Chap11 - Moral Hazard

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

moral hazard

tendency for insurance against loss to reduce incentives to prevent and minimize the cost of loss

(carelessness, fraud)

moral hazard with health insurance

insured people take risks with health that uninsured people would not take, and demand more expensive treatment from their doctors when they get sick

downside of health insurance

moral hazard, because it raises society’s level of healthcare expenditures

social loss

riskier behaviour creates a _____ because the costly event X occurs more than it would have without insurance.

Ex Ante moral hazard

behaviour changes that occur BEFORE an insured event happens and make that event more likely (such as leaving stove on)

Ex post moral hazard

behaviour changes that occur AFTER an insured event happens and make recovering from that event more expensive (knee replacement surgery instead of painkillers)

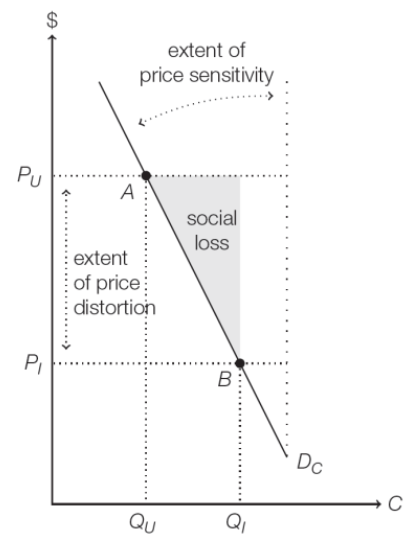

social loss caused by moral hazard

Price-consumption graph. Point A is socially efficient equilibrium, Point B is outcome with insurance. things between Qu and Qi result in more costs than they are worth

extent of price distortion

on price-consumption graph (PQ), the vertical distance between Pu and Pi

extent of price sensitivity

angle between demand curve (DC) and the vertical. larger angle —> more responsive behaviour is to price distortions and the larger the social loss from moral hazard

why price distortion

exists in insurance markets bc insurance companies cannot monitor everything patients fo and price their actions accordingly

moral hazard conditions

Cost of a risky or wasteful action to an individual is reduced, usually as a consequence of insurance

Asymmetric information prevents an insurer from adequately pricing the action

That individual responds to the price distortion

by changing his behavior—either by taking

more risks or demanding more covered goods

and services.

ways to reduce price distortion

coinsurance, copayment, deductibles, monitoring

coinsurance

insurance provision in which enrolees pay a percentage of each medical bill, and insurer covers the remaining portion

copayment

insurance provision in which enrollees pay only a fixed amount, called a copay

deductibles

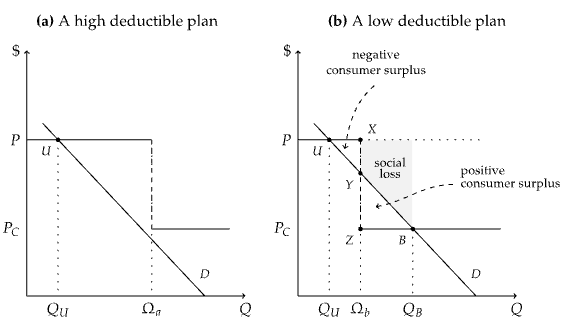

set minimal levels of expenses below which the insurer does not help reimburse medical expenses

ex. insured with deductible of $1000 must pay that much himself then insurance will help pay for the rest

can eliminate moral hazard

deductibles can, unless its low enough

monitoring

insurance companies try to observe/guide the preventative measures their customers take, while others choose to supervise medical care that customers receive

rand hie

people on free plan more likely to show up at the hospital with broken bones or drug abuse (ex ante)

those on free plan more likely to visit hospital (ex post)

ghana

insured households less likely to use mosquito nets, key for preventing malaria (ex ante)

seguro popular

low-income mexicans assigned to receive free insurance were less likely to get a flu shot and cancer screenings (ex ante)

standford employees

after a change that required a new 25% copay, visits to doctor declined by 24% (ex post)

germany

introducing deductibles leads to greatly decreased health expenditures (ex post)

Canada

people with prescription drug coverage visit doctor more often (ex post)

private market

navigate the tradeoff between moral hazard and uninsurance to provide the optimal contract if they are perfectly competitive

public market

non-voluntary, lacks self-corrective features that make national insurance policy both more complex and more critical

extra preventative care

beneficial effect of moral hazard, people consume less than they should

income effect

insurance makes people “richer” by making expensive surgeries or treatments unaffordable without insurance