FMI Lec2 determinants of interest rates

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

4 determinants of financial asset demand

wealth ; not income

expected return

risk

liquidity; ease and speed to convert to cash

wealth’s impact on financial assets

financial assets are normal goods

as wealth increases, demand for financial assets increases

expected returns

normal

increase in er increases demand

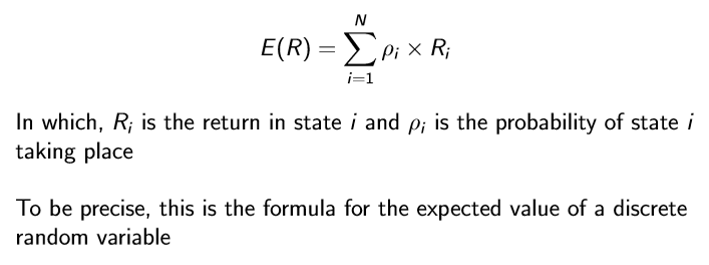

the average return across all states of nature

the Er of a portfolio a and b is equal to the sum of their individual er

risk-return trade off

high risk = high er, vice versa

Risk

negative correlation; increase in risk reduces demand

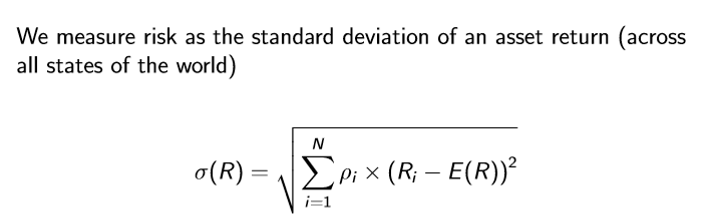

std dev

sum all probability x squared deviation, then sqrt

liquidity

normal— increase in liquidity increases demand

eg real estate is not liquid , stocks and bonds are

is there really one interest rate for the entire economy

no, but they will move together, so move forward like they do

with excess supply of bonds, price will:

drop

with excess demand, bond prices will:

rise

draw s and d curves

demand is negative

supply is positive

price on y axis

quantity on x axis

as supply of bonds increases, expected return will:

lower

market equilibrium

number of people who want to buy = number of people willing to sell at a given price

bonds prices and interest rates move in ___ directions

opposite

If expected interest rates E(i t+1) rise, what happens to demand?

demand shifts backwards, dropping prices and raising rates.

investors don’t want to buy bonds today. they expect prices to fall.

1 year bond YTM

FV-P / P

real interest rate

nominal - pi^E

pi^E is expected inflation

why does expected inflation causedemand to fall

because the real return falls.

rising liquidity of bonds has what impact on demand

raises demand, shift to right

If profitability of investment rises, what happens to supply

supply rises

if expected inflation rises, what happens to supply

raises, because the real cost of borrowing has decreased. They will owe same nominal amount of money, but real value will be diminished.

If government deficit increases, what effect on supply?

supply increases to right, as government requires more refinancing.

total effect of expected inflation on supply curve

causes demand to fall (to the left) because returns will be worth less

causes supply to increase (to the right) because real cost of borrowing decreases.

prices fall and interest rates rise.

Fisher effect

due to market equilibrium, nominal interest rates will rise with inflation rates.

Increase in wealth effect [business cycle expansion] on supply and demand curves

both move to the right (but the demand curve less so)

demand: financial assets are normal goods

supply: more profitable investments, so investment rises

prices fall and rates rise (where demand increases less than supply)