Important Terms

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

Long-run Economic Growth

the process by which rising productivity increases the average standard of living.

real GDP per capita

the amount of production in the economy, per person, adjusted for changes in the price level

Formula for current real GDP

Rule of 70

determine how long it will take for an economic variable to double

Labor Productivity

the quantity of goods and services that can be produced by one worker or by one hour of work

Potential GDP

the level of real GDP attained when all firms are operating at capacity

Capacity

refers to “normal” hours and a “normal” sized workforce.

Financial System

the system of financial markets and financial intermediaries through which firms acquire funds from households

Financial Markets

markets where financial securities, such as stocks and bonds, are bought and sold

Financial Security

a document (sometimes electronic) stating the terms under which funds pass from the buyer of the security to the seller.

Stock

financial security representing partial ownership of a firm

Bond

financial security promising to repay a fixed amount of funds. Essentially a loan from a household to a firm

Financial Intermediaries

firms, such as banks, mutual funds, pension funds, and insurance companies, that borrow funds from savers and lend them to borrowers.

3 key services of the financial system

Risk Sharing

Liquidity

Information

Risk Sharing

By allowing investors to spread their money over many different assets, investors can reduce their risk while maintaining a high expected return on their investment

Liquidity

The financial system allows savers to quickly convert their investments into cash

Information

The prices of financial securities represent the beliefs of other investors and financial intermediaries about the future revenue stream from holding those securities.

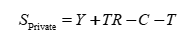

Private Savings

household income that is not spent

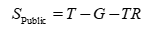

Public saving

The government “saves” whatever it brings in but does not spend

Balanced Budget (Spublic=0)

the government spends as much as it brings in

Budget Deficits (Spublic = –)

when money going out (spending ) exceeds money coming in (revenue)

Budget Surplus (Spublic = +)

when money going in (revenue) exceeds money coming out (spending)

Market for Loanable Funds

a (conceptual) interaction of borrowers and lenders that determines the market interest rate and the quantity of loanable funds exchanged

Crowding Out

a decline in private expenditure as a result of increases in government purchases

Great Recession

The period of recession starting in late 2007 and ending in mid 2009 was the longest and most severe since the Great Depression of the 1930s

Great Moderation

Business cycles have been particularly mild since the mid-1980s