Money Growth & Inflation - Principles of Macroeconomics

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

The Value of Money

P = the price level

(e.g., the CPI or GDP deflator)

P is the price of a basket of goods, measured in

money.

• 1/P is the value of $1, measured in goods.

• Example: basket contains one candy bar.

–If P = $2, value of $1 is 1/2 candy bar

–If P = $3, value of $1 is 1/3 candy bar

• Inflation drives up prices and drives down the

value of money.

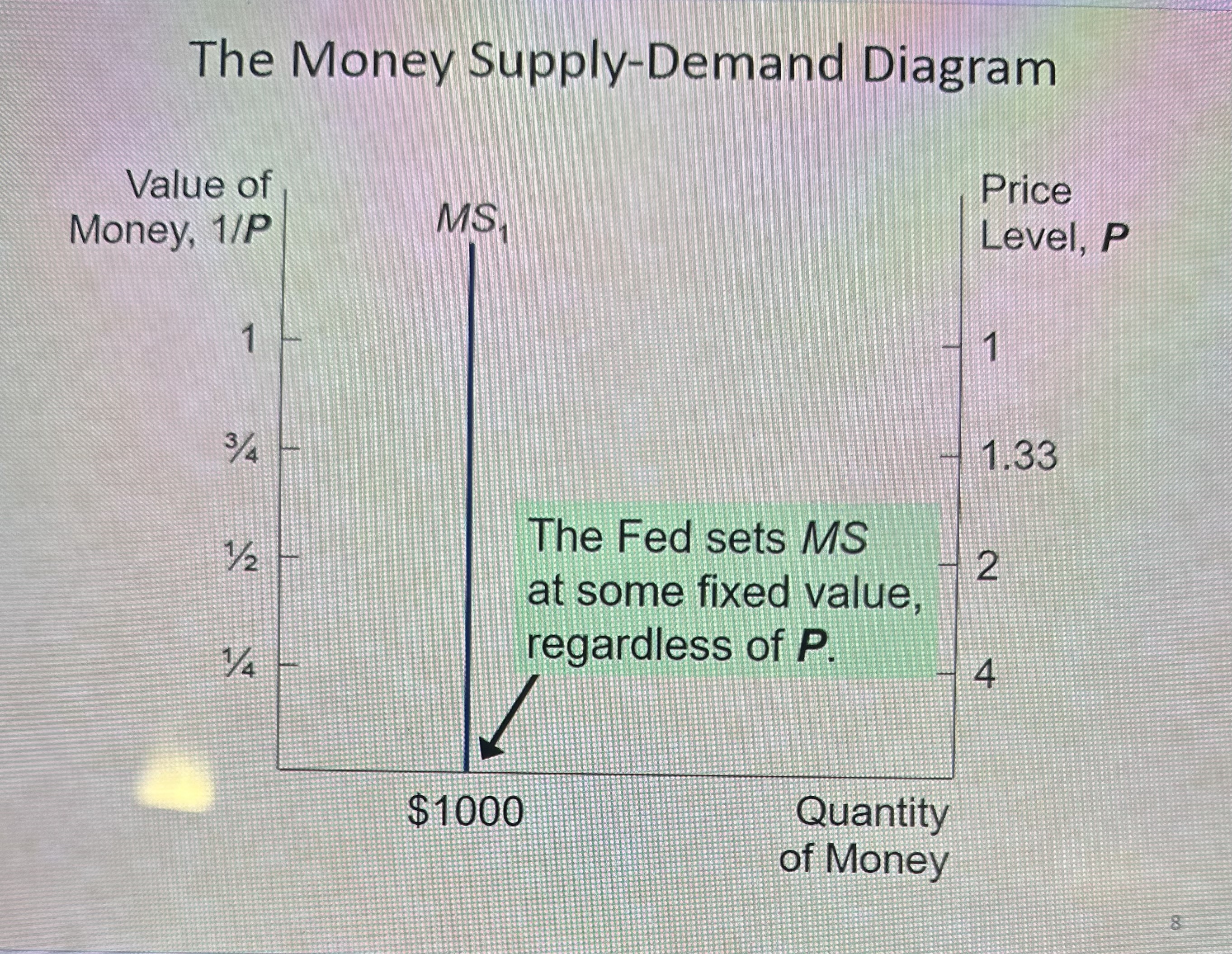

Money Supply (MS)

In the real world the money supply is

determined by the Fed, the banking system,

and consumers.

• In this model, we assume the Fed precisely

controls MS and sets it at some fixed amount.

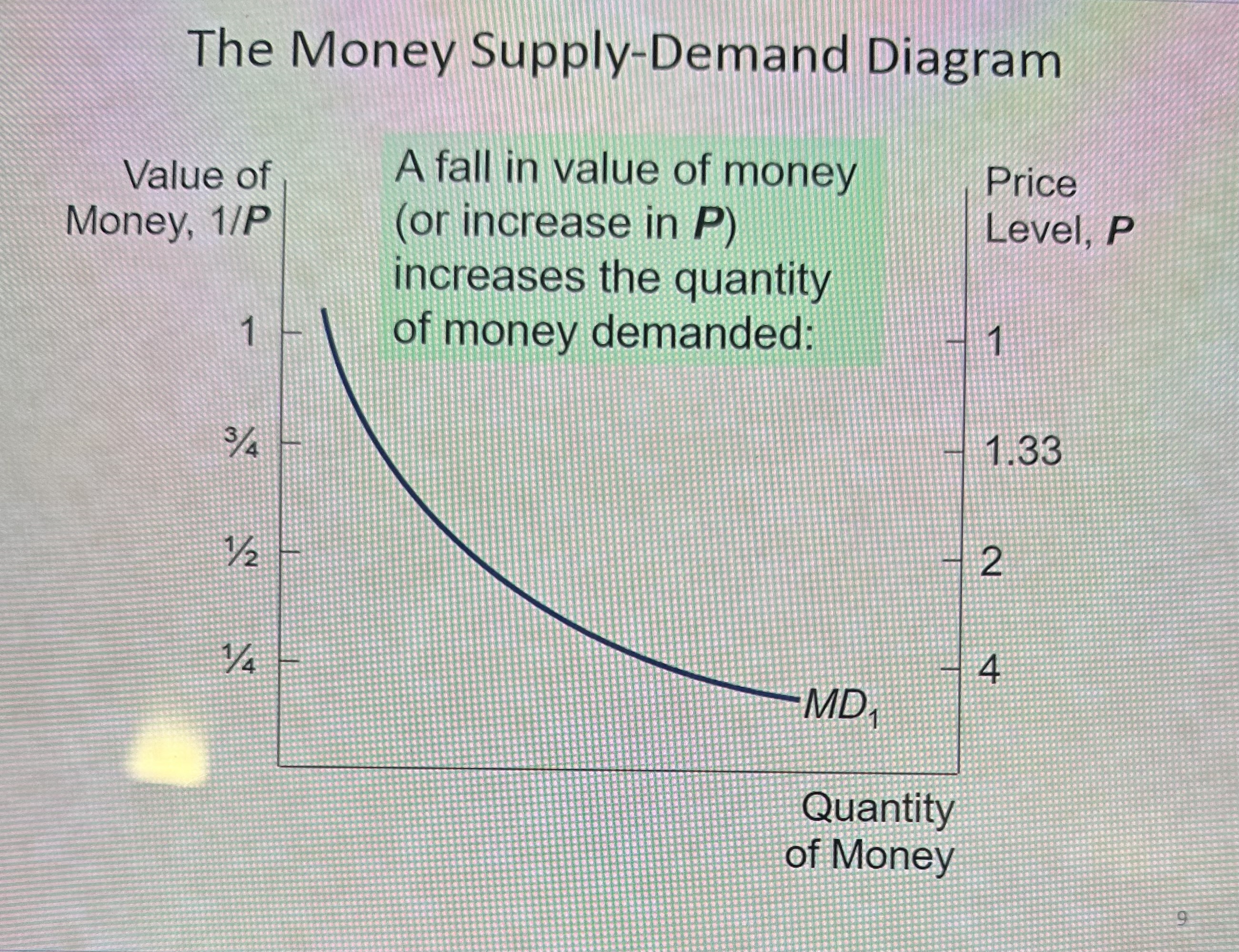

Money Demand (MD)

Refers to how much wealth people want to

hold in liquid form.

• Depends on P:

An increase in P reduces the value of money,

so more money is required to buy goods and

services.

• Thus, quantity of money demanded

is negatively related to the value of money

and positively related to P, other things equal.

(These “other things” include real income,

interest rates, availability of ATMs.)

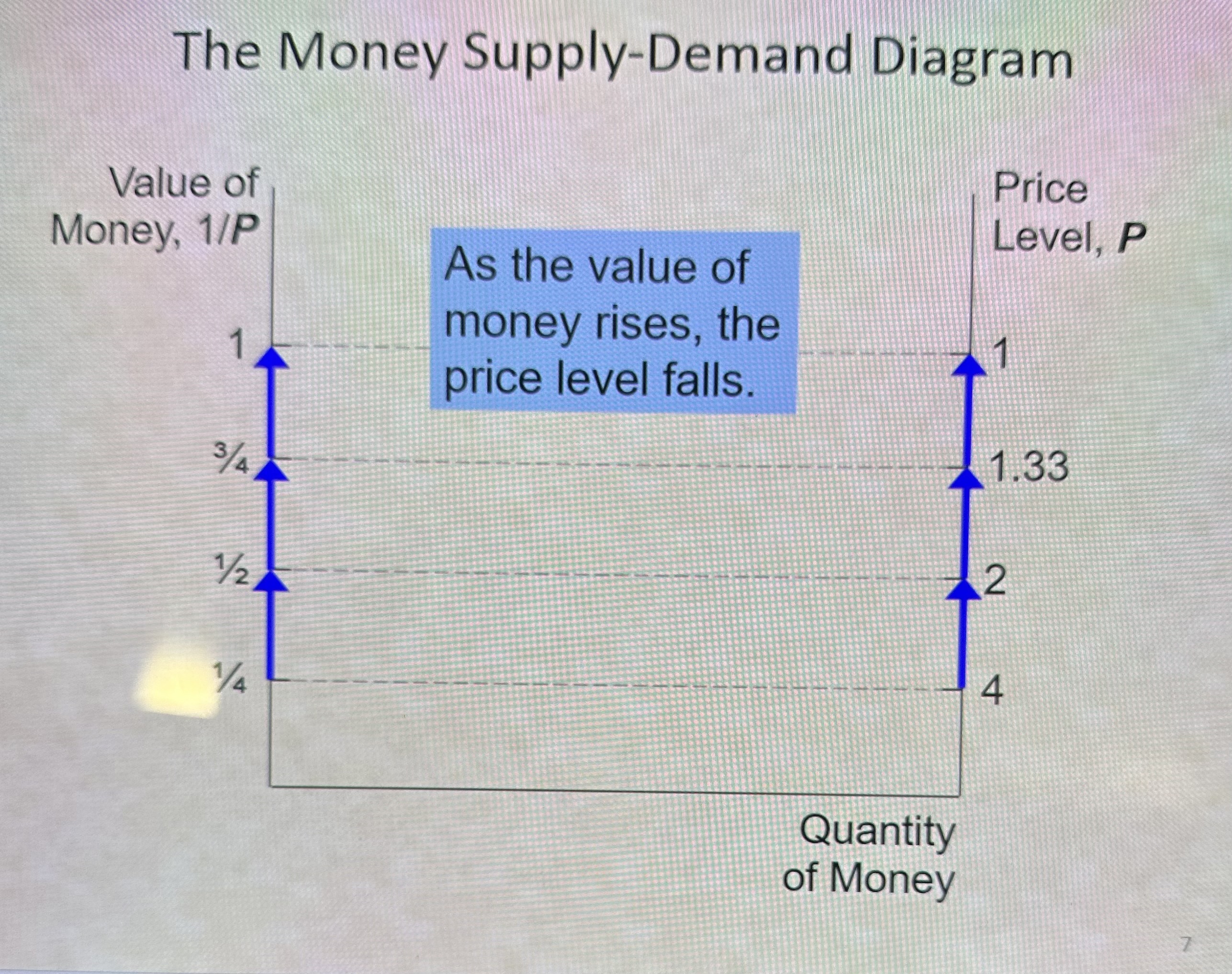

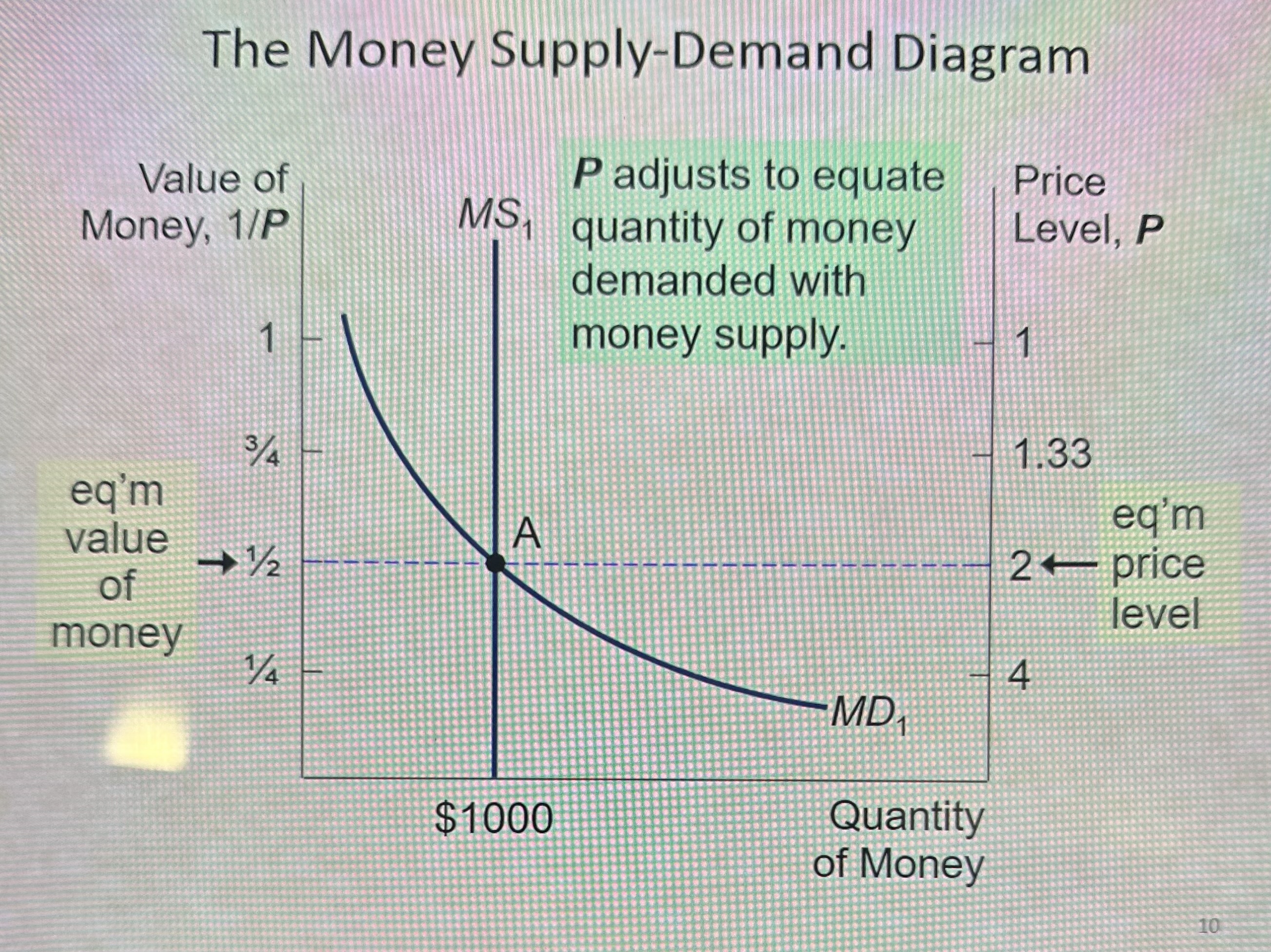

The Money Supply-Demand Diagram

The Money Supply-Demand Diagram pt. 2

The Money Supply-Demand Diagram pt. 3

The Money Supply-Demand Diagram pt. 4

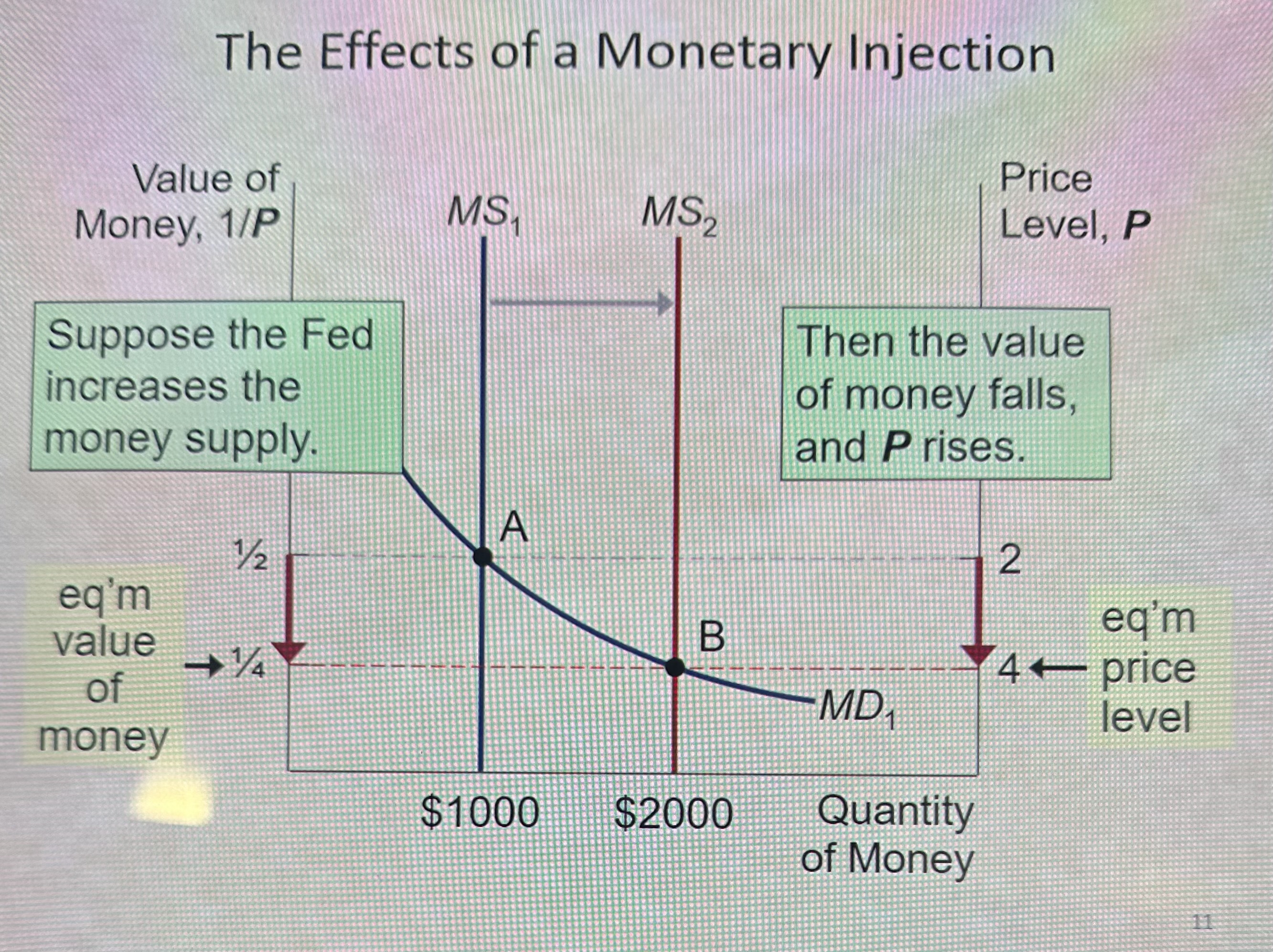

The Effects of a Monetary Injection

Real vs. Nominal Variables

Nominal variables are measured in monetary

units.

Examples: nominal GDP,

nominal interest rate (rate of return measured in $)

nominal wage ($ per hour worked)

• Real variables are measured in physical units.

Examples: real GDP,

real interest rate (measured in output)

real wage (measured in output)

Real vs. Nominal Variables example Prices are normally measured in terms of money.

– Price of a t-shirt: $15/t-shirt

– Price of a pepperoni pizza: $10/pizza

Prices are normally measured in terms of money.

– Price of a t-shirt: $15/t-shirt

– Price of a pepperoni pizza: $10/pizza

A relative price is the price of one good relative to

(divided by) another:

– Relative price of t-shirts in terms of pizza:

price of t-shirt

price of pizza

$15/t-shirt/

$10/pizza

=

Relative prices are measured in physical units so they are real variables.

Real vs. Nominal Wage

An important relative price is the real wage:

W = nominal wage = price of labor, e.g., $15/hour

P = price level = price of g&s, e.g., $5/unit of output

Real wage is the price of labor relative to the price

of output: w/p = $15/hour/$5/unit of output.

The Neutrality of Money

Monetary neutrality: the proposition that changes

in the money supply do not affect real variables

• Doubling money supply causes all nominal prices

to double; what happens to relative prices?

• Initially, relative price of t-shirt in terms of pizza is

price of t-shirt

price of pizza = 1.5 pizzas per t-shirt

$15/t-shirt

$10/pizza

=

After nominal prices double,

price of t-shirt

price of pizza = 1.5 pizzas per t-shirt

$30/t-shirt

$20/pizza

=

The relative price

is unchanged.

The Neutrality of Money pt.2

Monetary neutrality: the proposition that changes

in the money supply do not affect real variables

10The Neutrality of Money

• Similarly, the real wage W/P remains unchanged, so

– quantity of labor supplied does not change

– quantity of labor demanded does not change

– total employment of labor does not change

• The same applies to employment of capital and

other resources.

• Since employment of all resources is unchanged,

ttotal output is also unchanged by the money supplyput is also unchanged by the money supply

The Velocity of Money

Velocity of money: the rate at which money

changes hands

• Notation:

P x Y = nominal GDP

= (price level) x (real GDP)

M = money supply

V = velocity

• Velocity formula: V = P x Y/ M

The Velocity of Money example Example with one good: pizza.

Y = real GDP = 3000 pizzas

P = price level = price of pizza = $10

P x Y = nominal GDP = value of pizzas = $30,000

M = money supply = $10,000

V = velocity = $30,000/$10,000 = 3

The Quantity Equation

Multiply both sides of formula by M:

M x V = P x Y

• Called the quantity equation

• Relates directly to Quantity Theory:

– Money supply growth causes inflation

• Assumes relatively constant V & Y

The Inflation Tax

When tax revenue is inadequate and ability to

borrow is limited, government may print

money to pay for its spending.

This results in an inflation tax:

printing money causes inflation, which is like

a tax on everyone who holds money.

• The inflation tax is our first cost of inflation

The inflation fallacy

most people think

inflation erodes real incomes.

• But inflation is a general increase in prices

of the things people buy and the things they sell

(e.g., their labor).

• In the long run, real incomes are

determined by real variables, not the

inflation rate.