Energy and commodities markets

1/9

Earn XP

Description and Tags

UPM course 2025

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

What are the use cases of derivatives?

• To hedge risks

• To speculate (take a view on the future direction

of the market)

• To lock in an arbitrage profit

• To change the nature of a liability

• To change the nature of an investment without

incurring the costs of selling one portfolio and

buying another

What is a Derivative?

An instrument whose value depends

on, or is derived from, the value of another asset, index or interest rate.

What are examples of derivatives?

Futures, forwards, swaps, options, exotics

Two places derivatives are traded

CBOE - Chicago Board of Options Exchange

OTC - Over the counter

Definition of forward price

The delivery price that would be applicable to the contract if it was negotiated today

What is the basis risk?

The uncertainty about the value of the basis (S0 - F0) at the moment a hedging position is closed out.

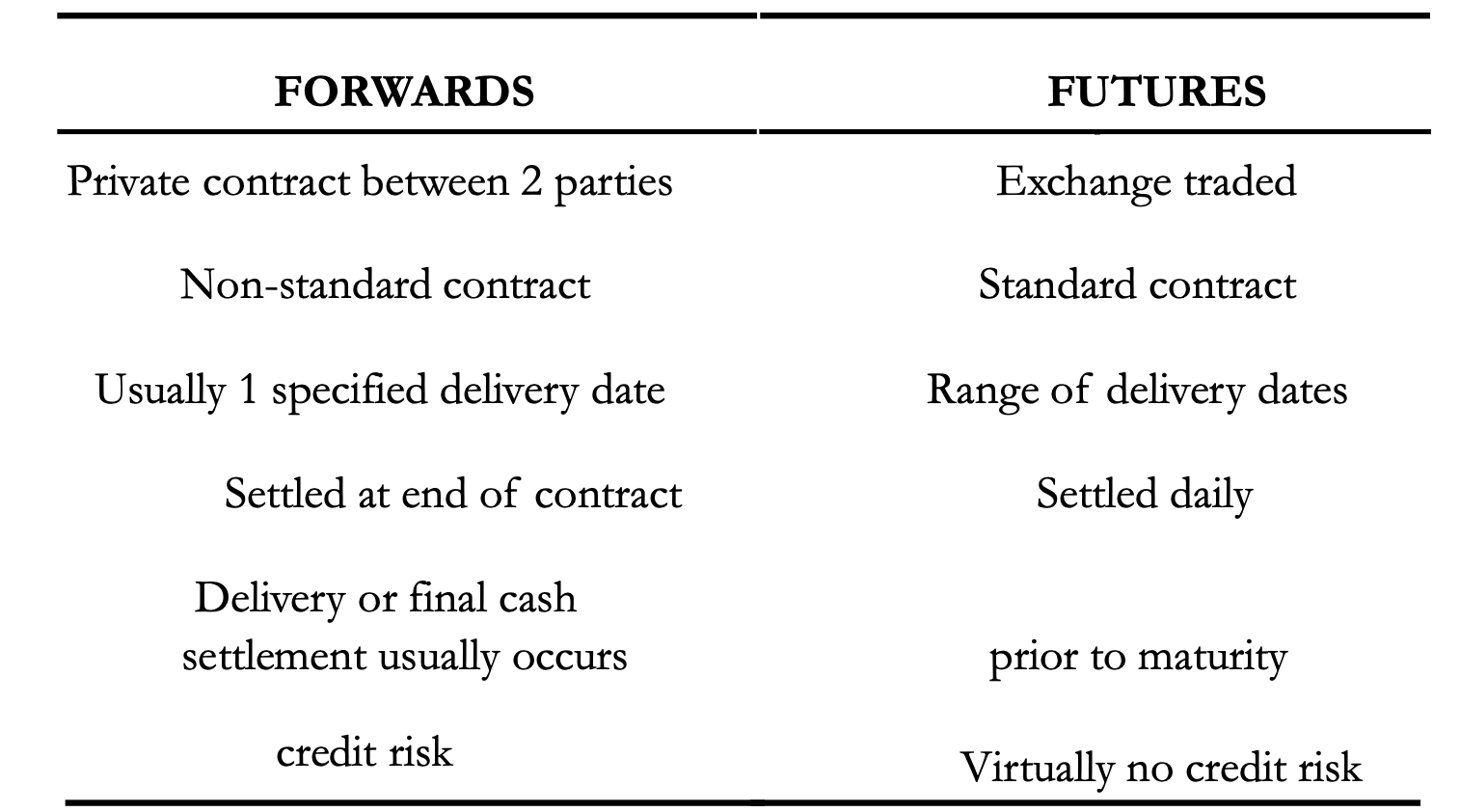

What are the differences betweens forwards and futures?

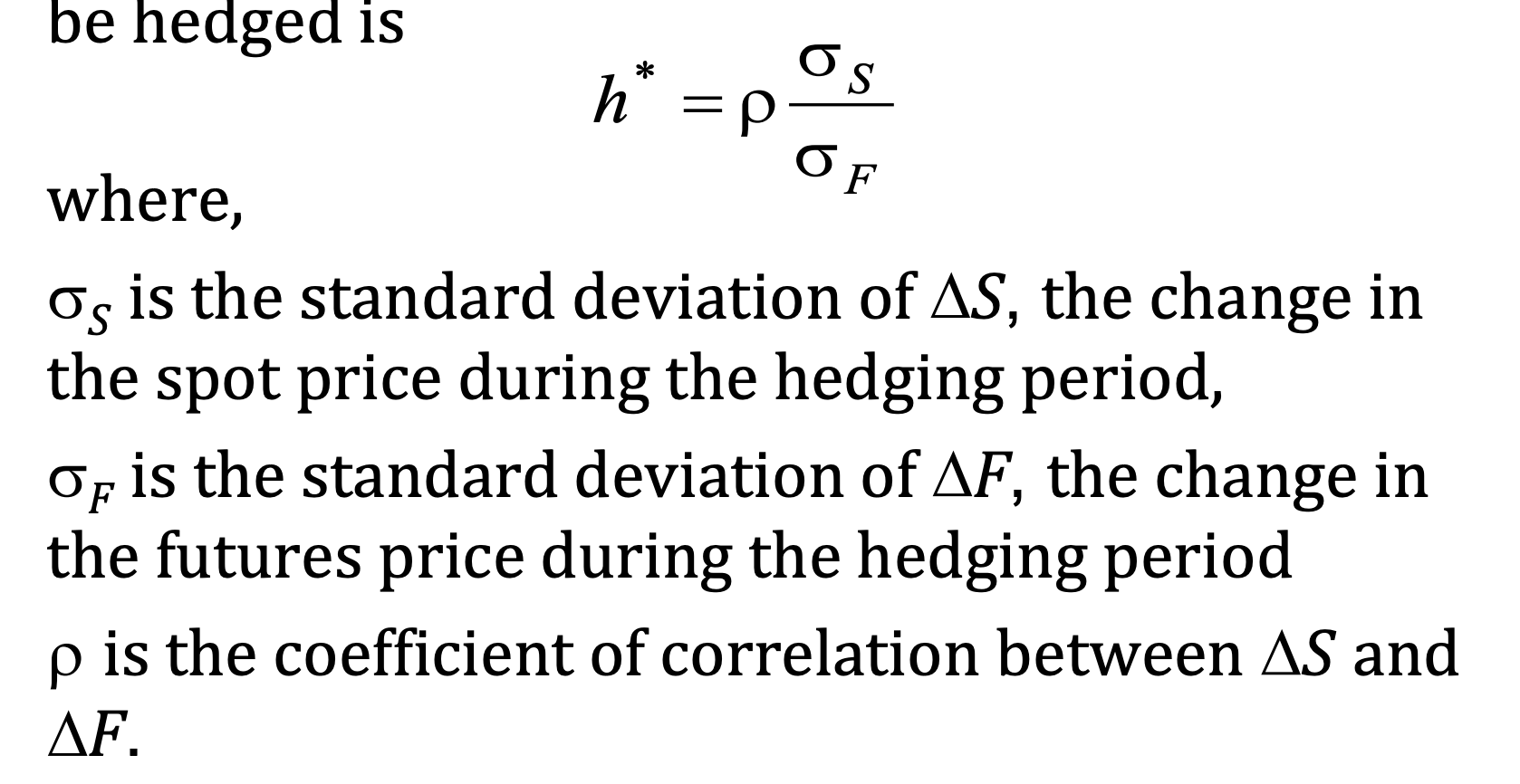

What is the optimal hedging ratio?