3.4 - inflation, deflation, Philips curve

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

inflation

a sustained increase in the average prices of goods and services in the entire economy

deflation

a sustained decrease in the average prices of goods and services in the entire economy

disinflation

a decrease in the rate of inflation (eg. 10% → 7%)

consumer price index

index of prices of the costs of living for a typical household

compares the value of a basket of goods and services in one year with the value of same basket in base year

CPI for a base year is always 100

formula for CPI for a specific year

CPI for a specific year = (value of basket in specific year / value of basket in base year) x 100

real income formula in relation to CPI

real income = (nominal income / CPI) x 100

problems with CPI (overstating degree of inflation)

different rates of inflation for different income earners

CPI reflects average prices

different rates of inflation depending on regional or cultural factors

changes in consumption patterns

due to more sales and discounts

due to consumer substitution when relative price changes

new products

changes in product quality

CPI doesn’t account

core rate of inflation

excludes volatile items such as food and energy prices to provide a clearer view of long-term inflation trends.

types of inflation

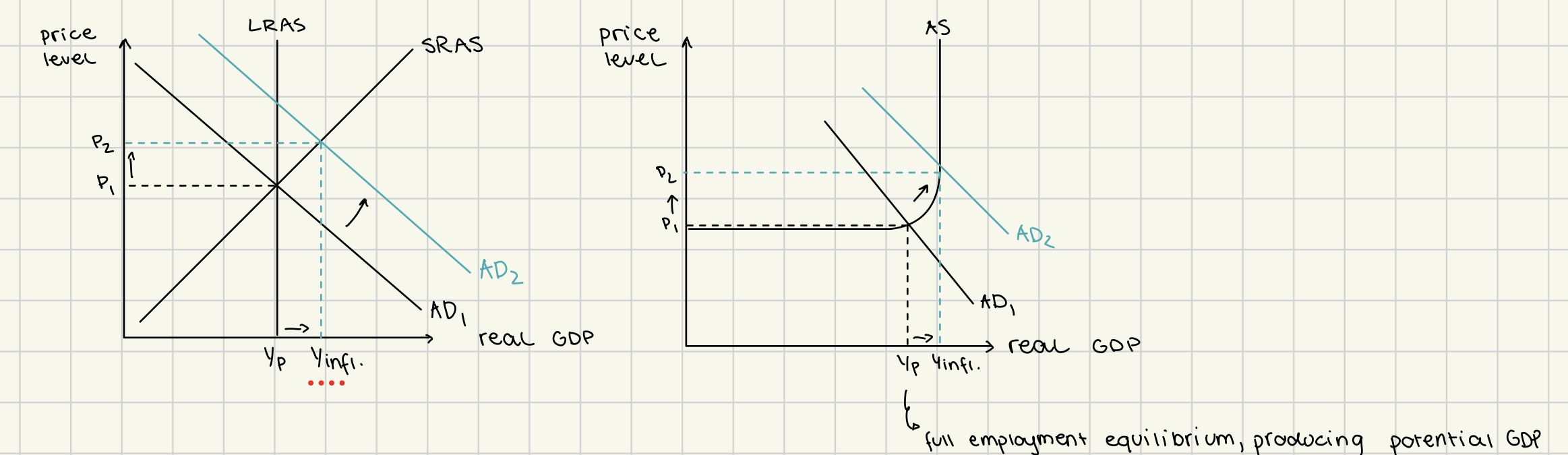

demand-pull inflation

cost-push inflation

demand-pull inflation

increase in AD

real GDP>potential GDP

inflationary gap

unemployment <natural rate of unemployment

demand is so large the unemployment temporarily find jobs

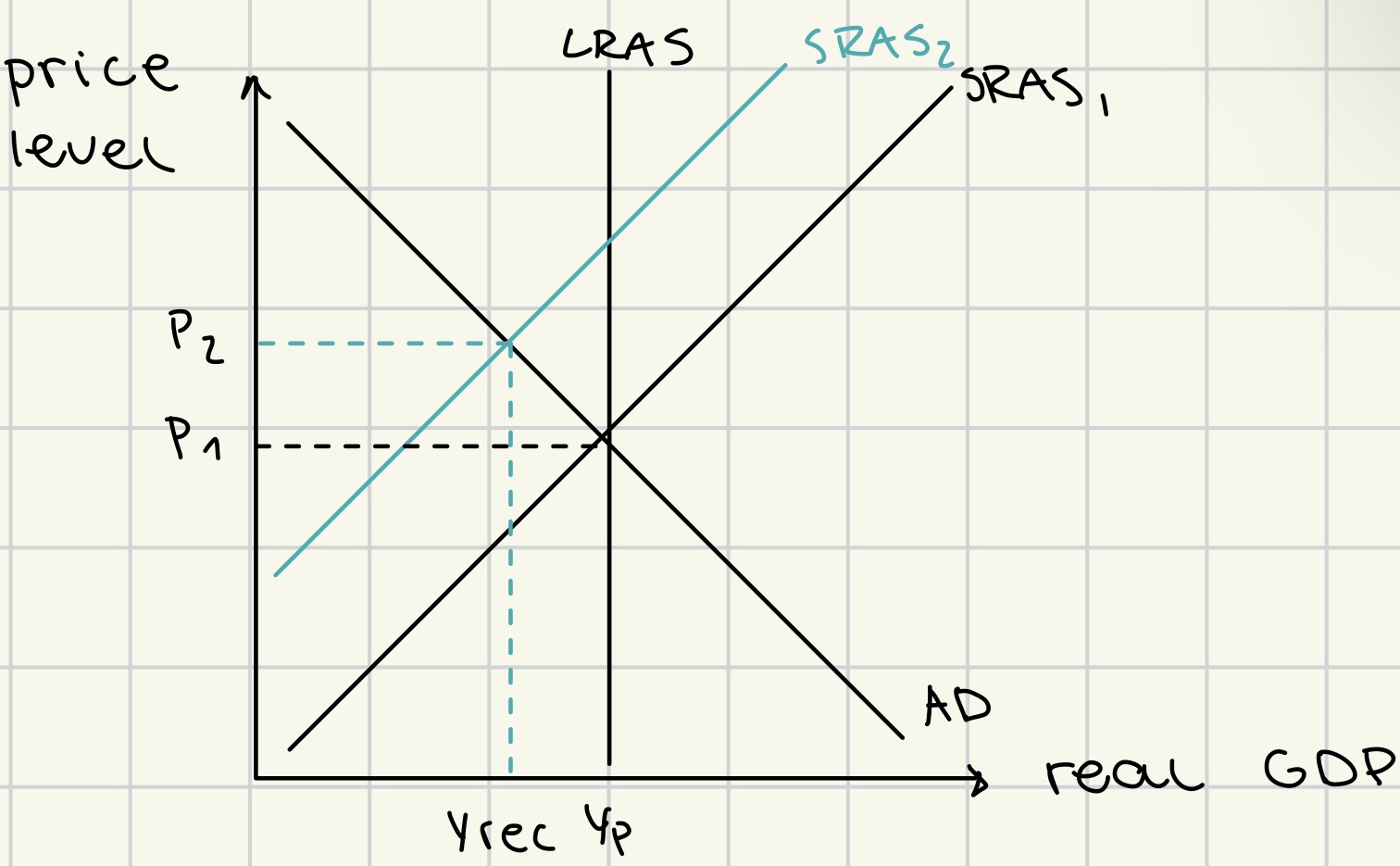

cost-push inflation

fall in SRAS, due to increased costs of production/ supply-side shocks

real GDP < potential GDP

although indicates recession, its NOT called recessionary gap

STAGFLATION

purchasing power

quantity of goods and services that can be bough with money

decreases with inflation

increases with deflation.

%change in pp = %change in nominal income - %change in price level

price level ↑ = purchasing power↓

costs of inflation

redistribution effects

uncertainty

fewer investments

effects on savings

lowered incentive to save

international export competitiveness

negative effect on economic growth

inflation = lower AD = lower economic growth

social and personal costs are unequally distributed

redistribution effect definition

inflation redistributes income away from certain groups of economy to other

redistribution effect: groups who lose from inflation (real value ↑)

people with fixed incomes/wages

people who receive incomes/ wages that increase less rapidly than rate of inflation

holders of cash

savers

creditors (when lending interest rate < rate of inflation)

redistribution effect: groups who gain from inflation (real value ↓)

borrowers (because the real value of their debt decreases)

payers of fixed incomes/ wages

payers of incomes/ wages that increase less rapidly than rate of inflation

cost of inflation: international export competitiveness

decline in international export competitiveness

as domestic goods become more expensive compared to foreign goods, potentially reducing demand for exports.

hyperinflation

a rapidly accelerating inflation rate, typically exceeding 50% per month

due to significant increases in the supply of money

governments printing money

consequences of hyperinflation

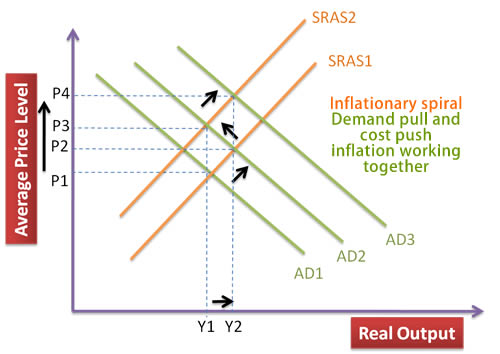

inflationary spiral

inflationary spiral

(money value ↓↓ = consumer spending ↑ = feeding AD = demand-pull inflation = worker demand for higher wages ↑= cost-push inflation = ….)

businesses stop investing

businesses withold goods from sale

creditors suffer massive losses as real value of debts falls dramatically

money loses value all together

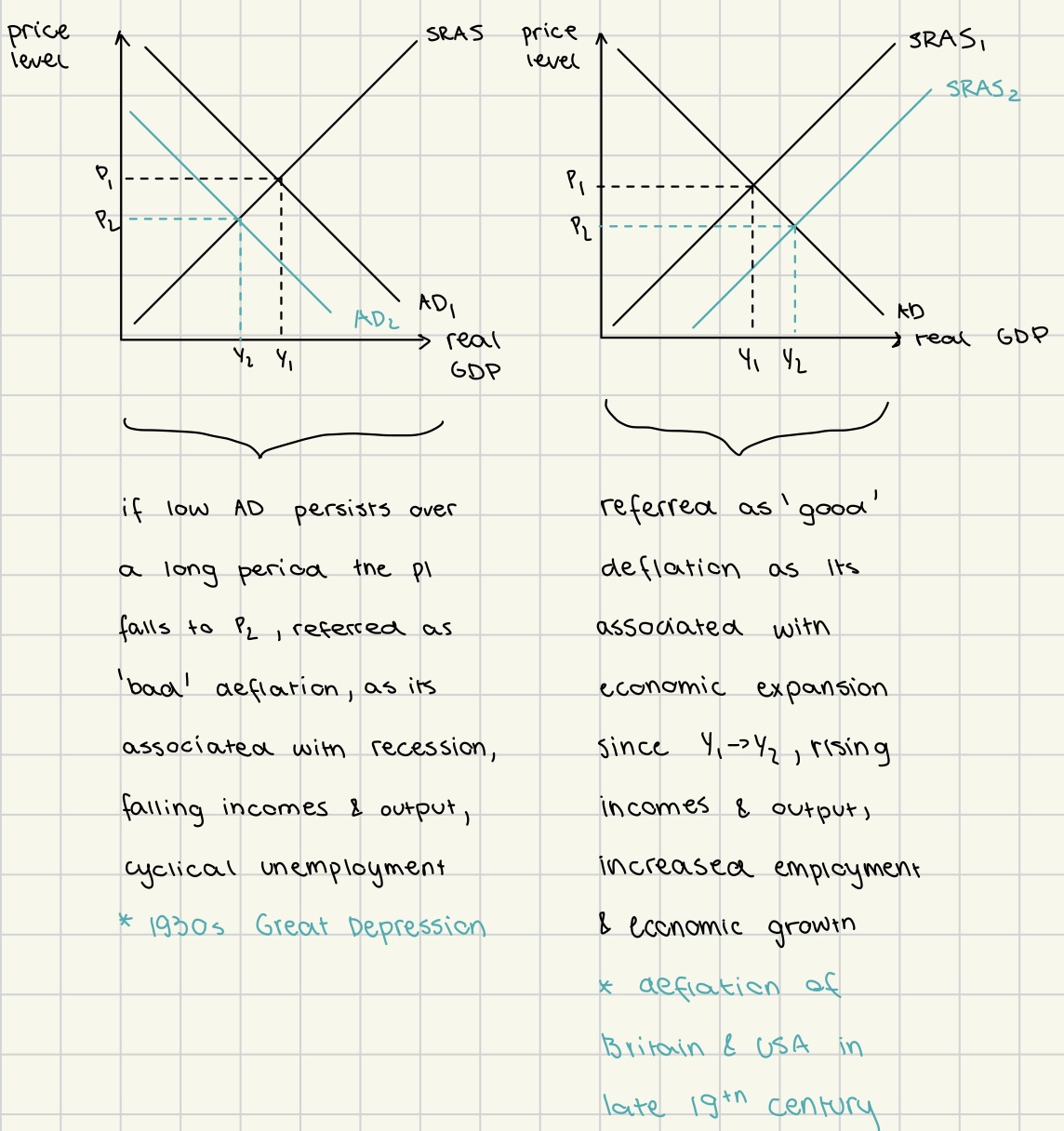

deflation

due to fall in AD

due to increase in SRAS

costs of deflation

redistribution effect

increase in purchasing power

deffered consumption

deflationary spiral

risk of bankruptcies

inefficient resource allocation

increased unemployment

economic stagnation

policy ineffectiveness

central banks struggle to stimulate the economy due to lower interest rates.

redistribution effect: groups who gain from deflation (real value ↑)

individuals on fixed incomes/wages

holders of cash

creditors

redistribution effect: groups who lose from deflation (real value ↓ )

borrowers

payers of fixed incomes/wages

deflationary gap

(…. real value ↓ = AD↓ = rGDP ↓= cyclical unemployment ↑ = AD ↓↓= real value ↓ ….)

consumers and businesses anticipate falling prices, leading to decreased demand for goods and services

further economic contraction

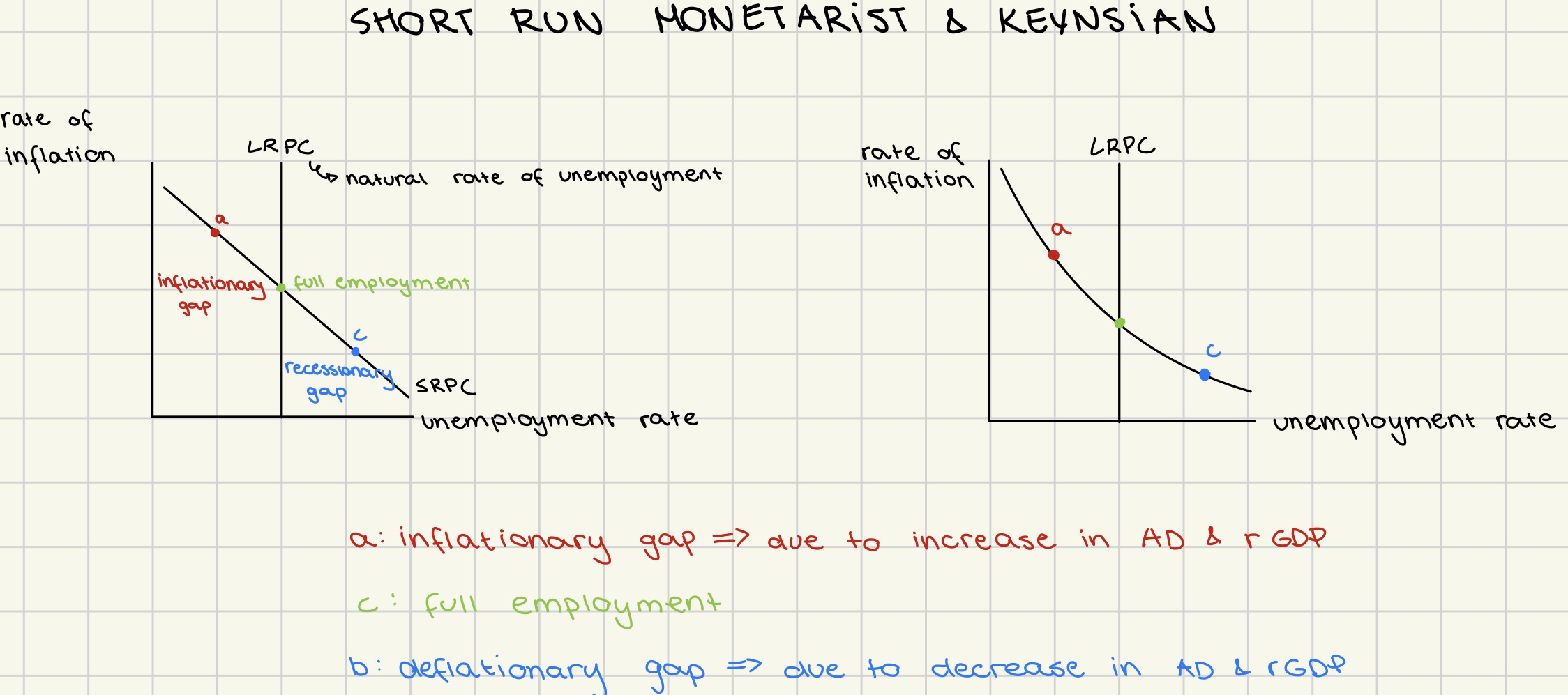

Phillips curve in short run (monetarist and keynesian)

illustrates the inverse relationship between inflation and unemployment rates

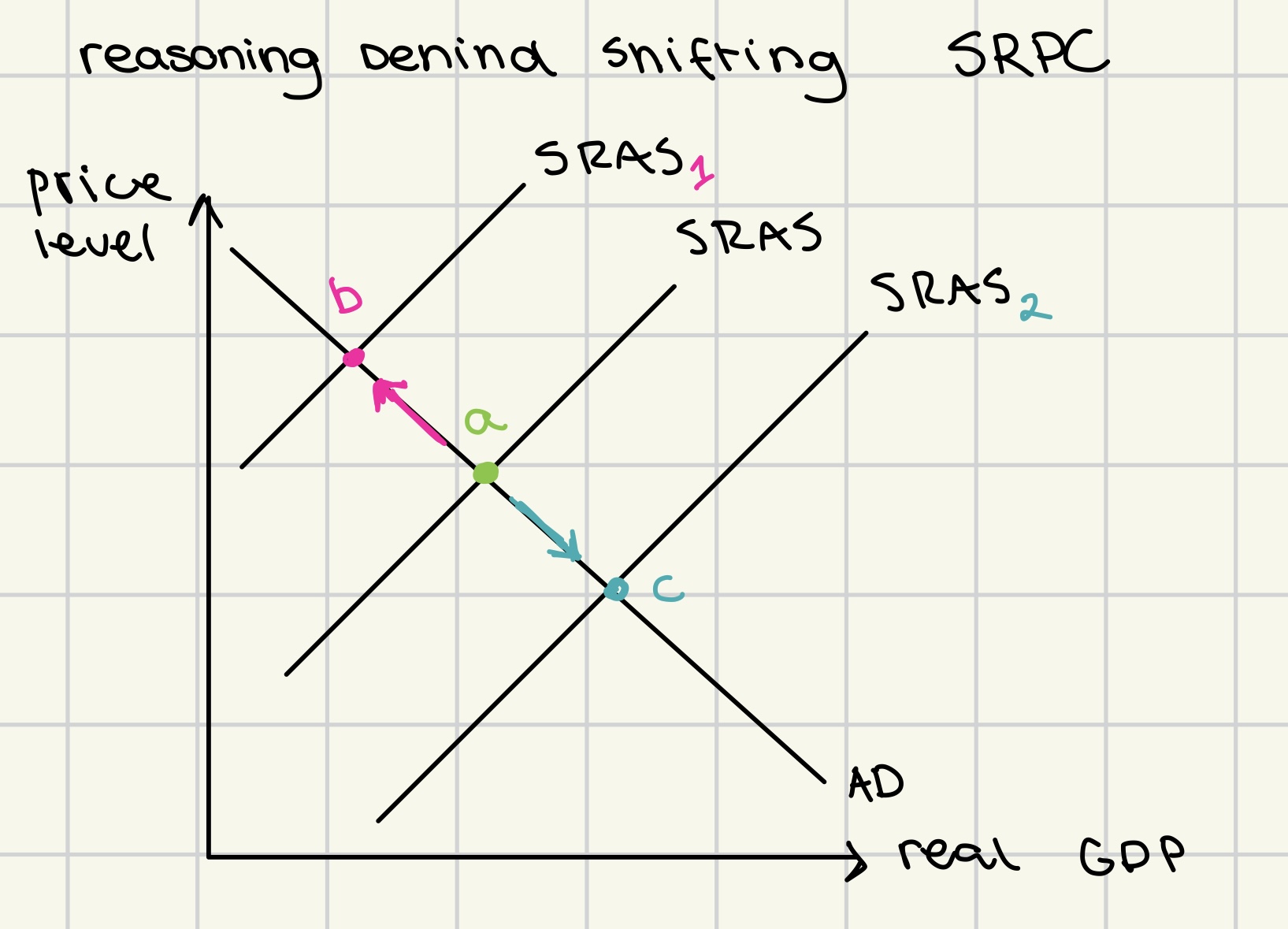

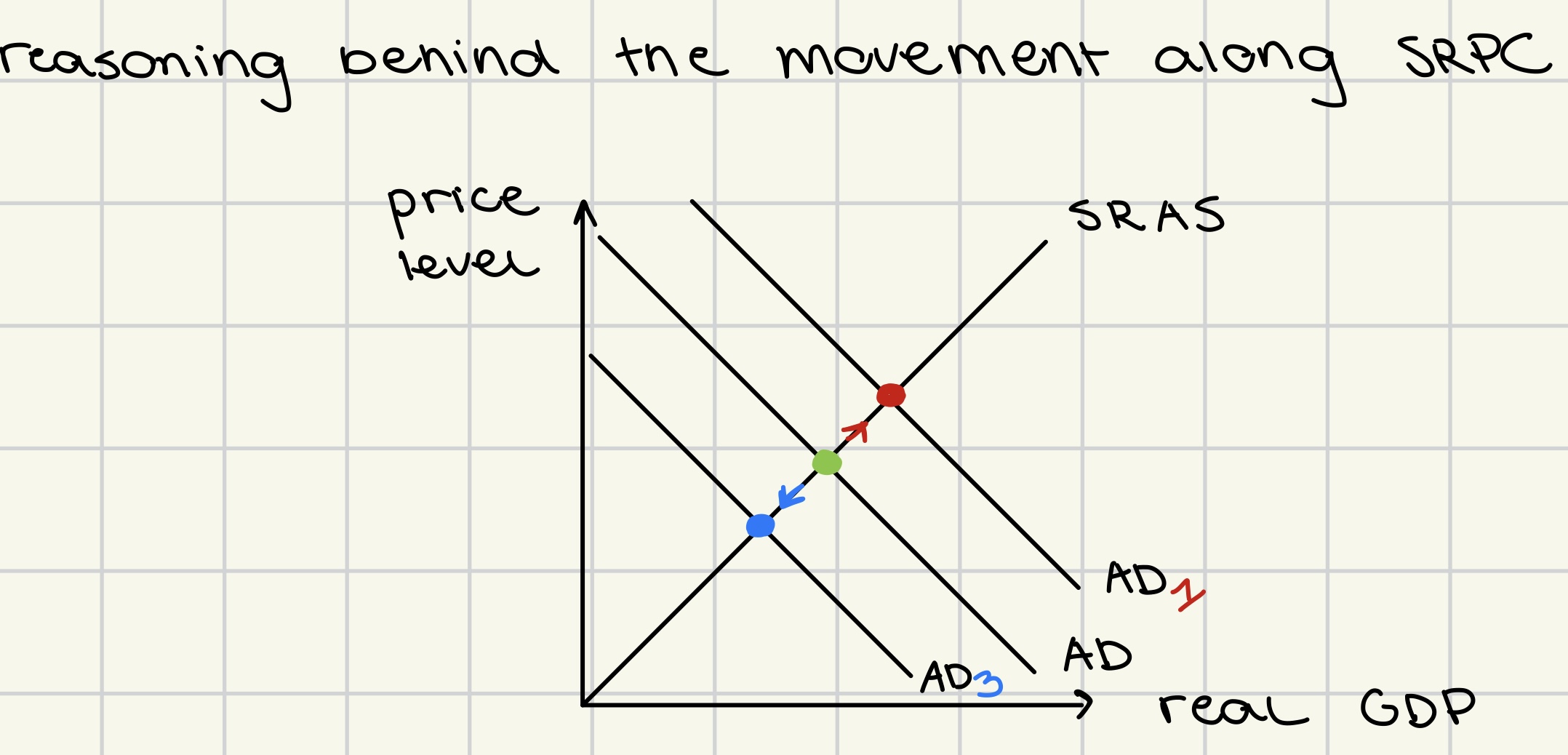

reasoning behind the movement along SRPC

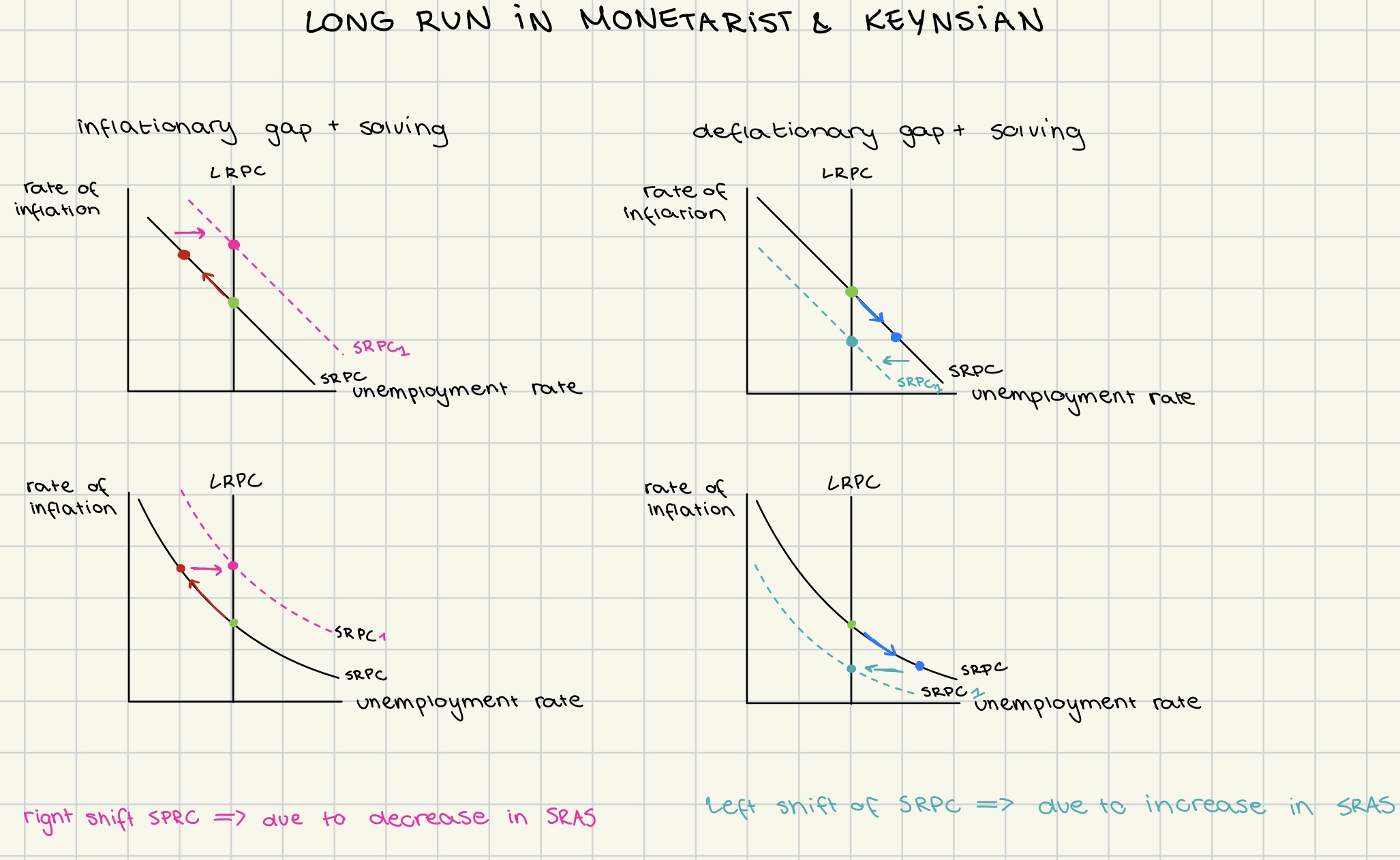

Philips curve in long run Monetarist and Keynesian

reasoning behind shifting SRPC in long term