Chapters 8-12 Financial Accounting

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

Characteristics of current liabilities (1)

due within one year from the balance sheet date

obligations that use up current assets like cash

examples:

deferred revenue, sales tax payable, and current portion of LT debt

Characteristics of long term liabilities (1)

due in more than one year from the balance sheet date

companies prefer to report liabilities as long-term, rather than current, as it makes them seem less risky, which leads to lower interest rates and higher stock prices

Stated Rate

Used ONLY to calculate the actual Cash Interest Paid (Face Value $\times$ Stated Rate).

Market Rate

Used ONLY to calculate Interest Expense (Carrying Value $\times$ Market Rate)

Record interest accrual for current notes payable (1)

Issuance of note payable on Nov 1

Cash (Dr)

Notes Payable (Cr)

Accrued Interest on Dec 31

Interest Expense (Notes Payable x rate x months/12) (Dr)

Interest Payable (Cr)

(record interest incurred, but not paid)

Payment of note and interest at maturity

Notes payable (Dr)

Interest Payable (accumulated) (Dr)

Interest Expense (for current month) (Dr)

Cash (Cr)

employee payroll expenses (2)

Federal and State Income taxes

Employee portion of Social Security and Medicare (FICA taxes -7.65%)

employee contribution for health, dental, disability, and life insurance

Employee investments in retirement or savings plans

employer payroll expenses (2)

Federal and State Unemployment taxes (FUTA and SUTA)

Employer matching portion of Social Security and Medicare (FICA taxes- 7.65%)

Employer contributions for health, dental, disability, and life insurance

Employer contributions to retirement or savings plans

fringe benefits (additional employee benefits paid for by the employer)

Record employee salary expense and withholdings (0)

Salaries expense (starting payroll) (Dr)

Employee Income Tax Payable (Cr)

FICA Tax Payable (FICA tax rate x salaries expense) (Cr)

Salaries Payable (Take-home pay) (Cr)

to find income tax and FICA multiply each by the salaries expense and then take those numbers and subtracts from total to find salaries payable

Record employer-provided fringe benefits (0)

Salaries Expense (fringe benefits) (Dr)

Fringe Benefits Payable (to Blue Cross) (Cr)

Fringe Benefits Payable (to Fidelity) (Cr)

Record employer payroll taxes (0)

Payroll tax expense (total) (Dr)

FICA tax payable (FICA tax rate x salaries expense) (Cr)

Unemployment tax payable (rate x salaries expense) (Cr)

Effect of deferred revenues on accounting equation (1)

cash received in advance from a customer for products or services to be provided in the future

later when those services are provided or goods are delivered, deferred revenue is decreased and revenue is recognized

ex: gift cards, tickets, etc.

Liability account

increase: assets & liabilities

decrease: liabilities & increase: revenue

Receive cash for gift card (0)

Cash (Dr)

Deferred Revenue (Cr)

IS: no effect

BS: increase assets and increase liabilities

Record revenue from merchandise sales using a gift card (0)

Deferred Revenue (Dr)

Sales Revenue (Cr)

IS: increase revenue and increase net income

BS: decrease liabilities and increase stockholders equity

calculate sales tax (1)

sales tax collected from customers by the seller, representing current liabilities payable to the government

Cash (Dr)

Sales Revenue (price of good) (Cr)

Sales Tax Payable (price of good x sales tax rate%) (Cr)

reporting current portion of LT debt (1)

Debt that will be paid within one year from the balance sheet date

report the currently maturing long-term debt as a current liability in the balance sheet

reclassify long-term portion of note as current (0)

Notes Payable (long-term) (Dr)

Notes Payable (current) (Cr)

entry has no effect on total liabilities, simply reporting in different category

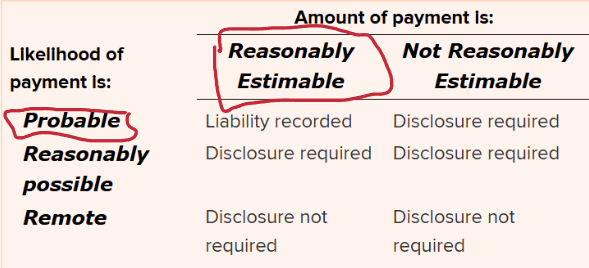

reporting lawsuit contingencies (2)

Uncertain situations that can result in a gain or loss for a company

Recorded ONLY if a loss is Probable and the amount is Reasonable Estimable (use the lowest number from the range)

record a contingent liability

Loss (Dr)

Contingent Liability (Cr)

record warranty liabilities and expenditures (1)

most common example of contingent liabilities

Probable and reasonably estimable

warranty liability is not always equal to warranty expense

Warranty Liability account is increased when the estimated warranty liability is recorded, but then is reduced over time by actual warranty expenditures

Warranty expense (Dr)

Warranty Liability (Cr)

Amount of estimated cost is found by

multiplying total months sales x % of sales for expected future warranty

Record actual warranty expenditures (0)

Warranty Liability (Dr)

Cash (Cr)

Amount is the real warranty claims

Warranty Liability will still have rest of amount in it

any balance remaining in warranty liability will expire at the end on the year and be written off if not used

debt financing (2)

borrowing money from creditors (liabilities)

advantage that interest on borrowed funds is tax-deductible

borrowing money from external sources with a contractual obligation to repay the principal amount plus interest over a specified period

equity financing (2)

obtaining investment form stockholders (stockholders’ equity)

recorded in the owners’ equity section

do not create a liability or interest expense

the process of raising capital by selling an ownership stake (shares) in a company to investors

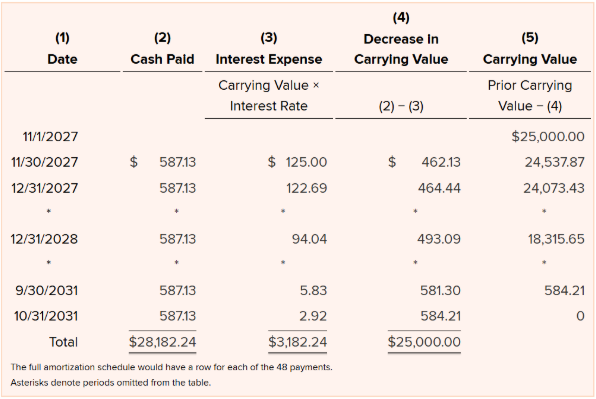

calculate interest expense and carrying value of installment notes (2)

carrying value: the amount for which a liability is reported in the balance sheet

installment payment: includes both an amount that represents interest and an amount that represents a reduction of the carrying value

interest = principle (new) x rate x month/12

take payments and subtract interest, left with change in carrying value

carrying value-change in carrying value=new carrying value

issue a note payable (0)

cash (Dr)

notes payable (Cr)

pay monthly installment on note (0)

nov 30 (first month)

interest expense (P x R x T) (Dr)

Notes Payable (difference) (Dr)

Cash (monthly payment amount) (Cr)

dec 31 (second month)

interest expense (new P x R x T) (Dr)

notes payable (difference) (Dr)

cash (monthly payment amount) (Cr)

Notice that the amount of cash paid is the same for each payment but

The amount of interest expense is decreasing

The amount paid on the note's principal balance is increasing

recording leases (2)

WILL ASK FOR BEGINNING VALUE OF LEASE

Lease: a contractual arrangement by which the lessor (owner) provides the lessee (user) the right to use an asset for a specified period of time

number one method of external financing

recorded by the lessee:

lease asset (Dr)

lease payable (Cr)

obligation to make payments over the lease period

initial down payment is usually required

use present value table

number of total payments (y-axis) (n)

interest per payment (x-axis) (i)

make sure to divide by the amount of payments per year

find number on chart and multiple by payment

characteristics of bonds (2)

bond: a formal debt instrument issued by a company to borrow money

the issuing company is obligated to pay back to the investor

a stated principal, at a specified maturity date

periodic interest payments over the life of the bond (traditionally twice a year, every 6 months)

The stated interest rate is specified in the bond contract

The interest rate to be paid by the company to investors in the bond

The market interest rate is not specified in the bond contract

Implied rate based on the amount the investors pay to purchase a bond

secured bonds (0)

bonds that are supported by specific assets pledged as collateral

unsecured bonds (0)

bonds that are not supported by specific assets pledged as collateral

most bonds

term bonds (0)

bonds that require payment of the full principal amount at a single maturity date

most bonds

serial bonds (0)

bonds that require payment of the principal amount of the bond over a series of maturity dates

sinking fund (0)

an investment fund used to set aside money to be used to pay debts as they come due

callable (0)

a bond feature that allows the borrower to repay the bonds before their scheduled maturity date at a specified call price (usually just above face value)

protect the issuing company against future decreases in interest rates

convertible (0)

liability can be exchanged for common stock

issuing at a discount (0)

if the bonds stated interest rate is less than the market interest rate the bonds will issue below face amount

payments go towards making the bond face value (bring up)

issuing at a premium (0)

If the bonds stated interest rate is more than the market interest rate the bonds will issue above face value

payments go towards making the bond face value (bring down)

debt-to-equity ratio (2)

Total liabilities divided by stockholders' equity; measures a company's risk

The higher the ratio the higher the risk of bankruptcy

disadvantages of corporate form of business (1)

Double Taxation

Corporate income is taxed once on earnings at the corporate level and again on dividends at the individual stockholder level

More Paperwork

Intended to ensure adequate disclosure of the information investors and creditors need

rights of common stockholders (1)

Right to Vote

Stockholders vote on matters, including the election of corporate directors

Right to Receive Dividends

Stockholders share in profits when the company declare dividends.

The percentage of shares a stockholder owns determines his or her share of the dividends distributed

Right to Share in the Distribution of Assets

Stockholders share in the distribution of assets if the company is dissolved.

The percentage of shares a stockholder owns determines his or her share of the assets, which are distributed after creditors and preferred stockholders are paid

authorized stock (1)

number of shares available to sell, as stated in the company’s articles of incorporation

= issues + unissued

issued stock (1)

number of shares sold to investors; includes treasury shares

=outstanding + treasury

Outstanding stock (1)

number of shares that currently are held by investors; does not include treasury shares

only these shares receive dividends

issued - treasury stock

treasury stock (1)

a company’s own issued stock that it has repurchased

when resold, use the original repurchase price for the treasury credit and the difference goes to APiC

Additional Paid-in Capital (APiC)

the portion of the cash proceeds from issuing stock above par value

paid-in capital in excess of par

record issuance of par common stock (2)

cash (shares x amount per share) (Dr)

common stock (shares x par value per share) (Cr)

additional paid-in captial (difference) (Cr)

record issuance of no-par common stock (0)

cash (shares x amount per share) (Dr)

common stock (Cr)

calculate dividends for Preferred Stock (1)

Dividends accumulate until the company decides to declare them

Preferred stock has preference over common stock in receiving dividends and in the distribution of assets in the event the corporation is dissolved

number of shares x par value x percent rate

if cumulative: take this number and multiply by number of years since last paid

if not cumulative: only use current years value

the rest of dividend amount goes to common stockholders after the preferred stockholders get theirs

calculate dividends for Common Stock (1)

find the total amount available (total dividends - preferred dividends)

For Dividends Per Share: then divide by the number of common shares outstanding

per share x outstanding shares (after preferred stockholders)

will be given per share value

record purchase of Treasury Stock (1)

Treasury Stock (shares x price bought for) (Dr)

Cash (Cr)

*the stock’s par value has no bearing on the balance sheet effect of treasury stock purchases*

Decreases stockholders' equity and cash

Normal debit balance

the IS is unaffected (only affects BS, with cash and stockholders equity both decreasing)

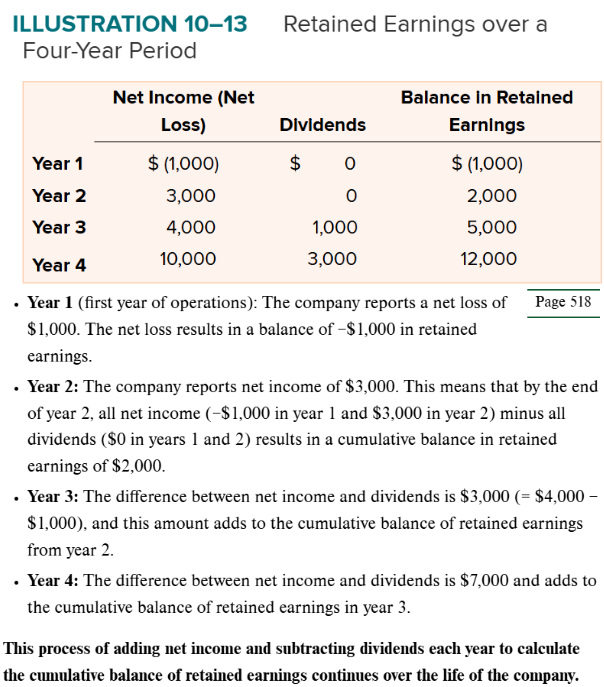

describe retained earnings and apply the Retained Earnings formula (2)

Retained earnings = All net income since the company began – all dividends since the company began

Dividends Dates (0)

Declaration date

The date the board of directors announces the next dividend to be paid

Created a binding legal obligation

On this date

Debit: Dividends

Credit: Dividends Payable

Record date

The date on which a company looks at its records to determine who the stockholders of the company are

no journal entry

Payment date

The date of the actual distribution of dividends on shares outstanding

Dividends are not paid on treasury shares

Debit: Dividends Payable

Credit: Cash

purpose of stock dividends and splits (1)

stock dividends: give people more stock if they already own it

drive down share price

reduces retained earnings and increases common stock (doesn’t affect stockholders equity overall) (transfers value from retained earnings to capital)

stock splits: split current value of the stock (2-for-1 split = double shares)

adjust par value

no journal entries required

drive down share price

get more shares at a lower price (ownership percentage doesn’t change)

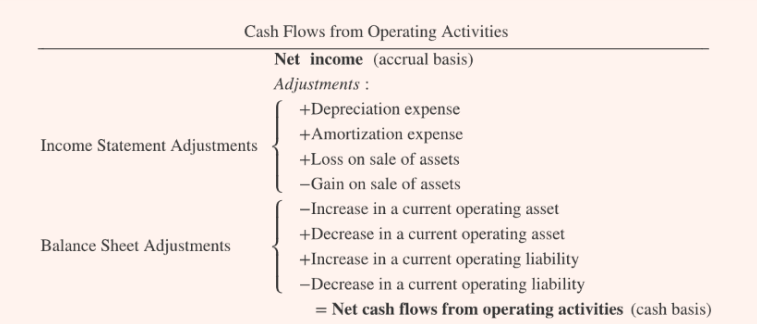

Indirect method

Begins with net income and then lists adjustments to net income in order to arrive at operating cash flows

only deals with operating section

add back depr. and amorit.

-gain and +loss

current assets

increase (-)

decrease (+)

current liabilities

increase (+)

decrease (-)

paying dividends

financing

receiving dividends

operating

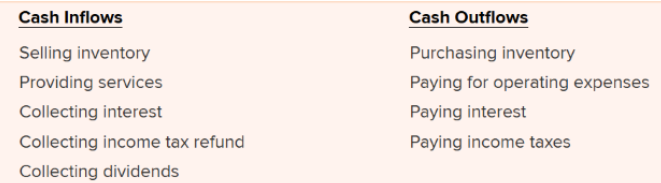

classify cash transactions as operating activities (4)

Transactions involving revenue and expense activities

Ex: collecting cash from customers or paying cash for inventory, salaries, and rent

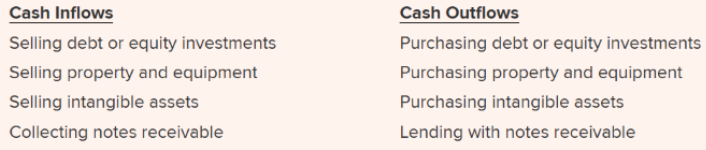

classify cash transactions as investing activities (0)

Transactions involving the purchase and sale of long-term assets and current investments

Companies periodically invest cash to replace or expand productive facilities such as buildings, land, and equipment

Stocks or bonds of other companies

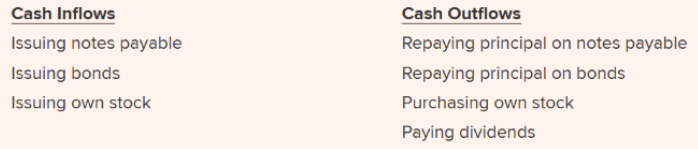

classify cash transactions as financing activities (0)

Transactions with lenders, such as borrowing money and repaying debt, and with stockholders, such as issuing stock, paying dividends, and purchasing treasury stock

It’s the lenders and stockholders who provide external financing to the company

purpose of Statement of Cash Flows (1)

to show activities involving cash inflows and cash outflow over a period of time

Cash inflow: cash received by the company during the period

Cash outflow: cash paid by the company during the period

Net cash flows: difference between cash inflows and outflows

Separately reports the net cash flow from operating, investing, and financing activities

purpose of the operating activities section of Statement of Cash Flows (1)

to show how much cash a company generates from its core business operations

helpings users assess its ability to generate sustainable cash to fund itself, pay debts, and invest

prepare the operating activities section (2)

use the indirect method

prepare the investing activities section (1)

FOLLOW THE CASH

The second step in preparing the statement of cash flows is to determine the net cash flows from investing activities

This section reports the actual cash received or paid for an asset, which is usually not the same as the change in the asset account reported in the balance sheet

Companies periodically invest cash to replace or expand productive facilities such as property, plant, and equipment

We can find a firm's investing activities by analyzing changes in long-term asset accounts from the balance sheet.

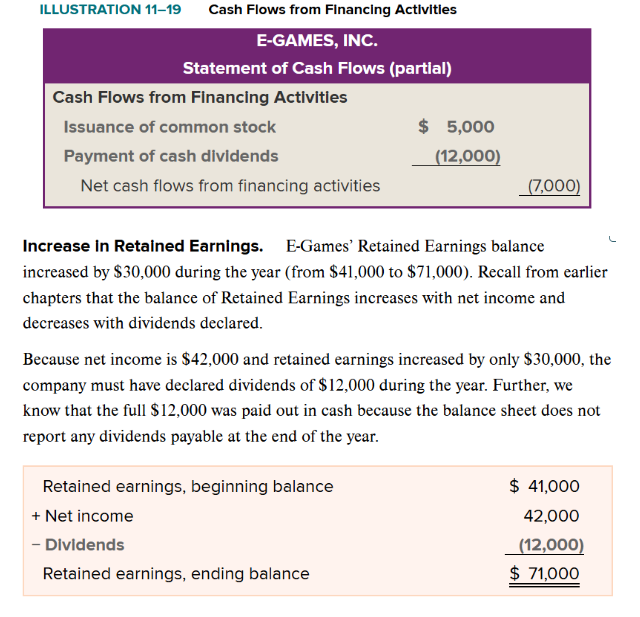

prepare the financing activities section (1)

FOLLOW THE CASH

The third step in preparing the statement of cash flows is to determine the net cash flows from financing activities

To fund its operating and investing activities, a company must often rely on external financing from two sources- creditors and shareholders

In the financing activities section of the statement of cash flows, companies list separately cash inflows, such as borrowing money and issuing stock, and cash outflows, such as repaying amounts borrowed and paying dividends to shareholders

We can find a firms financing activities by examining changes in long-term liabilities and stockholders' equity accounts from the balance sheet

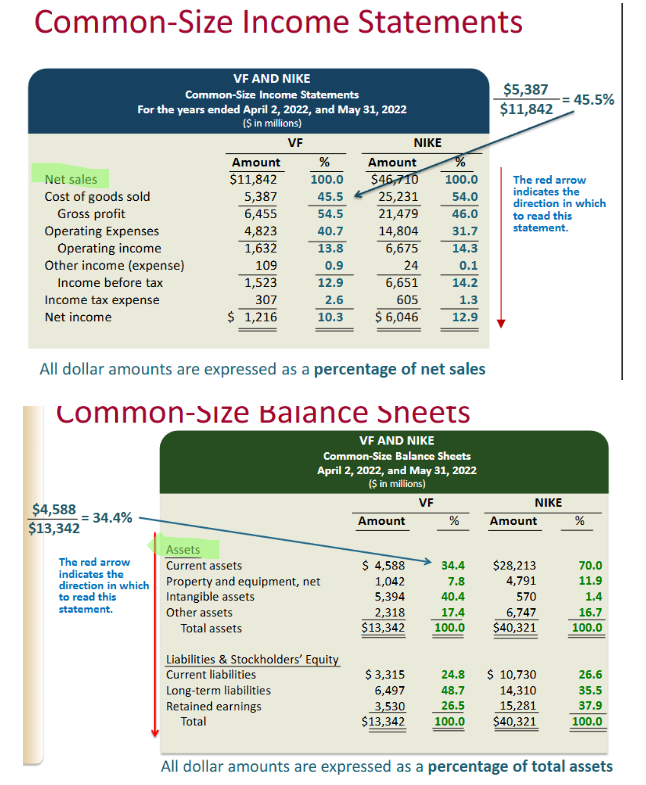

understand vertical analysis (2)

Expressing each item in a financial statement as a percentage of the same base amount measured in the same period

Income statement items expressed as a percentage of sales

Balance sheet items expressed as a percentage of total assets

In percentages instead of numbers

compare financial statements between companies of different size

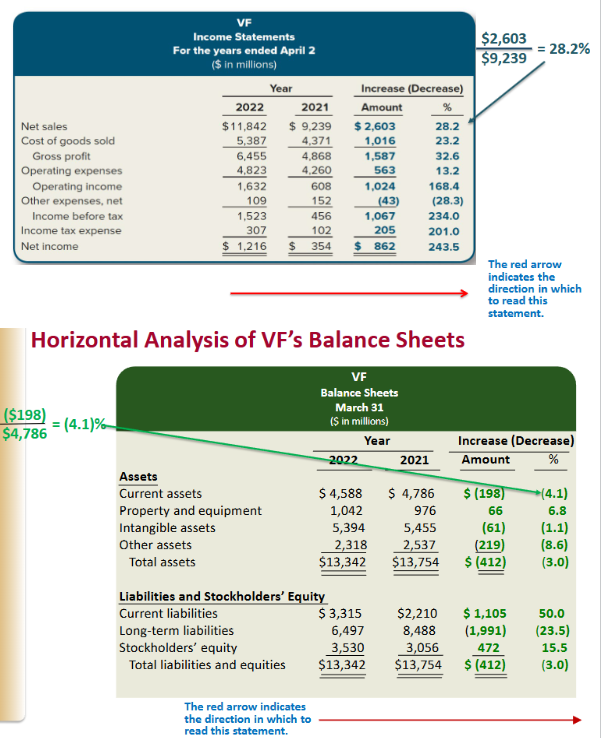

understand horizontal analysis (1)

Analyzing trends in financial statement data for a single company over time

Such as the amount of change and the percentage change, for one company over time

Find difference between years and then make that a percentage by dividing difference by older year

(new-old)/old

signals of low liquidity (2)

receivables turnover (low worse)

average collection (high worse)

inventory turnover (low worse)

average days in inventory (high worse)

current (low worse)

acid-test (low worse)

effect of transactions on liquidity ratios (1)

how does a transaction of current assets and current liabilities affect these ratios

current ratio: as assets and liabilities decrease, the ratio increases favorably to assets

growth stocks vs value stocks (1)

growth stock: shares focused on companies with high future earnings potential and revenue faster than the overall market

more risky

reinvests profits for expansion rather than paying big dividends

value stock: seeks established companies trading for less than their perceived worth

price earnings ratio is typically lower

higher dividend and less risky

price earnings ratio = stock price/earnings per share

comparing company earnings to earnings per share

earnings persistence (1)

current earnings that will continue or persist into future years

what do you currently do

different than one-time income items (not expected to persist)

conservative vs aggressive accounting (2)

Conservative:

Result in Reporting

Lower income

Lower assets

Higher liabilities

Aggressive:

Result in Reporting

Higher income

Higher assets

Lower liabilities