Ch 3 : Audit Planning, Types of Audit Tests, and Materality

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

steps in a audit

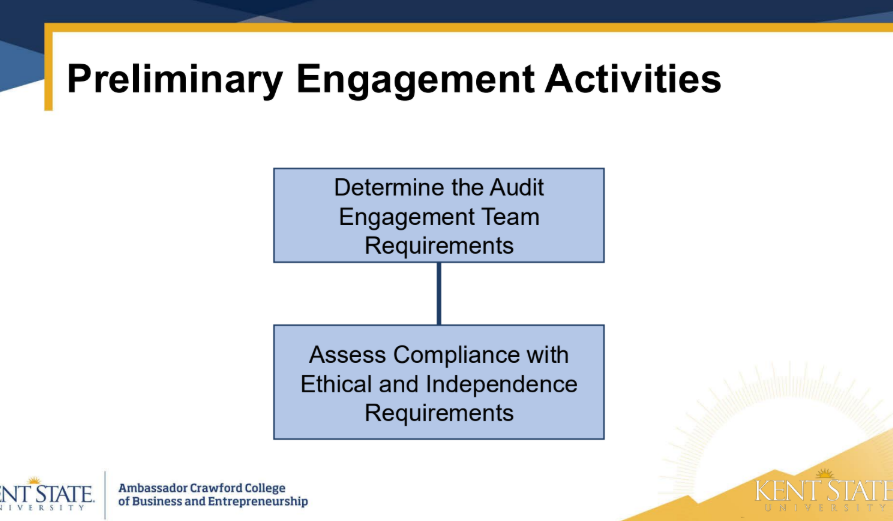

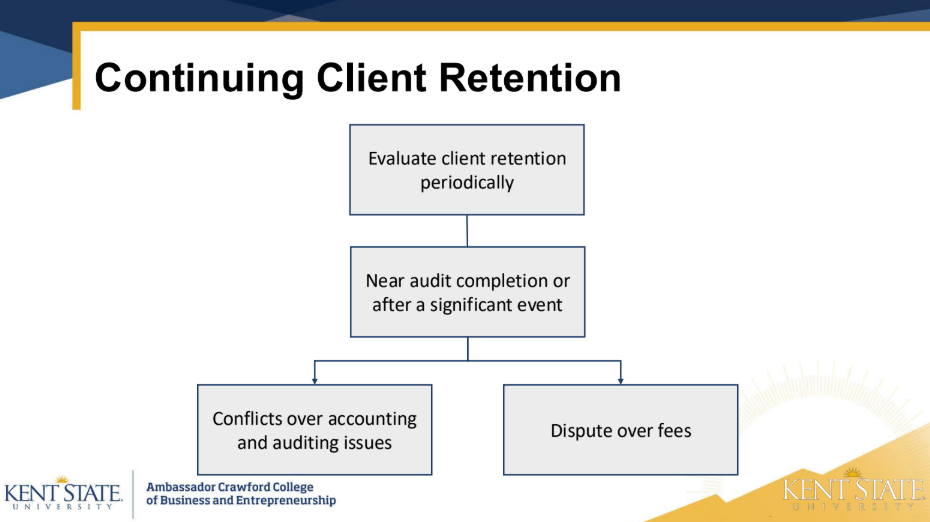

client acceptance and continuance —> preliminary engagement activities —>

what must a firm do before accepting a client

1. Has the capabilities to perform the engagement

2. Complies with legal and relevant ethical requirements

3. Has considered the integrity of the client

slides 4 5 6

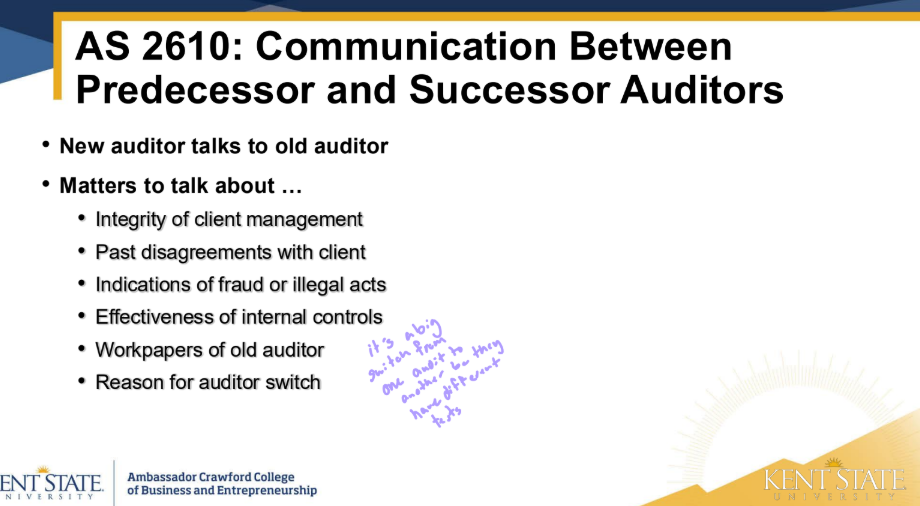

discussion - A switch in auditors sometimes occurs. What are

possible reasons for a switch in auditors?

financial struggles

disagreements

grew too big

discussion - Why do financial statements users want to know the

true reason for the switch in auditors? (public

entities)

can be used to hide fraud

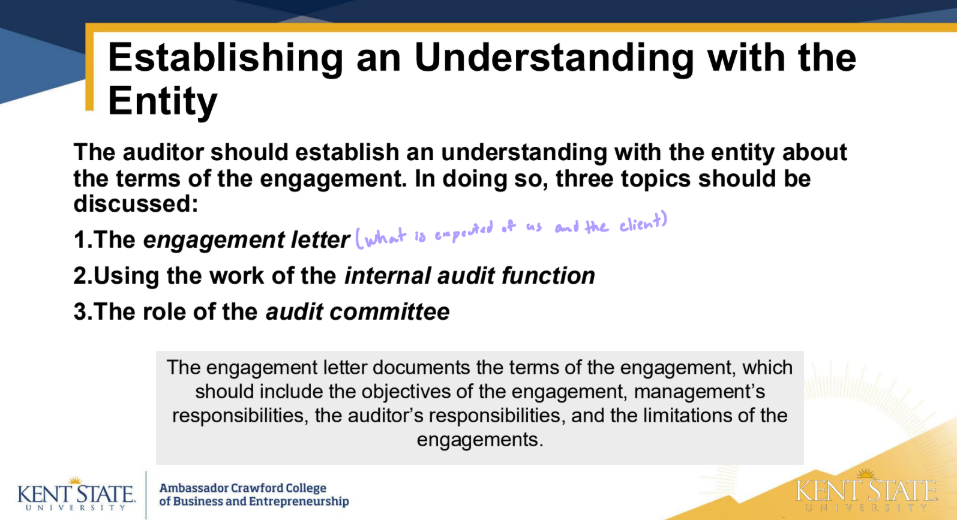

what is a engagement letter

formalized agreement between auditor and client

who signs the engagement letter?

the partner

Factors for Evaluating the Reliability of the Internal Audit Function

objectivity

competence

systematic and disciplined approach

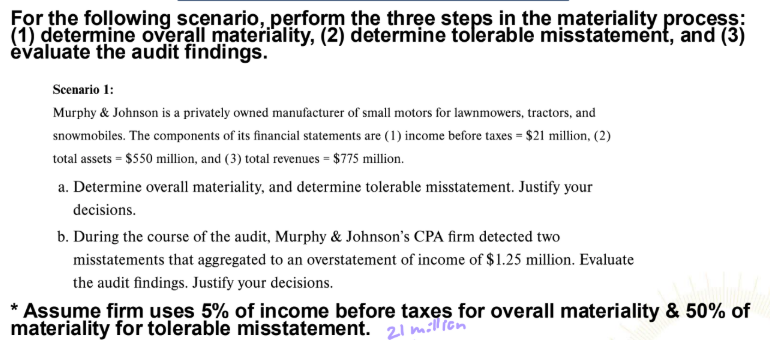

steps to establish materiality

determine overall materiality —>determine tolerable misstatement —> evaluate aduit findings

slides 20 21 22

Which of the following would an auditor most likely use in

determining overall materiality when planning an audit?

A.The anticipated sample size of the planned substantive tests

B.The entity’s income before taxes for the period-to-date (e.g., 6

months)

C.The results of tests of controls

D.The contents of the engagement letter

B

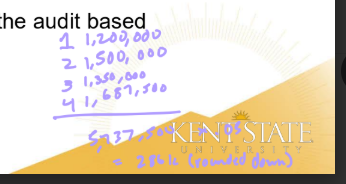

Suppose that you are the auditor of a major retail client and your firm sets materiality at 5% of income before taxes (IBT).

Your client reported the following IBT for the first two quarters of the year: 1st quarter = $1,200,000 and 2nd quarter = $1,500,000. You are in the process of establishing overall materiality for the client. Based on prior years, the client has a 10% decline in IBT from the 2nd quarter to the 3rd quarter. You also know that IBT in the 4th quarter increases by 25% over the 3rd quarter.

Required: Determine the amount of overall materiality for the audit based on these preliminary accounts.

mulit location businesses

how do auditor determine how much attention to each location

level of risk

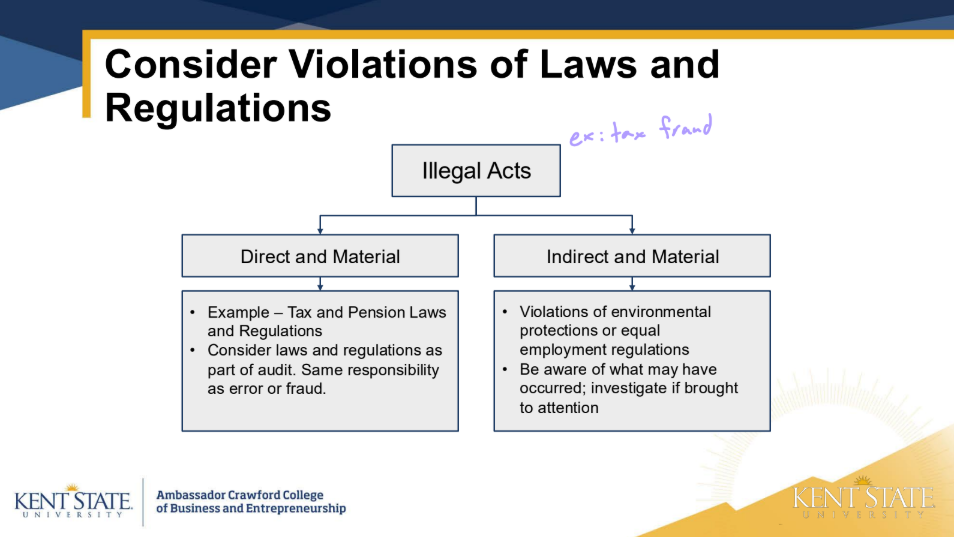

Which of these statements concerning illegal acts by clients is correct?

A. An auditor’s responsibility to detect illegal acts that have a direct and material

effect on the financial statements is the same as that for errors and fraud

B.An audit in accordance with auditing standards normally includes audit

procedures specifically designed to detect illegal acts that have an indirect but

material effect on the financial statements

C. An auditor considers illegal acts from the perspective of the reliability of

management’s representations rather than their relation to audit objectives

derived from financial statement assertions

D. An auditor has no responsibility to detect illegal acts by clients that have an

indirect effect on the financial statements

A