sustainable energy chp. 2

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

25 Terms

economic assessment goal

to provide useful financial insight and enable comparison between various energy objections

objectives of energy flow analysis and resource accounting

conceptualize and compare different energy system investments, account for external costs and identify sustainability issues

largest renewable

hydropower

sustainable energy engineering approach

use quantitative analysis to understand the end use, environmental and social requirements, and resource availability

unit cost of energy

Cs= Co/Q x t

Cs- unit cost of energy produced

Co- intial construction and installation cost

Q- units of energy

T- time

payback period (pp)

time required for the system to payback initial costs

found by comparing total cost to annual benefit- energy produced or energy saved

PP= Co/BiCs

Co- total cost of equipment and installation

Bi- value of energy saved/yr

Cs- unit cost of energy ($/kWh)

assumes no loans, which is generally not the case

time value of money

when money is invested and financed through bonds/stock, rate of return on investment is expected

if you borrow money you owe interest

present worth

fixed monetary value, future value of that flow, accounting for the time value of that money

future value of money

F= P(1+i)^t

F- future value

P- sum of money

invested today at annual interest rate i

t- time interval

disregarding monetary inflation

present worth factor (PWF)

i,t key for discounted cash flow analysis

used for comparing different options for investing in different energy management or conservation opportunities

revenues in future worth less money than earned in the present

PWF= 1/(1+i)^t

discount rate

interest rate used in discounted cash flow analysis to determine present value of future cash flows

annuity

future cash flows are fixed in size (A) and regularly occur over specific number of periods

inflation rate (j)

current dollars= actual cash flow

constant dollars around base year (F0), then future dollar equivalent after t years of inflation rate

not constant or know- add extra percent to account for future inflation rate

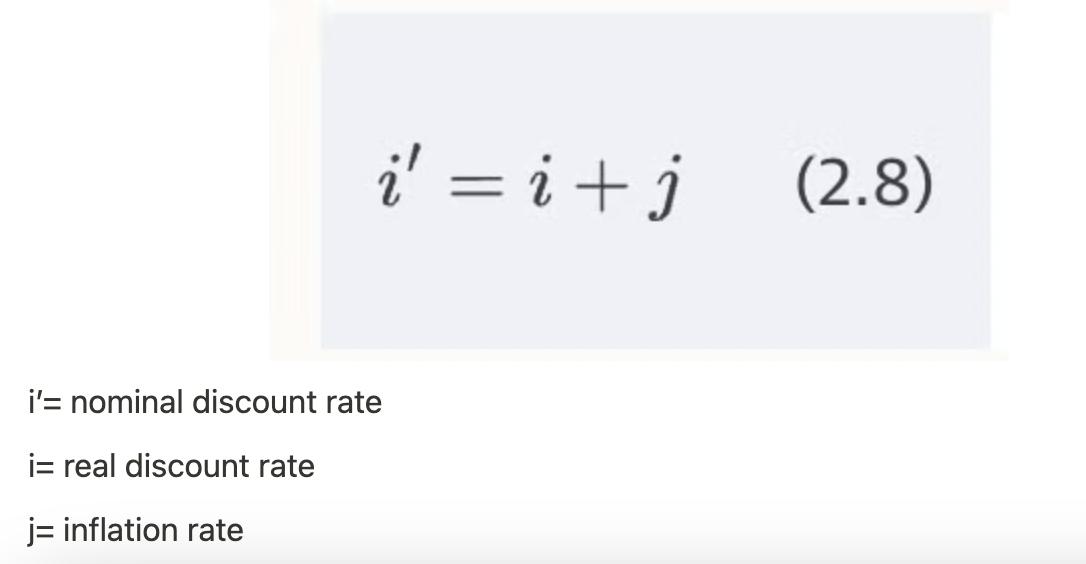

real vs. nominal discount rates

real- excludes inflation, used if cash flow is in constant dollars

nominal- includes inflation, used if cash flow is in current dollars

nominal discount rate

= real discount rate + inflation rate

return on investment required to invest in a project

present value analysis

can take into effects of inflation

determines current value of future cash flows- idea that money today is worth more than in the future

9 factors that investors and companies use to evaluate risk and rewards for projects

unit cost of energy

payback period

time value of money

discount rate

inflation

nominal discount rate

present value analysis

total life cycle costs

internal rate of return

capital recovery factor

levelized cost of energy

societal and environmental costs

total life cycle costs

considers all significant dollar costs over the life of a project

costs are discounted to base year using present value analyses

TLCC+ C0 + PVOM (nonprofit, residential, govt)

C0- initial investment

PVOM- precent value of all O&M costs

taxes must be included for by rpfoit companies- T

internal rate of return (IRR)

compare variety of investment activities

commonly used for accept/reject decisions by comparing IRR with minimal acceptable rate (hurdle rate)

rate of return that will make net present value (NPV) equal to zero, summation of discounted cash flows that equal initial investment

capital recovery factor (CRF)

ratio of uniform payment (annuity) to present value of receiving that annuity for a given length of time

each payment is a mix of interest and principal repayment

self amortizing loan

periodic payments include both principal and interest

payments made on predetermined schedule

loan will be fully paid off by end of agreed upon term

ex: home mortgage, solar energy by private companies

levelized cost of energy (LCOE)

used for comparing different energy generation technologies

present value of all investment costs plus operation and maintenance, fuel costs, in each future year per unit power generation- will equal to TLCC when discounted back to base year

LCOE formula

total lifetime costs/total lifetime energy production

LCOE= (TLCC/Q) x CRF

TLCC- total life cycle costs

Q- electricity generated

CRF- capital recovery factor (interest, time)

externalities

hidden societal and environmental costs or activity of one agent that affects the well being of another agent

not included in conventional energy economics

hard to pinpoint values- human health or life, global warming

externalities example

ExternE focuses on air pollutant emissions, human health effects, effects on crops, materials and climate

40-50% of costs from climate change

costs will change based on proximity to population