CFA - Fixed Income

1/103

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

The provisions of a recourse loan are most likely structured to protect:

A.) the lender from other creditors claims on the borrower’s property

B.) the borrower from incurring penalties in the event of missed payment

C.) the lender from shortfall between the loan balance and the proceeds received from the sale of the property in the event of a foreclosure

Answer: C.) the lender from shortfall between the loan balance and the proceeds from the sale of the property in the event of foreclosure

If a mortgage is a recourse loan, the lender has a claim against the borrower for the shortfall between the amount of the outstanding mortgage balance and the proceeds received from the sale of the property.

however, having a recourse loan does not protect borrowers from changes in the interest rate.

it also does not protect lenders from other creditors claims on the borrowers property.

A recourse loan gives the lender the right to pursue the borrower personally if the collateral (usually property) is insufficient to cover the full loan balance in the event of defualt.

What does this mean?

if the borrower defaults and the foreclosure sale does not fully cover the debt, the lender can go after the borrowers other assets or income to recover the shortfall

this provides greater protection to the lender compare to a non-recourse loan, where the lender can only claim the collateral.

Compared to an option-free, fixed-rate security, a floating-rate note most likely carries:

A.) Less interest rate risk in any interest rate environment

B.) less interest rate risk only when interest rates are rising

C.) greater interest rate risk in any interest rate environment

Answer: A.) Less interest rate risk in any interest rate environment

Interest rate risk is defined as the risk that a bonds value will be affected by fluctuating interest rates.

because their coupon rates are periodically reset to prevailing market rates, floating-rate notes (FRN) carry minimal interest rate risk.

As a result, FRNs typically trade close to their par value.

Although prices of FRNs may change in response to a change in the credit quality of their issuer, these securities carry less interest rate risk than plain vanilla fixed-rate securities in any interest rate environment.

A floating-rate note (FRN) is a bond whose coupon payments reset periodically based on a reference rate (LIBOR SOFR, or other benchmark) plus a fixed spread.

Because the coupon adjusts with market interest rates, FRN exhibit:

Lower duration than fixed-rate bonds

Reduced sensitivity to interest rate changes (lower price volatility)

This makes them less exposed to interest rate risk than fixed-rate, option-free bonds in any interest rate environment - whether rates are rising or falling.

The role of a special purpose vehicle (SPN) in the securitization process is most likely to:

A.) Originate the loans

B.) Issue asset-backed securities to investors

C.) Collect principal and interest payments from borrowers

Answer: B.) Issue asset-backed securities to investors

The seller is the party who originates the loans.

The SPV the party who buys loans from the seller and sells asset-backed securities to the investors.

The servicer is the party who collects principal and interest.

In the securitization process, a Special Purpose Vehicle (SPV) or Special Purpose Entity (SPE) plays a central role by:

Purchasing a pool of financial assets (mortgages, loans) from originator

Issuing asset-backed securities (ABS) to investors, backed by those assets

Acting as a bankruptcy-remote entity, which isolates the financial risk of the originator from the securities

As a company’s financial position worsens, which of the following will most likely to occur first?

A.) The market price of its debt will increase

B.) Rating agencies will downgrade its issues

C.) The company will renegotiate the terms of its debt

A.) The market price of its debt will decrease

Changes in a company’s financial position are first reflected in adjustments to the market price of risk.

In a well functioning markets, investors can react quickly to a deteriorating financial position by requiring a higher yield as a compensation for holding the issuers debt.

Credit rating agencies typically downgrades issuers after changes in the market price of risk have already been observed.

Debt restructuring, which involves negotiating changes to the terms of outstanding debt, is usually only done in order to avoid an impending bankruptcy.

Market yields will already have adjusted before such action is taken.

Which of the following is most likely an example of an non-amortizing loan?

A.) Automobile loans

B.) Credit card receivables

C.) Traditional residential mortgage loans

Answer: B.) Credit card receivables

Traditional residential mortgage loans and automobile loans are examples of amortizing loans.

Credit card receivables are an example of non-amortizing loan.

A non-amortizing loan is a loan where there borrower is not required to pay down the principal on a fixed schedule.

Instead:

The borrower may make minimum payments (often covering only interest and fees.

The principal balance can remain unchanged or even grow over time

The loan is revolving - meaning the borrower can borrow, repay, and borrow again.

Credit card receivables are a prime example of non-amortizing debt because:

They are revolving lines of credit

Payments vary and may not reduce principal significantly

There is no fixed end date unless the account is closed

Which of the following statements about securitization is incorrect?

A.) The ABS that are created by securitization have characteristics similar to those of equity investments.

B.) Buying securitized debt helps investors increase exposure to the risk-return characteristics of a wider range of underlying assets

C.) Securitization transactions allow issuers to create risk-return characteristics to satisfy the risk tolerance of different investors.

Answer: A.) The ABS that are created by pooling loans and receivables have characteristics similar to those of a standard bond.

AR&C Limited leases private jets to corporations in North America for a fixed term of five years. AR&C retains ownership of the jets. The corporations make equal interest payments each month. If a customer defaults, AR&C can repossess the jet. AR&C has been in business for approximately fifteen years and has a B3 credit rating, meaning that its debt is non-investment grade. AR&C has $500 million in leases on its balance sheet that it wants to securitize into ABS.

Bond Class

A (Senior) - Tranche A Notes: Face Value = $250 million: Interest RAte: MRR + 1.00%: Maturity: One year

B (subordinated) - Tranche B Notes: Face Value = $100 million: Interest rate: MRR +2.00%: Maturity two years

C (subordinated) - `Tranche C Notes: Face Value: $100 million: Interest Rate: MRR +3.00%: Maturity Three years

D (subordinated) - Tranche D Notes: Tranche D Notes: Face Value: $50 Million: Interest rate: MRR + 4.00%: Maturity: Four years

Total: $500 million

Select which of the following statements related to the collateralized bonds issued directly by the SPE is most accurate.

A.)This senior/subordinated structure is an example of time tranching.

B.) Losses are realized by the subordinated bond classes before any losses are realized by Class A bonds.

C.) In a waterfall structure such as this one, losses are shared proportionally across all subordinated bond classes.

.

Answer: B.) Losses are realized by the subordinated bond classes before any losses are realized by Class A bonds.

Losses are realized by the subordinated bond classes before any losses are realized by the senior class A bonds.

This structure describes a senior-subordinated tranching in a securitization process, commonly referred to as a waterfall structure.

Key Concepts:

Senior/Subordinated Tranching (Credit Tanching):

Class A is the most senior - it gets paid first and bears losses last.

Classes B, C, and D are subordinated - they are paid after more senior classes and absorb losses first.

This structure enhances the credit quality of senior tranches (like class A), even if the underlying collateral is risky - as is the case here with AR&C’s B3 rating (non-investment grade)

Half of Mojofon’s senior unsecured bonds are issued by its major operating subsidiary, which contributes over 90% of the group’s cash flow and assets, and the remainder of the group’s senior unsecured bonds are issued by the holding company that relies on dividend unstreamed by its subsidiary. There is no cross-guarantee between the holding company and the subsidiary. In an event of default, it is most likely that:

A.) The unsecured bonds issued by the holding company will have a higher recovery rate.

B.) the unsecured bonds issued by the operating subsidiary will have a higher recovery rate.

C.) The recovery rate will be the same for all senior unsecured bonds since they rank pari passu with each other.

Answer: B.) The unsecured bonds issued by the operating subsidiary will have a higher recovery rate

Senior unsecured bonds issued by the holding company are said to be structurally subordinated to those issued by the major operating subsidiary.

debt at the operating subsidiary will be serviced by the cash flow and assets of the subsidiary first before any funds can be up streamed to the holding company to service debt at that level.

Since the operating subsidiary accounts for over 90% of the groups cash flow and assets but only half of the groups senior unsecured debt, the holdign company debt can only be serviced after the operating subsidiary debt it paid in full.

the unsecured bonds issued by the subsidiary will most likely have higher recovery.

In a corporate structure where:

The major operating subsidiary generates 90%+ of the group’s cash flows and holds most of the assets.

The ho’slding company relies on dividends from the subsidiary to meet its obligations

No cross guarantee exists between the subsidiary and the holding company

Then in the event of a default or bankruptcy, the subsidiary’s creditors have direct claims on the operating assets, while the holding company’s creditors do not.

instead, the holding companys ability to repay depends on:

Receiving dividends or payments upstream from the subsidiary

These payments may be restricted or subordinated in a default scenario

Implications: Subsidiary bondholders (those with claims directly on the cash-generating entity) will typically recover more, because:

they have first access to the operating cash flows and assets.

Their claims are not structurally subordinated

Holding company bondholders are effectively structurally subordinated, since they depend on the residual value after subsidiary creditors are paid.

Which industry characteristics most likely has a positive effect on a company’s ability to service debt?

A.) Low barriers to entry in the industry

B.) High number of suppliers to the industry

C.) Broadly dispersed market share among large number of companies in the industry

Answer: B.) High number of suppliers to the industry

An industry with a high number of suppliers reduces the suppliers negotiating power, thus helping companies control expenses and aiding in the servicing of debt.

An industry with a high number of suppliers tends to offer greater input flexibility and bargaining power for the companies operating within it.

This often results in:

Lower input costs

Improved margins

Greater operational efficiency

All of which support higher and more stable cash flows, thus enhancing a companys ability to service debt.

A fixed income security has an approximate modified duration of 10.3 and an approximate convexity adjustment factor of 88.5. If the yield increases from 5.1% to 6.9%, the estimated percentage decrease in the bonds price is closes to:

A.) 15.7%

B.) 17.1%

C.) 20.0%

Answer: B.) 17.1%

The estimated percentage change due to approximate modified duration is simply:

Duration Effect

-Approximate modified duration Change y 100

-10.3 × 0.018 × 100 = -18.54

The approximate convexity adjustment can be calculated from the following formula:

Approximate Convexity Adjustment

½ x C x (Change y)² x 100

½ x 88.5 x (0.018)² * 100 = 1.434

Total percentage change is:

-18.54% - 1.434% = - 17.11%

A characteristic of negotiable certificates of deposit is:

A.) they are mostly available in small denominations

B.) they can be sold in the open market prior to maturity

C.) a penalty is imposed if the depositor withdraws funds prior to maturity

Answer: B.) they can be sold in the open market prior to maturity

A negotiable certificate of deposit (CD) allows any depositor (initial or subsequent) to sell the CD in the open market prior to maturity

Negotiable certificates of deposit (CDs) are large denomination time deposits issued by banks that:

Can be traded on the secondary market - this makes them negotiable

Are typically issued in denominations of $100,000 or more

Have fixed maturities and interest rates

Their negotiability allows investors to sell them before maturity without incurring an early withdrawal penalty, unlike traditional (non-negotiable) CDs.

Which of the following statements best characterizes external strength for a non-reserve currency sovereign country?

A.) The ability to impose and enforce strict capital controls

B.) The establishment of a fixed exchange rate regime

C.) The ability to generate sufficient stable foreign currency cash inflows

C.) The stability to generate sufficient stable foreign currency cash inflows

A key factor influencing whether a non-reserve currency sovereign government can meet external debt obligations is external liquidity and solvency, or the ability to generate sufficient, stable foreign currency inflows to meet interest and principal payments on external debt.

External strength for a non-reserve currency soveriegn refers to the country’s ability to:

Meet its external obligations (such as debt payments, imports, etc.)

Maintain currency stability

Build and sustain foreign exchange reserves

The most important factor is the country’s ability to earn foreign currency reliability and consistency - typically through:

Exports

Foreign direct investment (FDI) inflows

Tourism

Remittances

This ensures that the country can service external debt, stabilize its currency, and avoid balance of payments crises

If a default occurs in a non-recourse commercial mortgage-backed security, the lender will most likely:

A.) Recover prepayment penalty points paid by the borrower to offset losses

B.) use only the proceeds received from the sale of the property to recover losses

C.) initiate a claim against the borrower for any shortfall resulting from the sale of the property.

Answer: B.) use only the proceeds received from the sale of the property to recover losses.

In a non-recourse CMBS, the lender can look only to the income producing property backing the loan for interest and principal repayment.

if a default occurs, the lender can use only the proceeds from the sale of the property for repayment and has no recourse to the borrower for any unpaid balance.

In a non-recourse commercial mortgage backed security (CMBS), the loan is secured solely by the underlying property.

if the borrower defaults:

the lender has no legal claim against the borrowers other assets

the lender can only seize and sell the collateral property.

if the sale proceeds are insufficient to cover the outstanding loan balance, the lender absorbs the loss - the borrower is not personally liable for the shortfall.

The CDO tranche with a credit rating status between senior and subordinated bond classes is called the:

A.) equity tranche

B.) Residual tranche

C.) Mezzanine tranche

Answer: C.) Mezzanine Tranche

The mezzanine tranche consists of bond classes with credit ratings between senior and subordinated bond classes

In a collateralized debt obligation (CDO) structure, traches are typically divided into three levels based on credit risk and payment priority:

Senior tranche

Highest credit rating (AAA)

Paid first

Lowest risk, lowest yield

Mezzanine tranche

Intermediate level between senior and equity

Medium credit rating (BBB to BB)

Bears more risk than senior, but less than equity

Offers higher yield to compensate for increased risk

Equity Tranche (or residual Tranche)

lowest in the payment priority

absorbs first losses

often unrated

highest risk, highest potential return

The rating agency process whereby the credit ratings on issues are moved up or down from the issuer rating best describes:

A.) notching

B.) pari passu ranking

C.) cross-default provisions

Answer: A.) Notching

Recognizing different payment priorities, and thus the potential for higher (or lower) loss severity in the event of default, the rating agencies have adopted a notching process whereby their credit rating on issues can be moved up or down from the issuer rating (senior unsecured)

Notching refers to the adjustment of credit ratings upward or downward for specific debt issues relative to the issuer’s overall credit rating.

Rating agencies use notching to reflect the differences in credit risk between various securities issued by the same entity

For example, a secured bond might receive a higher rating than the issuer’s general credit rating, while a subordinated bond might receive a lower rating.

Securitization is beneficial for banks because it:

A.) repackages bank loans into simpler structures

B.) Increases the funds available for banks to lend

C.) allows banks to maintain ownership of their securitized assets.

Answer: B.) Increases the funds available for banks to lend

Securitization increases the funds available for banks to lend because it allows banks to remove loans from their balance sheets and raise funds that are backed by those loans.

securitization repackages relatively simple debt obligations, such as bank loans, into more complex, not simpler, structures.

Securitization involves transferring ownership of assets from the original owner - in this case, the banks - into a special legal entity.

As a result, banks do not maintain ownership of the securitizated assets.

Securitization allows banks to sell pools of loans (mortgages, auto loans, credit card receivables) to a special purpose vehicle (SPV), which then issues asset backed securities (ABS) to investors.

This process is beneficial to banks because it:

Frees up capital and liquidity, allowing banks to:

Remove assets from their balance sheets

Reduce credit risk and regulatory capital requirements

Use proceeds from the sale to fund new loans.

Ultimately, this increases the amount of capital available to lend, thereby expanding their lending capacity.

A Treasury bill with a face value of $1,000,000 maturing in 75 days is quoted at a discount rate of 2.3% for an assumed 360 day year. This bill price is closest to:

A.) $981,792

B.) $995,200

C.) $995,231

Answer: B.) $995,200

The formula for price given yield is:

Price = FV x (1 - (days remaining/days per year) x DR)

Where

FV is the face value

DR is the discount rate

in this example:

Price = $1,000,000 x (1 - (75/360) x 2.3%) = $995,208

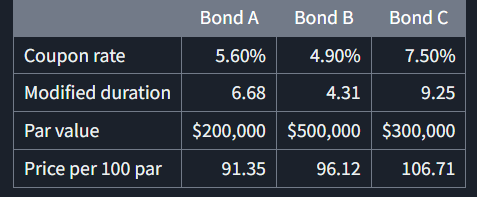

A fixed-income portfolio is composed of the following securities:

The portfolio’s approximate modified duration is closest to:

A.)6.27

B.) 6.36

C.) 6.75

Answer: B.) 6.36

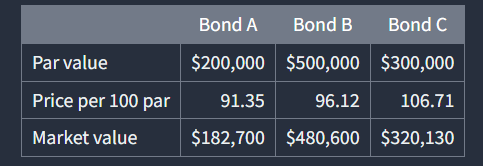

A portfolios approximate modified duration is simply the market value weighted average approximate modified duration of its components.

the market values of the securities in this example are:

The approximate modified duration of the portfolio in this example is calculated as follows:

(6.68 x $182,700 + 4.31 x $480,600 + 9.25 x $320,130)/ ($182,700 + $480,600 + 320,130) = 6.36

All else equal, which of the following actions would most likely cause a bond’s price to be less sensitive to a small, parallel shift in a benchmark yield curve?

A.) Lengthening its maturity

B.) Lowering its coupon rate

C.) Adding an embedded put option

Answer: C.) Adding an embedded put option

An investor of a bond will have lower interest rate risk if it is putable since that gives her a right to sell the bond if interest rates rise.

Compared to an otherwise equivalent option-free bond, a putable bond will lose less value as interest rates rise.

Unlike a callable bond, a putable bond does not exhibit negative convexity as interest rates fall because issuers are not able to repurchase putable bonds and force lenders to reinvest the proceeds in a lower interest rate environment.

All else equal, bonds of shorter maturities and higher coupon rates also have lower interest rate risk

A bond’s price sensitivity to changes in interest rates is primary measured by its duration.

The higher the duration, the more sensitive the bond is to interest rate changes.

Adding an embedded put option

Gives the bondholder the right to sell the bond back to the issuer at a specified price before maturity.

This limits downside price risk when interest rates rise (which would otherwise cause bond prices to fall)

As a result, the duration is lower, and the bond becomes less sensitive to interest rate increases

Which of the following statements is most accurate? The yield spread for a corporate bond relative to on the run US Treasury security of the same maturity:

A.) cannot be negative

B.) must be negative if the corporate bond is trading above its par value

C.) may be negative if the corporate bond contains an embedded option

Answer: C.) may be negative if the corporate bond contains an embedded option

It is possible that the yield spread is negative for a corporate bond with an embedded put option, which investors value because it grants the right to sell bonds back to their issuer if interest rates rise.

Investors may require less compensation for holding a putable corporate bond than an option-free US Treasury security of the same maturity (a negative yield spread)

Whether a corporate bond trades above its par value is a function of its coupon rate and expected future cash flows relative to the yield required by investors.

a bond trading above its par value does not necessarily have a negative yield spread relative ot an on the run US treasury security of the same maturity.

The yield spread between a corporate bond and a comparable on the run US Treasury reflects differences in credit risk, liquidity, and embedded features

May be negative if the corporate bond contains an embedded option

True - a corporate bond with a valuable embedded feature (a put option or convertibility) could trade at a lower yield than Treasuries

This lowers the required yield due ot the option value, potentially resulting in a negative spread.