what to do with profits

1/14

Earn XP

Description and Tags

financial ratios

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

responsibilities of financial manager

financial planning

investment(spending money)

financing (raising money)

goal of financial manager

maximise value of firm

consider ST and LT consequences of buisinesses’ actions

maximising profits

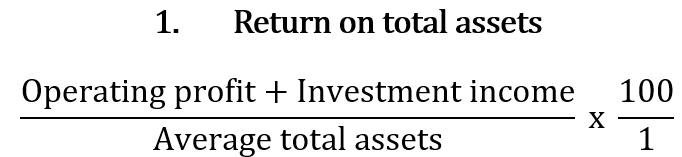

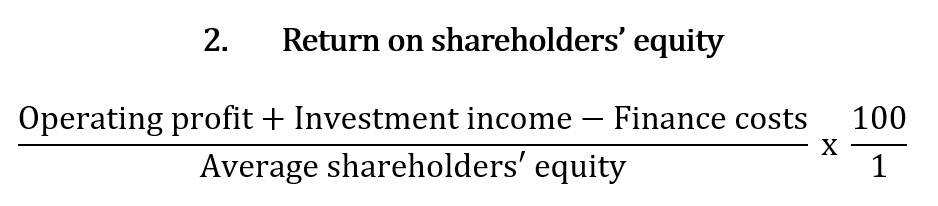

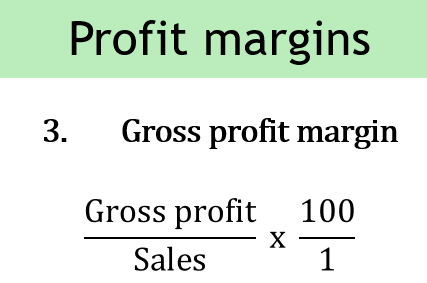

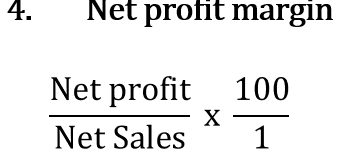

profitability ratios

return on assets

return on shareholders equity

return on assets

return on shareholders equity

gross profit margin

net profit margin

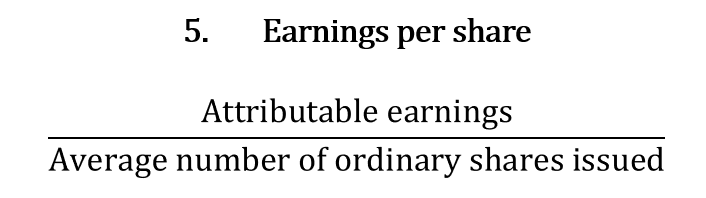

earnings per share

retained earning

profits not paid out

ways to apply retained earnings in business

invest in surplus finds

expand exisiting capacity and capabilities

create new product lines

expand externally through mergers & aquasitions

purchase patents

dividends as a soruce of return of shareholders

regular payments from after-tax profits earned over a lifetime of share ownership

capital growth as source of return of shareholders

increase in share price , only realise (earn) this return when sell the share

investor perspective 1

stable & growing dividends assigned to s/h of good fundamentals

dividends significant portion of total shareholders return

dividend history NB

future dividends and capital growth not guaranteed

investor perspective 2

mature & slower growing companies pay higher dividends (lower risk for buyers of shares)

younger & faster growing divs pay lower divs & reinvested in high-growth opportunities

dividends NB indicator when company is valued

companies perspective: dividends policy

rewards s/h now vs investing in growth opportunities that will reward s/h in future

factors influencing dividend policy

financial performance: profitability, cash flows, div coverage ratio

balance sheet strength: retained earnings, debt levels

legal contraints

investor expectations

most companies strive NOT to reduce divs even if experiencing difficulty

div policy not one size fits all