Chapter 5 - Exchange Rate

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

exchange rate

price of one currency in terms of another currency

trade weighted index(TWI)

price of AUD in terms of a basket of foreign currencies of most imp trading partners based on their share of trade with Aus

RMB highest TWI

how does AUD affect B.O.P

AUD appreciate makes M more expensive, M spending fall

makes X more expensive but since Aus mainly export comms, DD unchanged, X revenye improve

debt servicing cost falls

how does B.O.P affect AUD

if CAS due to X revenue high, it means business revenue high, hence ROI high, attract F.I, DD for AUD high and AUD appreciate

if CAS due to ROI down, means less foreign investors, DD AUD low, AUD depreciate

forex market

market where different currencies are bought and sold

types of ER

fixed ER

managed ER system

free floating ER system

fixed ER

gov of the country tries to keep the value of their currency constant against another widely used currency

managed ER system

floating in the foreign ER market but is subject to intervention from time to time

free floating ER system

determined directly by market forces, liable to fluctuate continually

gov intervention

direct intervention

interest rate changes

printing money

jawboning

direct intervention

RBA directly buys/sells currencies in forex market using AUD or foreign reserves

interest rate changes

affects F.I and affect DD for AUD

printing money

increasing supply of AUD cause AUD depreciation

jawboning

RBA talk down value of AUD to influence investors

factors affecting ER

comm price and TOT

inflation rate

interest rate

world economy

positive effects of AUD depreciation

X revenue for non commc increase, M spending fall

cheap for F.I to invest, savings investment gap filled

less dependant on M, boost M competing industry, less vulnerable

ROI value for investment abroad rise, NPY improve

negative effects of AUD depreciation

DD for comms unchanged, X revenue fall

M price increase, consumer less choice

M price increase, COP up, cost push inflation, wage demand high, cost of hiring workers high

debt servicing cost high, foreign debt worsen

trends

2015-2017 appreciate to USD0.80

2018-2020 depreciate to USD0.57

2020-2021 appreciate USD0.79

2021-now depreciate to USD0.66

2015-2017(APPRECIATE 0.80)

comm price high(comm DD unchanged, DD AUD high)

US interest rate fell

2018-2020(DEPRECIATE 0.57)

slow global growth

interest rate fell

border closure, T.P economy fell, slow investment into Aus

2020-2021(APPRECIATE 0.79)

strong comm price(borders open)

positive global growth, invest into Aus

2021 to now(DEPRECIATE 0.66)

speculation(unstable world economy)

closure of borders in China(low DD for Aus X)

US interest rates increase to 4.5%

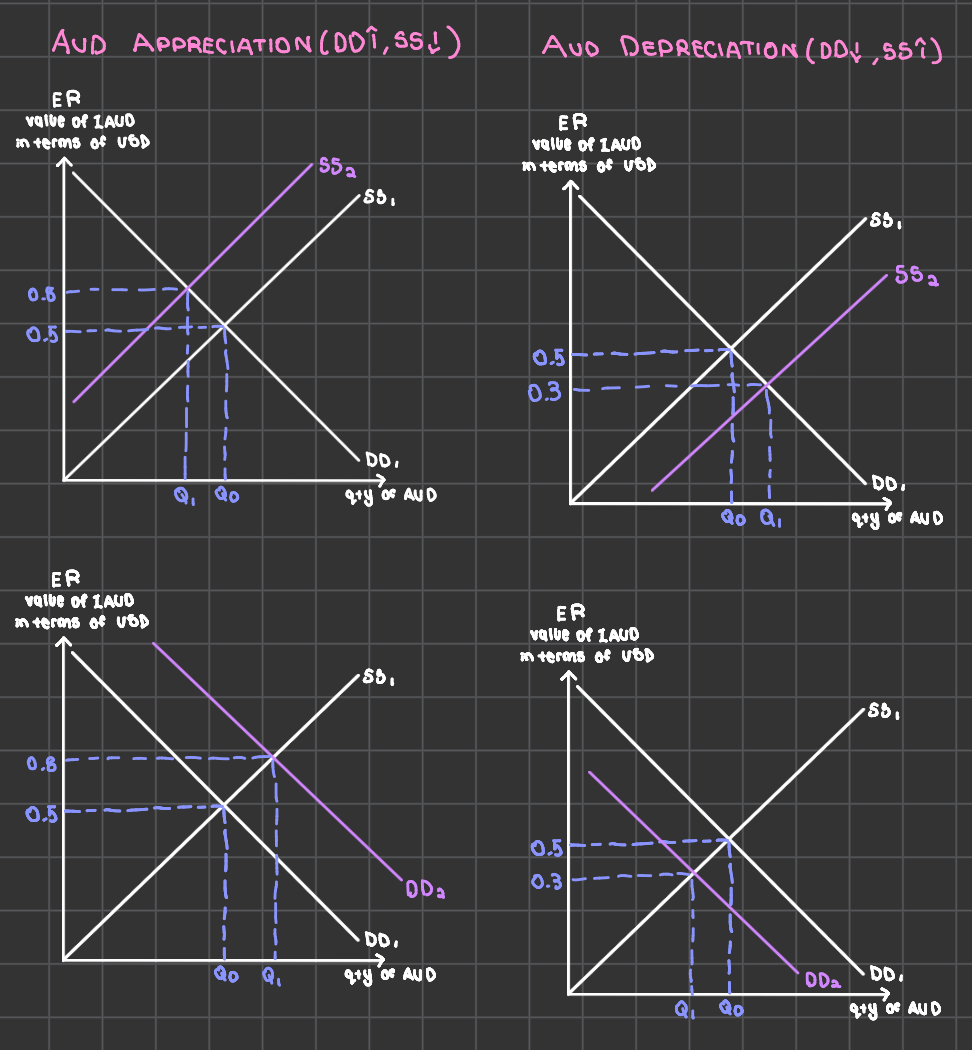

ER graph