Keynesian Economics: Concepts and Equilibrium Analysis

1/78

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

79 Terms

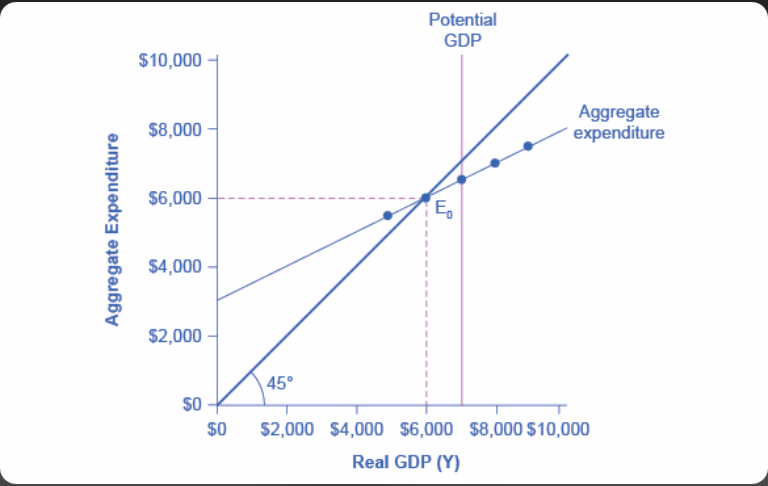

Keynesian Cross

A model showing where total spending equals total output (GDP) at a given price level.

Disposable income

Income (Y) - Taxes (T)

Marginal Propensity to Consume (MPC)

The fraction of extra income that people spend instead of save.

Example: You get $100 more and spend $80

Consumption function shifts

Changes in disposable income, consumer expectations, wealth, taxes.

Equilibrium spending formula

Y = C(Y) + I + G + (X-IM)

Output = Consumption(Income) + Investment + Government Spending + (Exports - Imports)

When total spending > output produced

Inventories fall, firms increase production

When total spending < output produced

Inventories rise, firms cut production

45° line in income-expenditure diagram

Line of points where the total income = total spending.

Expenditure schedule

The relationship between total spending and national income.

Equilibrium income determination

Point at the intersection of the 45° line and expenditure schedule.

Aggregate Demand (AD)

The relationship between the price level and the quantity of real GDP demanded.

Consumption when prices rise

Decreases due to erosion of purchasing power.

Consumption when prices fall

Increases due to enhanced purchasing power.

Downward shift of the consumption function

What do higher prices cause

Upward shift of the consumption function

Lower prices.

Higher price level effect on aggregate output demanded

Reduces it.

The effect of a lower price level on the aggregate output demanded

Increases it.

AD curve shifts

Changes in consumption, investment, government spending, and net exports.

Potential GDP

The level of output when resources are fully employed.

Full employment

When unemployment is at its natural rate (no cyclical unemployment).

Negative output gap

When actual GDP < potential GDP.

Positive output gap

When actual GDP > potential GDP.

Recessionary gap causes

Low spending, weak demand, high prices, low wealth.

Inflationary gap causes

High spending, strong demand, asset booms.

Natural closure of recessionary gap

Falling prices increase purchasing power and spending.

Natural closure of inflationary gap

Rising prices reduce purchasing power and spending.

Spending multiplier formula

1 / (1 - MPC)

Multiplier greater than 1 reason

Because each round of spending generates more income and spending.

Relationship between saving (S) and investment (I) at full employment

At full employment, total savings in the economy always equals total investment.

S = I when the economy is using all its resources efficiently.

If S > I

Recessionary gap.

If I > S

Inflationary gap.

Common reasons S > I

Credit crunch, low investment incentives, bank failures.

Government action to close recessionary gap

Increase public spending, cut taxes, boost investment.

Natural adjustment of the economy

Movements in wealth, prices, or exchange rates correcting output gaps.

Prevention of natural adjustment

Financial crises, misaligned expectations, market failures.

Role of expectations in investment and consumption

Positive expectations boost spending; negative expectations reduce it.

Exchange rate depreciation effect on NX

Makes exports cheaper, imports more expensive — raises NX.

Exchange rate appreciation effect on NX

Makes exports more expensive, imports cheaper — lowers NX.

Stock market boom effect on consumption

Increases wealth and boosts consumption.

Spending multiplier when MPC = 0.8

5

Spending multiplier when MPC = 0.75

4

MPC calculation

Δ Consumption / Δ Disposable Income

Marginal Propensity to Save calculation

1 - MPC

Relation between Marginal Propensity to Save and the multiplier

1 / MPS

Effect of increasing MPC on the multiplier

It gets larger.

Effect of decreasing MPC on the multiplier

It gets smaller.

Effect of taxes on the spending multiplier

Taxes reduce disposable income, thus lowering the multiplier effect.

GDP increase from initial spending of $100 million with multiplier 4

$400 million.

Spending multiplier when MPC = 0.6

2

Effect of increase in investment on AD curve

Shifts AD rightward (horizontal shift at each price level).

Effect of fall in net exports on AD curve

Shifts AD leftward.

Government spending needed for recessionary gap of $500 billion with multiplier 5

$100 billion.

GDP gap formula

Potential GDP - Actual GDP

Effect of increase in taxes on expenditure schedule

Downward.

Effect of decrease in taxes on expenditure schedule

Upward.

Effect of wealth increase on consumption function

It shifts upward.

Effect of rising interest rates on investment spending

It falls.

Effect of weakening foreign demand on net exports

NX falls, shifting AD left.

MPC when consumers save 30% of new income

0

GDP increase when MPC = 0.9 and initial spending is $50 million

$500 million (Multiplier = 10)

Spending increase needed for GDP shortfall of $1 trillion with multiplier 2.5

$400 billion.

Effect of sharp price rise on AD

Quantity of output demanded falls along the AD curve.

Effect of government cutting taxes on AD

AD shifts to the right.

Effect of stock market crash on AD

AD shifts to the left.

Effect of rising consumer wealth on equilibrium GDP

It rises.

Effect of investment boom on multiplier effect

GDP increases more than the initial investment.

Effect of rising foreign prices on net exports

Increases exports, improving NX.

Effect of rising interest rates on AD curve

Leftward shift (lower investment).

Lines drawn in the Keynesian Cross diagram

45° line and expenditure schedule.

Equilibrium GDP on income-expenditure graph

Where expenditure schedule intersects 45° line.

What shifts the expenditure schedule upward

Increases in C, I, G, NX.

What shifts the expenditure schedule downward

Decreases in C, I, G, NX.

Why does the Aggregate Demand (AD) curve slope downward?

Higher prices reduce real wealth and consumption.

X-axis of the AD curve diagram

Real GDP (Quantity of Output).

Y-axis of the AD curve diagram

Price Level.

Recessionary gap shown on a graph

Actual GDP to the left of Potential GDP.

Inflationary gap shown on a graph

Actual GDP to the right of Potential GDP.

Effect on AD curve if investment falls

It shifts left.

Marginal Propensity to Save (MPS)

Fraction of extra income that people save instead of spend