Negative Externalities

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

Externality

A third-party spill-over effect

Negative externality

A negative spillover.

Negative consumption externality

A negative third party spill over derived from the consumption of a good.

Negative production externality

A negative third party spill over derived from the production of a good.

S =

Marginal Cost

D =

Marginal Benefit

Social Cost formula

Private Cost + External Cost

Social Benefit formula

Private Benefit + External Benefit

Socially efficient equilibrium

The equilibrium best for society

Market equilibrium

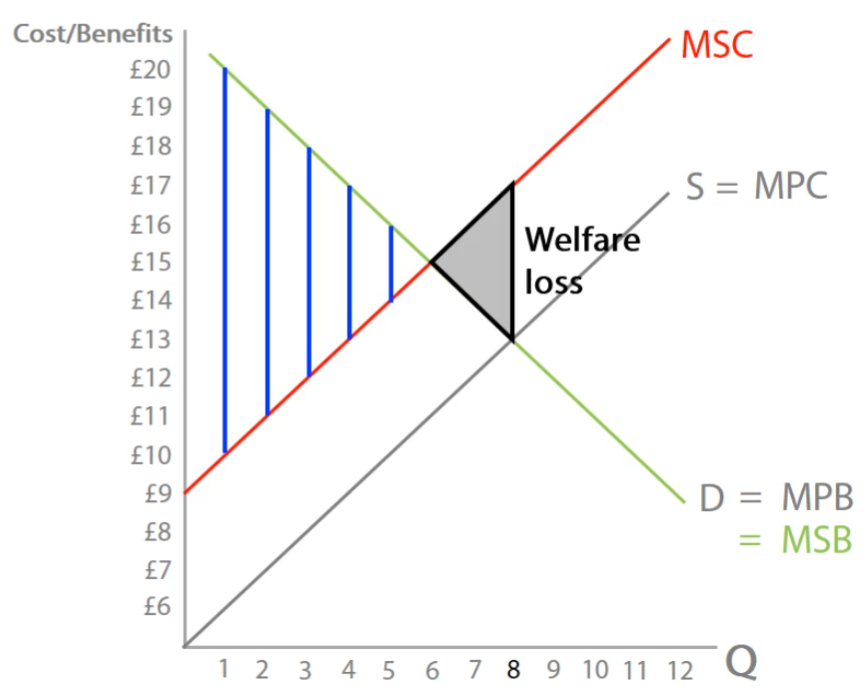

S = D leading to welfare loss

Socially Optimal Level/Cost

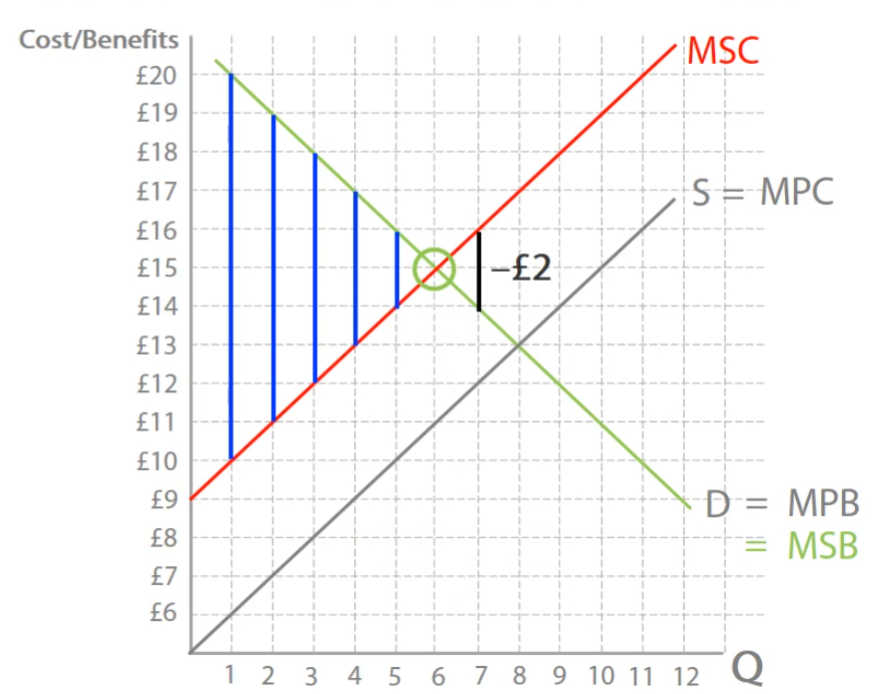

Marginal Social Cost = Marginal Social Benefit

Welfare loss

When there is overconsumption or overproduction

How to solve welfare loss?

Indirect taxations such as specific and ad valorem tax.

Tradable pollution permits

Minimum Price

Regulation

Main aim of taxation

To internalize external costs.

How does indirect tax affect firms

Makes production more costly, therefore shifts MPC upwards and internalizes overconsumption and welfare loss.

Assumptions of government taxation on negative production

Correct size of tax

Tradable Pollution Permits

Sets a cap on how much pollution a year is allowed. Raises government tax revenue through permits which are divided up until the cap is reached.

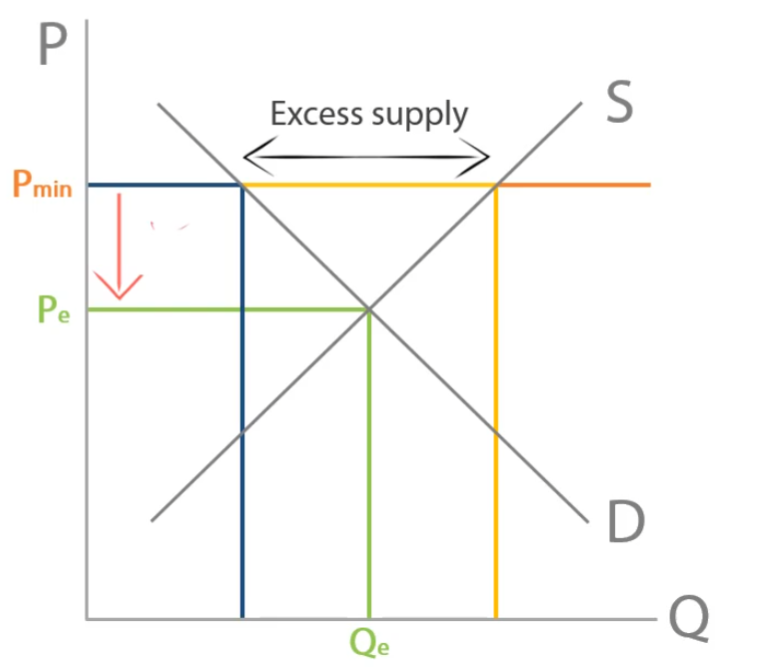

Minimum Price

The lowest price a supplier of a good can legally sell for to contract demand and reach socially optimum level. Leading to excess supply and therefore disequilibrium as it must be set above equilibrium price.

Regulation

When government makes changes to the law to correct market failure. Such as banning hard drugs to totally reduce consumption of hard drugs.