chapter ten - non-current assets and depreciation

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

Cattel plc purchases a new energy-efficient machine for which the supplier's list price is £28,000. Cattel plc pays £23,000 in cash and trades in an old machine, which has a carrying amount of £8,000. It is the company's policy to depreciate machines at the rate of 10% per annum on cost.

What is the carrying amount of the machine after one year?

£25,200

Demovil plc purchases a machine for £15,000 on 1 January 20X1. After incurring transportation costs of £1,300 and spending £2,500 on installing the machine it breaks down and costs £600 to repair. Depreciation is charged at 10% per annum.

At what carrying amount will the machine be presented in Demovil plc's statement of financial position at 31 December 20X1?

£16,920

T/F: Repair costs can be capitalised and will be added to the carrying amount of the NCA

False

A company disposes of an asset which cost £22,000 and had accumulated depreciation of £11,500 for £9,000 cash. The accounting system correctly recorded the proceeds in the cash at bank account but could not automatically match the transaction so recorded the other side in a suspense account.

What journal entry is required to correct the transaction in the accounting records?

A Debit Bank £9,000, Debit Accumulated depreciation £11,500, Debit Loss on disposal £1,500, Credit Machine cost £22,000

B Debit Suspense account £9,000, Debit Accumulated depreciation £11,500, Debit Loss on disposal £1,500, Credit Machine cost £22,000

C Debit Machine cost £22,000, Credit Suspense account £9,000, Credit Accumulated depreciation £11,500, Credit Profit on disposal £1,500

D Debit Machine cost £22,000, Credit Bank £9,000, Credit Accumulated depreciation £11,500, Credit Profit on disposal £1,500

B Debit Suspense account £9,000, Debit Accumulated depreciation £11,500, Debit Loss on disposal £1,500, Credit Machine cost £22,000

Deek plc purchased an electric delivery van on 1 October 20X0 for a total cost of £22,000 by paying £17,500 cash and trading in an old van. The old van had cost £20,000 and the related accumulated depreciation was £14,200.

The loss on disposal of the old van in Deek plc's statement of profit or loss for the year ended 31 December 20X0 is:

£1,300

Vernix plc purchased new equipment on 1 April 20X1 for £6,000. The scrap value of the new equipment in five years' time has been assessed as £300. Vernix plc charges depreciation monthly on the straight-line basis.

What is the journal entry to record the depreciation charge for the equipment in the year to 30 September 20X1?

A Debit Depreciation expense £570, Credit Accumulated depreciation £570

B Debit Accumulated depreciation £570, Credit Depreciation expense £570

C Debit Depreciation expense £600, Credit Accumulated depreciation £600

D Debit Accumulated depreciation £600, Credit Depreciation expense £600

A Debit Depreciation expense £570, Credit Accumulated depreciation £570

An electric car has a list price of £23,500 but the garage gives Ride plc a 10% trade discount. In settlement the garage accepts payment of £18,000, together with an old company car.

What is the amount to be capitalised by Ride plc in respect of the new car?

£21,150

A company purchased a car for £18,000 on 1 January 20X0. The car was traded in on 1 January 20X2 for a new hybrid car. The new hybrid car has a list price of £30,000 and the garage offered a part exchange allowance of £5,000. The company provides depreciation on cars using the reducing balance method at a rate of 25% per annum.

What is the amount of the loss on disposal that will be recognised in the statement of profit or loss for the year ended 31 December 20X2?

£5,125

What is the reasoning behind charging depreciation in historical cost accounting?

A To ensure funds are available for the eventual replacement of the asset

B To comply with the consistency concept

C To ensure the asset is included in the statement of financial position at the lower of cost and net realisable value

D To match the cost of the non-current asset with the revenue that the asset generates

D To match the cost of the non-current asset with the revenue that the asset generates

Which of the following is excluded from the initial cost of a tangible non-current asset?

A Site preparation costs

B Legal fees

C Costs of a design error

D Installation costs

C Costs of a design error

T/F: Abnormal costs can be capitalised

False

Any abnormal costs are not directly attributable to the asset and therefore should not be capitalised.

Wove Ltd purchased a machine for £5,000 on 1 January 20X1, when it had a useful life of four years and a residual value of £1,000. Straight-line depreciation was applied on a monthly basis. On 31 December 20X3, the machine was sold for £1,600.

The amount of profit or loss on disposal is:

A profit of £600

B loss of £600

C profit of £350

D loss of £400

D loss of £400

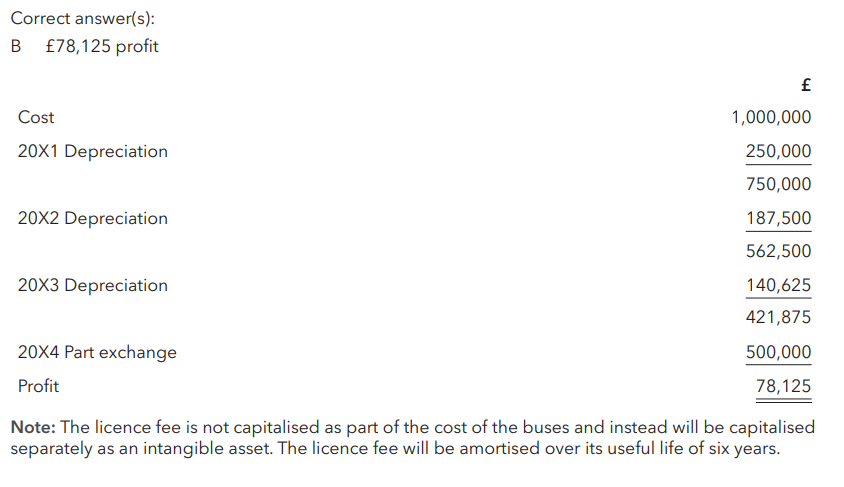

Prance plc purchased both a small fleet of buses and a licence to allow it to operate those buses for a six-year period from 1 January 20X1. The costs were as follows:

What is the profit or loss on disposal of the buses for the year ended December 20X4?

£78,125

The asset register showed a total carrying amount of £67,460. A non-current asset costing £15,000 had been sold for £4,000, making a loss on disposal of £1,250.

What is the carrying amount on the asset register after accounting for the disposal?

£62,210

On 1 January 20X5 a company purchased some plant. The invoice showed:

What amount should be capitalised for the plant in the company’s accounting records?

£50,600

T/F: Warranties count as Revenue Expenditure as it does not enhance the benefits that can be generated by the asset

True, should be recognised as an expense

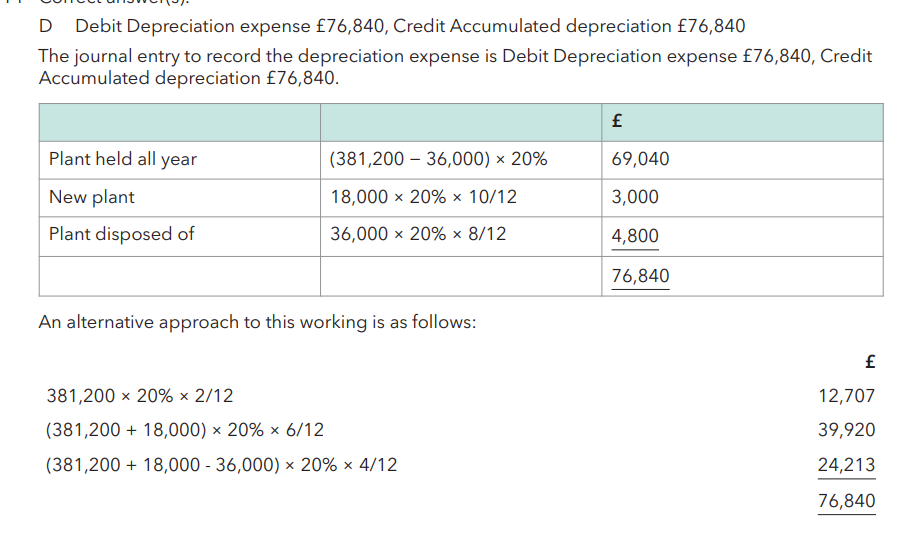

A company had plant and machinery with a cost of £381,200 at 1 October 20X1. It undertook the following transactions relating to plant and machinery in the year ended 30 September 20X2:

1 December 20X1 – purchased plant and machinery at a cost of £18,000

1 June 20X2 – sold plant and machinery which had a cost of £36,000 The company's policy is to charge depreciation at 20% per year on the straight-line basis.

What is the journal entry to record the depreciation charge for the year ended 30 September 20X2?

A Debit Accumulated depreciation £84,040, Credit Depreciation expense £84,040

B Debit Depreciation expense £84,040, Credit Accumulated depreciation £84,040

C Debit Accumulated depreciation £76,840, Credit Depreciation expense £76,840

D Debit Depreciation expense £76,840, Credit Accumulated depreciation £76,840

D Debit Depreciation expense £76,840, Credit Accumulated depreciation £76,840

The carrying amount of a company's non-current assets was £200,000 at 1 August 20X0. During the year ended 31 July 20X1, the company sold non-current assets for £25,000 on which it made a loss of £5,000. The depreciation charge for the year was £20,000.

The carrying amount of non-current assets to be included in the statement of financial position at 31 July 20X1 is:

£150,000

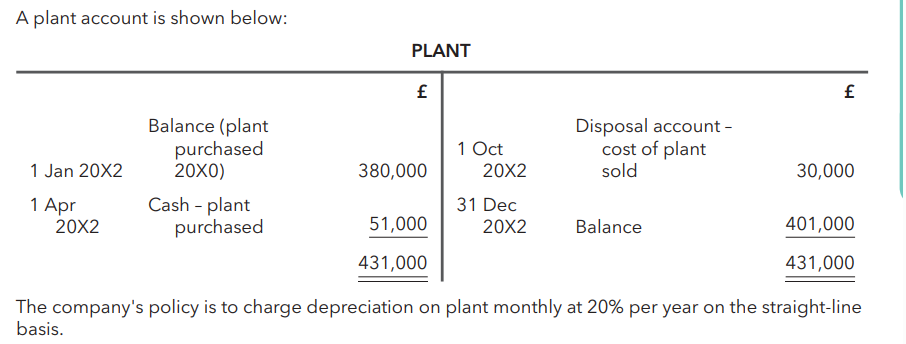

A plant account is shown below:

What should the company's plant depreciation charge be in the statement of profit or loss for the year ended 31 December 20X2?

£82,150

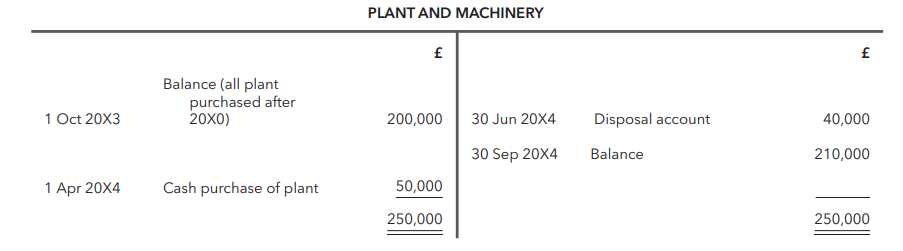

A company's policy for depreciation of its plant and machinery is to charge depreciation monthly at 20% per year on cost. The company's plant and machinery account for the year ended 30 September 20X4 is shown below:

What should be the depreciation charge in the statement of profit or loss for plant and machinery for the year ended 30 September 20X4?

£43,000

Beta plc purchased land and buildings on 1 December 20X0 for £420,000 of which £60,000 related to the land. Beta plc’s policy is to charge depreciation monthly on a straight-line basis over a 50 year useful life.

The journal entry to record the depreciation charge in Beta's statement of profit or loss for year ending 30 September 20X1 should be:

A Debit Depreciation expense £6,000; Credit Accumulated depreciation £6,000

B Debit Accumulated depreciation £6,000; Credit Depreciation expense £6,000

C Debit Depreciation expense £7,000; Credit Accumulated depreciation £7,000

D Debit Accumulated depreciation £7,000; Credit Depreciation expense £7,000

A Debit Depreciation expense £6,000; Credit Accumulated depreciation £6,000

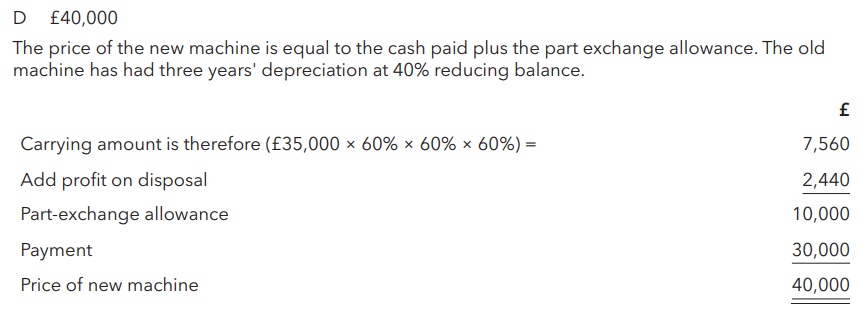

Exe plc, which has a year end of 31 December, purchased a machine on 1 January 20X1 for £35,000. It was depreciated at 40% per annum on the reducing balance basis. On 1 January 20X4 Exe plc part-exchanged this machine for a more advanced model. It paid £30,000 and realised a profit on disposal of £2,440.

The price of the new machine was:

£40,000

Automat plc purchases a machine for which the supplier's list price is £18,000. Automat plc pays £13,000 in cash and trades in an old machine which has a carrying amount of £8,000. It is the company's policy to depreciate such machinery monthly at the rate of 10% per annum on cost.

£16,200

Beehive plc bought a car on 1 January 20X7 for £10,000 and decided to depreciate it at 30% per annum on a reducing balance basis. It was disposed of on 1 January 20X9 for £6,000.

The net effect on the statement of profit or loss for the year ended 31 December 20X9 is a credit of:

£1,100

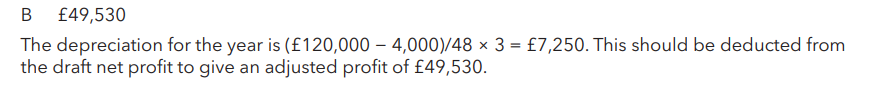

Bentrix Ltd has a draft net profit for the year ended 31 December 20X8 of £56,780 before accounting for the depreciation on a new machine. Bentrix Ltd purchased the machine for £120,000 on 1 October 20X8. The useful life is four years with a residual value of £4,000. Bentrix Ltd uses the straight-line method for depreciation and charges depreciation on a monthly basis.

The net profit after charging depreciation on the machine for the year ended 31 December 20X8 is:

£49,530

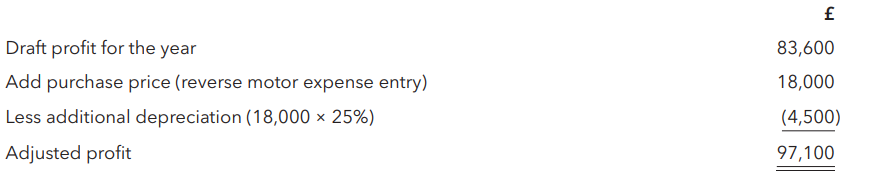

Sawtop plc's statement of profit or loss for the year ended 31 December 20X4 showed a profit for the year of £83,600. It was later found that £18,000 paid for the purchase of a van on 1 January 20X4 had been debited to the motor expenses account and no depreciation had been charged on the van. It is the company's policy to depreciate vans at 25% per year on the straight-line basis.

What is the profit for the year ended 31 December 20X4 after adjusting for this error?

£97,100

T/F: Internal Administration costs can be included as part of asset cost

False!!

On 1 January 20X4 Joffa plc purchased a new machine at a cost of £96,720. Delivery costs were £3,660 and internal administration costs of £9,450 were incurred. At that time Joffa plc planned to replace the machine in five years, when it would have no value, and to depreciate the machine on a straight-line basis. Joffa plc decides on 1 January 20X6 that the machine only has one remaining year of useful life. There is no change to the residual value at the end of its life.

How much depreciation will be charged in respect of this machine in Joffa plc's statement of profit or loss for the year ended 31 December 20X6?

£60,228

Stripes plc purchased new machinery on 1 August 20X4 for £38,000. The scrap value of the machinery at the end of its six-year useful life has been assessed as £2,000. Stripes plc's policy is to calculate depreciation monthly on the straight-line basis.

The depreciation charge in Stripes plc's statement of profit or loss for year ended 31 March 20X5 should be:

£4,000

On 1 June 20X3 Spamix plc purchased some plant at a price of £43,000. It cost £1,500 to transport the plant to Spamix plc's premises and set it up, plus £900 for a licence to operate it. The plant had a useful life of eight years and a residual value of £3,500. On 1 June 20X5 the directors of Spamix plc decided to change the depreciation method to reducing balance, at 40%.

What is the carrying amount of Spamix plc's plant in its statement of financial position at 31 May 20X6?

£20,550

On 1 April 20X5 Herepath plc bought a Foxy car for £23,500. The company's depreciation policy for cars is 30% per annum using the reducing balance method. On 1 April 20X7 the Foxy was part exchanged for a Vizgo car, which had a purchase price of £28,200. Herepath plc made a payment to the seller for £19,350, in final settlement.

What was Herepath plc's profit or loss on the disposal of the Foxy?

£2665 Loss

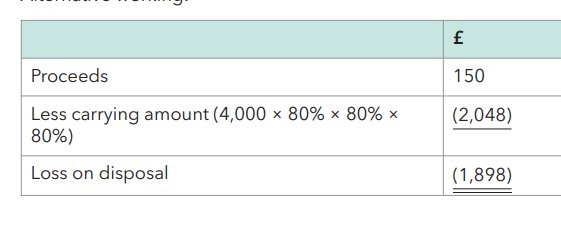

Mycher plc includes profits and losses on disposal of non-current assets in administrative expenses in its statement of profit or loss. Depreciation is charged on fixtures and fittings at 20% using the reducing balance method. On 1 July 20X6 some fixtures that cost £4,000 on 1 July 20X3 were sold for £150.

To account for the profit or loss in the administrative expenses account Mycher plc must:

A debit £1,450 B credit £1,450 C debit £1,898 D credit £1,898

C debit £1,898

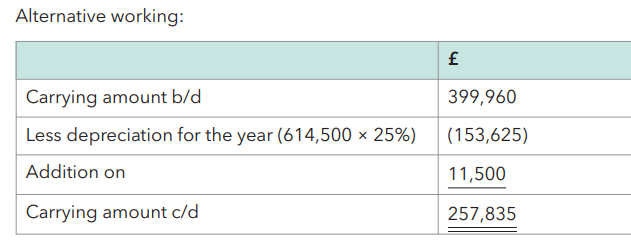

Redruth Ltd began trading on 1 April 20X3. The carrying amount of plant and equipment in Redruth Ltd's financial statements as at 31 March 20X5 was £399,960. The cost of these assets was £614,500. On 31 March 20X6 an asset costing £11,500 was acquired. Depreciation is charged on plant and equipment monthly at an annual rate of 25% straight-line. There are no residual values.

The carrying amount of Redruth Ltd's plant and equipment in its statement of financial position at 31 March 20X6 is:

£257,835

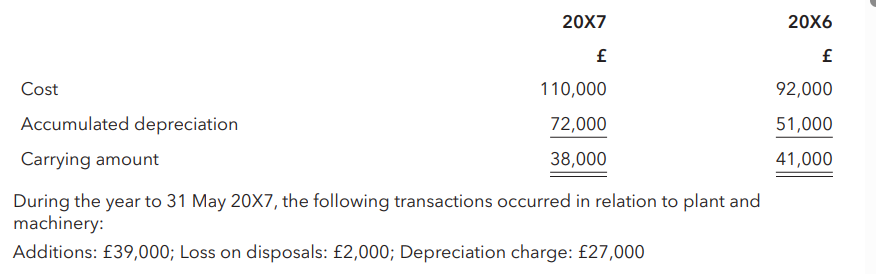

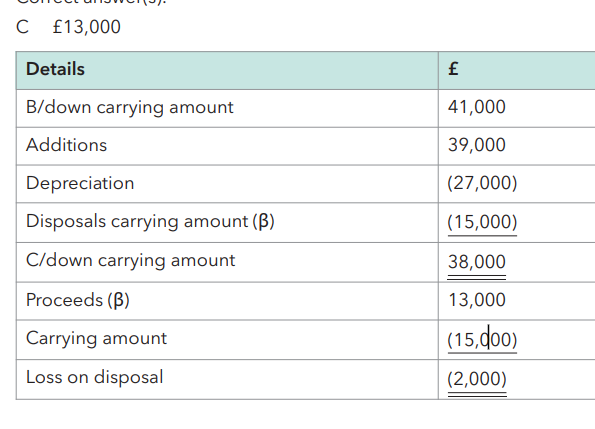

Morse Ltd has the following note to its statement of financial position relating to plant and machinery as at 31 May.

What were the proceeds from disposals of plant and machinery received by Morse Ltd in the year to 31 May 20X7?

£13,000

Anacon plc acquired a machine on 31 March 20X4, its year end, for £196,600. It made a bank transfer to the seller totalling £152,000 and traded in an old machine as a part exchange, receiving an allowance of £44,600. The old machine had cost £60,000 and had accumulated depreciation of £25,600 at the date of disposal.

The entry made in the accounting records in respect of this transaction was to debit the suspense account with £152,000, credit cash £152,000.

Which of the following journal entries is required to correctly reflect the purchase and disposal in Anacon plc's accounting records?

A Debit Machine – cost £196,600, Debit Machine – accumulated depreciation £34,400, Credit Disposal £79,000, Credit – suspense £152,000

B Debit Machine – cost £136,600, Debit Machine – accumulated depreciation £34,400, Credit Disposal £19,000, Credit – suspense £152,000

C Debit Machine – cost £196,600, Debit Machine – accumulated depreciation £25,600, Credit Disposal £70,200, Credit – suspense £152,000

D Debit Machine – cost £136,600, Debit Machine – accumulated depreciation £25,600, Credit Disposal £10,200, Credit – suspense £152,000

D Debit Machine – cost £136,600, Debit Machine – accumulated depreciation £25,600, Credit Disposal £10,200, Credit – suspense £152,000

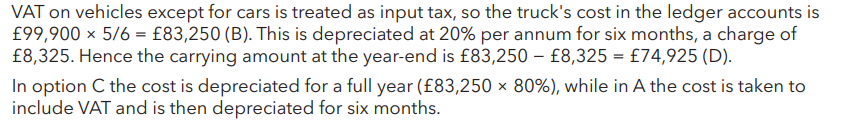

Glyntor plc acquired a new truck on 1 July 20X4 for £99,900 including VAT at 20%. The company applies straight-line depreciation to all vehicles at 20% per annum on a monthly basis.

What is the carrying amount of Glyntor plc's truck at 31 December 20X4?

D £74,925

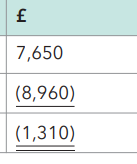

Crocker plc, a retailer, depreciates all vehicles on the straight-line basis monthly over five years. On 31 October 20X9 Crocker plc bought a car at a cost of £17,625 plus VAT, trading in an old car that had cost £16,800 including VAT on 1 July 20X7. A payment of £13,500 was also made. VAT is at a rate of 20%.

1,310

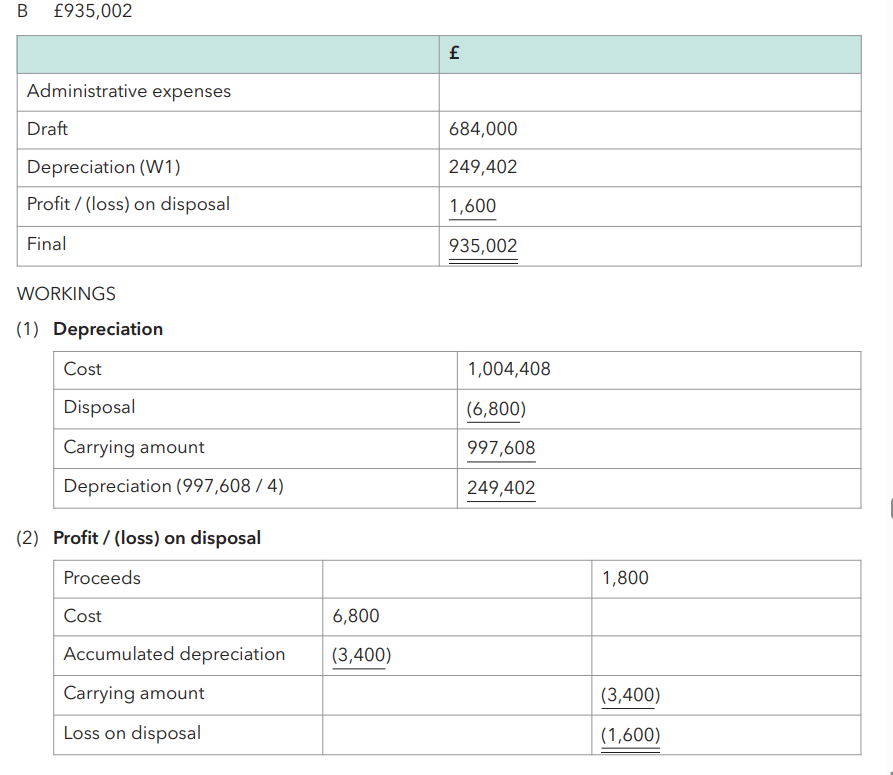

Plummet plc is preparing its statement of profit or loss for the year ended 31 December 20X4. Administrative expenses are £684,000 before accounting for depreciation and profits/losses on disposal in respect of the company's computer equipment.

At 31 December 20X3 Plummet plc had computer equipment that cost £1,004,408, all of which had been purchased on 1 January 20X2, and it had accumulated depreciation of £697,600. A computer system costing £6,800 was sold on 1 January 20X4 for £1,800. Computer equipment is depreciated monthly on a straight-line basis over four years. There were no additions to computer equipment during the year ended 31 December 20X4.

What is the amount of administrative expenses presented in Plummet plc's statement of profit or loss for the year ended 31 December 20X4?

£935,002

Dukakis plc provides data analysis for medical research purposes. Dukakis plc has a server farm which has a carrying amount at 1 April 20X2 of £150,000. On that date, it upgraded some of its servers which had cost £24,000 on 1 April 20X0 for new, faster servers which cost £34,600. Dukakis plc traded in the old servers, transferring £18,000 to the seller's bank account in full settlement of the purchase. Dukakis plc depreciates computers at 40% per annum on the reducing balance.

What is the journal entry to record depreciation for the year ended 31 March 20X3 in respect of computers?

A Debit Accumulated depreciation £56,544, Credit Depreciation expense £56,544

B Debit Accumulated depreciation £70,384, Credit Depreciation expense £70,384

C Debit Depreciation expense £56,544, Credit Accumulated depreciation £56,544

D Debit Depreciation expense £70,384, Credit Accumulated depreciation £70,384

D Debit Depreciation expense £70,384, Credit Accumulated depreciation £70,384

The carrying amount of machinery has reduced by £10,000 following the disposal of one item of machinery.

Which of the following statements relating to the disposal are correct?

A Disposal proceeds were £15,000 and the profit on disposal was £5,000

B Disposal proceeds were £15,000 and the carrying amount of the machinery disposed of was £5,000

C Disposal proceeds were £15,000 and the loss on disposal was £5,000

D Disposal proceeds were £5,000 and the carrying amount of the machinery disposed of was £5,000

A Disposal proceeds were £15,000 and the profit on disposal was £5,000

Yatton Ltd purchased a plant on 1 January 20X0 for £38,000. The payment for the plant was correctly entered in the cash at bank account but was incorrectly entered on the debit side of the plant repairs account.

Yatton Ltd charges depreciation monthly on the straight-line basis over five years and assumes no scrap value at the end of the life of the asset.

How will Yatton Ltd’s profit for the year ended 31 March 20X0 be affected by the error?

A Understated by £30,400

B Understated by £36,100

C Understated by £38,000

D Overstated by £1,900

B Understated by £36,100

Whipper Ltd has a machine which cost £40,000 and has a carrying amount of £32,000 on 1 April 20X7. It is being depreciated at 20% per annum on the reducing balance basis. On 31 March 20X8, Whipper Ltd sold the machine for £22,400.

What is the loss on disposal of the machine at 31 March 20X8?

£3,200

Dash Ltd has a property which cost £420,000 on 1 April 20X4. It is being depreciated on the straight What is the loss on disposal in respect of the property at 31 March 20X9?

What is the loss on disposal in respect of the property at 31 March 20X9?

£25,000

Pattern Ltd is a website development company. It was established on 1 January 20X5 and incurred costs relating to non-current assets in its first year.

Which of the following should be capitalised as an intangible asset in the year ended 31 December 20X5?

A £22,000 relating to computer hardware for its developers

B £5,000 relating to office equipment

C £12,000 on cables and servers

D £9,000 for a licence to use specialist design software

D £9,000 for a licence to use specialist design software

Manga Ltd purchased a licence on 1 July 20X2 to allow it to fish in protected waters. Manga Ltd paid £180,000 for the licence and incurred legal fees of £2,000 to secure the licence. General administrative costs of £3,800 were incurred by Manga Ltd during the process of securing the licence. The licence allows Manga Ltd to fish for a period of six years however, the directors only expect to fish in the waters for five years.

What is the carrying amount of the licence at 30 June 20X3?

£145,600

T/F: Legal Fees can be included when working out the carrying amount of an intangible NCA

True

T/F: Administrative Costs can be included when working out the carrying amount of an intangible NCA

False

Cyan Ltd has capitalised development costs which were initially measured at their cost of £200,000 on 1 June 20X3. The capitalised development costs were originally expected to generate benefits for Cyan Ltd over four years. On 1 June 20X5, the directors of Cyan Ltd assessed that the market was still positive and expected the capitalised development costs to continue to generate benefits for a further four years from that date.

What is the carrying amount of the capitalised development costs at 31 May 20X6?

£75,000

A company acquires non-current assets for use in the business.

Which of the following statements is true regarding such assets?

A All items of property, plant and equipment are depreciated

B If an asset is sold in a part exchange transaction, there is never a gain or loss on disposal

C It is assumed that all intangible non-current assets have a residual value which is 10% of their cost

D Development costs must be capitalised in the statement of financial position if the criteria are satisfied

D Development costs must be capitalised in the statement of financial position if the criteria are satisfied

A company acquires non-current assets for use in the business.

Which of the following statements is true?

A All intangible assets are assumed to have an indefinite useful life

B Tangible and intangible non-current assets are presented separately on the face of the statement of financial position

C The depreciation method is decided when the asset is purchased and is never changed

D On disposal of a non-current asset, any gain is recognised in revenue in the statement of profit or loss

B Tangible and intangible non-current assets are presented separately on the face of the statement of financial position