Chapter 4 - IFRS 15 Revenue

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Objective of IFRS 15

To establish the principles that an entity shall apply to report useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows arising from a contract with a customer

Revenue

Income arising in the course of an entity’s ordinary activities

Contract

An agreement between two or more parties that creates enforceable rights and obligations

Customer

A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration

Exemptions to IFRS 15

Any lease contracts - IFRS 16

Any insurance contrtact IFRS 17

Any financial instruments or contractual rights or obligations covered by IFRS 9 (Financial instruments), IFRS 11 (Joint arrangements), IAS 27 (Separate financial statements) and IAS 28 (Investments in associates and joint ventures)

same line of business agree to exchange non-monetary items

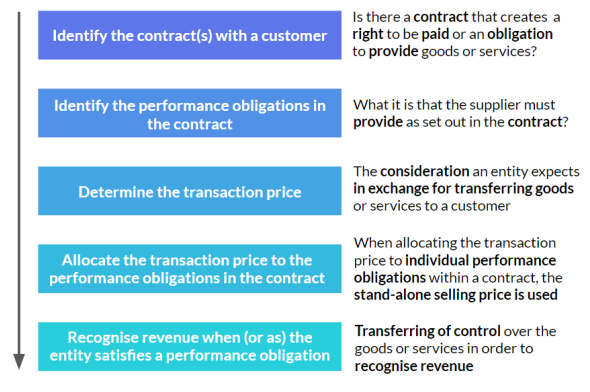

5 steps to determine revenue recognition

Identify the contract(s) with a customer

t must have approved the contract and must be committed to performing their respective obligation

o identify each party’s rights regarding the transfer of goods or services

payment terms for the goods or services must be identifiable

have commercial substance

probable that an entity will receive the consideration that it is owed

Identify the performance obligations in the contract

“A promise in a contract with a customer to transfer to the customer either:

• A good or service (or bundle of goods or services) that is distinct; or

• A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer.”

Determine the transaction price

The amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer

Variable consideration

any amount promised as part of a contract which includes a variable amount.

only be included as part of the transaction price of a contract if it is highly probable that these sums will be realised

Financing components

whether this price will be impacted by the time value of money

consider the following when assessing if a contract contains a financing component:

• The difference, (if one exists), between the promised consideration and the cash selling price of the goods or services

• The effects of a combination of:

-The length of time between the transfer of goods or services to a customer and the payment for said goods or services and;

-The prevailing interest rates in the relevant market

Non-cash consideration

must be measured at fair value. If this fair value isn’t attainable

the price at which goods or services are sold to a customer on a separate basis

Consideration payable to a customer

remove these amounts from their original transaction price, reducing the revenue they would recognise in their financial statements

Allocate the transaction price to performance obligations in the contract

When allocating the transaction price to individual performance obligations within a contract, the stand-alone selling price is used.

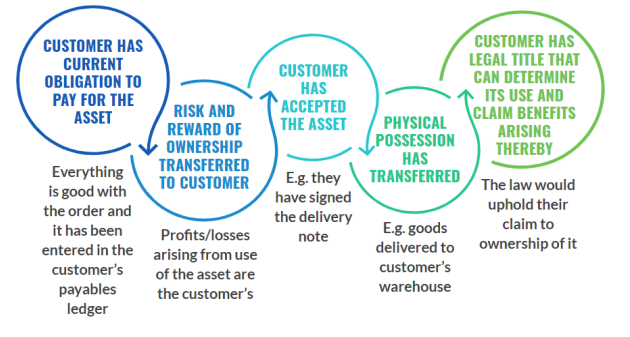

Performance obligations satisfied at a point in time

Performance obligations satisfied over time

Customers simultaneously receive and consume the benefits that an entity provides, as these are provided.

if another party would not be needed to re perform the work already carried out by the original contracted company as part of taking on the original performance obligation.

IFRS 15: 4 Steps

Is the contract profitable?

Measuring Progress

Income statement

Statement of financial position

Is the contract Profitable?

whether or not the contract itself is profitable

we will look at this IF profit is expected or lossess- and if this cannot be measured reliably no profit is recognised and is shown as a net 0 on the P&L.

Measuring Progress

simply means to measure how much of the project has been completed so far.

Using Input and Output methods - using accounting concepts like prudence and accruals/matching concept.

Income statement

This is where we need to recognise revenue and expenses related to the contract – specifically sales, cost of sales and profits (or losses).

Sales revenue

measured with reasonable certainty, sales value of work completed is included as part of revenue.

Cost of sales (COS)

y deducting the period’s profit from the period’s sales value.

Expected contract losses - recognised immediately, added to the period’s cost of sales

Uncertain outcomes - the costs incurred in the year should be recorded and a matching amount recorded as revenue (as long as the company are confident they will be able to recoup the costs in the future).

Contract profits

sales less cost of sales, as calculated by using % stage of completion. profits which have been recognised in previous years of the contract, deducted from the total profits to date.

Expected contract losses

revenues and costs are allocated in relation to the stage of completion, expected losses to the end of the contract must be shown in advance. using

Cost method or Value method

Statement of financial position

The main accounts here are receivables (asset) and payables (liability).

Contract assets

actual amounts received from the customer may be less than the amount recognised in the income statement. The difference is recorded as a contract asset on the statement of financial position.

Contract liabilities

a contract liability will be recognised in the statement of financial position.

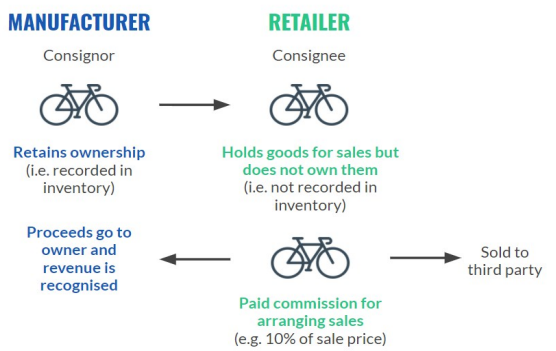

Consignment inventory

inventory owned by one party, being held by another party.

Sale with right of return

a customer will not only receive control of a product from an entity, but will also receive the right to return the product for various reasons such as dissatisfaction, e.g. it didn't work as promised

Warranties

provides a customer with assurance that the product that they have purchased will function as per the specifications agreed upon at the time of sale.

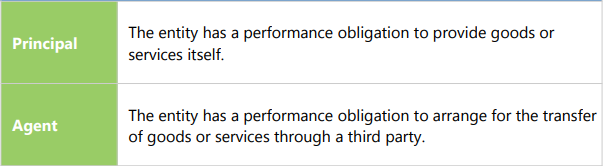

Principle vs. agent

entity has a performance obligation to provide goods or services itself, or whether it is arranging for these to be provided by a third party.