finalexam finc 460

1/169

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

170 Terms

What is FinTech?

Technological innovation in the way that capital is transferred, borrowed, or invested (checks, ATM, online banking, Robinhood, etc.)

Issues with the current banking system

Opaque

Inefficient

Centralized Control

Limited Access

Lack of Interoperability

Opacity

Current financial system is not transparent

We do not understand many underlying risks of banks

Bank trust is a function of regulation and gov’t backstops (FDIC insurance)

Inefficiency

Transactions are expensive (3% credit swipe)

Transactions take a long time (t+1, slow fund transfer, fraud, chargebacks, insecurity)

Centralized Control

Central Banks control currency (inflation, interest rates)

banking system is concentrated

Limited Access

7.1 million (5.4%) households in the US are unbanked

2 billion people in the world are unbanked

Entrepreneurs cant get smaller loans

Interoperability

Hard to move money and securities from one financial institution to another

How did Fintech 1.0 begin

transatlantic cable laid between London and New York

How did Fintech 2.0 begin

computer revolution, ATM, PC, mobile phone

How did Fintech 3.0 begin

underserved retail and small business customers, P2P platforms launched as well

Sample of FinTechs

M-Pesa (digital banking)

Wise Financial (payments)

Kickstarter (crowdfunding)

Lending Club (P2P lending)

Wealthfront (RoboAdvisor)

Robinhood (Trading)

T.F: Bitcoin ≠ Blockchain?

TRUE

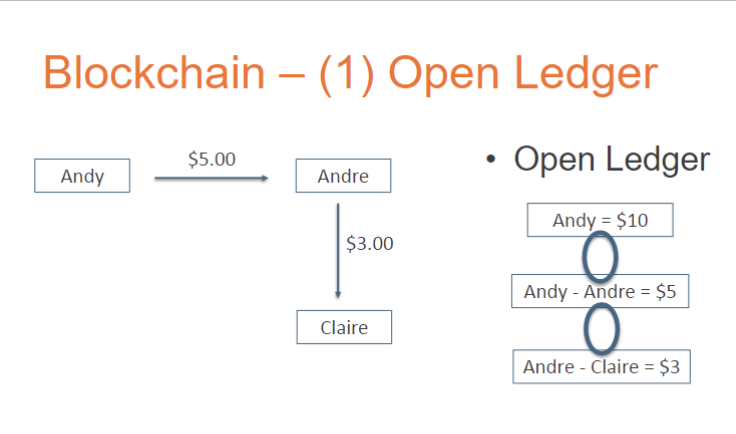

Open Ledger

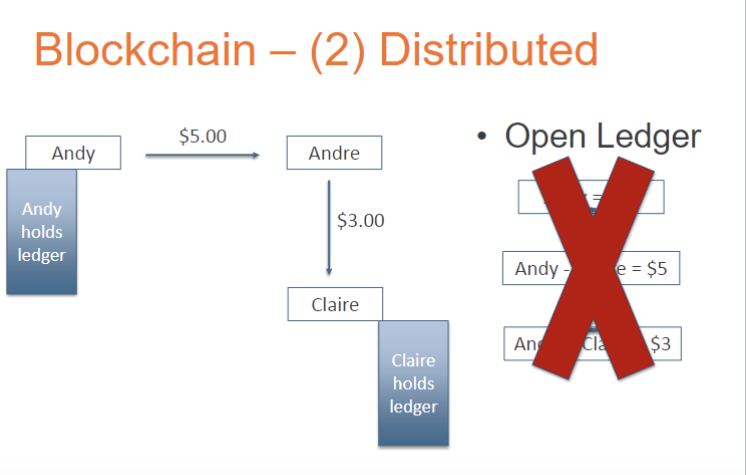

Distributed Ledger

No central authority to hold ledger or be attacked. All people (aka nodes) have complete ledger.

Could store:

Financial Transactions

Property Records

Shipments and Inventory

Grades

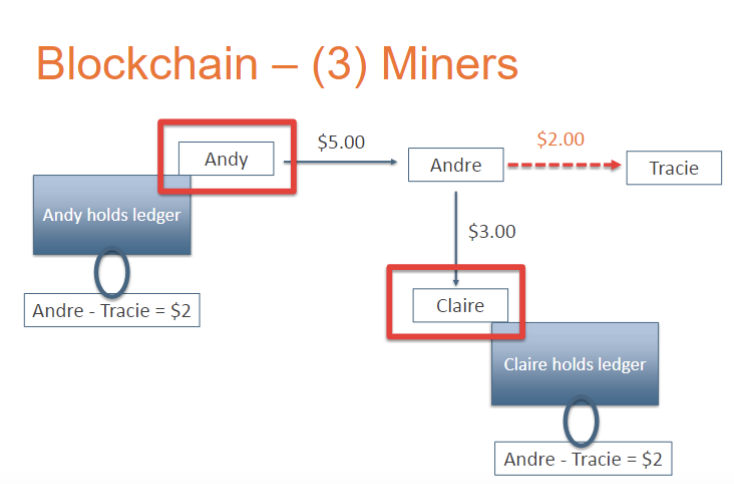

Miners

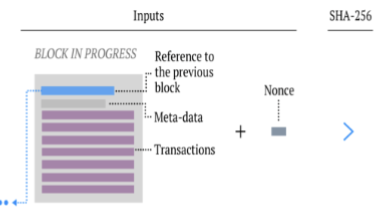

Miners group the transactions together (i.e. a “block”) and take a hash of the transactions plus an arbitrary number – the “nonce”

Transparent but anonymous ledger

ledger can be public while concealing identity

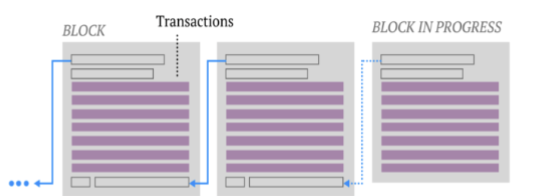

Append only ledger

Each entry (aka block) is linked to the previous entry via some math (aka hash)

Some nodes (aka miners) are paid for performing calculations (aka proof of work)

Immutable Ledger

Attacks to ledger are impractical due to need for majority of nodes (aka 51% attack) to agree to a change and the computational power required

Blockchain is technology

Many different blockchains (not just one)

data added is packaged into “blocks”

“blocks” are “chained” together cryptographically to allow an audit of prior history

Blockchain Transparency

The balance of all public keys are transparent (primary characteristic of blockchain)

Blockchain mechanics

Bitcoin blocks occur every 10 minutes

Last line over every block contains a hash

Last line (the hash) is repeated as the first line in the next line. This is why it is called “chain”. Altering any data in say block 1, means the last line will change and will not match the first line in block 2.

Hashing

SHA-256 (secure hashing algorithm) (256 bits no matter the input)

a primer

encodes a message

one way function

Nonce

Arbitrary number added to the hash of transactions

Proof of Work - Miners

Miners must guess a “nonce” that (along with the transaction data in the block) produces a hash with many leading zeros.

The current requirement for Bitcoin miners is 17 leading zeros.

The probability of guessing this a nonce that satisfies this requirement is (1/16)^17

Proof of Work machines

The Antminer S17 does 53 trillion hashes per second

often work in groups or networks

winning miner/network of miners receives 3.125 new bitcoin.

This cuts in half every 210,000 blocks or 4 years

Proof of Work benefits

extremely secure

The amount of work required to produce so many leading zeros mean that it is almost impossible for a bad actor (hacker or even country) to change a historical block

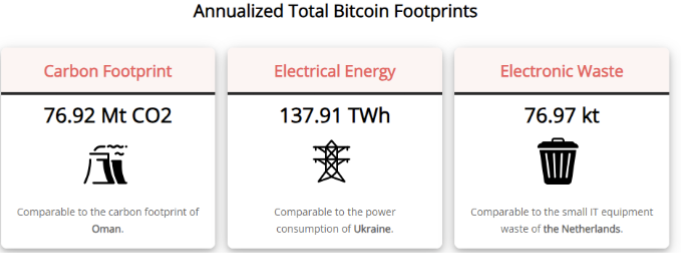

Proof of Work downsides

PoW mining is a wasteful activity, as the many nodes searching for the hash consume electricity

At year-end 2022 was estimated at 73 terawatt-hours, or the equivalent annual electricity usage of Austria.

At year-end 2023, it was 138 TWh equivalent to Ukraine.

Proof of Stake

PoS does not require mining to verify transactions. Instead, a holder of a given cryptocurrency must deposit or “stake” cryptocurrency with the network to be entered into a pool of validators.

Validators are randomly chosen to verify transactions and receive the block reward, with the probability linked to the amount of cryptocurrency they have staked.

A validator that verifies (or attests) malicious blocks loses their stake as a penalty.

In September 2022, the Ethereum network completed its transition from PoW to PoS, reducing its energy consumption by 99.95%

What makes bitcoin favorable to become a fiat currency

decentralized

not controlled by a central bank

accessible by individuals in most nations

Barter

peer-to-peer

inefficient (need to find exact match for trade)

evolution of money

rai stones

gold

fiat money

crypto?

First implementation of a cryptocurrency

Satoshi Nakamoto in 2009 created Bitcoin

Characteristics of money

Unit of account: way to compare value of different goods

Medium of exchange: non-barter transactions

store of value: allows value to be retained rather than decay (storing food

Issues with (fiat) money

inflation

bank runs

central bank issues, etc.

Hyper-inflation

a severe and rapid increase in the price of goods and services, which causes the value of a country's currency to decrease

Example: Zimbabwe 2007-2008 had a daily inflation rate of 98% (had signs to not use it as toilet paper)

Bank run examples

People attempt to withdraw a lot of money at same time and bank doesn’t have enough on hand. Silicon Valley Bank, Ghana, Afghanistan

Cryptocurrency can function as:

medium of exchange

contractual right to transact (e.g., use a service)

vote on governance

financial security providing cash flow claims

Unique claim (NFT) – e.g., ar

The unifying theme across coins/tokens is

distributed ledger technology (e.g., blockchain) on which the digital asset is secured and transactions are verified

Bitcoin

Satoshi’s motivation was to create a currency not controlled by a central authority

peer-to-peer version of electronic cash would allow payments to be sent directly from one party to another without going through a central intermediary such as a central bank

Ownership of bitcoins is recorded in an electronic distributed ledger called the blockchain

Blockchain

Distributed ledger where transactions are batch processed in blocks and secured using cryptography in an immutable, append-only, public ledger

What problems does bitcoin solve?

eliminates intermediaries

solves the “double spend” problem

The double-spend problem

Earlier digital currencies failed as no one could solve the “double-spend” problem: how to allow for the electronic exchange of money without a trusted intermediary to verify that the money had not be spent twice.

How did bitcoin solve the double-spend problem

Satoshi’s solution was to use a time-stamped electronic record-keeping system to record transfers of bitcoins.

This electronic ledger [blockchain] was secured against alterations using cryptography.

The blockchain would remain public and transparent, with multiple copies widely available on a P2P network run on independent computers (called nodes).

Bitcoin rules

maximum of 21 million bitcoins

maximum size of a block is 1 megabyte

transactions are batched processed with 1 block added every 10 minutes

Mining using proof of work

Only the owner can spend – verification by private key

Infinitely small probability of successful “hack”

Bitcoin Volatility

Extremely volatile. goes from 20k to 3k to 68k to 20k to 60k

Intrinsic Value - Iraqi Swiss Dinar

The Iraqi Swiss dinar was the currency of Iraq until the first Gulf War

The name derives from the fact that the plates to make the currency were produced in Switzerland and notes printed in the UK

In 1991, Iraq split in two - Saddam Hussein controlled the south and the Kurds controlled the north

Because of sanctions, Iraq could not import Swiss dinars - so Saddam ordered the printing of a new currency

May 1993 - Central Bank of Iraq declares citizens have three weeks to

exchange old 25 dinar notes for new ones

The Iraqi Swiss dinar had no official backing - yet it was accepted as money. Reason: because people were willing to accept it as money

USD demand comes from

taxes

purchase of goods denominated in USD

repayment of debt in USD

US economic expansions and contractions impact value

Central Bank (i.e., Federal Reserve) has the ability to inflate

Arbitrage

Arbitrage opportunities across exchanges have been large, profitable, and recurring despite the introduction of futures and margin trading.

Price deviations increase as the Bitcoin price rises, and during unusual events (following hacks and breaches of exchanges).

Bitcoin traders may not take advantage of these arbitrage profits due to a lack of capital and sophistication

Kimchi Premium - price of bitcoin in South Korea allowed for arbitrage

Bitcoin a fraud?

JPM Jamie Dimon calls bitcoin a fraud then “regrets calling it a fraud”

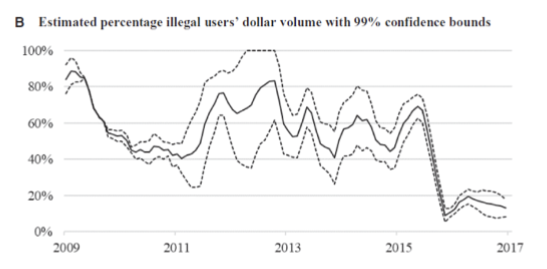

Bitcoin illegal activity

using the website silk road people purchased illegal items such as drugs and weapons using bitcoin

3.36 Billion cryptocurrency seizure and conviction in connection with silk road dark web fraud

Transaction Fees (Bitcoin)

no fees to process transactions

unverified transactions wait their turn to be processed in the memory pool “mempool”

however, senders wanting quicker confirmation can pay a voluntary fee to incentivize miners to pick them first

Miners choose transactions offering the highest fee-to-size ratio to maximize the fee for each block.

This fee is known as the “feerate” and is measured in Satoshi-per-byte, where 1 bitcoin is divisible into 100,000 Satoshis

Private Keys

When a token is transferred, the sender uses a digital signature algorithm to sign the token over to someone else’s address. The signature mathematically reveals that the sender has the private key associated with the sender’s public address

Private Key Issue

Around 20% of bitcoin appears to be lost due to people losing or stranding their digital wallets

Hard Forks

When the holders of a cryptocurrency disagree and vote to split, it can lead to the creation of a new digital coin with a similar name.

A new blockchain is created to verify new transactions; these new coins are no longer recognized as valid by the original blockchain.

Both coins share the same transaction history up to the fork

T/F: Bitcoin has hard forked?

TRUE

Bitcoin Fork

Bitcoin Cash forked on Aug 1 2017 at block 478,558 on the Bitcoin blockchain.

The hard fork was in response to Segregated Witness (SegWit), which aimed to increase processing speed.

Bitcoin Cash introduced larger block size up to 8M, requiring a more complex mining process that favored large miners with more computing power.

Bitcoin alternatives

23,000+ tokens, coins, and other crypto assets with a total market cap of 1.65T

Stablecoins

tokens backed by:

fiat currencies (e.g. U.S. dollar)

commodities (gold, oil)

other cryptocurrencies, or nothing at all (algo stables)

Ether (ETH)

most innovative and transformational cryptocurrency. It is the token used to run decentralized applications (dapps) on the Ethereum blockchain

Crypto can be traded…

24/7 over 400 exchanges

coinbase is centralized or decentralized

centralized

T/F: Francis Suarez, the mayor of Miami is pushing for crypto

TRUE

Ethereum

started by Vitalik Buterin in 2015

It is the foundation for decentralized finance (DeFI)

ethereum blockchain is more like an open-source platform where developers can build

decentralized applications (dApps)

create smart contracts

launch new tokens

Decentralized Finance (DeFi)

a global, decentralized financial system based on crypto assets, blockchains, and smart contracts

Ethereum use cases

savings account, P2P gambling, financial derivates, and new cryptocurrencies

T/F: ETH has a limit on how many can be created

FALSE

Smart contracts

code that can create and transform arbitrary data or tokens on top of the blockchain

allows the user to trustlessly encode rules for any type of transaction

many standard business contracts can be algorithmically encoded and algorithmically enforced

contracts run on the Ethereum blockchain

Example of an original “smart contract”

vending machines

Gas for Ethereum

Coding and hosting a dapp on ethereum is free

running a dapp has a gas fee (paid in ETH)

The amount of gas depends on the computational resources required to run a program. Promotes efficient coding

Until September 2022, ETH verified transactions using proof-of-work (PoW) just like Bitcoin. It used Ethash for hashing and was computationally demanding algorithm. Blocks were verified every 12 seconds… but now it uses ______________

proof-of-stake

Ethereum proof-of-stake benefits

reduced energy consumption by 99.95%

Who created ERC-20, and why?

Ethereum developer created it

standardize all fungible tokens using smart contracts to increase interchangeability

What does ERC-20 mean

Ethereum Request for comment-20

ERC-20

the most popular standard for “fungible tokens” – i.e., tokens that have identical utility and functionality.

Tether (USDT), Shiba Inu (SHIB), and Chainlink (LINK) are all ERC-20. Our GBO token is ERC-20

Monetary example – US dollars are “fungible”. Two different $1 bills have the same value. Five $1 bills have the same value as a $5 bill

Benefit of ERC-20

The benefit of these standards is that application developers can code for one interface and support every possible token that implements that interface.

T/F: Any application (i.e., smart contract) that can generically handle ERC-20 functionality can handle any ERC-20 token (even tokens that do not yet exist!!)

TRUE

ERC-20 Token types

Payment token

stablecoins are a special case

Utility Tokens

Security Tokens (aka equity tokens)

Governance Tokens

Payment tokens

used as money to buy things online

cryptocurrencies are payment tokens

most payment coins are very volatile. Stablecoins emerged as a special case

T/F: Bitcoin and ethereum do not comply with ERC-20 programming protocols

TRUE

What emerged due to BTC and ETH not complying with ERC-20

“wrapped” BTC and ETH

Stablecoins

maintain price parity with some target asset (USD, Gold)

provide stability and allow investors to participate in many smart contracts and DeFi applications

types of stablecoins

fiat collateralized

crypto collateralized

algorithmic

Stablecoins - Fiat Collateralized (give examples)

backed by an off-chain reserve of target asset (USD, Gold)

Ex: Tether, USDC (both centralized)

Stablecoins - Crypto Collateralized (give examples)

MakerDAO - DAI is the most popular crypto collateralized stablecoin (backed by ETH)

sUSD - linked to the Synthetix, backed by SNX network token

Stablecoins - Algorithmic (give examples)

not backed by an underlying asset

uses algorithmic expansion and contraction of supply to shift the price to the peg

Token holders in the platform receive the increase in supply when demand increases.

When demand decreases and the price slips below the peg, these platforms would issue bonds of some form which entitle the holder to future expansionary supply before the token holders receive their share

Example: Terra/Luna

Stablecoins - Terra and Luna

a blockchain with its own governance token, LUNA, linked to algorithmic stablecoin TerraUSD (UST)

backed by LUNA. algorithm automatically adjusting UST supply to keep price at $1

Collapsed in May 2022. It was a Ponzi Scheme

Ponzi Scheme

A type of investment fraud that promises high returns with little risk to investors. It pays returns to earlier investors using the capital from new investors, rather than from profit earned by the operation of a legitimate business. Eventually, it collapses when the operator can no longer attract enough new investors to pay returns.

ERC-20 Utility Tokens

Fungible tokens that are required to utilize some smart contract system

It is possible for these tokens to have an intrinsic value (proposition) that is defined by its smart contract system

ERC-20 - Utility token use cases

pay application-specific fees (FILE, DAI, LINK)

to be collateral (SNX)

ERC-20 - Security/Equity Token

represents ownership of an underlying asset or pool of assets

each corresponds to an identical share in the pool

Example: suppose a token, TKN, has a total fixed supply of 10,000, and TKN corresponds to an ETH pool of 100 ETH (held in asmart contract).

The smart contract stipulates that for every 1 token of TKN it receives, it will return a pro rata amount of ETH. Fixing the exchange ratio at 100 TKN = 1 ETH

Equity Tokens other examples

Compound: Variable interest-rate mechanics

Uniswap: Contract that owns a multi-asset pool with a complex fee structure

Set Protocol: A standard interface for creating equity tokens with static or dynamic holdings

Governance Tokens

similar to equity tokens as they represent percentage ownership

Applies to voting rights

many smart contracts have embedded clauses stipulating how the system can change. These changes include

adjusting parameters

adding new componets

altering the functionality of existing components

Purpose of governance tokens

A contract without the capacity for change is rigid, however, and has no way to adapt to bugs in the code or changing economic or technical conditions.

For this reason, many platforms strive for a decentralized upgrade process, often mediated by a governance token.

Examples of Governance tokens

can be implemented in many ways: static, inflationary, deflationary supply

MKR - static supply

COMP - inflationary supply

ERC-721 is ________

the standard for “non-fungible tokens) - NFTS. These unique tokens are used as unique claims (bored ape)

ERC-721: NFT

non-fungible token

started with crypto kitties

unique digital code that is secured and stored on a public blockchain

one token is not interchangeable with another

cannot be further divided

most NFTs are currently deployed as ERC-721 non-fungible tokens on Ethereum

Highest sold NFT price

$69 million USD

$69 million NFT. What did the auction winner buy as the NFT does not confer exclusive access to the digital art or any royalty income

bragging rights?

the NFT procides a disintermediated, secure ownership record that is recorded (immutable) on the Ethereum blockchain

Example of something that is nonfungible

lottery tickets (non-winners are useless)

Ethereum transactions

Transactions involve sending data or ETH (or other tokens) from one address to another

An Ethereum user can control addresses through an externally owned account (EOA) or by using smart contract code (contract account)

When sending data to a contract account, the data are used to execute code in that contract. The transaction may or may not have an accompanying ETH payment for use by the contract