types of trade protection

1/25

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

26 Terms

trade protection

government intervention aiming to limit imports and/or encourage exports by setting up trade barriers that protect from foreign competition

tariff

a tax that is placed on imports to protect domestic industries from foreign competition and to raise revenue for the government

quota

an import barrier that set limits on the quantity or value of imports that may be imported into a country

production subsidy (international)

an amount of money paid by the government to a firm, per unit of output, to encourage production and provide the firm an advantage over foreign competition

export subsidy

payments made by the government to exporting firms on the basis of the number of units exported

administrative barriers

trade barriers in the form of regulations that aim to limit imports into a country. these barriers may take the form of product safety standards, sanitary standards or pollution standards

why countries might not want to engage in free trade

protect infant industries

national security

environmental standards

anti-dumping

unfair competition

government revenue

domestic job protection

ELDC diversification

winners from tariffs

domestic producers are better off

domestic employment in protected industry increases

government gains tariff revenues

losers from tariffs

domestic consumers are worse off

domestic income distribution worsens (regressive tax)

increased inefficiency in production

foreign producers are worse off

global misallocation of resources

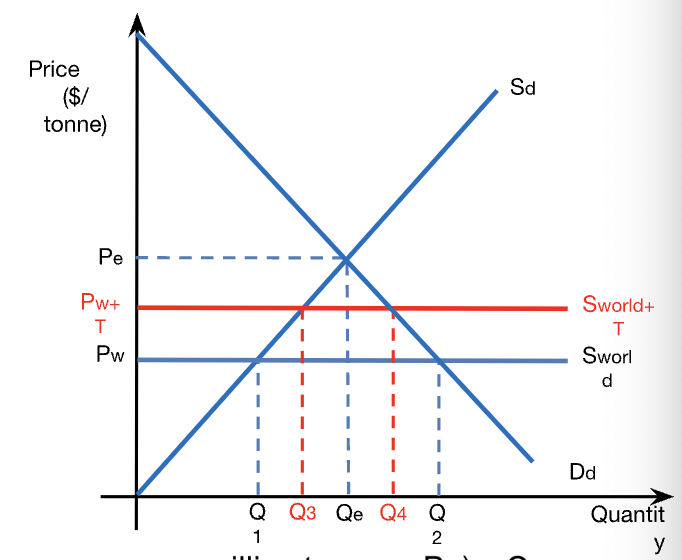

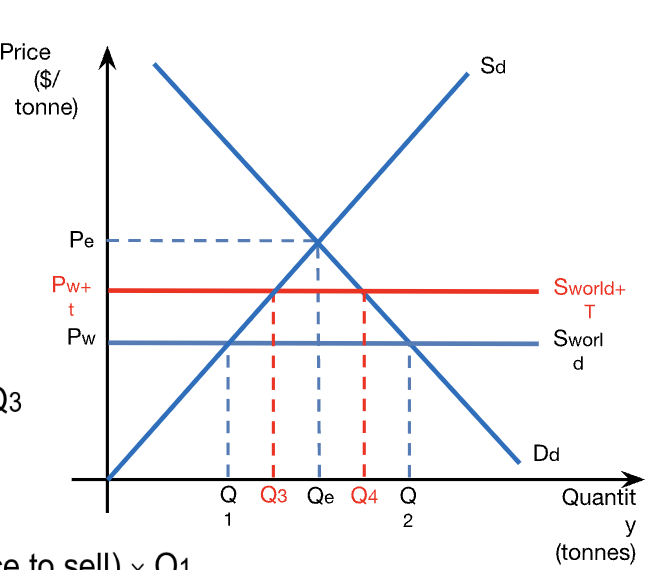

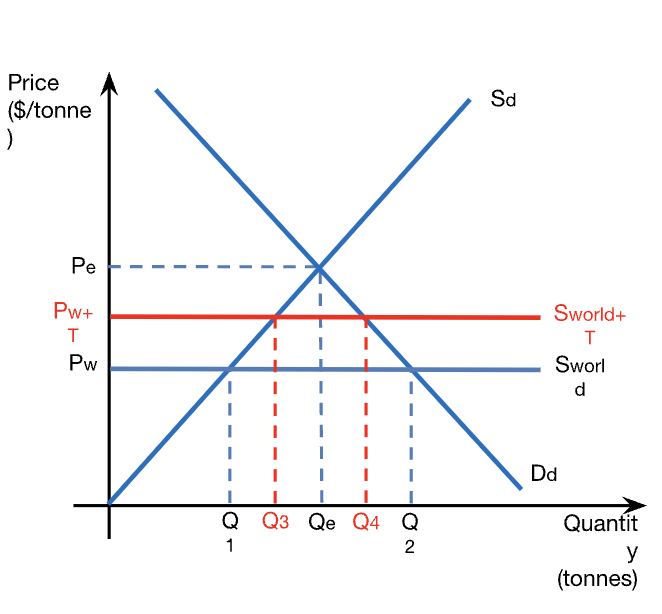

calculations: consumer expenditure from tariffs

consumer expenditure = P x Q

consumer expenditure before tariff = Pw x Q2

consumer expenditure after tariff = (Pw + T) x Q4

calculations: consumer surplus from tariffs

consumer surplus before tariff = (max price consumers pay - Pw) x Q2 / 2

consumer surplus after tariff = (max price consumers pay - (Pw - T)) x Q4 / 2

calculations: domestic producer revenue from tariff

domestic producer revenue = P x Q

domestic producer revenue before tariff = Pw x Q1

domestic producer revenue after tariff = (Pw + T) x Q3

calculations: producer surplus from tariff

producer surplus before tariff = (Pw - min price to sell) x Q1 / 2

producer surplus after tariff = ((Pw + T) - min price to sell) x Q3 / 2

calculations: foreign producer revenue from tariff

foreign producer rev = Pw x import quantity

foreign producer rev before tariff = Pw x (Q2 - Q1)

foreign producer rec after tariff = Pw x (Q4 - Q3)

calculations: gov’t revenue from tariff

gov’t rev = tariff x import quantity

gov’t revenue = T x (Q4 - Q3)

anti-dumping

tariffs that aim at raising the artificially low price of a dumped imported good to the level of the higher domestic price

dumped good: one that is exported at a price below cost of production

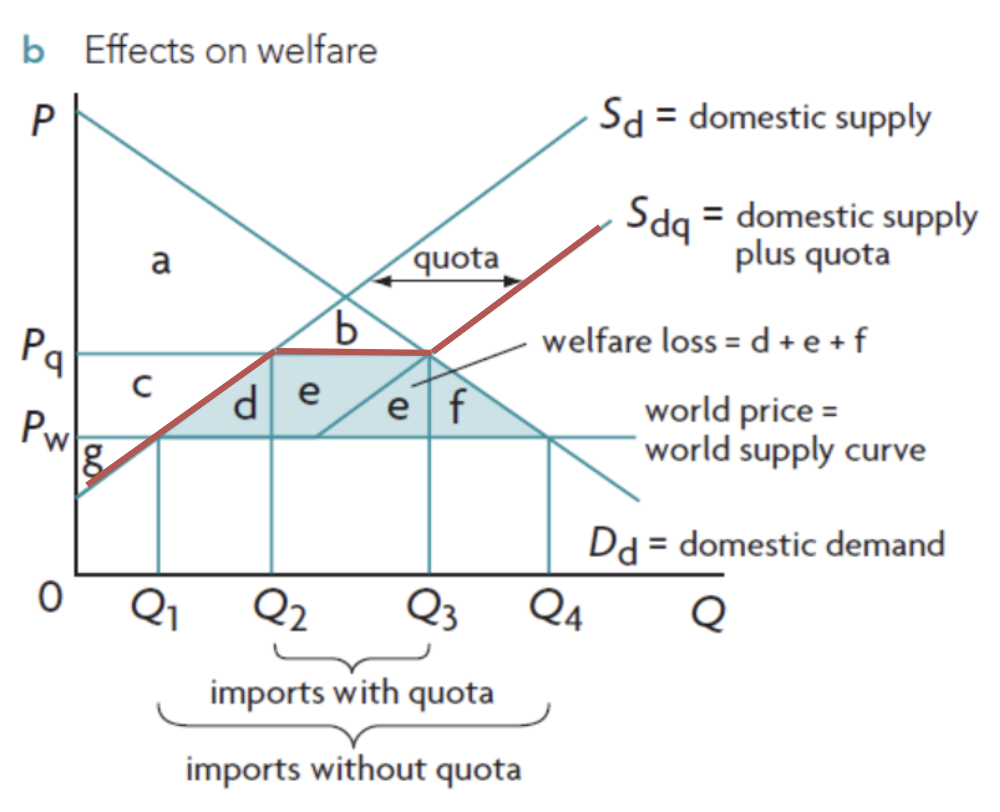

winners from quota

domestic producers are better off

domestic employment in protected industry increases

neutral impact from quota

the gov’t = no gain or loss

losers from quota

domestic consumers worse off

domestic income distribution worsens (regressive)

increased in efficiency in production

foreign producers are both worse and better off

global misallocation of resources

quota diagram

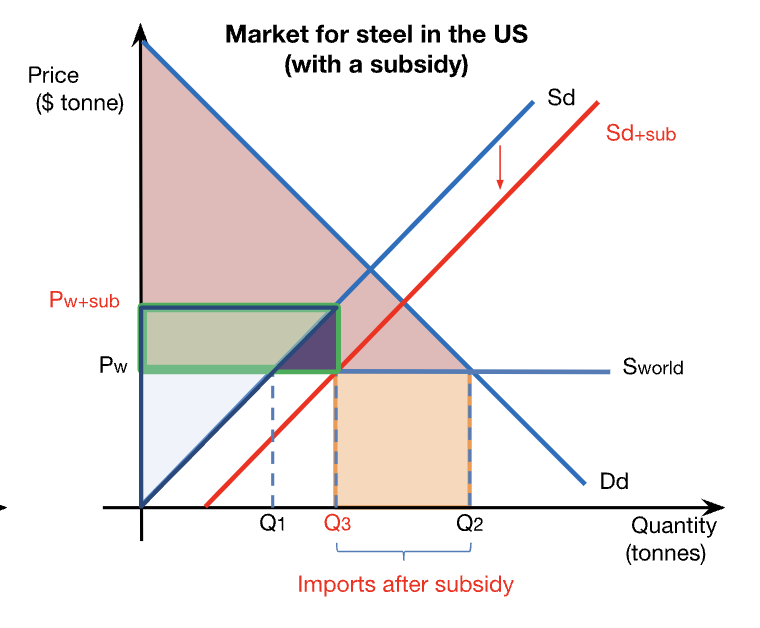

winners from production subsidies

domestic producers are better off

domestic employment in protected industry increases

consumers are not affected

losers from production subsidies

gov’t budget loses

taxpayers are worse off

increased inefficiency in production

exporting countries are worse off

global misallocation of resources

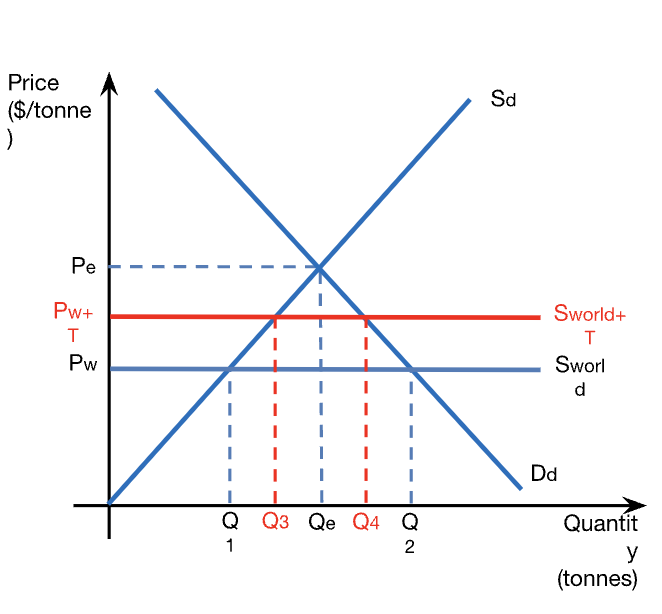

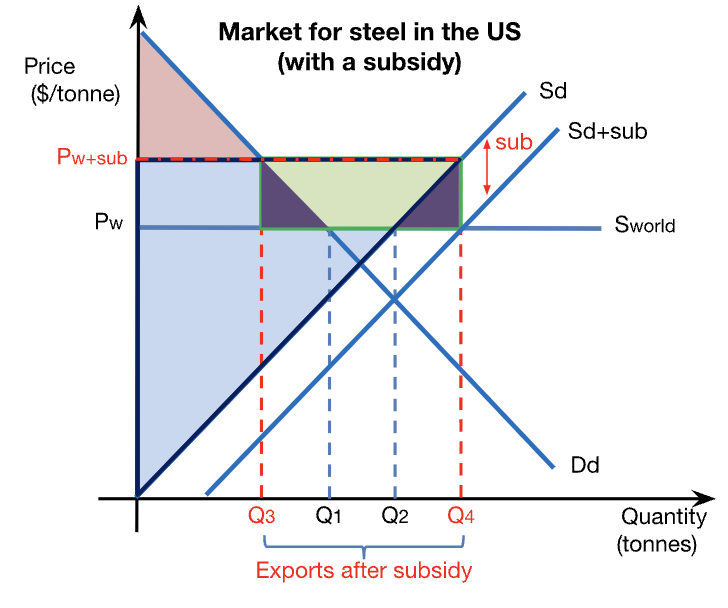

export subsidy diagram

winners from export subsidies

producers better off

domestic employment increases

losers from export subsidies

consumers are worse off

gov’t budget loses

taxpayers worse off

domestic income distribution worsens

exporting countries worse off

global misallocation of resources

production subsidy diagram