Economics Exam Yr 10 Semester 2 Perth Modern

1/115

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

116 Terms

economics

Economics is the study of rationing systems (planned and free market economies and how scarce resources are used to fulfil the infinite wants of consumers.

Importance of economics in understanding everyday activity, personally and for society

· The study of economics helps individuals and society as a whole with decision making and resource allocation in order to best satisfy our needs and wants.

· It can help governments make the best decisions for their country.

· It can help businesses with effective resource allocation

· It can help individuals understand the fiscal and monetary policy measures that the government or central bank takes and the effects of these on their daily lives.

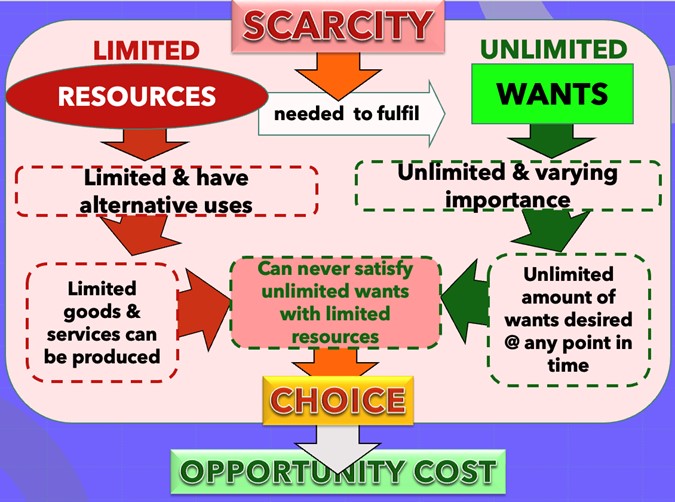

basic economic problem

People have unlimited wants but scarce resources, so we need to make choices based on our resource usage, leading to opportunity cost.

scarcity

limited resources = lack of resources to fulfil unlimited wants

choice

how we chose to use finite resources

opportunity cost

real cost of next best alternative forgone

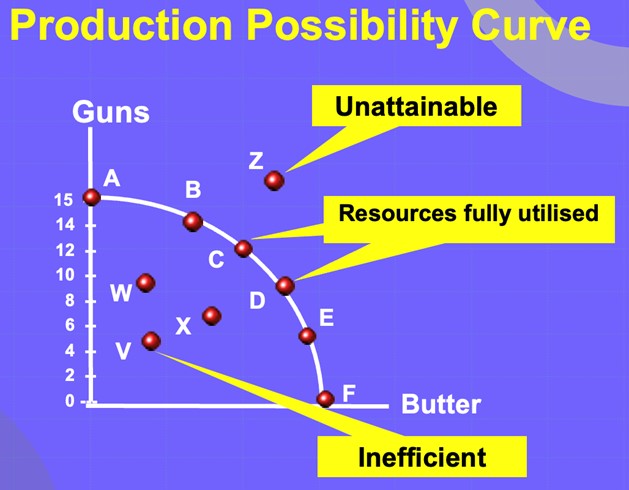

PPF + basic economic problem

PPF is combinations of 2 products given fixed resources, technology + full utilisation

The PPF represents that there is a scarce amount of resources and represents the opportunity cost when a choice is made on how to allocate the resources.

4 economic questions

what to produce, how to produce, for whom to produce, how much to produce

purpose of 4 economic questions

help determine what kind of economic system is in place and help us to decide how best to allocate resources to meet our needs and wants to the best degree.

what to produce

what goods + services should an economy produce

how to produce

how should goods and services be produced- labour intensive/land intensive e.t.c.

how much to produce

amount produced based on demand + supply

factors of production

land, labour, capital, enterprise

land- def, example, + payment received

natural resources available for production- e.g minerals recieve rent

labour- def, example, + payment received

physical + mental efforts of those involved in production- e.g. construction worker receive wages

capital- def, example, + payment received

non natural/manufactured resources used in production e.g. machinery recieve interest

enterprise- def, example, + payment received

management + organization of other 3 FoP e.g entrepreneur, receive profit

economic system

way an economy organises itself to address the basic economic problem- system of production, resource allocation + distribution in society

3 main economic systems

market, mixed, planned/command

market economy

law of supply(Fop) + demand(purchases by businesses, consumers + gvt) direct the production + distribution of goods and services.

businesses sell their products at highest price consumers will pay + buyers look lowest prices in goods and services they want.

workers bid their services at highest possible wage skills will allow + employers look for the best employees at lowest possible price.

6 characteristics of a market economy

private property: most goods + services privately owned

freedom of choice: freedom to produce, sell + purchase in market

motive of self interest: everyone sells to highest bidder and negotiates lowest price for their purchases

competition: competitive pressure to keep prices low

system of markets + prices: price changes reflect demand + supply

limited government: role of government is to keep free market working

strengths of market economy

chance of wealth

goods + services being produced reflect wants of consumers

promotes innovation + efficiency

weaknesses of market economy

poor working conditions

poverty

negative externalities like pollution

planned/command economy

central govt. makes all economic decisions in accordance with a central plan + owns means of production.

govt. sets quotas + price controls

no free market forces of demand + supply

no competition

aims to allocate resources in most efficient way possible

aims to use each individuals skills to highest capacity + eliminate unemployment

strengths of planned/command economy

less inequality

resources can be efficiently and rapidly mobilised e.g for war

weakness of planned/command economy

lack of innovation

goods + services produced may not reflect needs + wants of society

mixed economy

Combines characteristics of market, command and traditional economies, having advantages and disadvantages of all.

private enterprise with strong regulatory oversight and government provision of public goods e.g roads

basic welfare

demand + supply to determine prices

strengths of a mixed economy

allows production in economy to reflect needs + wants of consumers

regulation of business ensures good working conditions

weaknesses of a mixed economy

government failure/poor planning can result in inefficient outcomes

business regulation may limit productivity

socio-political economic systems

economic systems which incorporate social and political structures and ideologies

socialism

A political and economic theory that advocates for the rights of the working class.

means of of production owned by collective

progressive taxation

Strengths of socialism

reduces relative poverty due to minimum basic income for unemployed

free healthcare results in increased labour productivity contributing towards economic growth.

a more equal society is more cohesive as socialism promotes selflessness over selfishness.

environment is protected due to limiting pollution as profits are not the highest priority but rather long term welfare

weaknesses of socialism

lack of incentives as businesses may be discentivise due to high rates of progressive taxation.

government failure can result in an inefficient allocation of resources.

an overly generous welfare state can disincentives working thus reducing the labour force

communism

state/community owns all property and means of production leading to a theoretically classless society

strengths of communism

centrally planned economy can easily mobilise resources + executive massive projects

equality on a level capitalism can never offer

employment opportunities for everyone who wants a job

weaknesses of communism

government owns everything meaning they exert significant control over citizens lives

citizens may set up a black market for goods/services not in the central plan eroding trust.

limited efficiency + productivity due to lack of incentives

poverty as the first priority is to maintain the government structure meaning people are asked to get by on the bare min.

no laws of demand/supply to set prices meaning there are often surpluses/shortages

capitalism

means of production like factories, equipment, etc are privately owned rather than controlled by the government.

believes in the lassiez faire approach:

free market will regulate itself without govt. intervention

forces of demand and supply will set prices

strengths of capitalism

spread of power meaning government is not overbearing

efficiency: firms in a capitalist society face incentives to efficiently produce goods and services that are in demand.

innovation: firms seek to develop profitable products which leads to a greater choice of goods for consumers

economic growth: firms + individuals face incentives to work hard which creates a climate of economic growth.

weaknesses of capitalism

private ownership of capital enables firms to gain monopoly power and charge higher prices.

negative externalities: negative externalities such as pollution from production ignored.

inherited wealth creates inequality in a society that is supposedly based on equal opportunity.

inequality in wealth creates resentment and social division.

classical economics

brought into mainstream by Adam Smith

no govt. intervention in the marketplace

believes in “invisible hand” - unseen forces which move the free market economy

through individual self interest and freedom of production + consumption the best interests of society are fulfilled.

market will find its equilibrium without govts forcing it into unnatural patterns

keynesian economics

school of economic thought founded by John Maynard keynes

aggregate demand by households, businesses + govt and not free market is the driving force in the economy

economy has no self balancing mechanisms leading to full employment

macroeconomy can be in recession for considerable amount of time.

advocated for govt. intervention especially during times of recession to stimulate aggregate demand

advocates for higher government deficit spending to recover from recession

shift from microeconomics to macroeconomics

supply side economics

taxes reduce incentives for work, savings + investment

accelerated economic growth without inflation can be achieved by increasing the supply of goods and services

increased production drives economic growth

supply side FP focuses on business + firms

tools are tax cuts + deregulation of businesses

companies benefit + hire more workers

resultant job growth creates more demand which further boosts job growth

monetarism

money supply is most important driver of economic growth

As the money supply increase, people demand more goods and services (increase in AD)

therefore factories produce more creating jobs

central banks play a critical role by managing monetary policy

money supply expands = lowered interest rates = consumers borrow more and buy more big ticket items

decreasing money supply raises interest rates and slows down economic growth

purpose of govt economic objectives

To ensure the economy continues growing at a sustainable rate and remains competitive.

Australian macroeconomic objectives

price stability, full employment, sustainable economic growth

sustainable economic growth

stable economic growth that can be maintained over the long term

production capacity of an economy increases over time

measured in GDP growth and has target of 3-4%

GDP

monetary value of final goods and services produced in a country in a given period of time

price stability

gradual + sustainable increase in price levels of goods and services

measured using inflation rate (CPI)

2-3%

full employment

everyone who is willing and able to work is employed

not equal to 0 unemployment (skills mismatches/moving)

<5%

economic indicators

anything that can be used to predict or ascertain financial or economic trends.

leading indicators

signal future events- not always accurate

money supply

share prices

lagging indicators

follow an event/help confirm a pattern

inflation

unemployment rate

coincident indicators

occur at same times as the events they signal

GDP growth

personal income

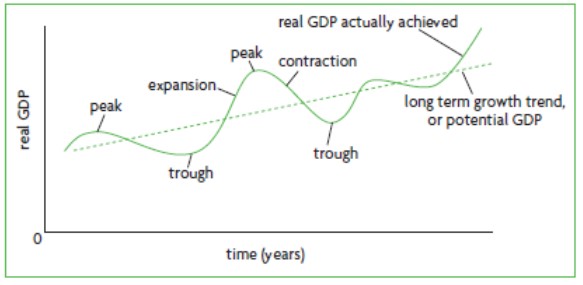

BTC

·The business trade cycle (BTC) represents fluctuations in the growth of real output, consisting of alternating periods of expansion (increasing real output) and contraction (decreasing real output).

real gdp on y axis time on x axis

long steady periods of expansion are desirable

large cyclical fluctuations over short periods not desirable

more steady + less rapid growth gives people more time to adapt

reducing intensity of expansion and contraction would lessen the problems of each

Phases of BTC

trough, expansion, peak, contraction

Expansion

sloping up = positive growth in real GDP

employment of resources increases

production increases

unemployment is decreasing

inflation is rising as households have more disposable income

Peak

max real gdp + end of expansion

employment of resources is max

unemployment is lowest + wages are high

inflation is extremely high

cost of living is high and consumers begin purchasing less leading to downswing

Contraction

falling real gdp = slope down

employment of resources decreases

unemployment increases

inflation is decreasing

production is decreasing

Trough

min level of gdp in cycle, marks beginning of new cycle

employment of resources is at all time low

unemployment is high, wages decrease

inflation is extremely low

people start buying more + labour is cheap so more people get hired redirecting into upswing

aggregate demand

measurement of the total amount of demand for all finished goods and services produced in an economy.

how aggregate demand can increase/decrease

Increased household wealth/income (from lower interest rates) generally increases aggregate demand, while decreased household wealth does the opposite.

aggregate supply

The total supply of goods and services available to a particular market from producers. It normally takes longer to respond to increased demand due to needing more workers, equipment and/or infrastructure

fiscal policy

Fiscal policy refers to the use of government spending and taxation to affect:

the level of macroeconomic activity

resource allocation

income distribution

instruments of fiscal policy

changing tax revenue (T)

changing government expenditure (G)

Non-Discretionary FP

automatic or built in stabilisers in place to smoothen/offset fluctuations of the economic cycle without the need for additional govt intervention

don’t regularly change

examples of non-discretionary FP

welfare benefits

tax structures including income tax

unemployment benefits

Discretionary Fiscal Policy

Deliberate use of taxes + govt spending to influence the economy when non-discretionary fp is not enough

govt makes changes to taxation/spending in sectors

examples of discretionary fp

jobkeeper during covid

what is a budget

plan for the allocation of the govts spending + taxation

it can influence the achievement of the govt macroeconomic objectives

purpose of a budget

Decide how revenue should be raised and funds allocated to areas of need.

Redistribute income from the wealthy to the less wealthy.

Influences the level of macroeconomic activity.

possible budget outcomes

neutral/balanced, surplus, deficit

neutral budget

revenue = expenditure

neutral impact on AD and economic activity

little impact on production, employment + inflation

G=T

deficit budget

expansionary

G>T

less money taken out of economy through T than poured back in through G

stimulates aggregate demand

surplus budget

contractionary

G<T

more money is withdrawn from the economy through T than poured back in through G

limits aggregate demand

government revenue

examples of government revenue

money received by a government from taxes and non-tax sources to enable it to undertake public expenditure. It is a leakage from the economy

government expenditure

is an injection into the economy involving the government spending money on items such as public services to stimulate the economy.

examples of government expenditure

welfare payments

spending for public infrastructure such as roads

What budget outcomes will the government aim for if it wants to expand the economy?

a deficit budget to create an overall injection into the economy and stimulate AD

What budget outcomes will the government aim for if it wants to contract the economy?

surplus budget to result in an overall leakage from the economy to limit production, consumption and inflationary pressure

What is monetary policy

set of actions available to a nation's central bank to control inflation and achieve sustainable economic growth by adjusting the money supply. Monetary supply is controlled through cash rate.

what is the transmission of monetary policy

how changes made by the Reserve bank to the cash rate flow through to economic activity and inflation

2 stages of transmission of monetary policy

changes made by the RBA to the cash rate influences other capital market interest rates

changes to these interest rates affect economic activity and inflation through ‘channels’

3 transmission channels

savings + investment channel

wealth + asset price channel

cash flow channel

Savings + investment channel

Interest rates influence economic activity by changing the incentives for saving and investment.

A reduction in interest rates on deposits decreases a household’s incentive to save and encourages spending.

lower interest rates encourage households + firms to increase investment + borrowing as the return on investment is now more likely to be higher than the cost of borrowing.

cash flow channel

Interest rates influence the decisions of households and businesses by change the amount of cash they have available to spend on goods and services

mainly affects those who are liquidity constrained as reduced interest rates means they have more of their income to spend on other goods + services

households who receive income from from deposits may choose to limit their spending but first effect is greater

asset price + wealth channel

Asset prices and people’s wealth influence how much they can borrow and how much they spend in the economy.

lower interest rates = increased demand for houses/assets = increase in value of assets + houses

increases equity for banks to lend against meaning people can borrow more and spend more on investments

increase in asset prices also increases household wealth

greater household spending as households generally spend some proportion of their increase in wealth

standard of living

level of welfare and prosperity citizens of a country have

Material SoL

our access to physical goods and services

e.g. car, house, food

if citizens have more goods and services to satisfy their needs and wants, life in general is better.

Non Material Standard of Living

intangible things that cannot be measured in dollar terrms but still affect our enjoyment of life.

factors affecting non material SoL

freedom of speech

low levels of crime + discrimination

preservation of the environment

adequate leisure time

life expectancy

literacy rate

indicators for material SoL

GDP per capita, housing availability

indicators for non-material SoL

OECD better life index, leisure time, low crime rates, work life balance

Concept of Poverty

state in which an individual or household is not able to fulfil minimum consumption needs

can be measured in absolute or relative terms

poverty line

estimated minimum household income threshold required to fulfil basic necessities of life

absolut epoverty

defined using the poverty line, below poverty line = poor

indicates a failure in meeting the basic necessities of life (food, water, clothing, shelter)

relative poverty

state in which a person lacks the least amount of income required to maintain the normal standard of living, in the society to which they belong.

Causes of Poverty

lack of education

geographic location

housing crisis

disability/illness

Methods to overcome poverty + improve living standards

increase minimum wage from $21.38 to something higher

fund education + training

adjust progressive taxation

funding and creating more government infrastructure

GDP- strengths

good indicator of material SoL

more goods and services to fulfil needs + wants