ACYFARP14: Income Taxes, Employee Benefits, Share-based compensation

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

These are differences that will result in future taxable amount in determining taxable profit of future periods

a. Temporary differences

b. Taxable temporary differences

c. Deductible temporary differences

d. Permanent differences

B

These are differences that result in future deductible amount in determining taxable profit in future periods

a. Taxable temporary differences

b. Deductible temporary differences

c. Taxable temporary and permanent differences

d. Deductible temporary and permanent differences

B

A temporary difference which would result in a deferred tax liability is

a. Interest revenue on municipal bonds

b. Accrual of warranty expense

c. Excess tax depreciation over accounting depreciation

d. Subscription received in advance

C

The deferred tax expense is equal to

a. Increase in deferred tax asset less increase in deferred tax liability

b. Increase in deferred tax liability less increase in deferred tax asset

c. Increase in deferred tax asset

d. Increase in deferred tax liability

B

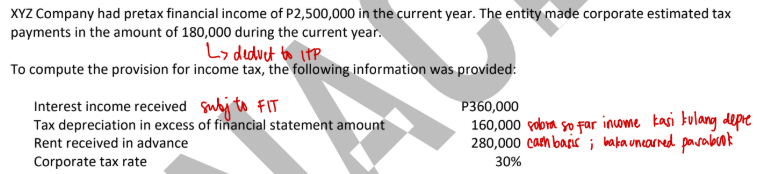

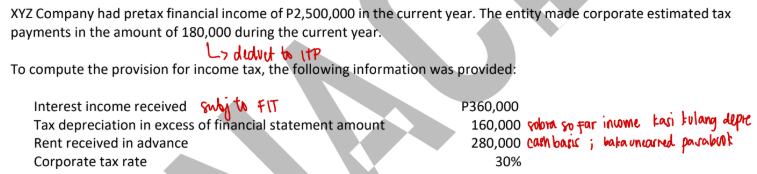

What amount of permanent difference between book income and taxable income existed at year-end?

a. P520,000

b. P360,000

c. P800,000

d. P280,000

B

What amount of current tax expense should be reported?

a. P786,000

b. P510,000

c. P750,000

d. P678,000

D

What amount of income tax payable should be reported?

a. P498,000

b. P606,000

c. P330,000

d. P570,000

A

What amount of total tax expense should be reported?

a. P714,000

b. P726,000

c. P642,000

d. P594,000

C

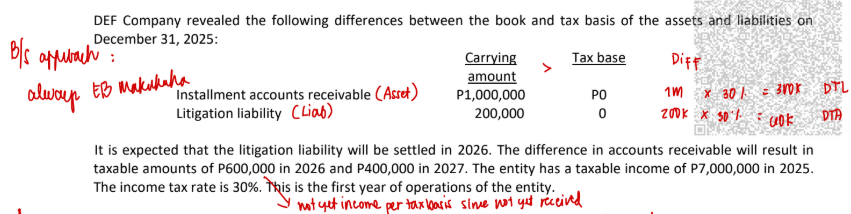

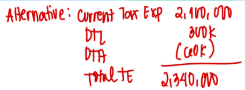

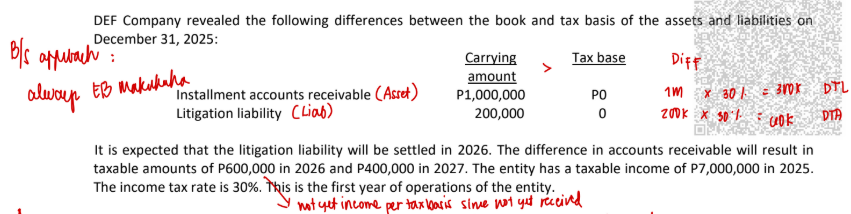

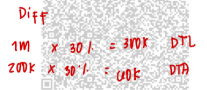

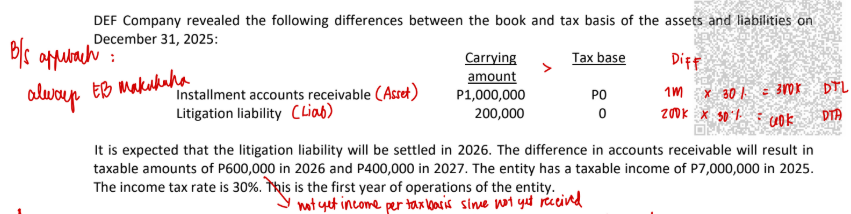

What amount should be reported as current tax expense?

a. P2,100,000

b. P2,400,000

c. P2,460,000

d. P2,040,000

A

What amount should be reported as total tax expense?

a. P2,400,000

b. P2,340,000

c. P2,160,000

d. P2,400,000

B

What amount should be reported as deferred tax liability?

a. P240,000

b. P360,000

c. P300,000

d. P0

C

What amount should be reported as deferred tax asset?

a. P300,000

b. P200,000

c. P60,000

d. P0

C

Which statement is true concerning the recognition and measurement of a defined contribution plan?

a. The contribution shall be recognized as expense in the period it is payable

b. Any unpaid contribution at the end of the period shall be recognized as accrued liability

c. Any excess contribution shall be recognized as prepaid expense but only to the extent that the prepayment will lead to a reduction in future payments or a cash refund

d. All of these statements are true about a defined contribution plan

D

In a defined benefit plan, the components of defined benefit cost include all, except

a. Service cost

b. Net interest

c. Remeasurements

d. Contribution to the plan

D

Which of the following components of defined benefit cost shall be recognized through other comprehensive income?

a. Current service cost

b. Past service cost

c. Net interest

d. Remeasurements

D

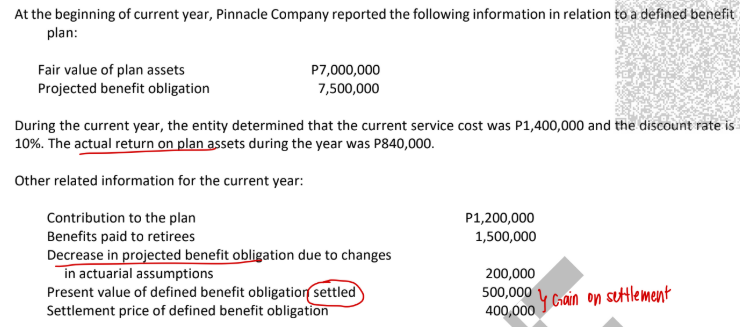

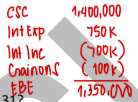

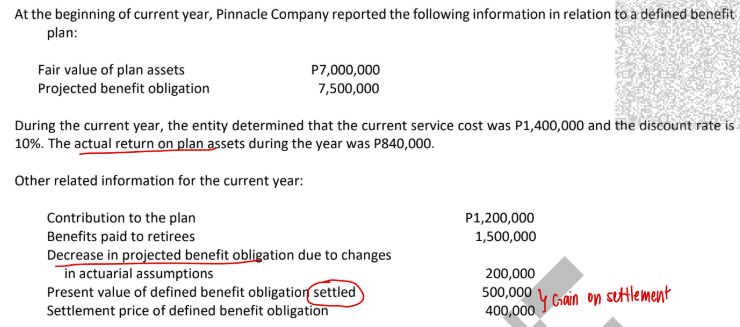

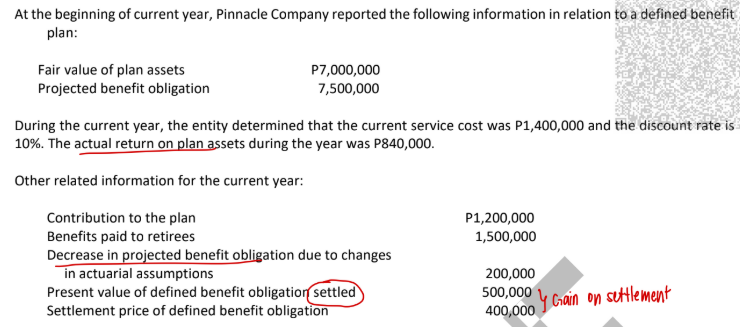

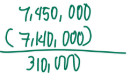

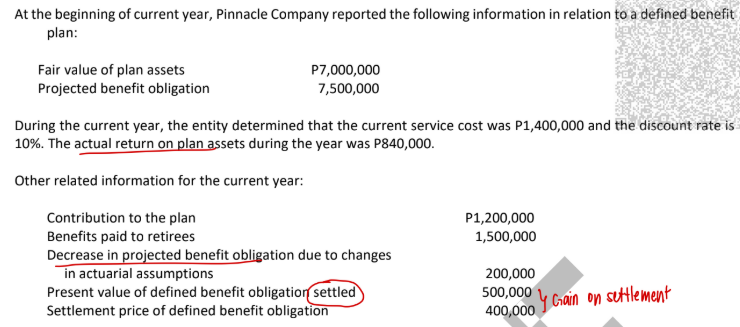

What amount should be reported in the income statement for the current year as employee benefit expense?

a. P2,150,000

b. P2,050,000

c. P1,350,000

d. P1,450,000

C

What is the net amount of “remeasurement” on December 31?

a. P140,000

b. P200,000

c. P340,000

d. P100,000

C

What is the fair value of plan assets on December 31?

a. P7,140,000

b. P7,540,000

c. P8,200,000

d. P7,000,000

A

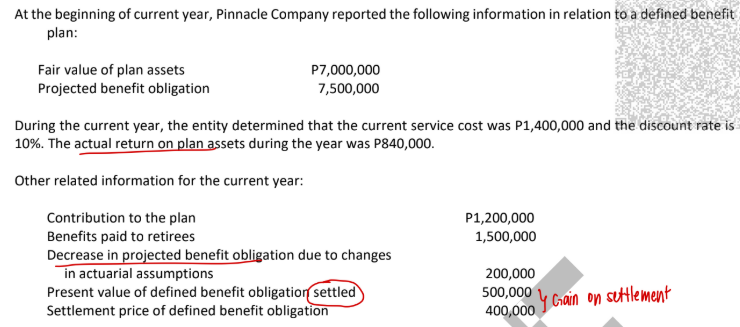

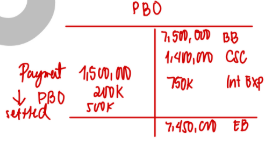

What is the projected benefit obligation on December 31?

a. P7,950,000

b. P7,450,000

c. P7,650,000

d. P9,650,000

B

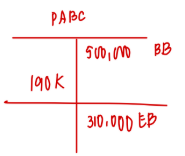

What is the balance of the prepaid/accrued benefit cost on December 31?

a. P310,000 debit

b. P310,000 credit

c. P650,000 debit

d. P650,000 credit

B

The total compensation expense in a share option plan normally is measured at

a. Fair value of share options on date of grant

b. Fair value of share options on date of exercise

c. Intrinsic value of share options on date of grant

d. Intrinsic value of share options on date of exercise

A

It is the difference between the fair value of the shares to be subscribed and the price required to be paid for those shares

a. Fair value

b. Intrinsic value

c. Market value

d. Book value

B

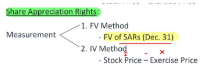

A cash-settled share-based payment transaction increases

a. A current asset

b. A noncurrent asset

c. Equity

d. A liability

D

Compensation cost for a share-based payment to employees that is classified as liability is measured at

a. The change in fair value for each reporting period

b. The total fair value at grant date

c. The present value of cash payment

d. The total cash outlay for the period

A

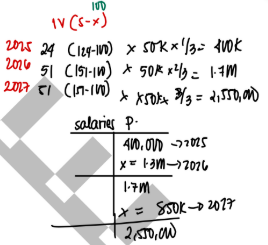

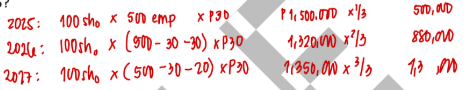

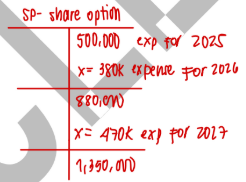

On January 1, 2025, Mr. Accounting Company granted 100 share options each to 500 employees, conditional upon the employee’s remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120.

On December 31, 2026, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, 2027, only 20 employees actually left and all of the share options are exercised on such date

What is the compensation expense for 2025?

a. P1,500,000

b. P750,000

c. P500,000

d. P0

C

On January 1, 2025, Mr. Accounting Company granted 100 share options each to 500 employees, conditional upon the employee’s remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120.

On December 31, 2026, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, 2027, only 20 employees actually left and all of the share options are exercised on such date

What is the compensation expense for 2026?

a. P1,320,000

b. P500,000

c. P380,000

d. P0

C

On January 1, 2025, Mr. Accounting Company granted 100 share options each to 500 employees, conditional upon the employee’s remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120.

On December 31, 2026, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, 2027, only 20 employees actually left and all of the share options are exercised on such date

What is the compensation expense for 2027?

a. P500,000

b. P880,000

c. P380,000

d. P470,000

D

On January 1, 2025, Mr. Accounting Company granted 100 share options each to 500 employees, conditional upon the employee’s remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120.

On December 31, 2026, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, 2027, only 20 employees actually left and all of the share options are exercised on such date

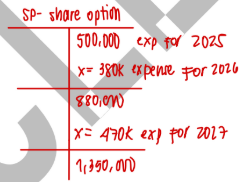

What is the share premium upon exercise of the share options on December 31, 2027?

a. P2,250,000

b. P2,350,000

c. P900,000

d. P0

C

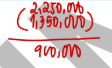

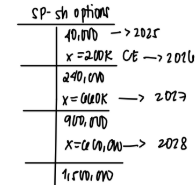

On January 1, 2025, CBA Company granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is P60 and the par value per share is P50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably.

The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The shares prices are P62 on December 31, 2025, P66 on December 31, 2026, P75 on December 31, 2027 and P85 on December 31, 2028. All share options were exercised on December 31,2028.

What is the compensation expense for 2027?

a. P120,000

b. P240,000

c. P200,000

d. P660,000

D

On January 1, 2025, CBA Company granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is P60 and the par value per share is P50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably.

The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The shares prices are P62 on December 31, 2025, P66 on December 31, 2026, P75 on December 31, 2027 and P85 on December 31, 2028. All share options were exercised on December 31,2028.

What is the compensation expense for 2028?

a. P900,000

b. P600,000

c. P660,000

d. P450,000

B

What amount should be reported as compensation expense for 2027 as a result of the share appreciation rights?

a. P2,550,000

b. P1,300,000

c. P850,000

d. P0

C