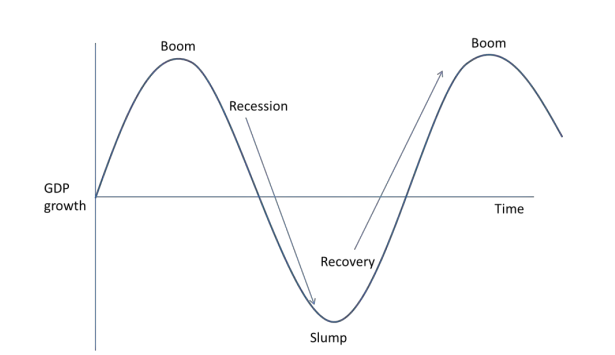

The business(economic) cycle

Explanation

Real output increases when there are periods of economic growth. This is the recovery stage.

The boom is when economic growth is fast, and it could be inflationary or unsustainable.

During recessions, the real output in the economy falls, and there is negative economic growth.

During recessions, governments might increase spending to try and stimulate the economy. This could involve spending on welfare payments to help people who have lost their jobs, or cutting taxes.

During periods of economic growth, governments may receive more tax revenue since consumers will be spending more and earning more. They may decide to spend less, since the economy does not need stimulating, and fewer people will be claiming benefits.

characteristics of a boom

High rates of economic growth

Near full capacity or positive output gaps

(Near) full employment

Demand-pull inflation

Consumers and firms have a lot of confidence, which leads to high rates of investment

Government budgets improve, due to higher tax revenues and less spending on welfare payments

Characteristics of a recession

In the UK, a recession is defined as negative economic growth over 2 consecutive quarters. The characteristics are:

Negative economic growth

Lots of spare capacity and negative output gaps

Demand-deficient unemployment

Low inflation rates

Government budgets worsen due to more spending on welfare payments and lower tax revenues.

Less confidence amongst consumers and firms, which leads to less spending and investment.

Seasonal Fluctuations

variation of economic activity resulting from seasonal changes in the economy.

Economic cycle

upswing and downside in aggregate economic activity taking place over 4 to 12 years. Also known as a business cycle or a trade cycle.

Actual output

level of real output produced in the economy in a particular year, not to be confused with the trend level of output. The trend level of output is what the economy is capable of producing when working at full capacity. Actual output differs from the trend level of output when there are output gaps.

costs of economic growth

Economic growth uses up finite resources such as oil and minerals that cannot be replaced

Economic growth leads to pollution and other forms of environmental degradation with the Earth eventually reaching a tipping point, beyond which it cannot recover

Growth can destroy local cultures and communities and widen inequalities in the distribution of income and wealth

Economic growth leads to urbanisation and the spread of huge cities, which swallow up good agricultural land

In the early phase, economic growth leads to a rapid growth in population, more mouths to feed and more people who are poor.

Growth produces losers as well as winners. Countries suffering low growth may enter a vicious circle of declining business confidence, low profits, low investment, a lack of international competitiveness, even lower profits, zero growth, and so on.

Benefits of economic growth

Economic growth increases standards of living and people’s welfare

Growth may lead to more civilised communities, who take action to improve environment

Growth provides new and more environmentally friendly technologies

Economic growth has increased the length of people’s lives and has provided the means to reduce disease

Economic growth provides a route out of poverty for much of the world’s population

Economic growth produces a ‘fiscal dividend’, namely the tax revenues that growth generates. tax revenues can be used to correct market failures, to provide infrastructure, thereby increasing the economic welfare of the whole community

For a particular country, economic growth can generate a ‘‘virtuous circle’ of greater business confidence, increased investment in state-of-the-art technology, greater international competitiveness, higher profits, even more growth and so on

The causes of change in the phases of the economic cycle

Fluctuations in AD - Keynes argued that economic recessions are caused by fluctuations in AD, which are caused by consumer and business confidence giving way to pessimism, and vice versa

Supply-side factors - It is now recognised that supply-side factors can also trigger economic cycles. Edward Prescott and Finn Kydland, have developed a theory of ‘real business cycles’, which argues that changes in technology on the supply side of the economy might be as important as changes in aggregate demand in explaining economic cycles.

Other factors that may cause or contribute to cyclical changes include:

The role of Speculative bubbles - Rapid economic growth can create asset price bubbles. When these burst, confidence collapses, leading to a recession.

Political Business Cycle Theory - Governments may manipulate economic policy before elections to boost demand, leading to cyclical fluctuations.

Outside Shocks - External events like wars or oil crises can disrupt both demand and supply, affecting economic stability.

Changes in Inventories - Firms overestimate demand, leading to excess stock accumulation. When demand slows, firms cut production, potentially triggering a recession.

Marxist Explanation – Economic cycles are seen as a restructuring process in capitalism. Recessions help stronger firms survive by allowing them to take over weaker competitors or buy their assets cheaply.

Multiplier/Accelerator Interaction – Keynesian theory suggests economic cycles arise from:

Multiplier Effect – Increased investment boosts national income.

Accelerator Effect – Rising income leads to higher investment.

The interaction between these two causes cyclical fluctuations in income and employment.

Climatic Cycles – Economic cycles may be influenced by weather patterns:

Stanley Jevons linked sunspot activity to agricultural output and business confidence.

El Niño, a major climate event, causes extreme weather (floods, droughts) that disrupt economies globally.