Cash Flows - Indirect Method

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

6 Terms

Cash flows from operations section?

What is the objective?

Start with net income and adjust it for non-cash transactions until you’re left with net cash inflow or outflow.

Prepare the operating section in this order.

Add back non-cash expenses

ex: Depreciation, Amortization, (Gain)/Loss on sale of non cash assets.

Adjust for movement in working capital. (Working capital is current assets less current liabilities)

Current assets are generally made up of inventory and receivables, whereas current liabilities are made up of payables.

More details about adjustments for working capital.

An increase in inventory means a business has less cash therefore this is a reduction to cash. On the flipside, a decrease in inventory means a business has more cash because it has sold more inventory.

An increase in receivables is similar to inventory. It means less cash has been recovered from customers so the cash balance goes down.

Payables are liability so they work the opposite of inventory and receivables.

An increase in A/P means more cash because less has been paid out to suppliers.

Cash flows from non-current assets and noncurrent liabilities.

These are not included in the operating section. They are included in the other two sections.

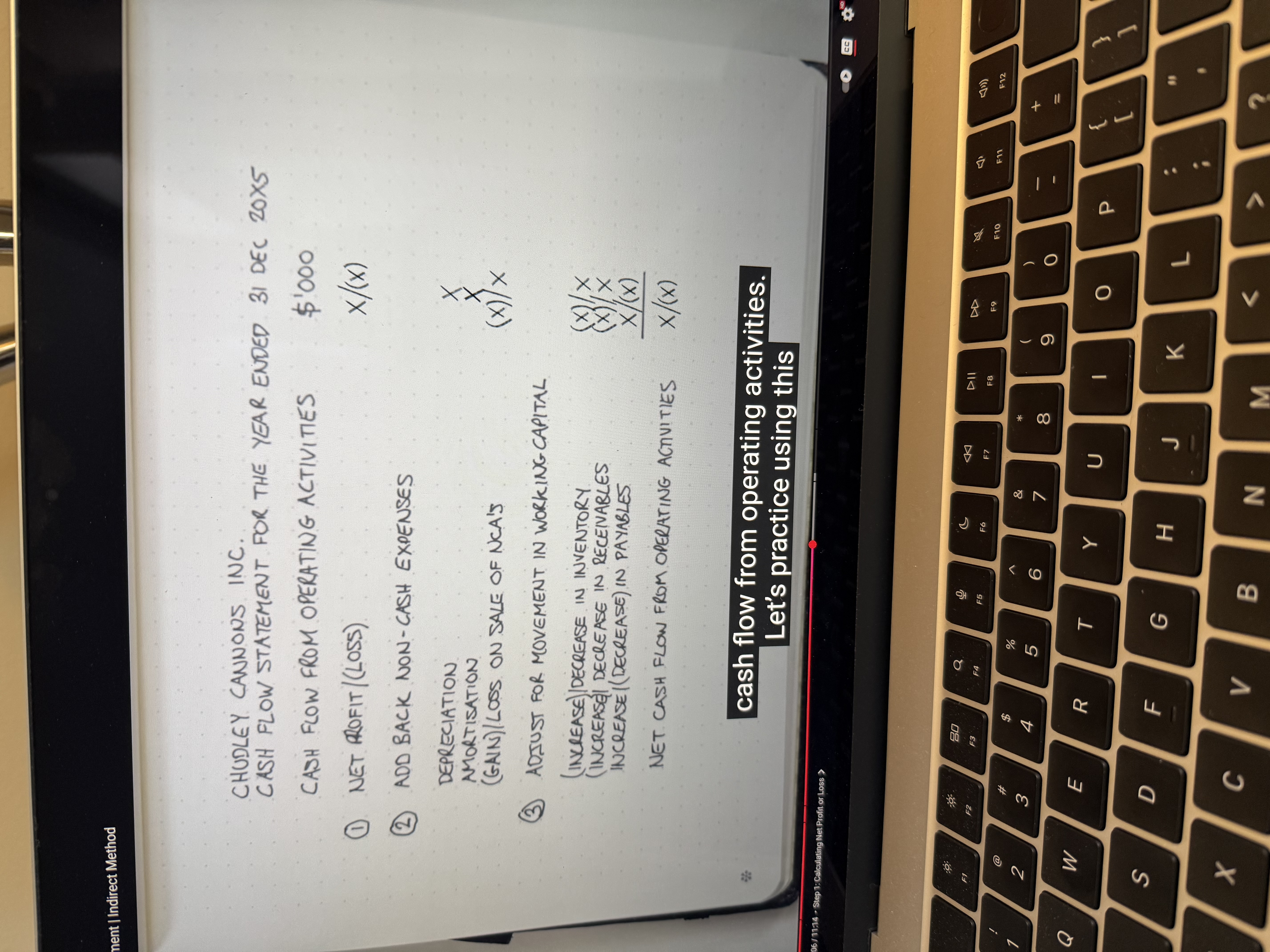

See sample template for the operating section.

See picture.

Bond Discount/Premium Note.

Amortization of Bond Discount is added to cash flow and amortization of Bond Premium is subtracted.