Audit Test 1

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

74 Terms

What factors create the demand for auditing services?

monitoring and/or stewardship

Insurance

Information

Business risk

risk that an entity will fail to meet its objectivies

Information Risk

probability that the info circulated by a company will be false or misleading

Assurance

lending of credibility to info

attestation

when assurance is provided for specific assertions made by management

auditing

when the assertions are embodied in a company’s financial statements

Auditing services

refers specifically to the certification of financial statements

Attest Engagement

providing assurance on other financial info; expanded set of financial info beyond financial statements

Financial Reporting provides

statement of financial position, results of operations, changes in cash flows, accompanying disclosures

Existance

does this cash really exist?

Rights and obligations

does the company really own this inventory?

Valuation

are the depreciation amounts properly valued?

Occurrence

did these sales really take place?

completeness

are all of the expenses included? Are they recorded in the correct period?

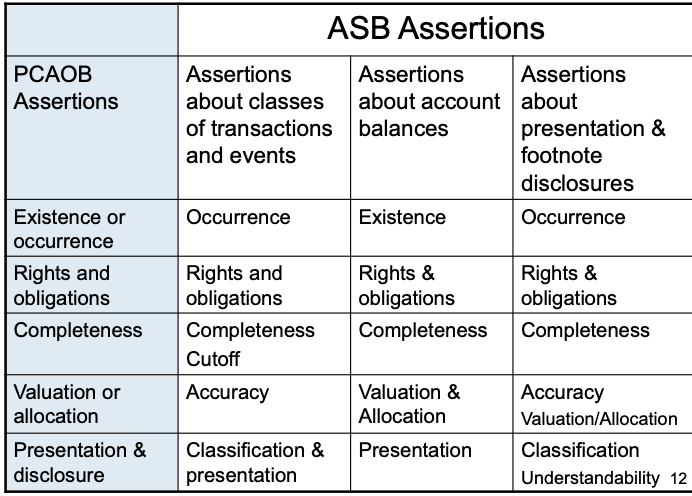

ASB Assertions

Concern

failure to record something

Professional Skepticism

auditor’s tendency to not accept management assertions without corroboration; “prove it”

Doveryai, no proveryai

trust, but verify

Services provided by CPAs

tax, advisory, assurance, personal financial planning, litigation support services, fraud investigation services

Audits of Financial Statements

systematic examination of financial statements

Operational and Internal Auditing

systematic review of activities. Focuses on effectiveness and efficiency

Compliance or Governmental

adherence to some established criteria, policies, or regulations

External Auditors (independent, public)

engaged by the company. Responsible for reporting whether the financial statements are presented fairly in conformity with GAAP

Internal Auditors

independent, objective assurance and consulting activity designed to add value and improve an organization’s operations

Regulatory or Governmental Auditors

determine compliance with laws, statutes, policies, and procedures

GAO

Government Accountability Office

AICPA

American Institute of CPAs

IIA

Institute of Internal Auditors

AAA

American Accounting Association

SEC

Securities and Exchange Commission

PCAOB

Public Company Accounting Oversight Board

PCAOB

created to oversee and discipline CPAs and public accounting firms that audit public companies

AUD

Auditing and Attestation

FAR

Financial Accounting and Reporting

REG

Taxation and Regulation

BAR

Business Analysis and Reporting

TCP

Tax Compliance and Planning

ISC

Information Systems and Controls

Sarbanes-Oxley Act of 2002

impacts any CPA actively working, created the PCAOB; requires rotation of lead audit partner and reviewing audit partner every 5 years; statute of fraud to 5 years; harsh penalties; prohibits what work can be done; internal controls

Why are standards importants

standards are established to measure the quality of performance. They represent the minimum rules/principles that a profession’s members have agreed to observe

GAAS

authoritative standards that CPAs must comply with in performing audit engagements

Stages of an audit

obtain engagement, engagement planning, risk assessment, audit evidence, reporting

Competence and capabilities

education, CPE, experience, and ability to develop and apply professional judgement in real-world situations

Independence and due care

comply with appropriate ethical requirements; must maintain an independence in mental attitude (in fact and appearance), must exercise due professional care

Skepticism

a state of mind

Judgement

the application of relevant training, knowledge, and experience in making informed decisions about appropriate courses of action during the audit

Reasonable assurance

a GAAS audit may not detect all material misstatements; auditors are not insurers regarding the fairness of the company’s financial statements

Planning and supervison

prepare a written audit plan, supervise the audit work, obtain knowledge of the client’s business, deal with differences of opinion among the firm’s own personnel

Effective internal control

lower level of control risk → allows auditors to evaluate less evidence and use less effective substantive procedures

Ineffective Internal control

Higher level of control risk → requires auditors to evaluate more evidence and use more effective substantive procedures

High Audit Evidence quality

auditor’s direct, personal knowledge

evidence obtained directly from independent external sources

Mid Audit Evidence Quality

evidence originating outside the client is considered competent when internal control is strong

Low Audit evidence quality

internal evidence consists of documents that are produced, circulated, and stored in the client’s information system

Verbal and written representations given by client

Unmodified Report

means GOOD; not calling attention to anything wrong

Modified Report

presented fairly “except for” some isolated departure or limitation

Adverse Report

not presented fairly

Disclaimer Report

no opinion given

Covered Member

new term that replaces “member”; refers to an individual, firm, or entity capable of influencing an attest engagement

Threats to Independence

familiarity, close relatives, undue influence, self-review, financial self-interest, management participation/advocacy, past employment with the client, future employment with the client

Commissions that are prohibited when the member or firm also performs the client’s

audit or review of financial statements

compilation of a financial statement

examination of prospective financial information

Permitted commissions and referral fees must be disclosed

disclosure must be made prior to the start of the service

must state the amount of the fee or the basis on which the fee will be computed

Common Law (unwritten law)

uses legal precedent to identify the fault and responsibility of parties when there is no violation of a written law or statute.

State-dependent and precedent based

arises due to breach of contract, negligence, or fraud

Statutory Law

legal decisions based on laws passed by legislative bodies and complied in federal, state, and municipal codes

has the law been violated by the actions of the party?

breach of Contract

claim that services were not performed in the manner described in the contract

Tort

cover other civil complaints arising from auditors’ failure to exercise the appropriate level of professional care

Privity of Contract

relationship of direct involvement between parties to a contract

ordinary or simple negligence

failure to exercise due professional care

unintentional breaches of duty

Gross negligence

extreme, flagrant, or reckless disregard for standards of due professional care

lack of minimal care

Fraud

misrepresentation of a material fact

deliberate intent to deceive

other party must prove resulting damages

CPA’s defenses

exercised due care, followed GAAS

not negligent

performed the engagement in accordance with terms of the contract

plaintiff’s loss caused by some other event

plaintiff's contributory negligence

ultramares approach

established an obligation to third parties not in privity with auditors for gross negligence and fraud

Primary beneficiaries approach

auditors know both name and intended use of financial statements

restatement of torts approach

exact identity of these third parties need not be known

rosenblum approach

cover all those whom the auditor should reasonably forsee as recipients of the financial statements