Finance Chpt. 14

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

disadvantages of mutual funds

– Lower-than-market performance

– Costs

– Risks

– You can’t diversity away a market crash

– Taxes

mutual funds

pooling money from multiple investors with similar financial goals

diversified portfolio

guided professional manager

investment objectives clearly stated

as the value of securities (stocks, bonds, ) in mutual funds increases…

the value of each mutual fund share rises

most pay dividends or interests to

shareholders

shareholders recieve a captial gains distribution when

the fund sells a security for more than originally paid

a fund is set up as a

corporation or trust owned by shareholders

shaerholders elect a

board of electors

a fund is run by a

managment company

each individual fund hires an investment advisor to

oversee the fund

a fund contracts with

a custodian

a transfer agent

an underwriter

companies invest the pooled money of the investors for a

fee

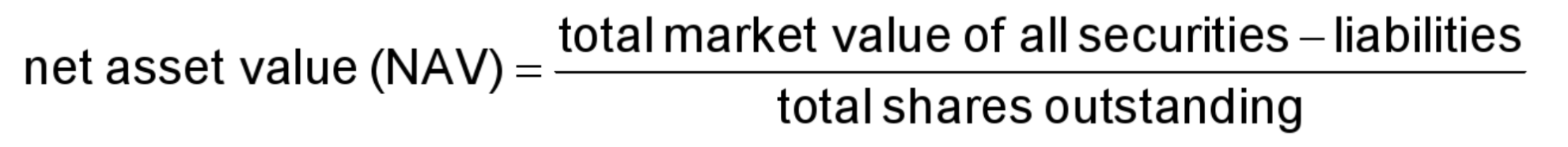

NAV Net Asset Value

dollar value of a share in a mutual fund

most popular are

open-end investment companies or mutual funds

open end investment companies

accept new investors, issue new shares, grow their assets

closed end invesment companies

cant issue new shares

investors must trade and cannot redeem them

unit investment trusts

a fixed pool of securities

how risky are hedge funds?

very!

hedge funds

pooled funds