Chapter 10: Dispositions of Partnership Interests and Partnership Distributions

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Basics of Sales of Partnership Interests

Like shareholders sell stock, partners sell their interests (to third parties, to another partner, to the partnership)

The flow-through structure of the partnership makes the accounting for dispositions a bit tricky

If we follow the entity approach, the total interest is a separate interest and gain and loss is recognized on the difference between the selling price and tax basis

If we follow the aggregate approach, disposition is the sale of each partners’ interests and gain characterization depends on the type of assets (ordinary, capital, 1231, etc.)

Seller Issues

Primary tax concern is calculating the amount and character of gain or loss on the sale of partnership interest

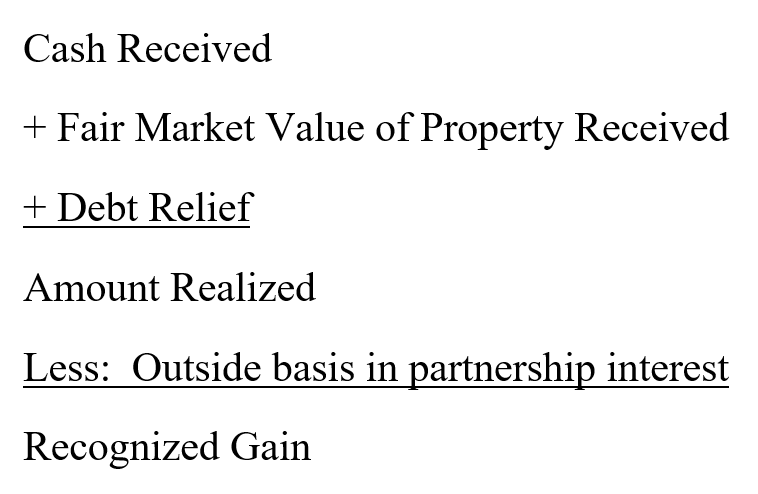

The selling partner determines gain or loss as the difference between the amount realized and his/her outside basis in partnership

Because selling partners are no longer responsible for their share of the partnership liabilities, any debt relief increases the amount that partners realize from the sale under general tax principles

The character of the gain or loss from a sale of a partnership interest is generally short-term or long-term capital gain or loss depending on the selling partner’s holding period

However, a portion of the gain or loss will be ordinary if a seller realizes any gain or loss attributable to unrealized receivables or inventory items

Practitioners often refer to these assets that give rise to ordinary gains and losses as hot assets

Hot Assets

Unrealized receivables include the right to receive payment for (1) “goods delivered, or to be delivered” or (2) “services rendered, or to be rendered”

For cash-method taxpayers, unrealized receivables include amounts earned but not yet received (A/R)

For accrual-method taxpayers, A/R are not considered unrealized receivables because accrual-method taxpayers have already realized and recognized these items as ordinary income

Inventory items include classic inventory, defined as property held for sale to customers in the ordinary course of business

Inventory items also include any assets that are not capital assets or §1231 assets (also excludes cash)

Calculating Gain / Loss with Hot Assets

Process for determining gain or loss:

Step 1: Total gain or loss = Amount realized − Outside basis

Step 2: Calculate the partner’s share of gain or loss from hot assets as if the partnership sold these assets at their fair market value

This represents the ordinary portion of the gain or loss

Step 3: Capital gain or loss = Step 1 − Step 2

Buyer and Partnership Issues

Buyer’s main tax concerns are determining their basis in the partnership interest they acquire and their inside bases of the partnership assets

Amount paid for the partnership interest will be the buyer’s outside basis in the partnership (plus any liabilities allocated to that partner)

Buyer steps into the shares of the selling partner

Selling partner’s capital account transfers to the buyer

Liabilities that are allocated to the new investor increase outside basis

The sale does not generally affect a partnership’s inside basis in its assets

A partner’s tax year closes for the selling partner upon the sale of a partnership interest

Varying Interest Rule

If a partner’s interest in a partnership increases or decreases during the partnership’s tax year, the partnership income or loss allocated to the partner for the year must be adjusted to reflect their varying interest in the partnership

Partners’ interests increase when they contribute property or cash to a partnership or purchase a partnership interest

Partners’ interests decrease when they receive partnership distributions or sell all or a portion of their partnership interests

Two methods for allocating income or loss to partners when their interests change during the year:

Partnership prorates income or loss to partners with varying interests

Sanction an interim closing of the partnership’s books

Basics of Partnership Distributions

Distributions from flow through entities are a mechanism to return profits or capital to the partners

Partner pays tax on his share of partnership income, regardless of whether the income is distributed to the partner

Like shareholders receiving corporate dividend distributions, partners often receive distributions of the partnership profits, known as operating distributions

Partners may also receive liquidating distributions, a distribution that terminates an owner’s interest in the entity

Operating Distributions

An operating distribution is distribution from a partnership that represent a distribution of entity profits, when the partners continue their interests afterward

Are usually paid to distribute the business profits to the partners but can also reduce a partner’s ownership

May distribute cash or other assets

Operating Distributions [Money Only]

Partnership generally does not recognize gain or loss on the distribution of property or money, and the partner does not recognize gain or loss when she receives distributed property or money

The partner simply reduces the outside basis in the partnership interest by the amount of cash distributed and the inside basis of any property distributed

In general, the partnership’s basis in its remaining assets remains unchanged

Exception: Recognize Gain When Distribution > Partner’s Basis

One exception is when the distribution is greater than the partner’s outside basis

Partner simply reduces their outside basis to 0 and recognizes gain (generally capital) for the excess

Partner never recognizes a loss from an operating distribution

Operating Distributions [Includes Property Other Than Money]

Partners must reallocate their outside basis to the distributed assets (including money) and their continuing partnership interests

Carryover basis: partner takes a basis in the distributed property equal to the partnership basis in the property

Order in which to allocate outside basis to the bases of distributed assets:

First, the partner allocates the outside basis to any money received and then to other property as a carryover basis

Remainder is the partner’s outside basis after the distribution

When the partnership distributes property other than money with a basis that exceeds the remaining outside basis, the partner assigns the remaining outside basis to the distributed assets, and the partner’s outside basis is reduced to 0

The first allocation of outside basis in the interest goes to money, then to hot assets, and finally to other property

In this case, the partner’s basis in the property received in the distribution will be less than the property’s basis in the hands of the partnership

Because a partner’s outside basis in a partnership interest includes their share of the partnership liabilities, the outside basis in a partnership interest must reflect any changes in a partner’s share of partnership liabilities resulting from a distribution

In essence, a partner treats a reduction of their share of liabilities as a distribution of cash

If the partner increases their share of liabilities, the increase is treated as a cash contribution to the partnership

Liquidating Distributions

Partnership distributes the assets and terminates the interest

Partner does not retain interest; receives distribution and files final return related to interest

Tax issues are basically to:

Determine whether the terminating partner recognizes gain or loss

Reallocate his or her entire outside basis to the distributed assets

The rationale behind the rules for liquidating distributions is simply to replace the partner’s outside basis with the underlying partnership assets distributed to the terminating partner

In theory, there would be no gain or loss on the distribution, and the asset bases would be the same in the partner’s hands as they were inside the partnership; however, this rarely occurs

Gain or Loss Recognition in Liquidating Distributions

Generally, both partners and partnerships do not recognize gain or loss from liquidating distributions

Partner will allocate basis in partnership interest to the distributed assets

Exceptions

Recognize Gain

Partner recognizes gain when partnership distributes money (includes debt relief), and the amount > the partner’s outside basis in the partnership interest

Recognize Loss

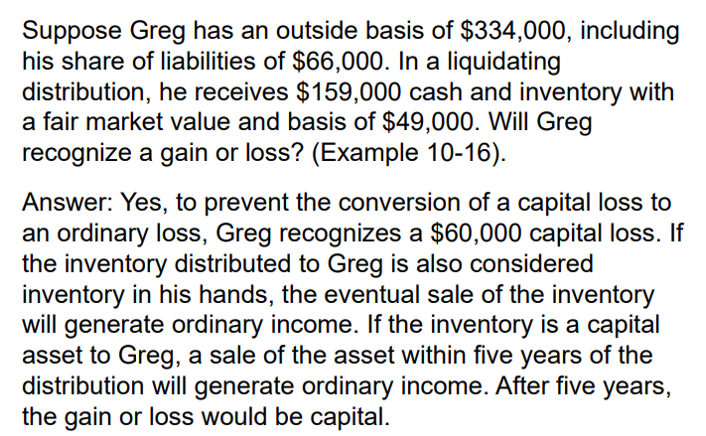

Partner recognizes loss when two conditions are met:

Distribution consists of only cash and hot assets, AND

The partner’s outside basis > the sum of the inside bases of the distributed assets

Is treated as a capital loss

Basis in Distributed Property

The primary objective of the basis rules in liquidating distributions is to allocate the partner’s entire outside basis in the partnership interest to the assets the partner receives in the liquidating distribution

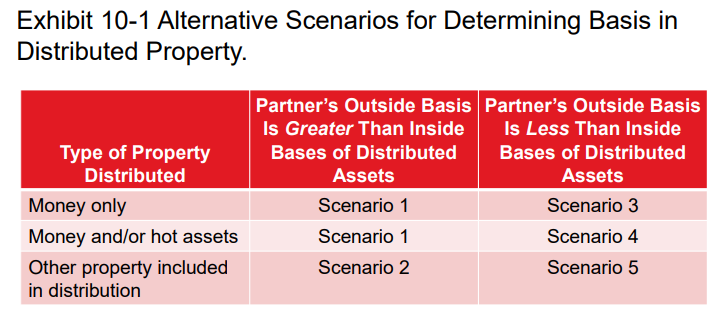

The allocation essentially depends on two things:

The partnership’s bases in distributed assets relative to the partner’s outside basis

The type of property distributed-whether it is money, hot assets, or other property

Character of the distributed assets usually stays the same to the partner as in the partnership

Partner’s Outside Basis in an Interest Is Greater Than Inside Bases of Distributed Assets

Scenario 1: Distributions of Money, and/or Hot Assets

If partnership distributes only money, inventory and/or unrealized receivables, and partner’s outside basis is greater than sum of inside bases of distributed assets, partner recognizes a capital loss

The partner assigns a basis to the distributed assets equal to the partnership’s inside basis in the assets, and the remaining outside basis in the interest is equal to the recognized loss

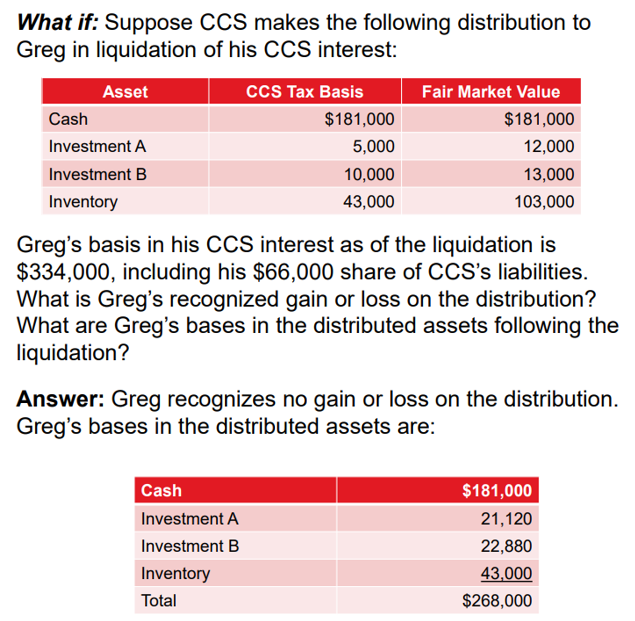

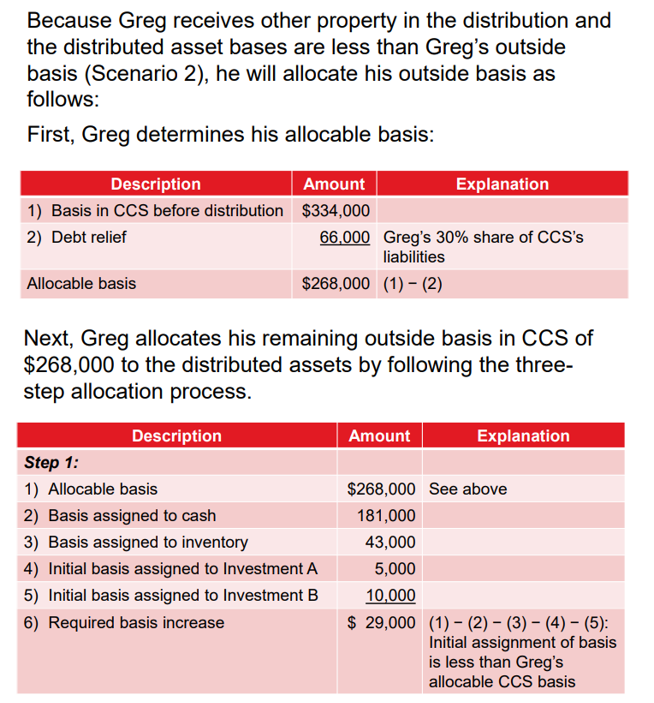

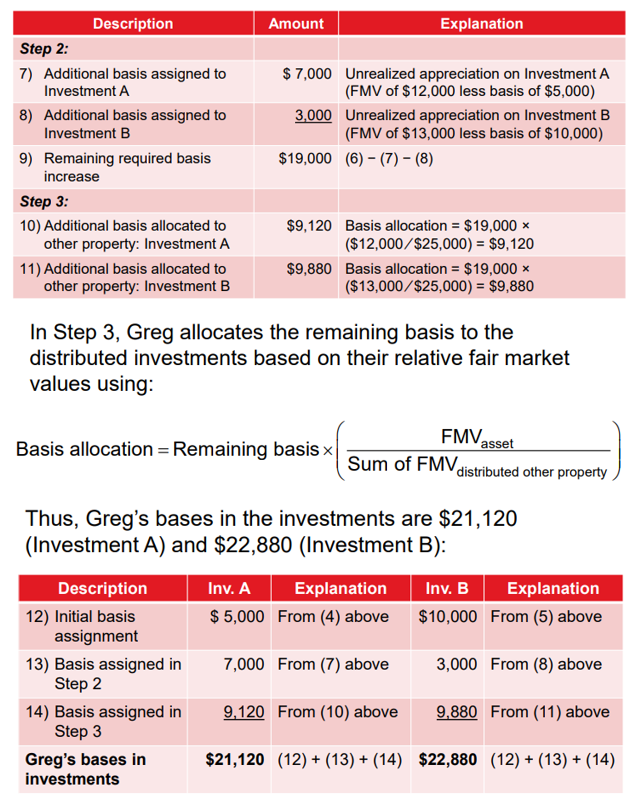

Scenario 2: Other Property Included in Distributions

When other property is distributed, the liquidating partner must allocate all the outside basis to distributed assets

Partner never increases bases of distributed hot assets (that would change the character of the loss)

Partner can adjust the basis of other property without converting ordinary gains to capital gains, and the liquidating partner will not currently recognize any gain or loss from the distribution

Procedure:

First, partner determines outside basis net of debt relief, and allocates that amount to any money, inventory, and unrealized receivables equal to the partnership’s basis in these assets, also assigns basis to the other distributed assets in an amount equal to the partnership’s basis in those assets

Partner then allocates the remaining outside basis (full outside basis less amounts assigned in 1) to other distributed property that has unrealized appreciation to the extent of that appreciation

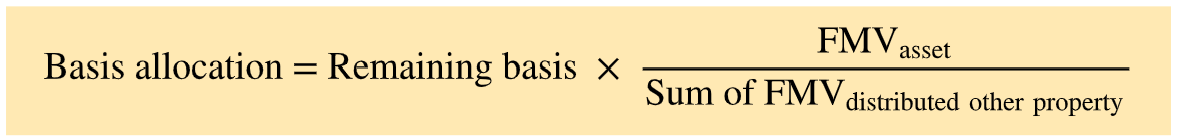

Partner allocates any remaining basis to all other property in proportion to the relative fair market values of the other property

Scenario 1 & 2 [Examples]

Scenario 1

Scenario 2

Partner’s Outside Basis in an Interest Is Less Than Inside Bases of Distributed Assets

Scenario 3: Distributions of Money Only

Same tax consequences as in operating distributions of only money

A partner recognizes a capital gain if the partnership distributes money (only) that exceeds the partner’s outside basis in their interest

Scenario 4: Distributions of Money, and/or Hot Assets

Partner reduces the basis in the distributed assets other than money but does not recognize gain or loss

Basis reduction may apply to hot assets as well as other property because tax law does not restrict reducing basis of ordinary income assets

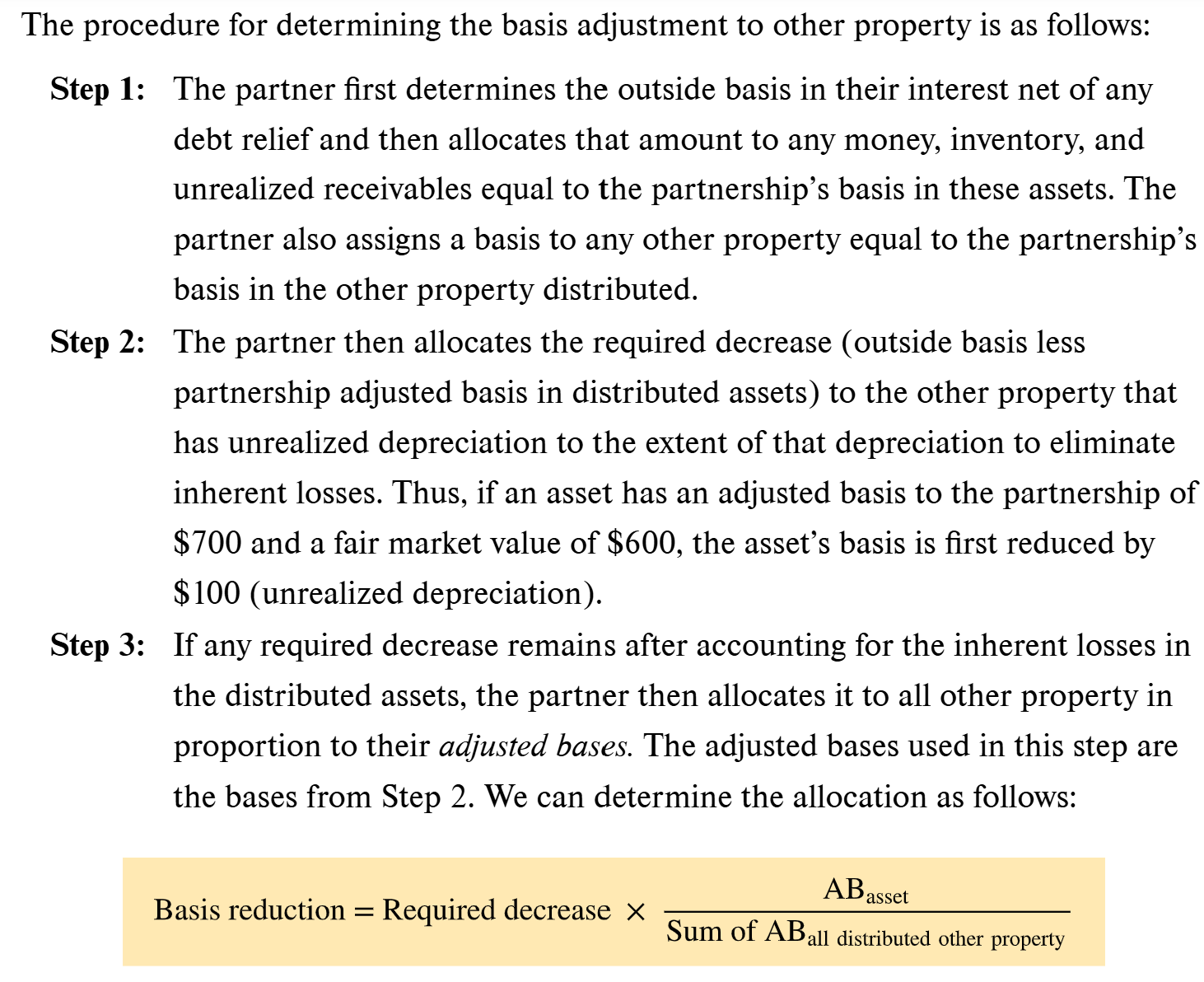

Procedure:

Step 1: Assign outside basis to distributed assets in amount equal to the assets inside bases

Partner reduces basis of hot assets distributed, assuming any money distributed does not exceed basis

Required decrease in basis of distributed assets is equal to difference between partner’s outside basis in their interest and partnership’s inside basis in the distributed assets

Partner assigns basis to money and then to other assets received in an amount equal to the assets’ inside bases

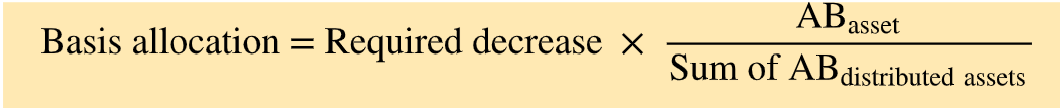

Step 2: Allocate the required decrease to assets with unrealized depreciation

The partner allocates the required decrease to the assets with unrealized depreciation, to reduce or eliminate any existing losses built into the distributed assets

Step 3: Allocate any remaining required decrease to the distributed assets in proportion to their adjusted bases using:

Scenario 5: Other Property Included in Distributions

Terminating partner does not recognize gain or loss but rather decreases the basis in the property distributed

Partner first decreases the basis in the other property distributed before decreasing basis in any distributed hot assets

Procedure is like the procedure under Scenario 4 except the required decrease reduces bases in other property rather than hot assets

Character and Holding Period of Distributed Assets

Generally, the character stays the same for the partner as it was in the partnership to reduce opportunity for converting ordinary assets to capital gains

If partner sells certain assets with ordinary character after the distribution, partner will recognize ordinary income from sale

Assets are 751(d) and 751(c) inventory and unrealized receivables

Inventory retains “taint” of ordinary income for 5 years after distribution

For unrealized receivables, a subsequent sale at any time after distribution will result in ordinary income

If partnership distributes a capital asset that would be characterized as inventory in the hands of terminating partner, partner will have ordinary income from eventual sale, not capital gain or loss

Partner’s holding period includes partnership’s holding period

Disproportionate Distributions

In practice, distributions may not always reflect each partner’s proportionate share of the appreciation in hot assets

Both operating and liquidating distributions can be disproportionate distributions

A disproportionate distributions is a partnership distribution that changes a partner’s relative ownership of partnership hot assets

Intent is to prevent partners from converting ordinary income into capital gains through distributions

Disproportionate distributions occur when assets distributed in operating or liquidating distributions do not represent the partner’s proportionate share of the partnership’s unrealized appreciation in its hot and other assets

Disproportionate distribution causes a shift in the proportion of ordinary income and capital gain income from the partnership

Rules require partner to treat disproportionate distributions as sale/exchange, which may change the character and timing of income or losses that are recognized

Partners receive more or less than their share of unrealized appreciation or losses in hot assets 751(b) such as substantially appreciated inventory (FMV 120% basis) and unrealized receivables

If a partner receives less than their share of appreciation in hot assets in a liquidating distribution

Perhaps a partner receives cash only in a liquidating distribution from partnership with hot assets

Rather than only applying rules, partners must treat part of distribution as sale/exchange

Disproportionate distribution rules treat partner as having sold their share of hot assets to partnership in exchange for cold assets (non 751b)

If partner receives more cold assets than the proportionate share owed by that partner in a distribution, partner will generally recognize ordinary income in an amount equal to that partner’s share of appreciation in hot assets not distributed to the partner

If partner receives more hot assets than proportionate share owned, partner will recognize capital gain equal to that partner’s share of appreciation in cold assets not distributed to partner

.