Subsidies 1.2.9

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

What is a subsidy?

A grant given by the gov to firms to increase output + decrease costs of production

What are some reasons for subsidies?

Solve market failures (more consumption + more production of merit goods

Greater affordability of necessity g+s (beneficial for low income households)

Do subsidies shift supply in or out? (in most cases) Why?

Shift supply out

Gov supplies a subsidy → lowers costs of production → more profitable for firms to produce more at every price level → leads to outward shift

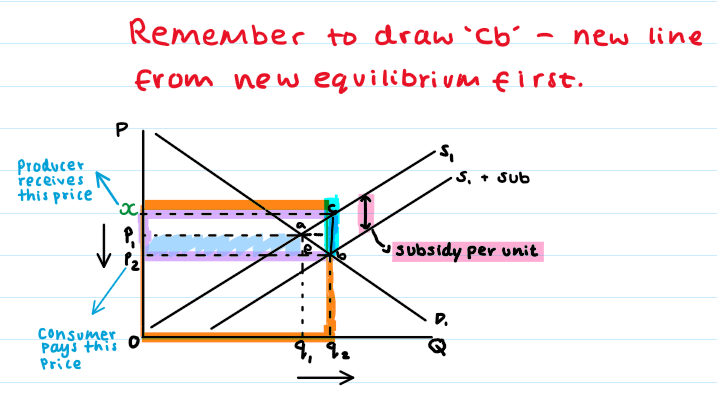

What does the diagram look like?

Gov cost: xcbp2

Producer rev: increased from p1aq10 → xcq20/ Producer sub: subsidy - consumer subsidy - xcap1

Consumer savings/sub: p1p2ea

Dead-weight loss: abc (cost to society due to market inefficiency - when s+d are out of equilibrium)

Effects on consumers?

Overall good/bad?

Overall good

Price decreases, consumer surplus increases

More choice in markets + higher quantity

Benefits low-income households

Eval - bad:

How will the subsidy be funded?

Tax rises

Cuts to other areas of gov spending

*Long-run concerns*

Effects on producers?

Overall good/bad?

Definitely good!

Increase in producer rev

Increase in producer surplus

Greater employment

Effects on gov?

Overall good/bad?

Really depends on if the 2 main gov objectives are being met - e.g. is market failure being tackled

Eval/bad:

Mindful of how expensive the sub is/ opp cost/ long-run funding concerns

How are the subs being used? Are producers taking advantage of this extra money in a negative way?

How do subsidy diagrams differ from indirect tax diagrams?

When dealing with a subsidy, the producer benefit is now the top portion of the incidence area and consumer incidence is below.

Logically, it makes sense. Producers are given an extra amount of money for each unit by the government so this raises the sales revenue they receive, while at the same time lowering the price consumers pay.

If demand for a product has a PED>1 what does this mean in terms of a subsidy being imposed? For firms + gov

Firms:

For a subsidy that lowers the price, this will lead to a more than proportionate increase in QD - benefitting firms by significantly increasing sales

Price elastic

Gov:

Subsidies can be an effective way to increase consumption - beneficial for merit goods (e.g. public transport, green energy)

If demand for a product has a PED<1 what does this mean in terms of a subsidy being imposed?

Firms:

If demand is price inelastic - a subsidy will have little effect on QD, and much of the subsidy will go towards increasing firm rev rather than boosting consumption

Price inelastic

Gov:

Subsidies may not significantly increase consumption but will reduce consumer costs or increase producer profits - gov may need to consider alternative policies

YED + subsidies - effect on firms + gov

Effect of a subsidy on normal/luxury goods (YED>0) compared to inferior goods (YED<0)

Firms:

Normal/luxury goods: firms might benefit more from subsidies during periods of economic downturn - as gov intervention can maintain demand

Inferior goods: subsidies might be less effective in boosting long-term demand since consumers switch away as income rises

Gov:

If aim is to help lower-income households - subsidising necessities - income inelastic is more effective

Subsidising luxury goods (income elastic) may not align with gov priorities unless aim is to boost specific industries (e.g. electric vehicles)

XED + subsidies

Firms: understanding how products relate (subs/complements) helps firms adjust pricing strategies alongside gov subsidies

Gov:

If aiming to shift consumption (e.g. from petrol cars to electric vehicles), subsidies should be placed on substitutes to encourage switching

Subsidising complementary goods (e.g. bus tickets) can enhance policy effectiveness - more people will use bus as = cheaper, but if bus fuel is also subsidised, bus operators can run more frequent + affordable services

(subsidizing one product can make another related complementary product more attractive or useful, leading to a greater overall effect)

Evaluation point for d+s diagrams?

They don’t take externalities into account such as social costs or benefits, which can lead to an incomplete analysis of the true market situation.

Deadweight loss

Loss of consumer surplus + producer surplus → cost to society due to market inefficiency