2.3.3 - long run AS

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

2 views of how LRAS works in an economy

og view = classical

John Maynard Keynes’ view (1936) = Keynesian

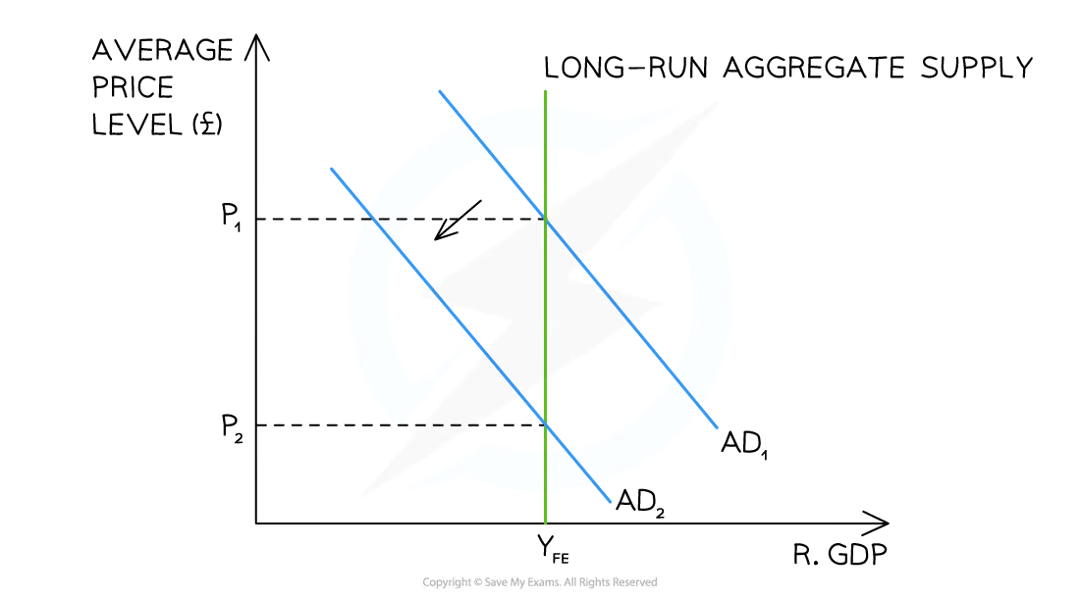

what is the classical LRAS view

LRAS is perfectly inelastic (vertical) at a point of full employment of all available resources

same as being on the boundary of a PPF

this quantity is referred to as YF or YFE

why does the classical view say its at a point of full employment

it believes that in the long run the economy will always return to its full employment level of output

(think the straight and wiggly line like in the trade/business cycle)

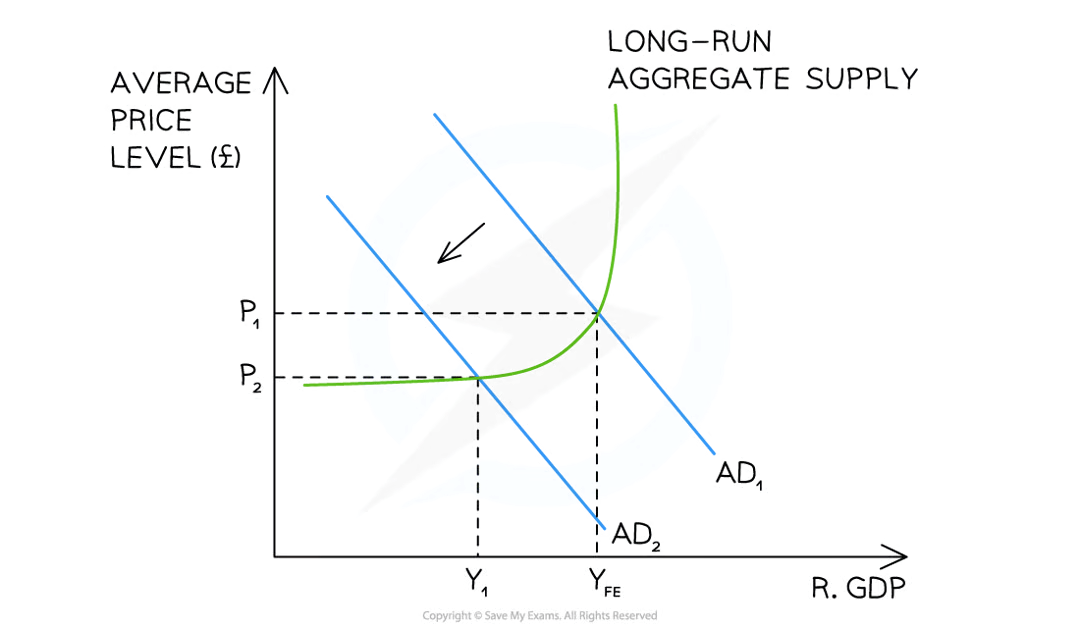

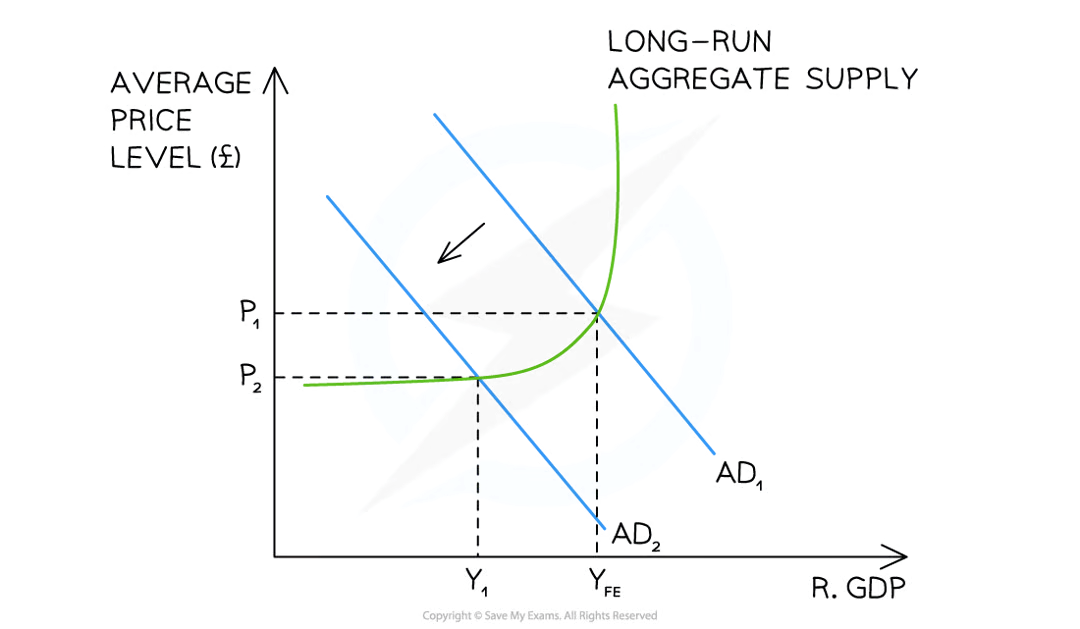

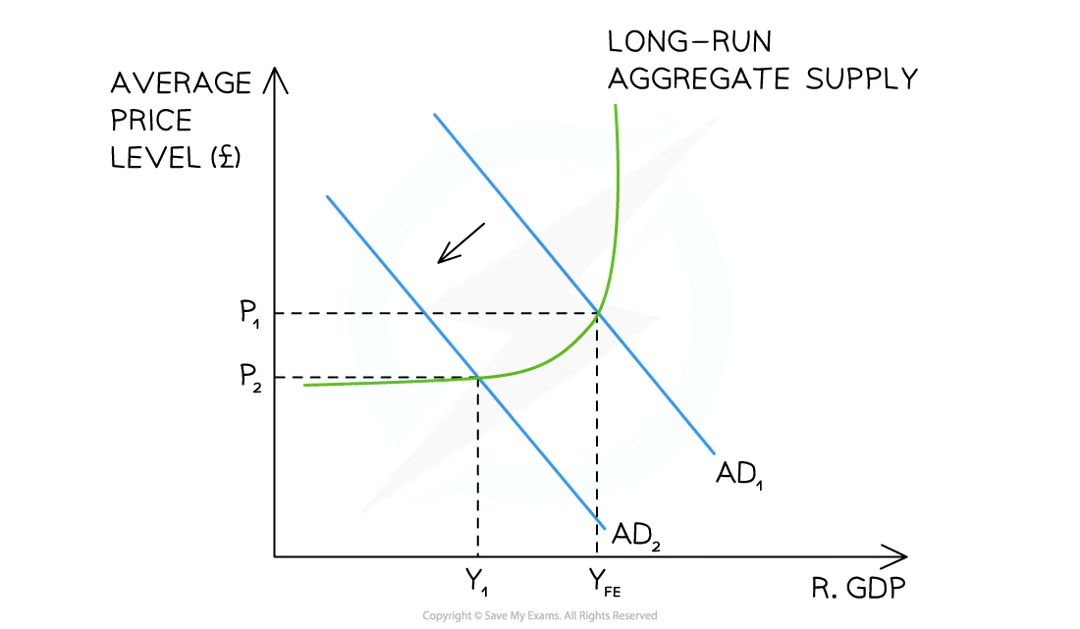

what does keynes believe ab LRAS

that the curve is L shaped (as pictured)

explain the L shaped graph

supply elastic at lower levels of output because there is lots of spare production capacity in the economy (can increase output without raising prices/without high opportunity cost)

like a PPF, it starts to get more and more inelastic as the curve goes on (employing less and less suitable FoPs)

until it reaches Y(FE) (full employment), where supply becomes perfectly inelastic (vertical) - must now raise prices to increase output as it competes for scarce resources

what does keynes believe ab the economy self correcting to full employment levels

it won’t always do so, as it can get stuck at an equilibrium well below full employment level (eg. the great depression)

what does keynes believe we should therefore do in a recession

the government should spend lots, so that AD shifts right, which will change the ANIMAL SPIRITS in the economy, thus re-stimulating the economy

two types of output gaps that could present themselves

inflationary (positive) gap

recessionary (negative) gap

inflationary output gap

when real GDP exceeds potential GDP

can develop during extreme economic growth periods

CLASSICAL: will self correct in the long run - return to the long run level of output but at a higher average price level

KEYNES: not usually seen on a keynesian LRAS

(on a diagram this is the AD curve shifting outwards)

recessionary (negative) output gap

when real GDP is less than potential GDP

can develop during slowdowns/recessions

CLASSICAL: will self correct in the long run - return to long run level of output but at a lower average price level

KEYNES: might stay at that equilibrium for a while

(on a diagram this is the AD curve shifting inwards)

2 key things to take away from this graph (one about the output gap, one evaluation point)

recessionary gap = space between Y1 and YFE

can get to a point where output is lowering but prices aren’t (good evaluation)

what kind of thing will be a factor influencing the LRAS of an economy

any factor that changes the quantity or quality of a FoP

will result in a shift in the PPF and the LRAS curve of the economy (in the same direction, either outwards or inwards)

6 examples of things that could affect LRAS

tech advances - more fops

changes in relative productivity - better fops

changes in education + skills - better fops

changes in government regulations (bureaucracy) - more fops

demographic changes + migration - more fops

competition policy - better fops

define productivity

output per unit of input used