IB Microecon Notes Demand/Supply (2.5, 2.6)

1/67

Earn XP

Description and Tags

Demand/Supply/Markets

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

68 Terms

Non-price determinant of Demand - Income

For normal economic goods, when real consumer income rises, consumers will demand a greater quantity of goods

Real income could be affected by increase in income, price decreases etc.

Law of diminishing marginal utility

As an individual consumers additional units of a good, the additional satisfaction decreases

Substitution effect

When the price of a product falls relative to other products, there is an incentive to purchase more of the product, since marginal utility/price ratio has been improved.

Conversely, as the price of a good increases, the substitution effect increases as consumers are more inclined to purchase cheaper substitutes to maximize utility.

Difference between demand and quantity demanded

Quantity demanded is the willingness and ability to purchase a quantity of good/service at a certain price over a given time period (a specific point)

Quantity demanded changes when price changes, and is shown by movement along the same demand curve

A shift in the demand curve is attributed to non-price factors where the whole relationship between price and quantity demanded is changes

Law of diminishing marginal returns

A short run law of production stating that as more and more units of the variable factor (usually labor) are added to a fixed factor (usually capital), there is a point beyond which total product continues to rise but at a diminishing rate (and marginal cost starts to increase)

Change in Equilibrium and Market forces

equilibrium is affected by any non-price determinant of demand of demand or supply

This leads to a shift of either curve and excess demand/excess supply

In order to eliminate excess demand/supply, it is necessary for price to rise/fall until the quantity demanded once again equals quantity supplied

Price Mechanism of markets

The price mechanism of markets has 3 significant functions (1) signalling (2) rationing (3) incentivizing

1- prices are set by the actions of consumers and producers, and reflect changing circumstances in market. Signalling those in the market to act in a certain way

2- if there is excess demand, prices will become relatively high, so the low supply will be rationed to those willing/able to pay the higher price

3- manages demand and supply through opposing and balancing incentives. High price acts as a disincentive for consumers and incentive for producers, and vice versa

Consumer Surplus

difference between how much a consumer is able and willing to pay for a good and how much they actually pay

Producer surplus

Difference between how much a producer is able and willing to sell a good for and how much they actually sell it for

Allocative efficiency

Achieved when just the right amount of goods and services are produced from society’s point of view so that scarce resources are allocated in the best possible way. It is achieved when, for the last unit produced, price (P) is equal to marginal cost (MC) or more generally, if marginal social benefit (MSB) = Marginal social cost (MSC)

Inelastic PED

0<PED<1 , a change in the price of a good or service leads to a proportionately smaller change in the quantity demanded of the good or service in the opposite direction

Elastic PED

PED>1, a change in the price of a good or service leads to a proportionately larger change in the quantity demanded of the good or service in the opposite direction

PED non price determinants

Degree of Necessity (and how broadly it is defined

Absolute value of product and how much income consumer uses to purchase good

Availability and degree of substitutes

Time frame purchase decision has to be made in

Primary VS manufactured commdity

Impacts of Indirect tax on market

1- indirect tax causes supply curve to shift up

2 - higher price causes excess supply

3 - price has to fall until new equilibrium

(Note that the equilibrium price ≠ original price + tax)

Indirect tax when PED = PES

Burden of tax imposed is shared equally between consumers and producers

Indirect Tax when PED > PES

burden of tax will be greater on producers than consumers

Producers cannot pass on a lot of the burden of the tax because demand is very elastic and too many consumers would stop buying the product

Therefore, producers bear most of the burden of the tax, and the price for consumers only rises a little

Indirect tax when PED<PES

Burden of tax imposed will be greater on consumers of the product than on producers

Producers can pass on a lot of the burden of the tax, because demand is fairly inelastic and so consumers are not very responsive to the increase in price

Price Elasticity of Supply (PES)

A measure of the responsiveness of the quantity supplied of a good or service to a change in its price.

%∆QTY supplied ÷ %∆ Price

Elastic PES

PES > 1, change in the price of a good or service leads to a proportionally larger change in the quantity supplied of the good or service (in the same direction)

Price Inelastic Supply

PES<1 Where a change in the price of a good or service leads to a proportionately smaller change in the quantity supplied of the good or service in the same direction.

PED Formula

%∆Quantity Demanded ÷ %∆Price

Price Elasticity of Demand

a measure of the responsiveness of the quantity demanded of a good or service to a change in its price.

PED = 0

vertical line; perfectly inelastic demand

a change in price will lead to no change in Quantity Demanded. (this means there are no substitutes of the good, and it is necessary)

PED = ∞

horizontal; perfectly elastic demand

any change in price would lead to 0 demand for the product (because there is an abundance of perfect substitutes)

Factors of PED

number and closeness of substitutes

Necessity of good

Proportion of income spent on product

Time period

PED affected by Number & Closeness of substitutes

if consumers can easily exchange one product for another similar one, quantity demanded will be more elastic.

PED affected by Necessity of Good

For goods and services that are essential, quantity demanded will be inelastic. As price goes up, consumers cannot change the amount of the good they purchase by too much.

PED affected by proportion of income spent on product

If consumers spend a large proportion of their income on a product, it is more likely to be elastic.

PED affected by time period

In the short run, demand will be more inelastic as i takes time for consumers to find an alternative. However, in the long term, as consumers change their buying and consumption habits, PED tends to become more elastic.

PED of Primary Commodities

More inelastic

PED of Primary Commodities explained

Primary commodities have little to no substitutes

they are essential for production

Large amount of time needed to grow/extract primary commodities

PED of Manufactured Products

More elastic

PED of Manufactured Products explained

many close substitutes

Lower necessity

Proportion of income spent is relatively high

Revenue

Price x Quantity

Revenue for PED inelastic demand

When price is increased, quantity demanded falls by a proportionally smaller amount. So, a small increase in price raises total revenue.

Revenue for PED elastic

When price is decreased, quantity demanded increases proportionally more. Therefore, small increases in price will raise total revenue.

Unitary PED

PED= 1 for every point on the graph

Shape of the graph looks like a rational function 1/x

PED use for government

allows governments to assess the impacts of indirect taxes on the market

Tax on PED elastic —> too much burden passed on to firms, leading to implications such as firing workers

Tax on PED inelastic —> generate large amounts of revenue, and most of the tax burden is on consumers

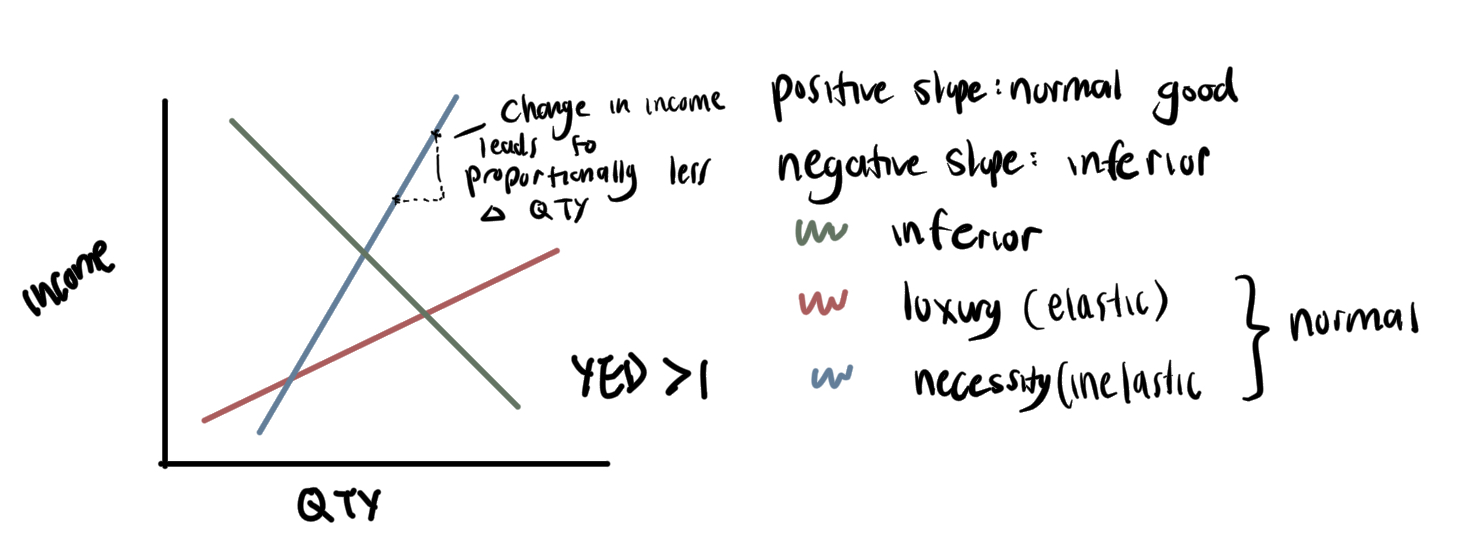

Income elasticity of demand (YED)

%∆Quantity / %∆Income

Negative YED

inferior good

With rise in income, consumers start using superior goods, which they can now afford

Positive YED

normal good

|YED| < 1

YED is inelastic and means the good is a necessity. A change in income of consumer leads to a less than proportional change in quantity demanded.

|YED|>1

Elastic YED and means the good is luxury. Change in income of a consumer leads to a more than proportional change in quantity demanded.

Factors of YED

Necessity of good

Degree of Luxury

How degree of Necessity affects YED

The more necessary a good is to a consumer, the more inelastic the demand will be. While these goods are more necessary in life, consumers also don’t need to purchase more than they consume.

How degree of Luxury affects YED

Goods that have higher degree of luxury have m ore elastic YED. Once consumers have more income and have satisfied their needs, they begin to purchase more expensive goods of superior quality. However, conversely, if income decreases, quantity demanded of these goods will fall by a larger than proportional amount, as consumers will cut on non essential spending first.

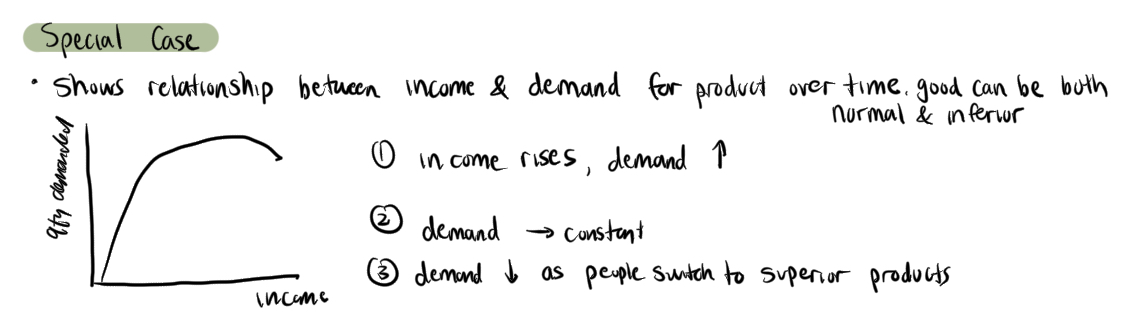

Engel curve for YEDs

YED can change over time

Application of YED (firms)

firms can use YED to estimate the impact of changes in real income on different products. If possible, they can switch production accordingly

E.g. during a depression, income falls, and so goods with large YED will be more negatively affected

Application of YED (government planning)

governments can use YED to estimate the impacts changes in gross national income (GNi) has on different markets.

This will allow them to plan ahead in eras of the need for welfare, subsidies, and other support schemes.

Applications of YED (sectoral changes)

The primary, secondary, and tertiary sector each produce products that have a different YED

A government looking to develop and grow its economy needs to understand the YED of the products it produces and reflect on which sectors they are mostly comprised of

To gain more profit, countries should move towards producing in the tertiary sector, as those products have the highest YED.

Price elasticity of Supply (PES)

%∆Quantity Supplied / %∆Price

Elastic PES

PES > 1, a change in price leads to a proportionally larger change in quantity supplied.

Inelastic PES

PES < 1, a change in price leads to a proportionally smaller change in quantity supplied.

Perfectly elastic supply

PES = ∞ (no possible IRL), refers to a situation where the supply of a good or service is infinitely responsive to changes in price

Perfectly inelastic supply

a change in price does not affect the quantity supplied

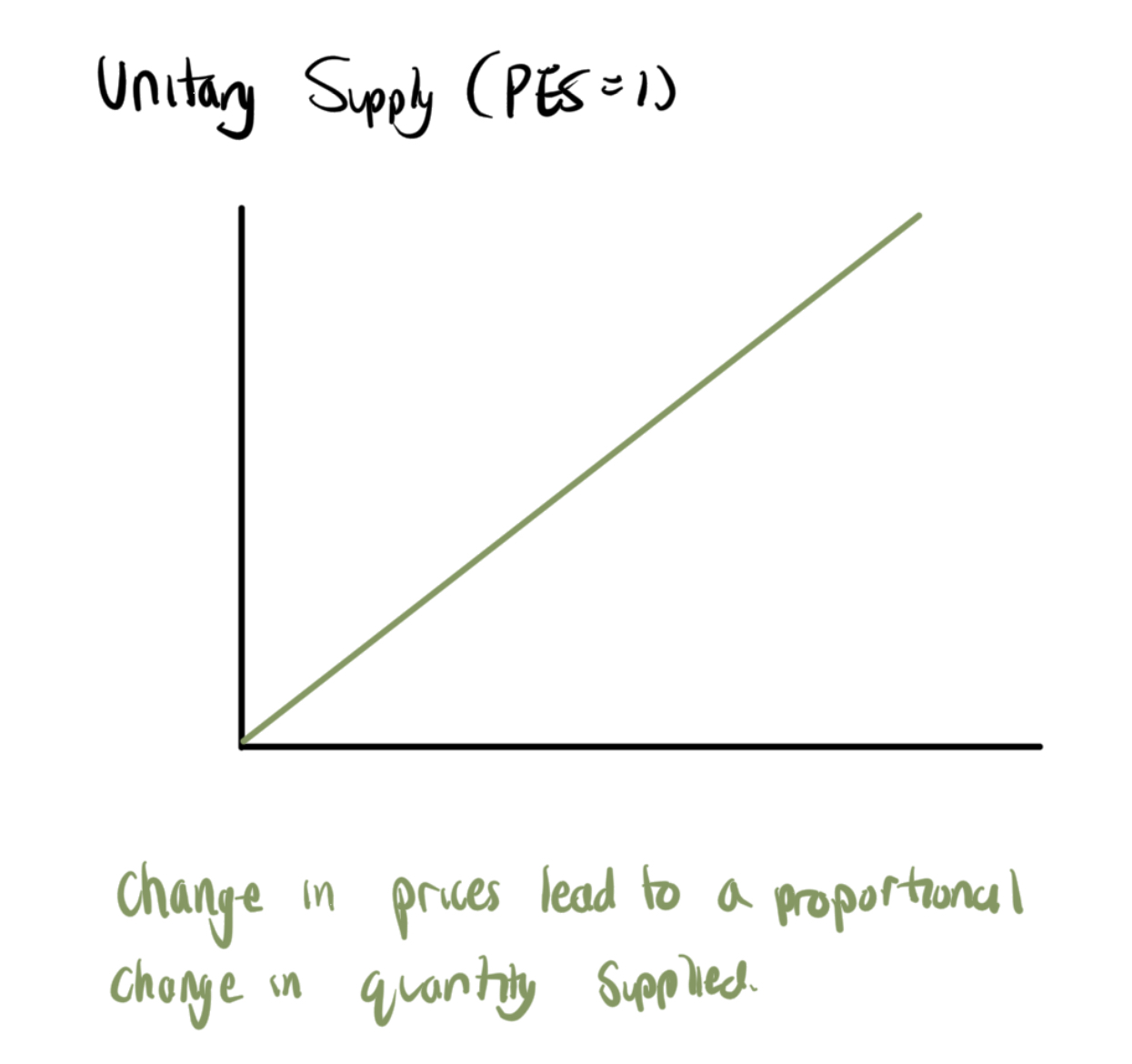

Unitary PES

PES = 1 at every point

Determinants of PES

mobility of factors of production

rate at which marginal cost/cost of production increases

ability to store goods

spare capacity to increase production

time period

Mobility of factors of production affecting PES

if producers can switch resources between products, PES will be more elastic.

Rate at which cost of production increases affecting PES

if the marginal cost increases at a slow rate, supply will be more elastic, as producers will be willing to produce more in response to increased prices. However, if it incurs too much additional cost to produce more, quantity supplied will be more inelastic.

Ability to store goods affecting PES

If products can be easily stored, PES is more elastic as producers can quickly increase supply by releasing goods from inventory or vice versa

Spare Capacity affecting PES

Spare capacity exists when the current level of production is below that max output possible in the short run. This means there are spare labour and capital inputs available.

If there is spare capacity then a business can increase output without a rise in unit costs and thus supply will be price elastic.

Time Period affecting PES

In the short run, quantity supplied will tend to be more inelastic, as producers may find it harder to respond to an increase in prices, especially because it takes time to produce the product. However, in the long run, they can change any of their factors of production.

PES of Primary VS Secondary Goods

the PES of primary goods is generally more inelastic compared to secondary goods. This is because of four primary reasons:

Time

Inventory

Marginal Cost

Spare Capacity

How time affects Primary VS Secondary Goods

Primary goods: it takes longer to grow and harvest primary goods. If there were to be an increase in the demand of a primary product, producers would be unable to respond with a proportionate increase in quantity as it takes time to grow/harvest goods. Similarly, they will not be able to decrease supply easily.

Secondary goods: with a supply chain set up and resources readily available, it takes a much shorter period to create an additional unit of good.

How Inventory affects Primary VS Secondary Goods

Primary: as primary goods as usually easily perishable and damaged, producers cannot keep extensive inventory of primary products.

Secondary: can be stored for longer periods of time

How Marginal Costs affect Primary VS Secondary Goods

primary: producing 1 extra unit is harder (e.g. to get 1 more apple, you need a new tree)

secondary: large amounts of identical objects can be mass produced in the same, established, supply chain. So the marginal cost of 1 additional unit is low.

How Spare Capacities affect Primary VS Secondary goods

primary: land is fixed in supply, so there is very little spare capacity and new primary products can’t be grown within a set amount of time

manufactured: capital and tech intensive output that can be mobil