Chapter 6 - Consumer Choice and Demand - NOT DONE

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

Intro to consumer choice

This chapter explores how individuals make decisions about what to consume given their limited resources to maximize their well-being or satisfaction.

Demand Formation

The consumption choices people make collectively form what we understand as demand.

Rational Decision-Making (Assumption)

Demand analysis often rests on the assumption that individuals are rational decision makers who aim to maximize their well-being.

Two Major Approaches to Consumer Choice

Utility Theory (Utilitarianism)

Indifference Curve Analysis

Utility Theory (Utilitarianism)

Explains choices based on maximizing happiness or satisfaction given limited income. Proposed by Jeremy Bentham.

Indifference Curve Analysis

A more modern approach that does not require measuring utility but focuses on preferences between bundles of goods. Developed by Francis Ysidro Edgeworth.

The Budget Line and Choices

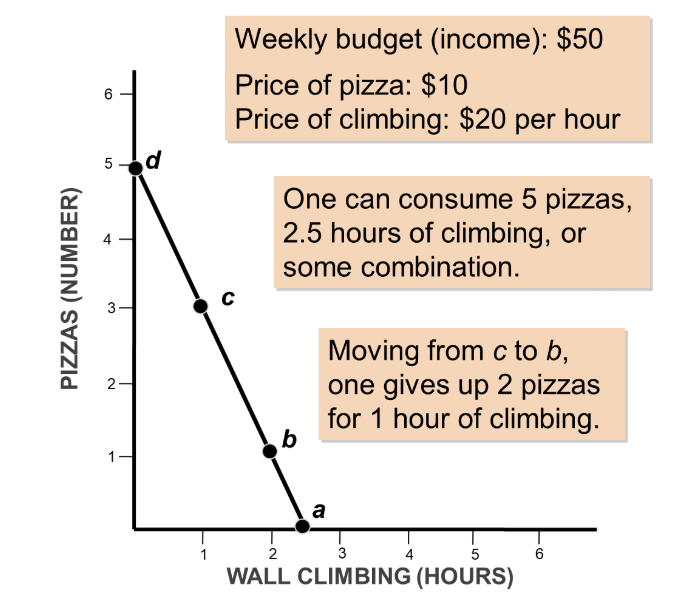

Budget Line

The budget line illustrates the limits on consumption choices given a limited income (budget) and the prices of goods and services. Shows all the possible combinations of two or more good

Budget Constraint

The budget line acts as a constraint on consumer choices; combinations beyond the line are unattainable. (Similar to PPF)

Changes to the Budget Line

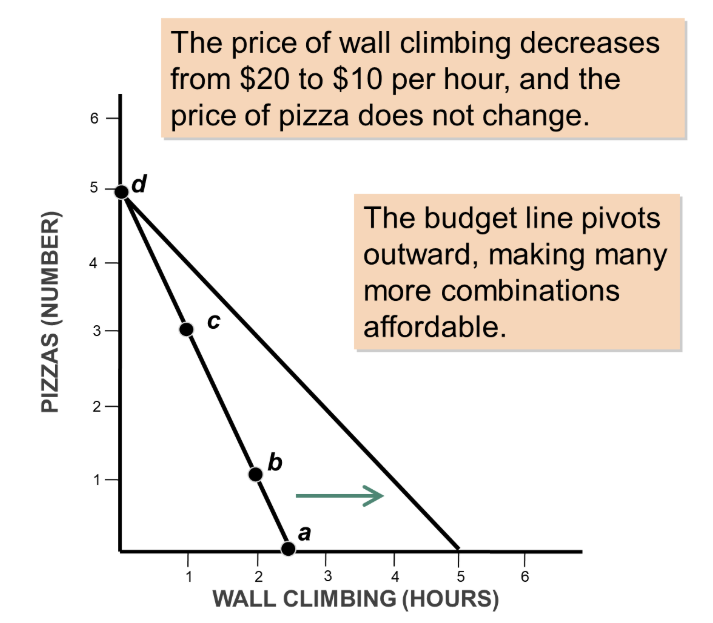

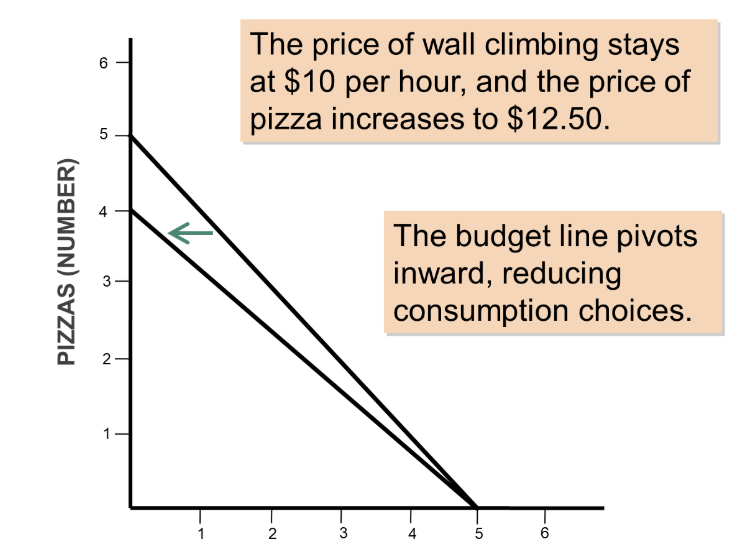

Changes in the Price of a Good

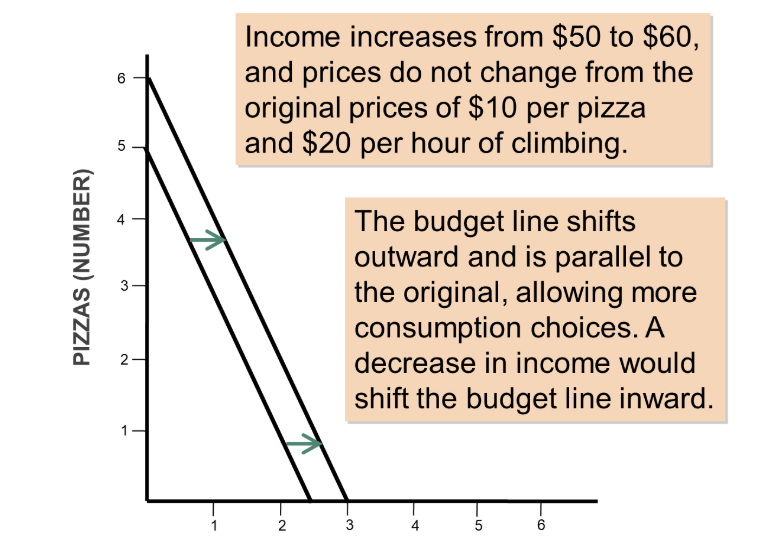

Changes in Income

Changes in the Price of a Good - DECREASE

A decrease in the price of a good causes the budget line to rotate outward along the axis representing that good, increasing the affordable combinations.

Changes in the Price of a Good - INCREASE

An increase in the price of a good causes the budget line to rotate inward, reducing the affordable combinations.

Changes in Income - DECREASE

A decrease in income causes a parallel inward shift of the budget line, reducing the affordable quantities of both goods.

Changes in Income - INCREASE

An increase in income causes a parallel outward shift of the budget line, allowing the consumer to afford more of both goods at the same prices.

Marginal Utility Analysis

Utility

A hypothetical measure of consumer satisfaction or happiness derived from consuming goods and services. Utils are the hypothetical units of utility.

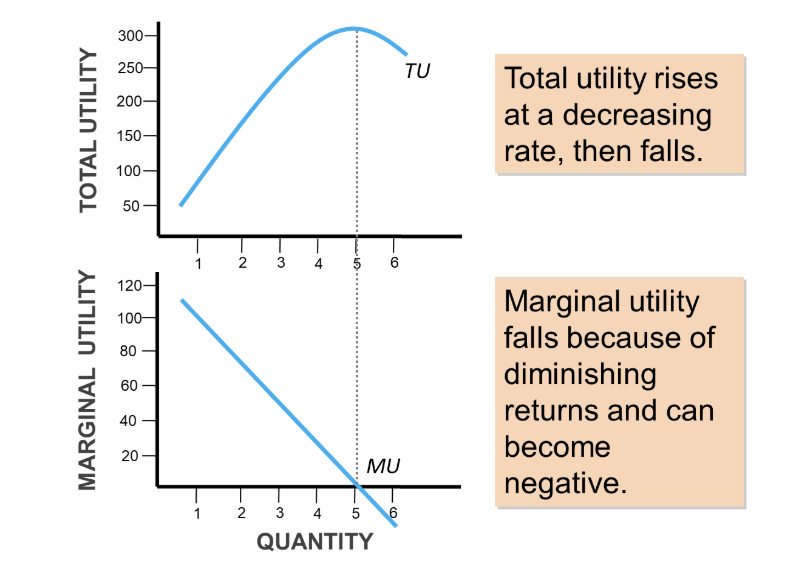

Total Utility

The total satisfaction a person receives from consuming a given quantity of goods and services. It generally increases with consumption but at a decreasing rate.

Marginal Utility

The additional satisfaction gained from consuming one more unit of a good or service. It is the change in total utility resulting from a one-unit increase in consumption.

Relationship between TU and MU

Total utility rises by an amount exactly equal to the marginal utility of the last unit consumed.

The Law of Diminishing Marginal Utility

States that as we consume additional amounts of a product, the rate at which our total satisfaction increases will decline.

Eventually, consuming even more of the product may lead to a decrease in total satisfaction, meaning marginal utility becomes negative.

Maximizing Utility

Consumers allocate their limited budget to achieve the highest possible total utility.

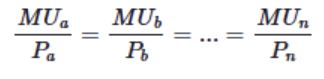

Marginal Utility per Dollar

To maximize utility with a fixed budget, consumers should compare the marginal utility per dollar spent on each good.

Marginal Utility per Dollar FORMULA

(Marginal Utility of Good) / (Price of Good)

Utility-Maximizing Rule

Consumers maximize their total utility by allocating their budget such that the marginal utility per last dollar spent is the same for all goods.

Limitations of Marginal Utility Analysis

Difficulty in Measuring Utility

Divisibility of Goods

Complexity of Calculations

Explaining Irrational Behavior

Difficulty in Measuring Utility

Assumes that consumers can precisely measure the utility they derive from consumption, which is virtually impossible in reality.

Divisibility of Goods

Assumes that goods are easily divisible into small units, which is not always the case

Complexity of Calculations

It is unrealistic to assume that consumers constantly perform complex calculations to compare marginal utility per dollar for all possible goods and services.

Explaining Irrational Behavior

Marginal utility analysis does not fully explain why individuals sometimes make seemingly irrational decisions.

Behavioral Economics

The study of how human psychology influences economic behavior and explains why individuals sometimes act counter to the predictions of standard economic models.

Focuses on predictable deviations from rational behavior.

Psychological factors can be exploited by marketers.

Five Key Psychological Factors

Sunk Cost Fallacy

Framing Bias

Overconfidence

Overvaluing the Present Relative to the Future

Altruism

Sunk Cost Fallacy