3.6 fiscal policy

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

85 Terms

fiscal policy definition

Fiscal policy is the use of taxation and government expenditure to influence the level of economic activity in order to achieve macroeconomic objectives.

sources of government revenues

- taxation

- sales of g/s from state owned enterprises

- sale of government assets

direct/indirect taxation

Income taxes, inheritance taxes (both direct), sales taxes, carbon taxes (both indirect).

sale of goods and services from state owned enterprises

Most governments own some companies, who provide revenue.

sale of government assets

By selling state-run businesses like the postal service, the state telecom, etc., the government can make money. This can only occur once, though, as you can't sell a company twice.

types of government expenditures

- current expenditures

- capital expenditures

- transfer payments

current expenditures

Spending on goods and services within the current year, such as spending on healthcare and education.

capital expenditures

Long-term investments by the government, such as a new airport.

transfer payments

Payments sent to people without any return. When the government gives unemployment benefits, no good or service is given in return.

goals of fiscal policy

- Low and stable inflation

- Low unemployment

- Promote a stable economic environment for long-term growth

- Reduce business cycle fluctuations

- Ensure an equitable distribution of income

- Ensure an external balance (exports = imports)

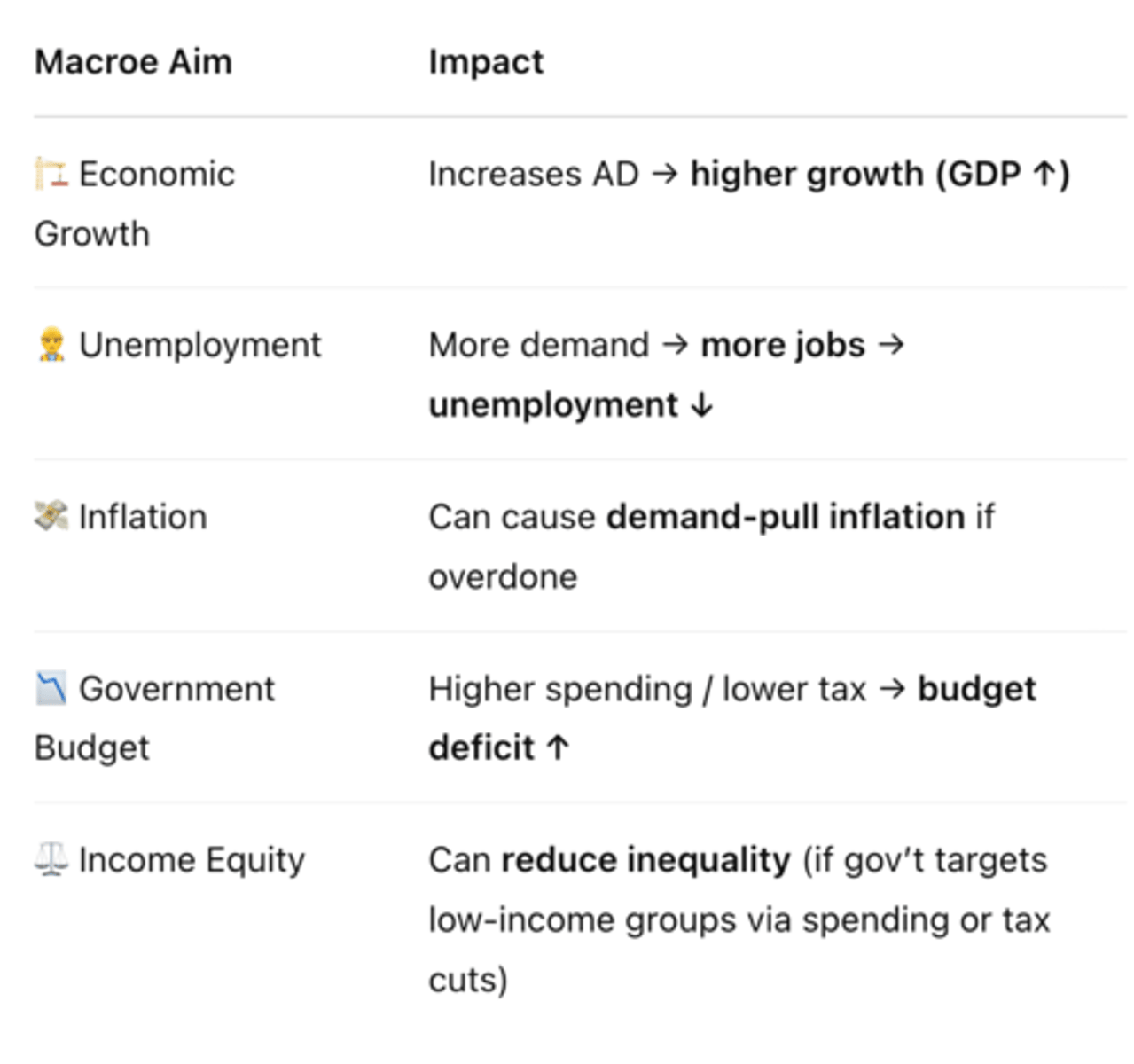

expansionary fiscal policy

the use of increased government spending and/or reduced taxes to stimulate economic activity and achieve macroeconomic objectives

when is expansionary fiscal policy used

- Economic growth is too slow

- Unemployment is rising

- Inflation is low or falling

- Consumer/business confidence is weak

goal of expansionary fiscal policy

Increase overall demand and stimulate economic activity.

tools of expansionary fiscal policy

Cut taxes: This means people and businesses will take home more money, incentivizing more consumption/investment.

Increase government spending (Main policy): Since G is a part of measuring real GDP (C + I + G + X - M), an increase in G will increase economic activity.

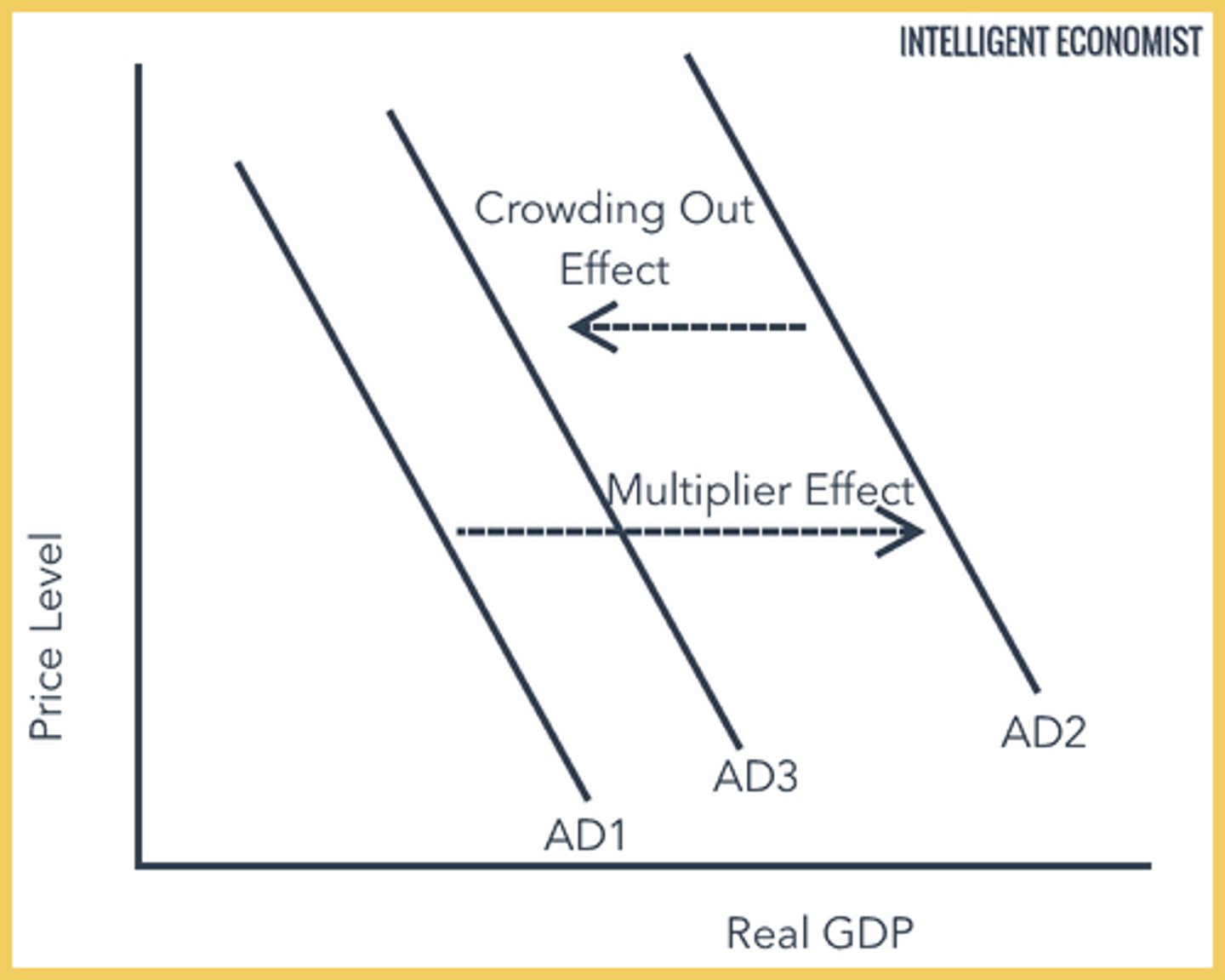

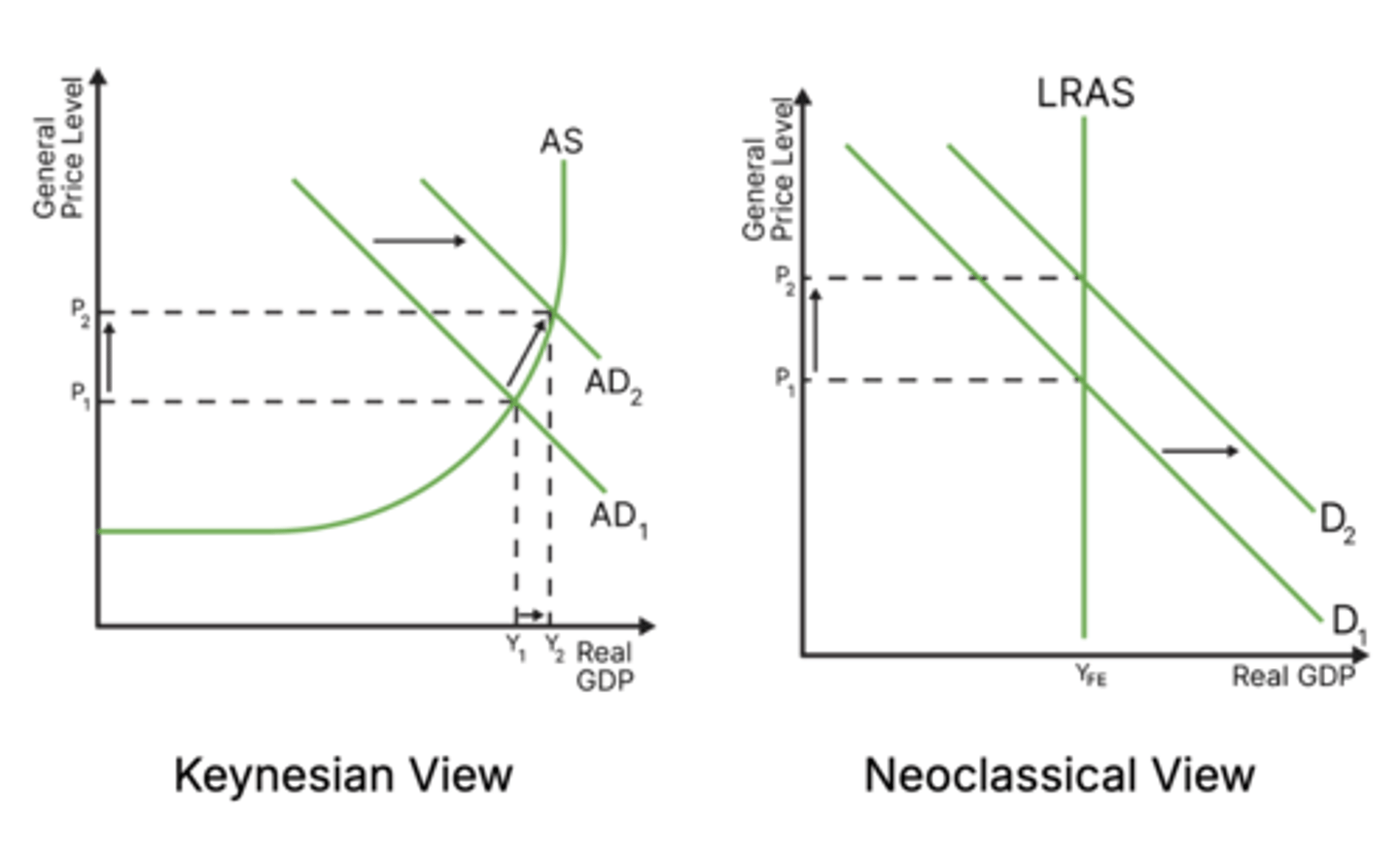

expansionary policy diagram

- economy initially @ macro equilibrium PL1, Y1 there is a recessionary gap

- govt. wanting to boost economic growth will lower the rate of income and corporate tax

- lower taxes cause investment and consumption to increase (components of AD)

- aggregate demand increases, AD 1 → AD 2

- economy new equilibrium: P2, YP a higher average price level and a greater level of national output

expansionary : neoclassical belief

Neoclassicalists believe fiscal policy is ineffective as you're just increasing demand, and no supply, which will, in the long run, just result in higher prices and more government debt.

impact of expansionary fiscal policy on economy

firms net profits increase → investment by firms increase → AD increases

impact of expansionary fiscal policy on macro aims

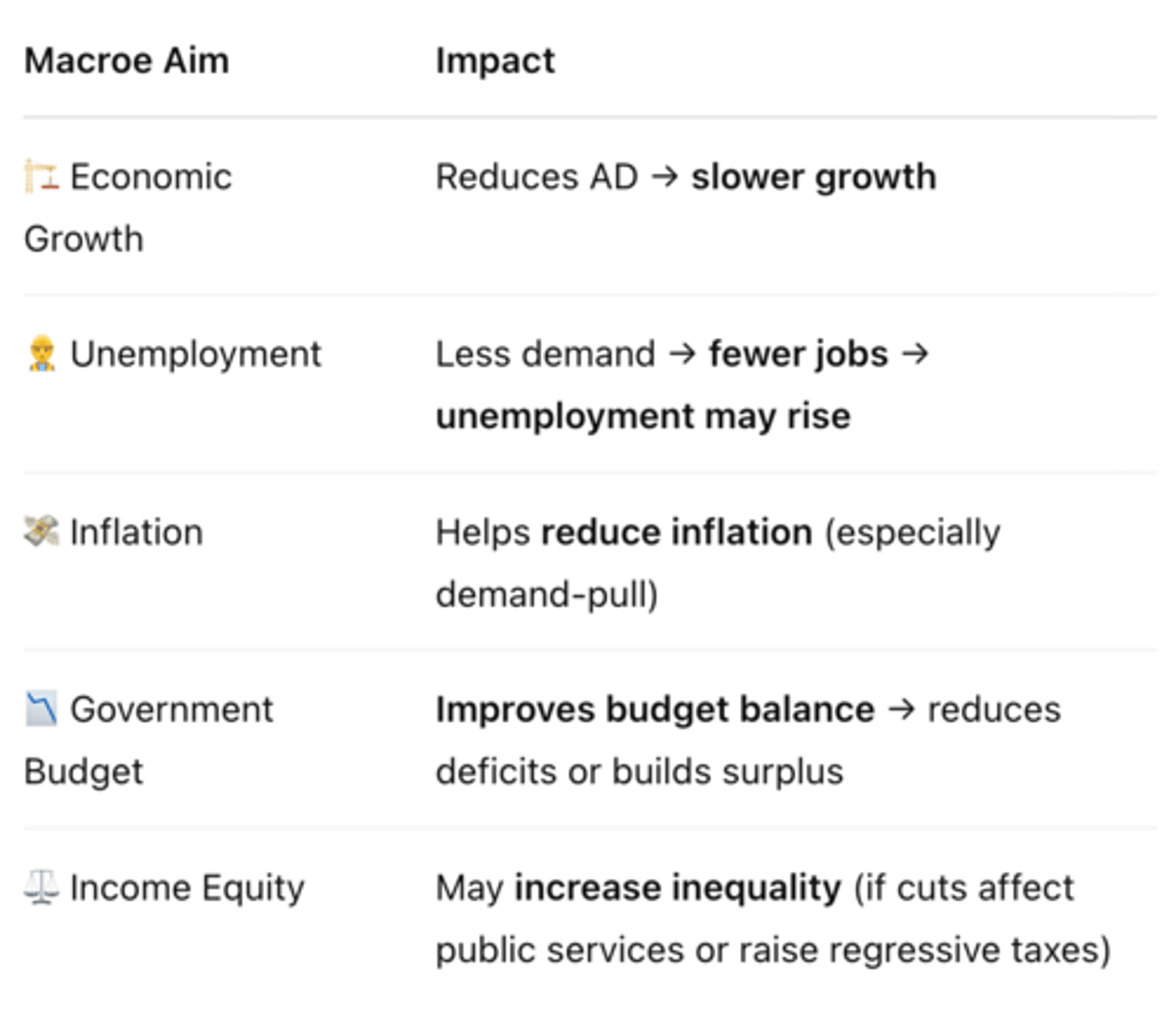

contractionary fiscal policy

Fiscal policy used to decrease aggregate demand or supply. Deliberate measures to decrease government expenditures, increase taxes, or both. Appropriate during periods of inflation.

when is contractionary fiscal policy used

- Inflation is too high

- Budget deficit is growing unsustainably

- Economy is growing too fast

- There's a risk of demand-pull inflation

tools of contractionary fiscal policy

Decrease government spending

Raise taxes

goal of contractionary fiscal policy

Reduce demand, cool down inflation, and avoid a boom-bust cycle.

contractionary policy impact

keynesian multiplier

It's a theory that shows how an initial injection of money into the economy leads to a proportionally larger increase in Aggregate Demand (AD) due to the circular flow of income.

why does the keynesian multiplier happen

Because money spent by one person becomes income for another, who then spends part of it, and so on—amplifying the total economic impact.

real-life example explaining the keynesian multiplier

If the government spends $1B on building a highway, contractors get paid, then spend on wages/equipment, and workers spend their wages—causing the total increase in GDP to exceed $1B.

when do we use the keynesian multiplier?

1. explaining fiscal policy effects

2. showing the impact of injections (I + G + X)

3. evaluating AD shifts in the keynesian model

4. explaining multiplier effects in development (how FDI/foreign aid may increase income)

induced expenditure

originated in the increase of national income

(upward sloping line)

autonomous expenditure

if it does not originate from an increase in national income but is instead driven by other factors (e.g. wealth & credit)

(horizontal line)

change in autonomous expenditure...

= change in national income = change in consumption (households adjust spending in response to new income levels = further changes in natural income

➜ leads to a cycle

marginal propensity

the tendency of consumers to increase spending in conjunction with increases in income

MPC (Marginal Propensity to Consume)

It's the fraction of additional income a person uses for consumption.

Example: If MPC = 0.6, they spend 60 cents of every $1 earned.

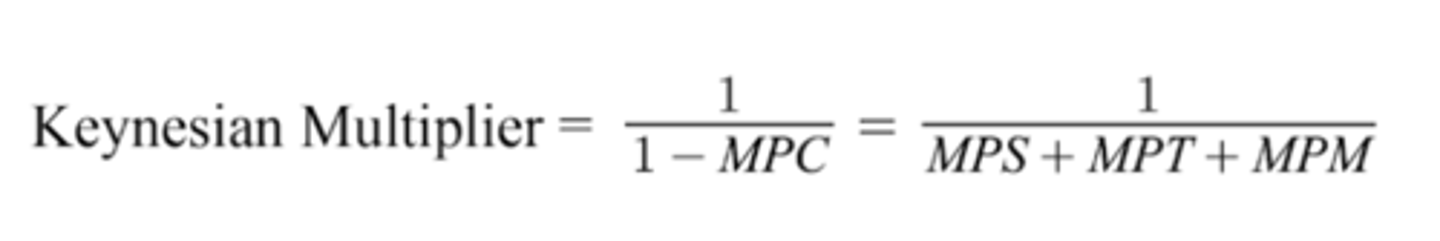

MPC formula

∆C / ∆Y

∆ consumption / ∆ income

MPS (Marginal Propensity to Save)

It's the fraction of additional income a person saves. This does not contribute to GDP.

MPS formula

∆S / ∆Y

∆ savings / ∆ income

MPC + MPS

= 1

MPT (Marginal Propensity to Tax)

It's the portion of extra income that goes to taxes. This also does not contribute to domestic GDP.

MPT formula

∆T / ∆Y

∆ tax / ∆ income

MPM (Marginal Propensity to Import)

It's the fraction of income spent on imports (foreign products), which also doesn't count toward domestic GDP.

MPM formula

∆M / ∆Y

∆ imports / ∆ income

MPW (marginal propensity to withdraw)

The proportion of extra income not consumed MPS + MPT + MPM or ⌂W/⌂Y.

leaks from the circular flow of income

What do MPC, MPS, MPT, and MPM add up to?

They always add up to 1.

since MPT + MPS + MPM + MPC = 1

MPW = 1 - MPC

Keynesian multiplier formula

If MPC = 0.6, what is the multiplier?

1÷(1-0.6) = 2.5

higher MPW / lower MPC ...

the weaker the multiplier effect because more money is leaking out of the economy

What does a higher Keynesian multiplier mean?

A larger final increase in national income from a small initial injection of spending (e.g., government expenditure, exports, investment).

When a higher multiplier is better:

- In a recession or deflationary gap, where the goal is to boost output and employment.

- In developing countries with underused resources — a higher multiplier makes government or aid spending more effective.

- When evaluating expansionary fiscal policy — a high multiplier means greater stimulus impact with less spending.

When a higher multiplier is risky or worse

- If the economy is near full employment, a high multiplier might lead to inflation rather than real growth.

- If the spending is poorly targeted, it could create wasteful booms or worsen debt without real benefits.

- If it's based on borrowed money, a higher multiplier might seem good short term but increase long-term fiscal deficits.

What does a lower multiplier mean?

The increase in income is smaller relative to the initial injection.

When a lower multiplier is okay or safer

- In economies with high inflation, it's good for fiscal policy to be less expansionary.

- If the goal is long-term stability or debt reduction, low multiplier effects mean spending doesn’t balloon the economy unsustainably.

- In open economies (high imports), multipliers are naturally smaller due to leakages.

When a lower multiplier is bad

Less effective stimulus, slower recovery

reverse keynesian multiplier

If people or the government cut back on spending, then:

Businesses earn less

So they hire fewer workers or cut wages

Then those people have less money to spend

So even more businesses lose money

And the cycle continues...

This chain reaction means the total fall in GDP is larger than the original cut.

why the reverse multiplier happens

Because of the interconnectedness of the economy:

- One person’s spending = another person’s income.

- Less spending = less income = even less spending.

use the reverse multiplier when talking about...

Austerity

Recessions

Cuts in investment or exports

Negative confidence shocks

change in GDP calculation

change in GDP = multiplier x injection

e.g. k = 5, government spending = 1000

change in GDP = 5 x 1000

What does a multiplier of 2.5 mean for a $1B government project?

It means the total increase in GDP would be $2.5B.

Why is the Keynesian multiplier important in fiscal policy?

It shows how government spending has a multiplied effect on GDP, justifying large-scale public investment—key in Keynesian economics.

strengths of fiscal policy

- It can target specific economic sectors.

- Government spending is effective in recessions, as it can boost confidence easily.

- Fiscal policies can include Automatic Stabilizers (HL): Fiscal policies that naturally reduce fluctuations of the business cycle. (progressive taxes & unemployment benefits)

automatic stabilisers

Automatic stabilisers are built-in government policies that reduce the impact of economic fluctuations without needing new legislation.

Why are automatic stabilisers important?

They help smooth out the business cycle by reducing the severity of booms and recessions, without delays or political debate.

progressive taxes

A tax system where people with higher income have a higher tax rate. If people suddenly earn less in a recession, tax rates automatically decease as people go into lower tax brackets.

unemployment benefits

A form of transfer payments for the unemployed, ensuring they have enough money to cover their needs. This is given to every unemployed person and will therefore automatically adjust when more people lose their jobs.

weaknesses of fiscal policy

Political pressure: Since it is done by the government, it needs political support, which may vary from what's actually best for the economy.

Time lags: It takes time to implement fiscal policies. Bureaucracy takes time, and the injection of money will take time.

Fiscal policy will also increase government debt, which is not sustainable in the long run.

crowding out effect in fiscal policy (HL)

When the government spends a lot (for example, on infrastructure or stimulus), it might borrow money by selling bonds to pay for it.

government spending "crowds out" private sector investment.

It’s when increased government spending leads to less private sector spending, especially due to higher interest rates.

Why does crowding out happen after government spending increases?

When the government borrows more money (by selling bonds), demand for money increases, pushing interest rates up. This makes it more expensive for businesses and consumers to borrow and invest.

How does crowding out affect private investment?

Higher interest rates discourage private firms from taking loans, which reduces investment in the economy.

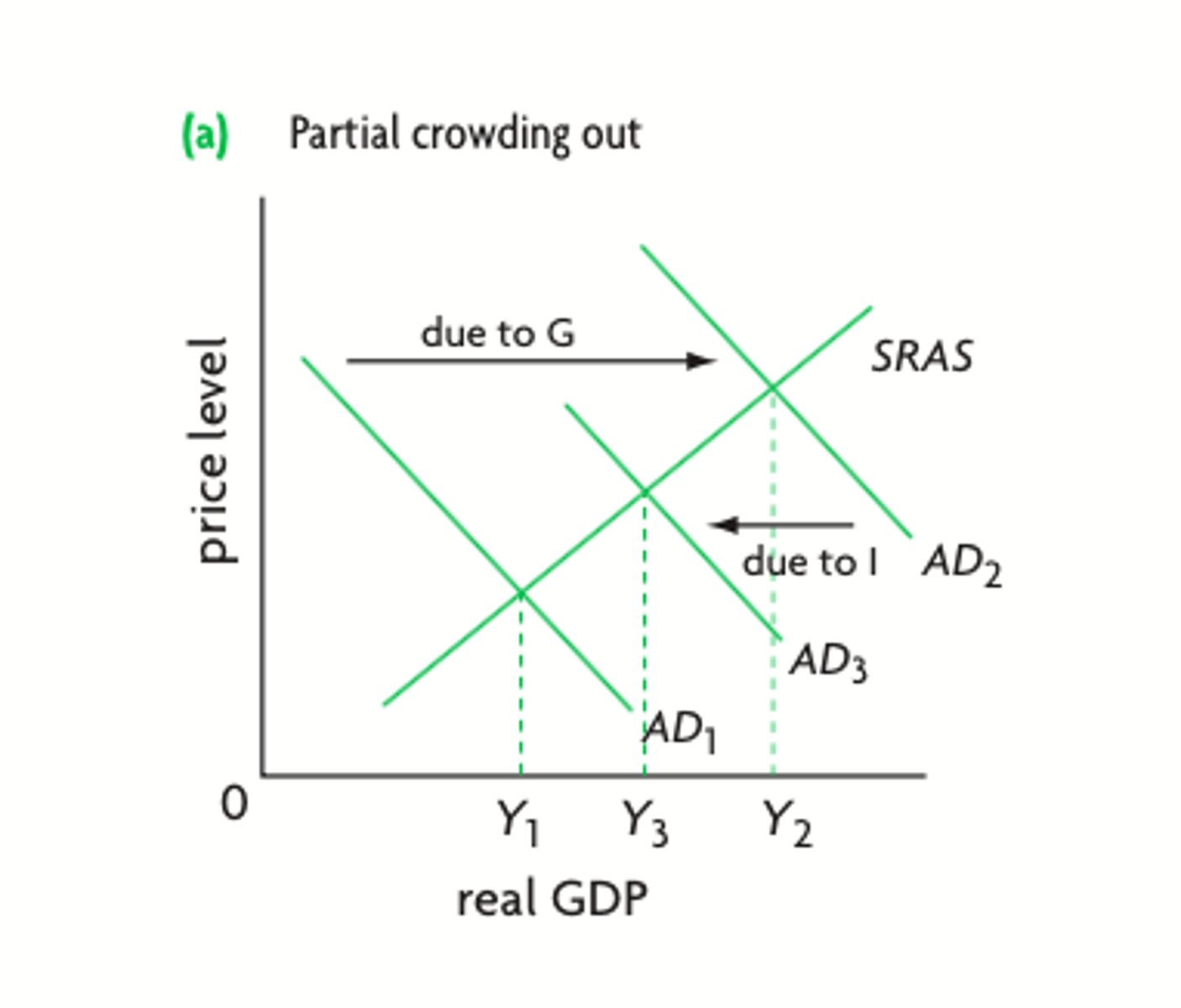

How does crowding out limit the effect of fiscal policy?

If private spending falls when the government increases spending, the total increase in GDP may be smaller than expected — dampening the multiplier effect.

partial crowding out

govt. spending increases gDP but less than expected

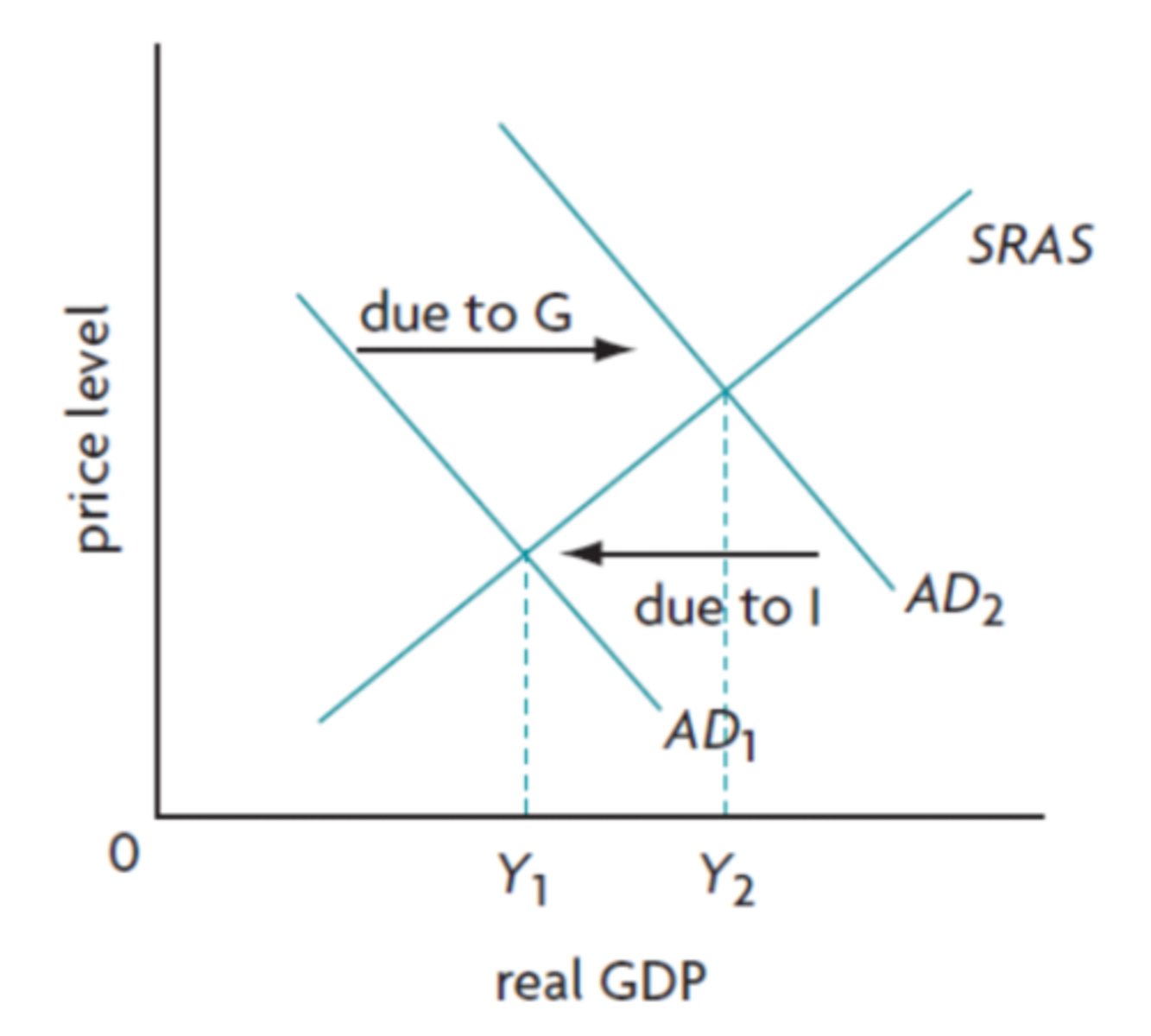

full crowding out

private spending falls by the same amount government spending rises → no change in total GDP

what happens to the economy after full crowding out

- no increase in AD (government spending rise, private investment falls by same amount)

- no boost to rGDP (output and income)

- interest rates remain high (keep private borrowing expensive)

- investment remains low

- potential increase in budget deficit (higher spending w/o benefit)

When is crowding out more likely to happen?

- When the economy is near full employment

- When the central bank is not accommodating fiscal expansion

- When interest rates are sensitive to debt levels

When is crowding out less likely to happen?

- During a recession or output gap

- When interest rates are already low

- When private sector is not borrowing much anyway

crowd out analysis

- This increases demand for money in the economy.

- As a result, interest rates may rise.

- Higher interest rates make it more expensive for businesses and consumers to borrow.

- So, private investment and spending may fall.

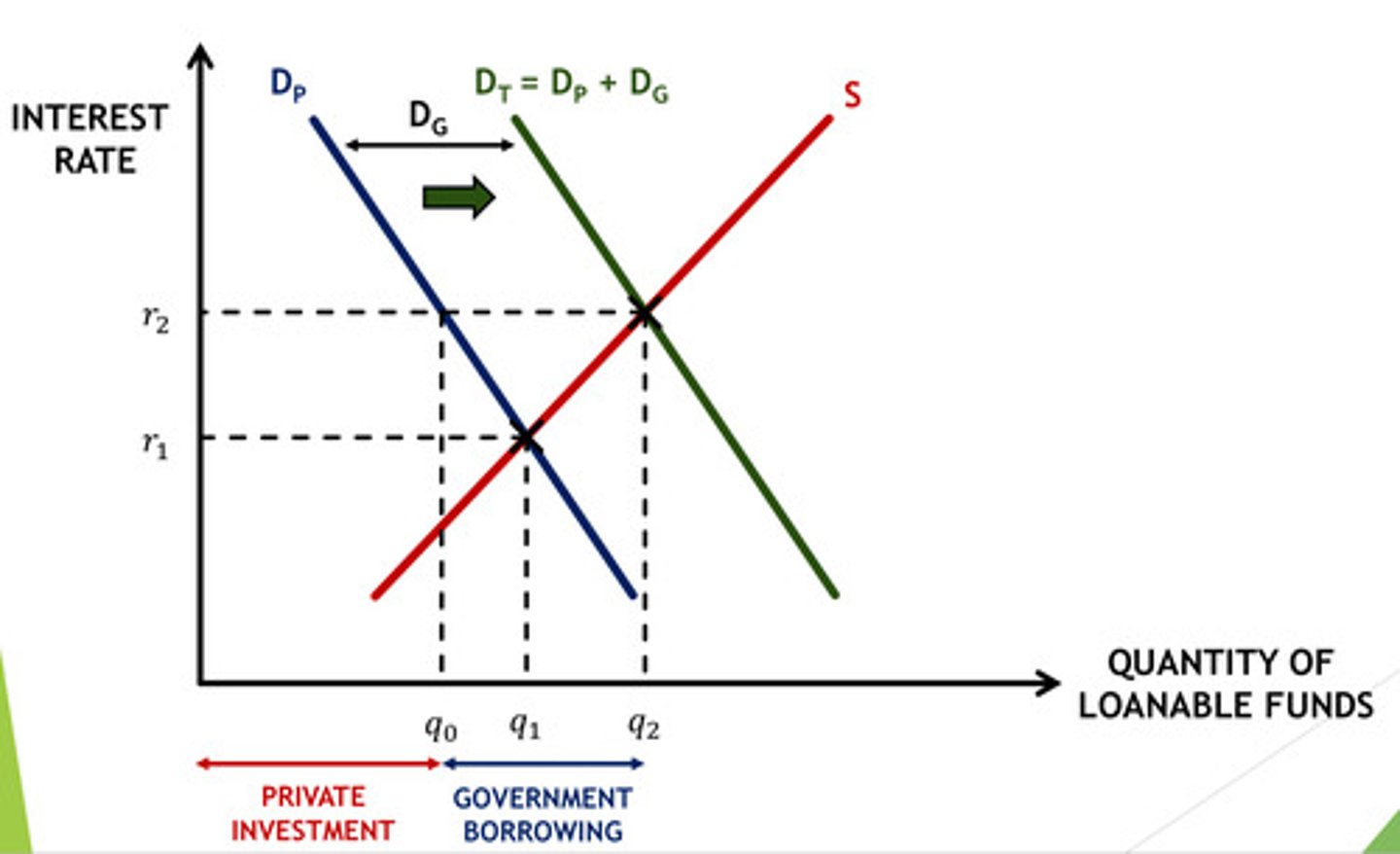

loanable funds market

a hypothetical market that illustrates the market outcome of the demand for funds generated by borrowers and the supply of funds provided by lenders

supply of loanable funds

the relationship between the quantity of loanable funds supplied and the real interest rate when all other influences on lending plans remain the same

-> comes from savings

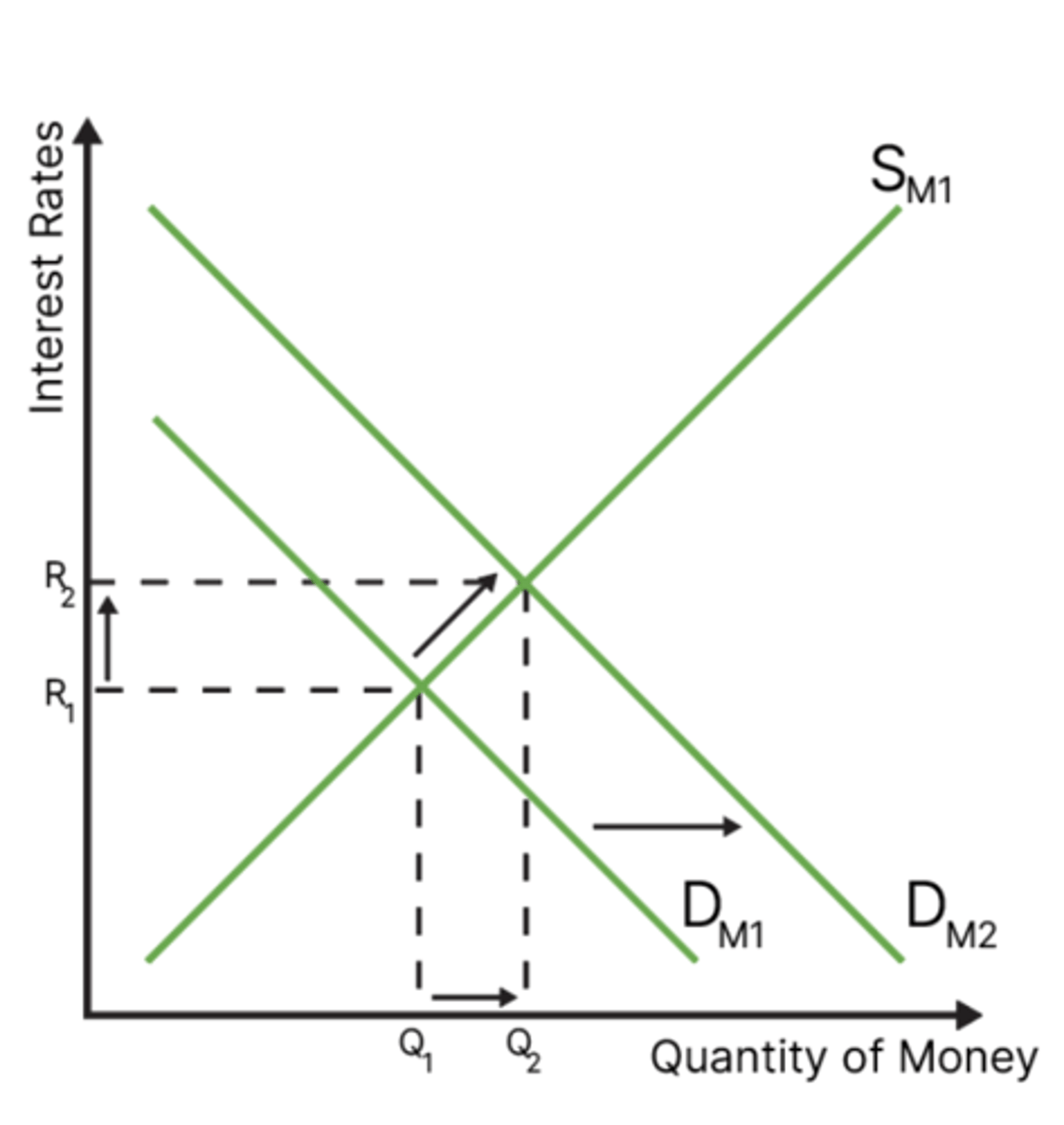

Effect of increased government spending on the loanable funds market (diagram)

Government borrows more → demand for money rises → interest rates increase

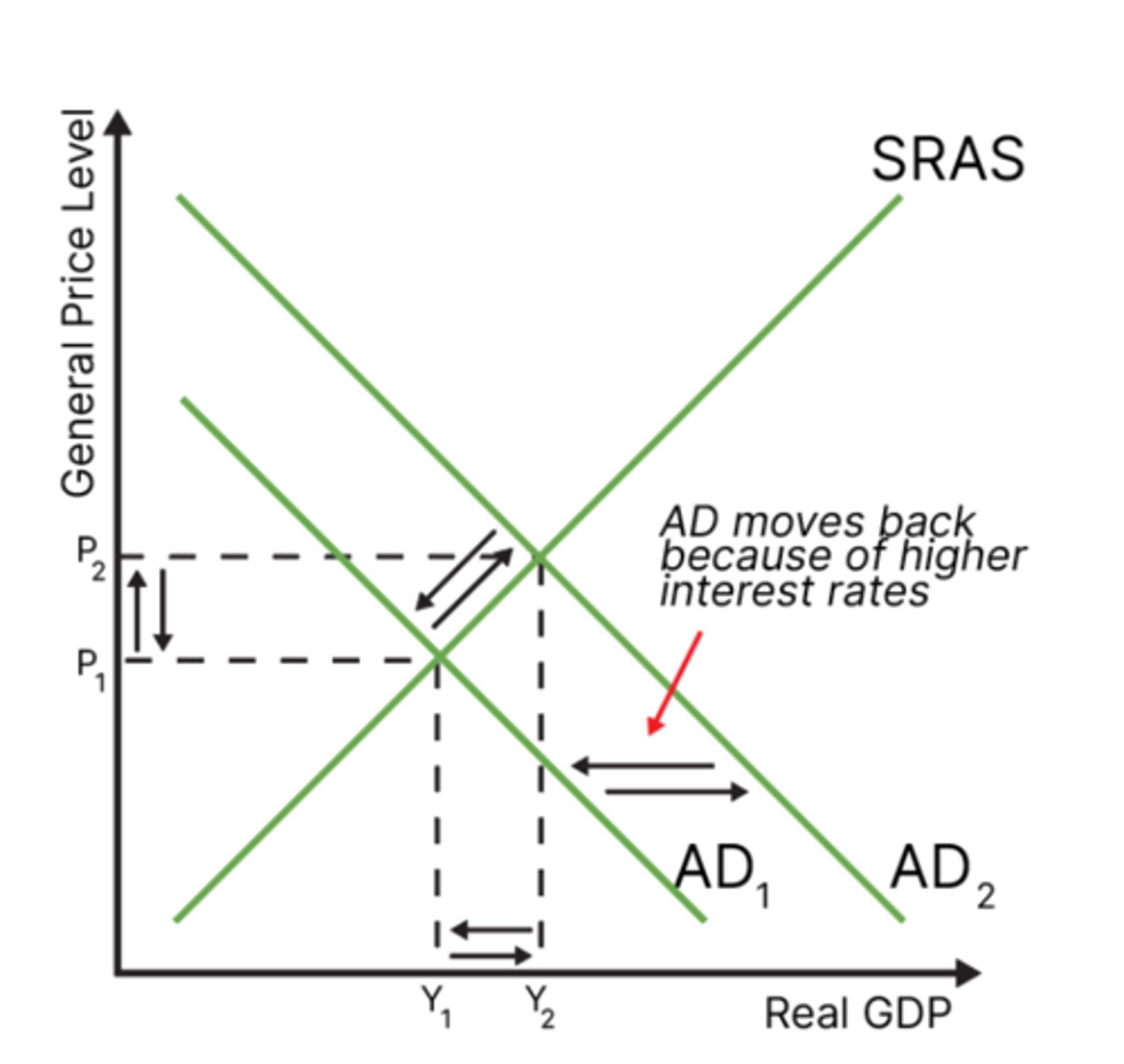

Effect of crowding out in the economy

Higher interest rates reduce private investment → Aggregate Demand (AD) decreases or grows more slowly → smaller rightward shift of AD.s

Why do Neoclassical economists not support fiscal policy?

Because they believe it causes crowding out, which reduces private spending.

How does fiscal policy increase demand for loanable funds?

Government borrows money → demand for loanable funds increases.

What happens to interest rates when the government borrows more?

Interest rates rise because demand for money increases while supply stays the same.

How do higher interest rates affect consumers and firms?

Borrowing becomes more expensive, so consumption and investment decrease.

What is the crowding out effect in terms of GDP components?

Gov't spending (G) increases, but consumption (C) and investment (I) decrease due to higher interest rates.

What's the result of crowding out on fiscal policy effectiveness?

Budget deficit grows with little to no economic stimulus, as G is cancelled out by falling C and I.

crowding out vs multiplier effect