step 4: 8. Further Accounting Standards

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

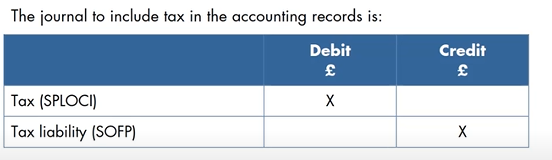

Accounting for tax

tax charge: expense (SPLOCI)

tax liability: liability (SOFP)

under-provision or over-provision of tax is adjusted in the ____ financial statement

next

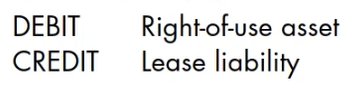

lease is a contract, or part of a contract, that conveys the right of use of an asset for a period of time in exchange for consideration

lease is a contract, or part of a contract, that conveys the right of use of an asset for a period of time in exchange for consideration

lease is a _______, or part of a contract, that conveys the right of use of an asset for a period of time in exchange for ______

contract

consideration

lessor

ownership of the asset

lessee

right to use the asset for an agreed period of time, in return of consideration (payment)

lease term: ___________ period for which the lessee has the right to use the underlying asset

non-cancellable

fair value

amount for which the asset can be exchanged (or liability settled) = same as the purchase price of the asset

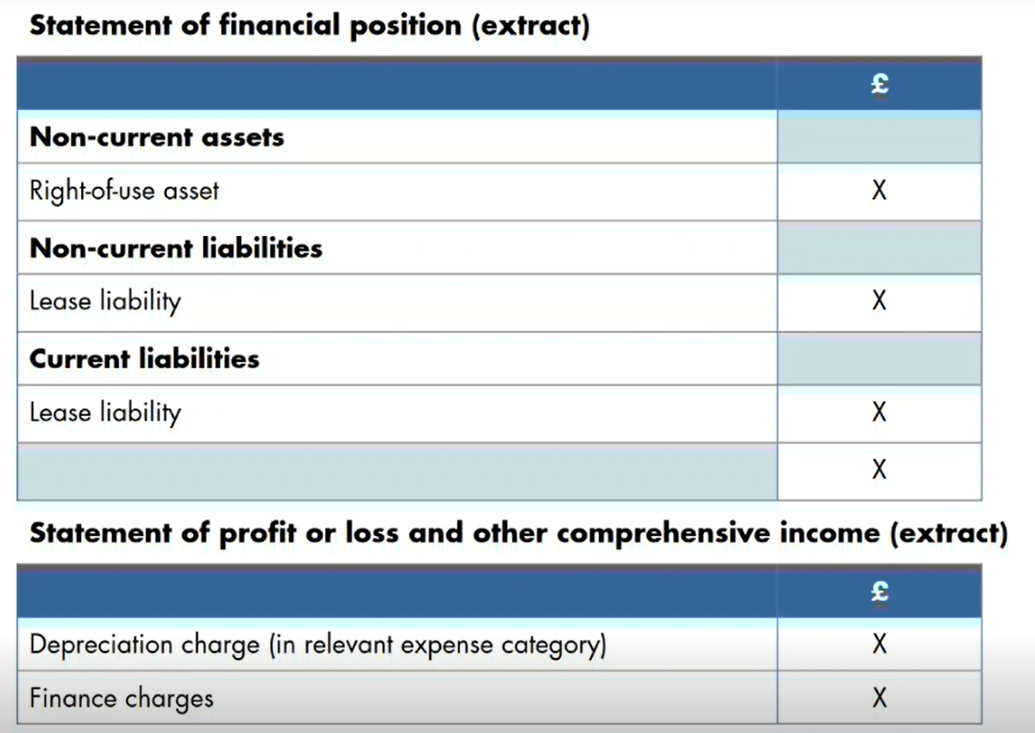

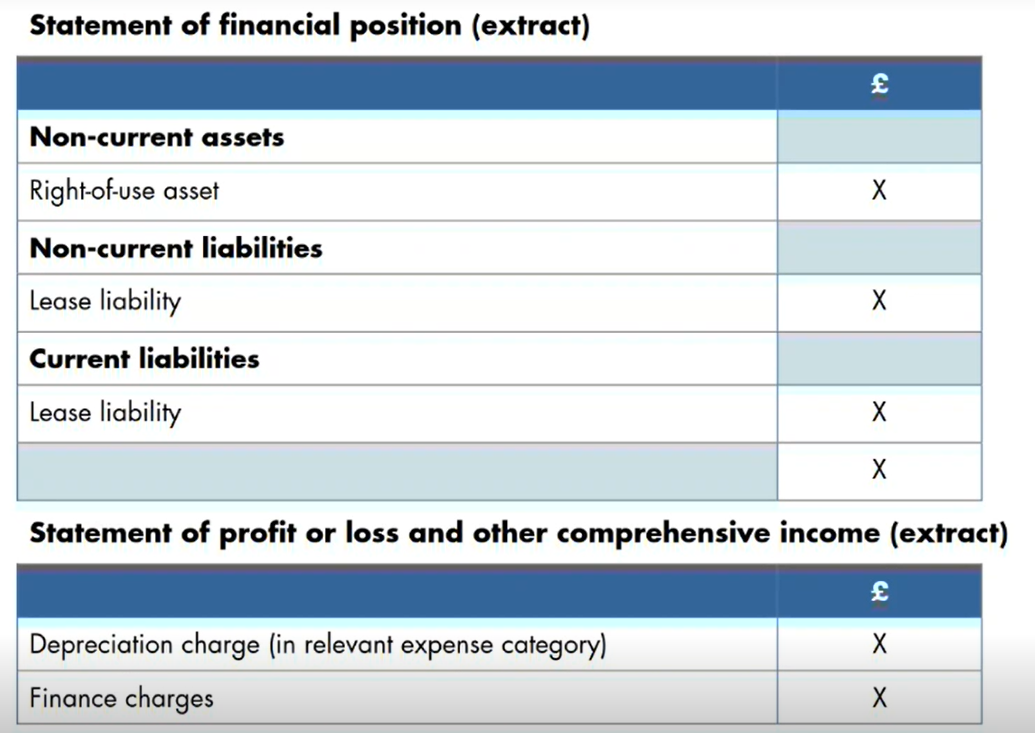

depreciation on a lease

depreciated over the shorter on the lease term and useful life of the asset

which type of leases are not recognised in SOFP

short term leases <1 year

low value asset leases

In SPL as expense

straight line depreciation

identifying a lease (3)

right to control - direct use of the asset

identified asset

period of time - e.g. may be the number of units produced by a machine

right of use asset must be depreciated over:

useful life of the asset, if you plan to buy at the end

shorter of the lease term and useful life if you don’t plan to buy

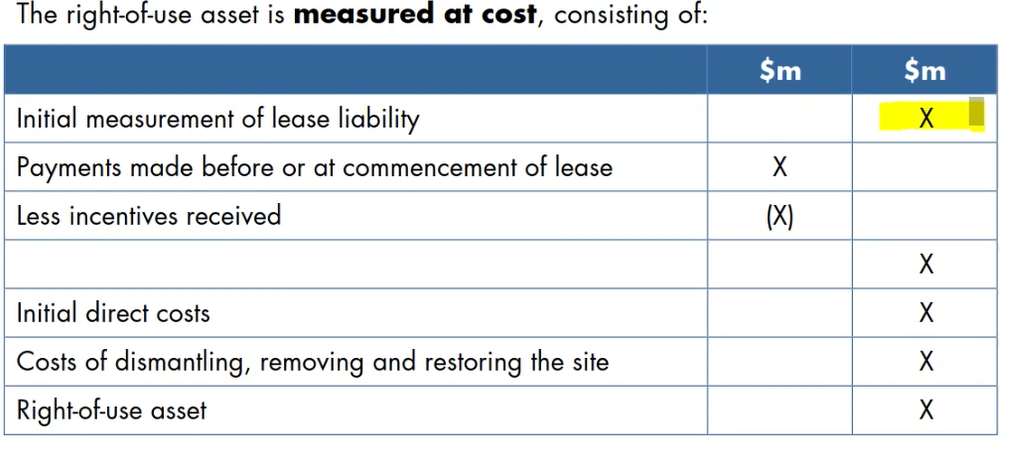

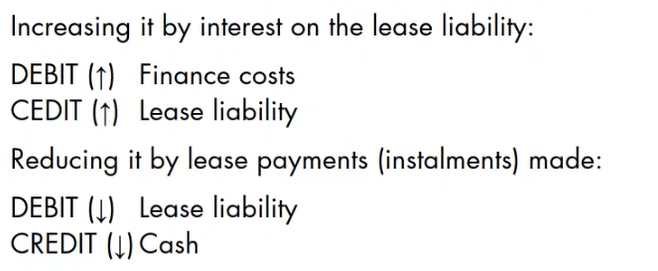

subsequent measure of lease liability

a lease that contains a purchase option cannot be a _____ lease, so are put into SOFP

short

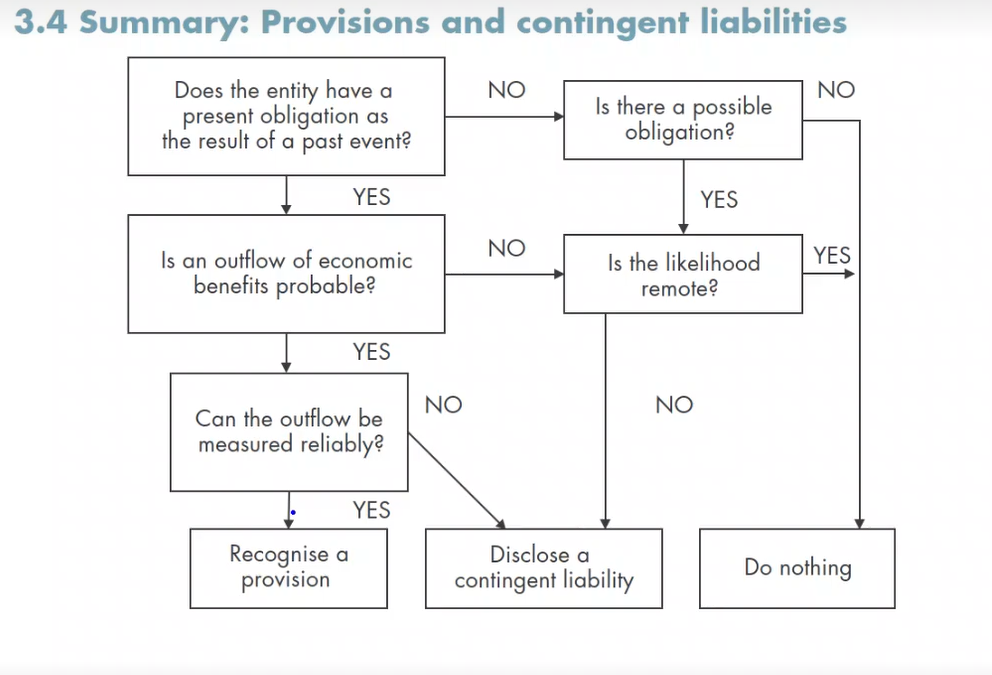

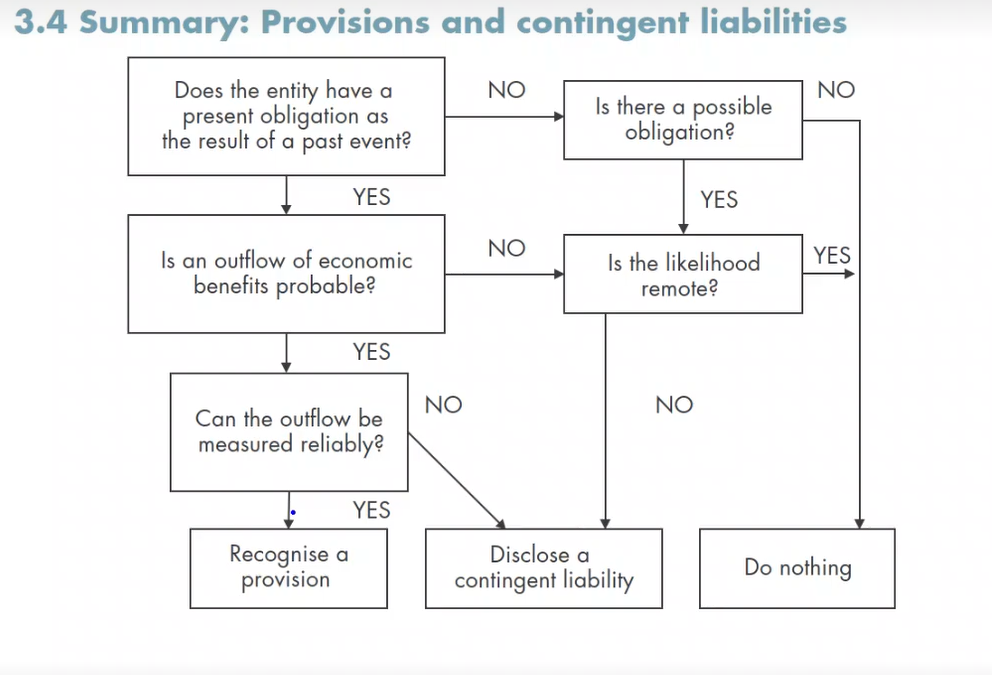

provision is a _______ of uncertain timing or amount

liability

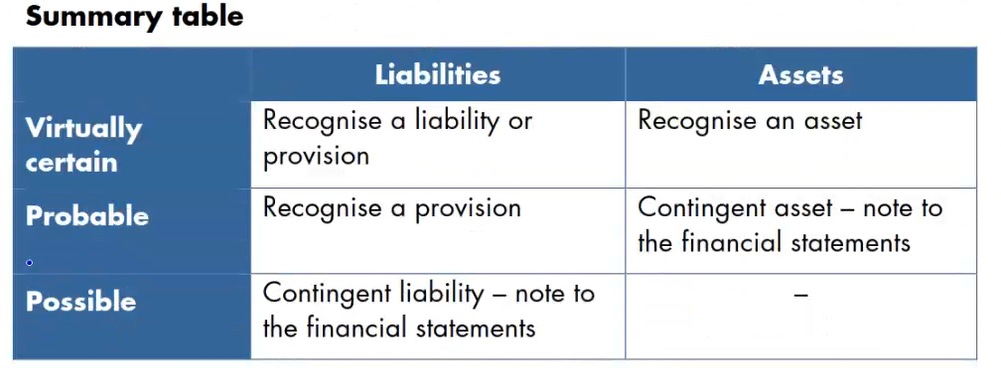

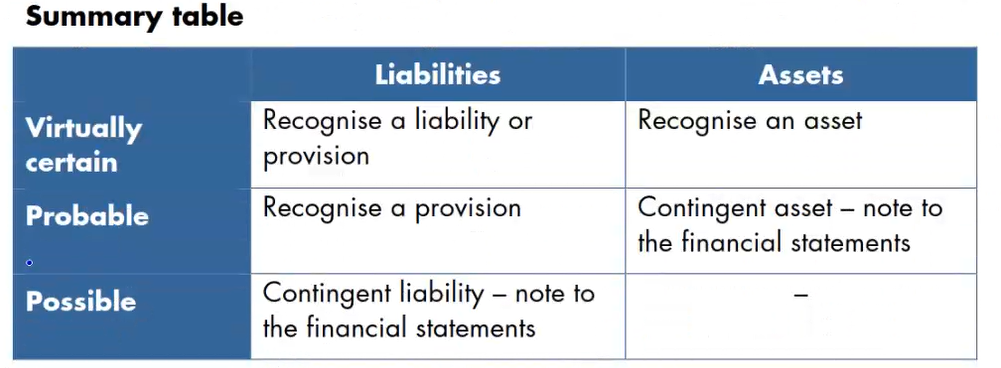

provisions are recognised as a liability when they meet ___

PPR

PPR

Present Obligation as result of a past event

Probable that money will be required to settle (more than 50%)

Reliable Estimate can be made of the amount of obligation

examples of provision

fines

amount of change in a provision is an ____

expense

contingent liabilities

possible costs a company might have to pay in the future dependent on future events

e.g. if a company is getting sued, they may have to pay

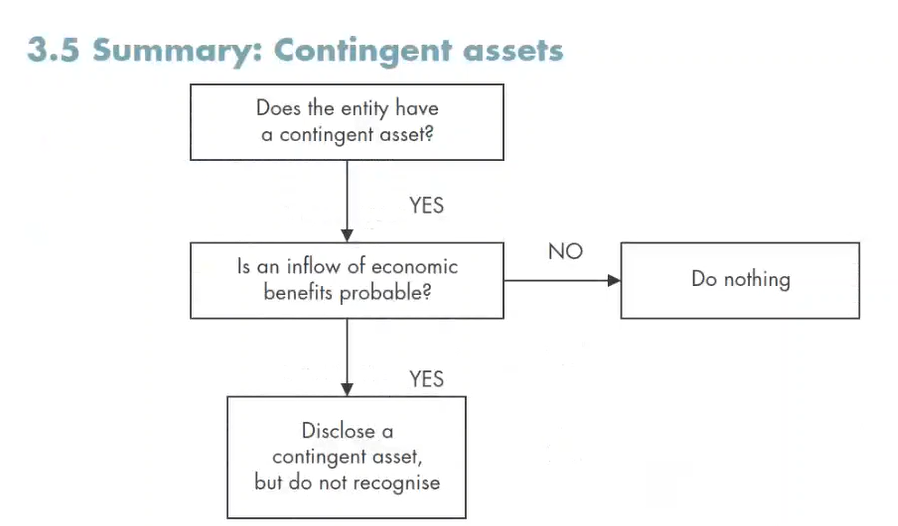

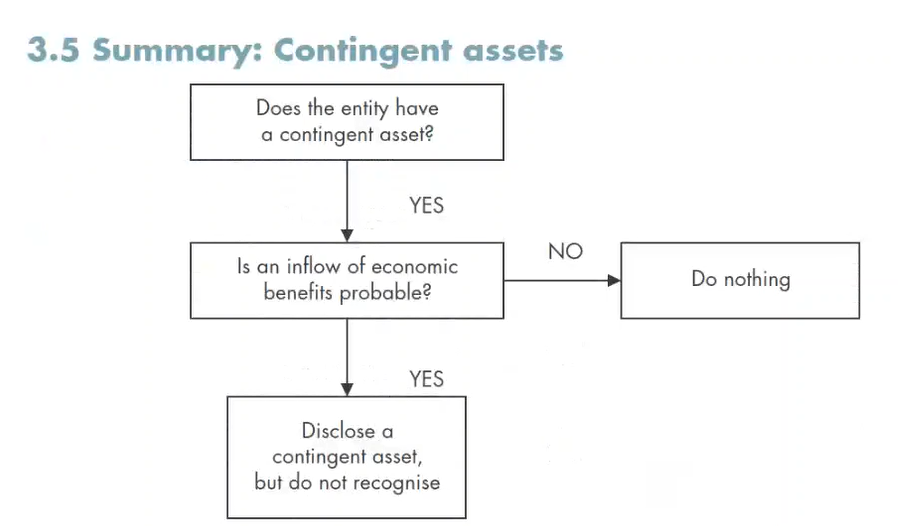

contingent assets

possible asset a company might gain dependent on future events

adjusting events provide evidence of conditions that existed at the year end date, if __________, changed should be made to the financial statements

material

examples of adjusting events

settlement of court case

assets where valuation shows impairment

inventories, when NRV is less than cost

trade receivables,

examples of non-adjusting events

business combination

major purchase of assets

loss of production capacity e.g. caused by fire/flood…

a material non-adjusting even after the year end should be _____

disclosed

step 5 for revenue

identify contracts with customer

identify performance obligations in the contract

determines the transaction price

allocate transaction price to the performance obligations in contract

recognise revenue when (or as) the entity satisfies a performance obligation

revenue is an entity’s income from it’s main ____ activities, such as sales and fees

operating

what is not revenue

sales taxes

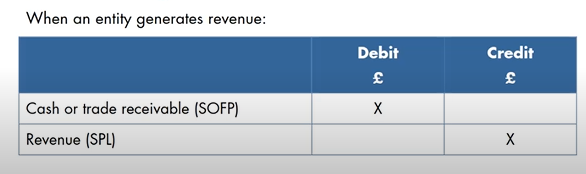

accounting for revenue

A customer owing £30,000 to Thriplow Ltd on 31 March 20X5 went into liquidation on 3 April 20X5. The £30,000 is still unpaid and it is unclear whether any monies will be received.

On 5 April 20X5 the company sold inventory valued at its cost of £53,000 for £42,000.

An issue of shares was made on 10 April 20X5. Fifty thousand 50p ordinary shares were issued at a premium of 25p.

On 15 April 20X5, a fire in one of the company's warehouses destroyed inventory valued at £22,000.

which of the events are nonadjusting events, according to IAS 10 Events after the reporting period?

3 and 4

refund liability instead of ____

revenue

performance obligation

transfer of goods or service