2 Money Demand, Interest Rates, Monetary Policy Transmission

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

Why is there Demand for Money

For simplicity assume only assets are money and bonds

Money Provides: Liquidity and universally accepted

Bonds: Provide financial return through interest rate

What does demand for money depend on?

Depends on how frequently we transact

Nominal GDP used to approximate volume of transactions

What is used to approximate the volume of transactions

Nominal GDP

Nominal Money Demand is Proportional to

Real Money Demand is proportional to

Nominal GDP

Real GDP

How do interest rates affect the demand for money.

Higher interest rates mean higher opportunity costs of holding money

So demand is lower

Lower interests rates meran its cheaper to borrow

So demand is higher

Real Money (Purchasing Power) Demand

Increases with

Decreases with

Increase with higher Real Income

Decrease with higher interest rates

Money Market Equilibrium

When the demand for money equals the supply of money at a given interest rate.

Formula for Real Money Supply

Real Money Supply = Nominal Money Supply / Price Level

Central Bank’s influence on real money supply

Short-run

Long-run

Short-run (Prices are Fixed)

Can influence real money supply, because prices are fixed and they can change nominal money supply

Long-run (Prices are flexible)

Cannot directly control real money supply

It can only adjust real money supply through controlling inflation (rate of price increase)

Relationship between interest rates and consumption demand

If Interest is high, stocks and bonds go down in price so people feel poorer

This reduces consumption

If interest is lower, stocks and bond go up in price, so people feel richer

Increasing consumption

Relationship between Interest Rates and Investment

High Interest, increases cost of borrowing so Lower investment

Low Interest, decrease cost of borrowing so Higher Investment

What does monetary policy of CB’s usually target?

usually targets stable inflation rate (price stability)

Also output and employment

Expansionary vs Contractionary Monetary Policy

Expansionary

Used to boost output during recession or low inflation

Increases Money Supply (and Inflation) by lowering interest rates encouraging higher investment and consumption

Contractionary

Used to reduce output during high inflation

Reduces Money Supply (and Inflation) by raising interest rates to curb spending and borrowing.

What is the Transmission Mechanism (Chain Reaction) of Monetary Policy

And what does it depend on

Shows how a change in interest rates by the central bank affects the overall economy

Depends on long-term projected interest rates that drive consumption and Investment (Increase AD)

Steps

Monetary Policy

Affects short term interest rates impact the projected long-term interest rates

Long-term interest rates affect Aggregate Demand

Influences cost of borrowing, hence C and I, leading impact on AD and inflation.

Why do modern central banks generally use the interest rate as an instrument for monetary policy?

Interest rates influence borrowing, saving, and consumption

Fast and Predictable Transmission

Easy to Communicate and Manage Expectations

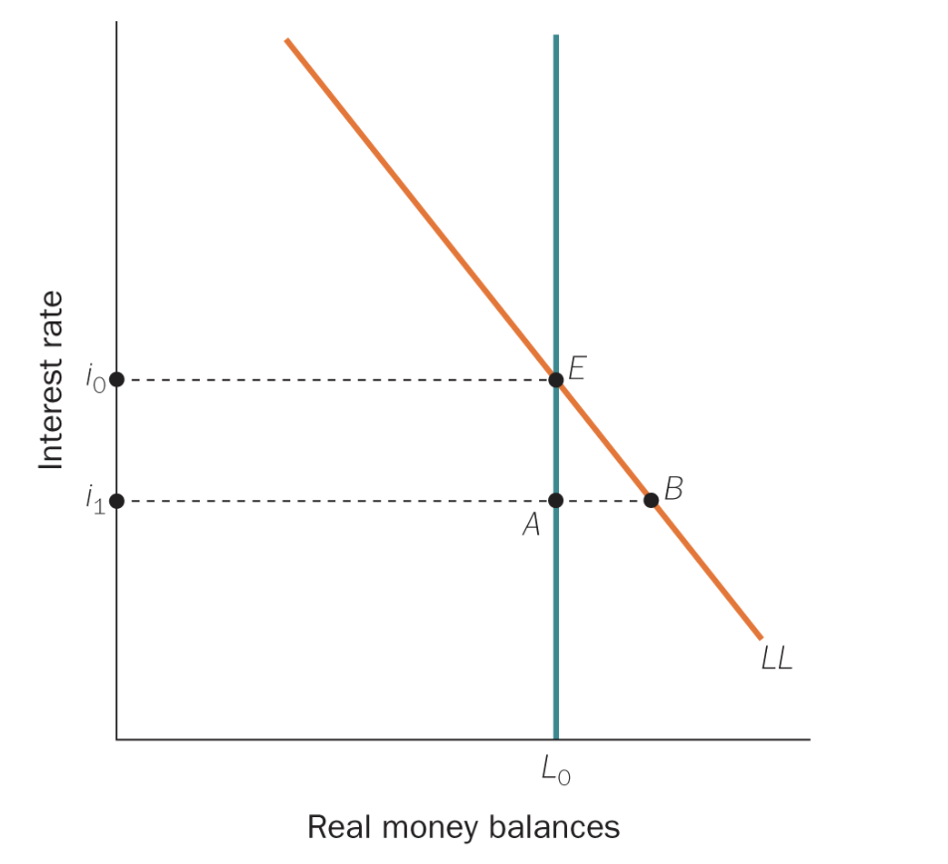

Model of Demand for Money

Vertical line (L₀):

Real money supply is fixed by the central bank (independent of interest rate).Downward sloping line (LL):

Demand for real money balances.

⤵ Interest rate ↑ → holding money is more costly → demand for money ↓Equilibrium at point E:

Interest rate i₀ where money demand equals supply (L₀).Point A (below E):

At lower interest rate i₁, people demand more money than is supplied → excess demand.Point B (off equilibrium):

Shows how demand would rise if interest rates fell, but supply (L₀) is fixed.

Intermediate Target meaning

Variable that Central Bank tries to control to help achieve inflation or employment goal

e.g. Money supply, interest rates, exchange rates

Quantitative Easing

A type of Non-traditional Monetary Policy

When a central bank creates new money to buy financial assets (like government bonds) to inject money into the economy and lower interest rates, especially when normal interest rate cuts aren't enough.

Money Illusion

When people focus on Nominal values instead of Real values