Risk Management Test 2

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

65 Terms

What is the life insurance benchmark for adequate coverage?

12-18 x gross annual pay (must be at least 10x)

What is the purpose of the life insurance benchmark?

To estimate how much coverage is needed to replace income and provide security for dependents

What is the free-look period

A 30-day window (in most states) allowing the cancellation of a life insurance policy for a full refund.

What is a grace period?

Typically 31 days after a missed premium where coverage remains active. If death occurs, the benefit is still paid minus the premium that is owed.

what is the greatest danger of a variable life insurance policy

You could die when the market is low, reducing the policy's cash value and death benefit

How long does an insurance policy have to rescind a policy due to misrepresentation?

Two years from the issue date

What can an insurer do if misrepresentation is found after the rescission period?

They can adjust the benefit and premiums based on the corrected information

Why do beneficiary designations override wills?

Beneficiary designations are the operation of law or titling

What is a Section 1035 exchange

A provision in the U.S. tax code that allows an individual to swap an existing life insurance policy or annuity for a new "like-kind" policy without triggering a taxable event on any gains

What determines the taxability of disability benefits

Whoever pays the premium. If it is paid with after-tax dollars, the benefits are tax-free. If it is paid with pre-tax or employer dollars, the benefits are taxable

What is the elimination period in disability insurance

The waiting period before benefits begin which is typically 90 days

why does paying attention to small details like elimination periods matter

they affect the cost of premiums and when benefits begin, influencing overall protection

what type of life insurance is best for a 30 year old single female

Term Life insurance because:

Affordable premiums: At age 30, she’s young and healthy, so term life rates are very low compared to permanent policies. She can get a large amount of coverage for a small monthly payment.

Covers key financial risks: Term life can protect against specific short- to medium-term obligations—like paying off student loans, a mortgage, or supporting dependents if she has them later—without overpaying for lifelong coverage she may not need yet.

Flexibility: If her life situation changes (marriage, kids, home purchase), she can renew or convert the policy later to permanent insurance.

Simple structure: Term life is straightforward—coverage lasts for a set period (e.g., 20 or 30 years), and only pays if death occurs during that term. There’s no cash value or investment component to manage.

What are the five laws of gold

1. Gold comes gladly to those who save

2. Gold labors diligently for the wise owner

3. Gold clings to the cautious owner

4. Gold slips away from the man who invests it in unfamiliar ventures

5. Gold flees the man who chases impossible earnings

Gold comes gladly to those who save

Save at least 10%

Gold labors diligently for the wise owner

Invest wisely

Gold clings to the cautious owner

Protect wealth

Gold slips away from the man who invests it in unfamiliar ventures

Avoid risky adventures

Gold flees the man who chases impossible earnings

Don't seek unrealistic returns

Start Thy Purse to Fattening

Save at least one-tenth of all you earn. For every ten coins you bring in, put one aside for the future.

Control Thy Expenditures

Live below your means and create a budget to ensure you have money for necessities, enjoyments, and worthwhile desires without overspending. Avoid lifestyle inflation, where expenses rise with income.

Make Thy Gold Multiply

Put your savings to work by investing them so that they generate more wealth for you.

Guard Thy Treasures from Loss

Only invest in ventures where your principal is safe, can be reclaimed, and will yield a fair return. Consult with wise and experienced men for advice.

Make of Thy Dwelling a Profitable Investment

Own your own home as a profitable asset.

Insure a Future Income

Provide in advance for your old age and the needs of your family.

Increase Thy Ability to Earn

Cultivate your own skills and knowledge to become more valuable. Invest in yourself through study and practice to improve your performance and earning potential

What type of insurance is used for business buy/sell agreements and why?

The best type of insurance for a business buy/sell agreement is life insurance. It provides the funds needed for surviving owners or the company to buy out the deceased or disabled owner’s interest, ensuring a smooth transition of ownership, financial stability, and fair compensation to all parties.

What is the purpose of life insurance

To provide income replacement, cover debts, and support dependents upon the insured's death

What are the main parties to a life insurance contract

Policy owner (who controls the policy), the insured (the person whose life is covered), and the beneficiary

What factors affect life insurance underwriting

age

gender

health

lifestyle

occupation

medical history

driving record

tobacco use

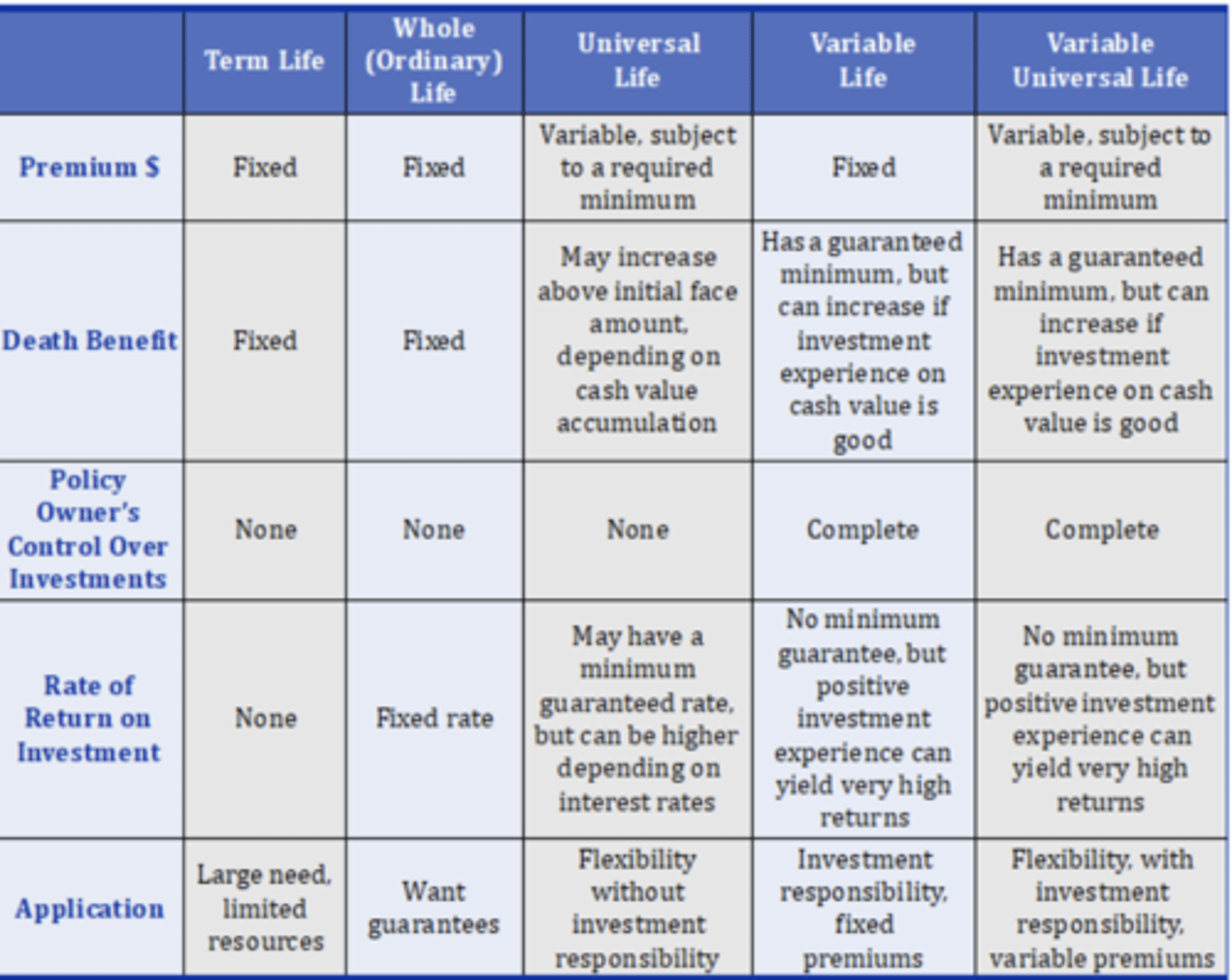

What are the three main types of life insurance

Term

Whole

Universal Life

What are the advantages of term life

Low cost, high coverage per dollar, and flexibility to convert to permanent insurance

What are the disadvantages of term life

No cash value, temporary coverage, and rising premiums with age

What are the advantages of whole life insurance

Lifetime protection, fixed premiums, cash value growth, and tax deferred savings

what are the disadvantages of whole life insurance

high cost, inflexible premiums, and limited investment return

What are the advantages of universal life insurance

flexible premiums, adjustable death benefits, and tax-deferred cash value growth

What are the disadvantages of universal life insurance

Higher cost and possible policy lapse if target premiums are not met

What are life insurance nonforfeiture options

cash surrender value, reduced paid-up insurance, and extended term insurance

what are common riders in life insurance

waiver of premium, double indemnity, guaranteed insurability, and long-term care riders

Double indemnity

an insurance provision that pays out double the policy's face value if the insured person dies accidentally

What is the purpose of the incontestability clause

It prevents the insurer from voiding the policy after two years due to misstatement, except for fraud

What is the difference in free look v. grace period

Free look = refund period after purchase

Grace period = covered protection after mispayment

What is group term life insurance

Employer provided life insurance under one master contract, often with up to $50,000 tax free benefit

What is the tax rule for an employer-paid group term life over $50,000?

The excess coverage is taxable to the employee based on IRS Table I rates

What is a modified endowment contract (MEC)

A life policy funded too quickly (fails 7-pay test); withdrawals taxed as income and penalized before age 59.5

What is the 7-pay test

It limits the total amount of premiums you can pay into the policy during the first seven years. If you pay more than the limit, the policy fails the test and can be reclassified as a MEC, which can lead to unfavorable tax treatment on withdrawals and loans

what is key person insurance

Insurance owned by a business to protect against financial loss if a vital employee dies

What are the main types of buy/sell agreements

Entity (stock redemption), cross-purchase, and wait-and-see agreements

What is the typical benefit level for disability income insurance

60-70% of gross income

What is the difference between short-term and long-term disability insurance

Short term lasts up to 2 years.

Long term can last to age 65 or a lifetime

What are common exclusions in disability insurance

war

self-inflicted injuries

work-related injuries (due to worker's comp)

criminal acts

intoxication

pre-existing conditions

what are residual benefits in disability insurance

Partial benefits are paid when returning to work with reduced income

what is the cost of living adjustment (COLA) rider

it increases the benefits based on changes in the consumer price index (CPI)

what are the future and automatic increase riders

Future increase = optional benefit growth with income

Automatic increase = yearly benefit raised by %

What are the main provisions of a life insurance policy

Grace period

Incontestability

Misstatement of age/gender

Assignment

Suicide clause

Reinstatement

Policy loans

What is the purpose of split-dollar life insurance

The employer and employee share the costs. The employer is reimbursed, and the remainder goes to the employee's beneficiary

What is the tax-free benefit rule

Life insurance proceeds are excluded from taxable income if paid due to death

What is the taxation rule for policy loans

They aren't taxable while the policy is in force, but reduce the death benefit if unpaid

What is the human life value approach?

Calculates insurance need based on:

(Future Income - Personal Expenses - Taxes) / (Work-Life Expectancy)

What is the needs approach

Estimates family's cash needs after death:

Final expenses, debt, income replacement, retirement for spouse

What is the capitalized earnings approach

Determines the lump sum needed so investment returns can generate the desired income perpetually

What are the dividend options for participating policies

cash

reduced premium

paid-up additions

interest accumulation

one-year term

What are surrender charges

Fees recouping insurer costs when a policy is surrendered early

What is the difference between preferred, standard, and underwriting classes

Preferred = low risk

Standard = average risk

Table-rated = higher risk with premium surcharges (A=25%, B=50%, C=75%)