2.6.3 Supply-side policies

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

SUPPLY-SIDE POLICIES

gov policies aimed at increasing productive potential of economy and moving supply curve to right

MARKET BASED POLICIES

policies which are designed to remove anything that prevents free market system working efficiently, causing lower output and higher prices

barriers include those which reduce willingness of workers to take jobs or lead to inefficient production, high prices or a lack of risk-taking

INTERVENTIONIST BASED POLICIES

policies designed to correct market failure

POLICIES

increase incentives

promote competition

reform labour market

improve skills and quality of labour force

improve infrastructure

INCREASE INCENTIVES

increasing incentive, will increase size of workforce, so more g and s would be produced

METHODS:

reduction in benefits will increase OC of being out of work so people will work (why gov introduced Universal Credit , which helps to ease transition into and out of work)

reduction in benefits and subsidising workers may prevent poverty/unemployment trap, where low income workers end up in same or lower position after a new job because of benefits received

could encourage parts of the workforce back to work, e.g. women offered free childcare

reducing taxes on firms would increase incentives to employ

reduction of min wage would increase incentive for firms to employ

INCREASE INCENTIVES- EVAL

many people argue small change in any tax will have little impact on people’s incentive to work

reductions of tax on high income earners and reducing benefits will lead to more income inequality

reduction of tax will mean govs have less revenue so have to decrease spending or borrow more

PROMOTE COMPETITION

privatisation- selling nationalised companies to private sectors

deregulation- reducing restriction on businesses which restrict entry to the market, makes firms more competitive

competition policy (e.g. CMA) used to prevent monopolies in market

competition necessary to make firms efficient as they have to offer a cheaper or better service

PROMOTE COMPETITION- EVAL

deregulation and privatisation may lead to a poorer quality service

could cause env issues if deregulation is seen in env regulations

REFORM LABOUR MARKET

will reduce unemployment- means that more g and s can be produced

METHODS:

increase retirement age-more working

labour market could become more flexible to make it more efficient as it can respond to external changes

weakening of unions- trade unions push up wages which can lead to firms laying off some workers and reducing production- limits AS

making it easier to change jobs, through higher mobility of labour: improved info about job vacancies and improved geographical mobility

to improve geographical mobility, gov has to improve house affordability

decrease min wage to prevent real-wage inflexibility unemployment

REFORM LABOUR MARKET- EVAL

trade unions already very weak so reducing their power further may have little effect

reducing benefits will lower AD-less profit, less employment + increased income inequality

making labour force more flexible will lead to low pay for some, which will increase income inequality and may reduce AD

IMPROVE SKILLS AND QUALITY OF LABOUR FORCE

means that workers are more efficient so can produce more g and s and be more skilled so can develop new tech etc.

METHODS:

increase spending on education and training to create a more educated workforce who will be more efficient and able to do more skilled jobs

could be in terms of academic education, or improving quality of on job training, such as apprenticeships

gov working w/ trade unions and firms to improve the skills of long term unemployed

increase in high skilled migrants would also improve quality of workforce

IMPROVE SKILLS AND QUALITY OF LABOUR FORCE- EVAL

improving education may have no effect if it’s in irrelevant skills to workforce

increasing education will create an OC

time lag of effects of increased education

IMPROVE INFRASTRUCTURE

METHODS:

could be done through offering tax incentives or subsidies on investment

Investment in UK is just 17% of GDP compared to 35% in South Korea- to improve this, gov planned to reduce corporation tax to 18% in 2020

gov could spend money to improve infrastructure-e.g. building new roads, HS2 and CrossRail

will mean new tech will be developed and more will be invested in buying new tech- improvement in efficiency

IMPROVE INFRASTRUCTURE- EVAL

offering tax breaks/subsidies will effect gov budget- lose tax revenue or create OC

some businesses may not actually invest this money and instead used it as a method of tax evasion

not all investment will be successful in improving supply as it may not achieve its aim or it may not be aimed at increasing supply

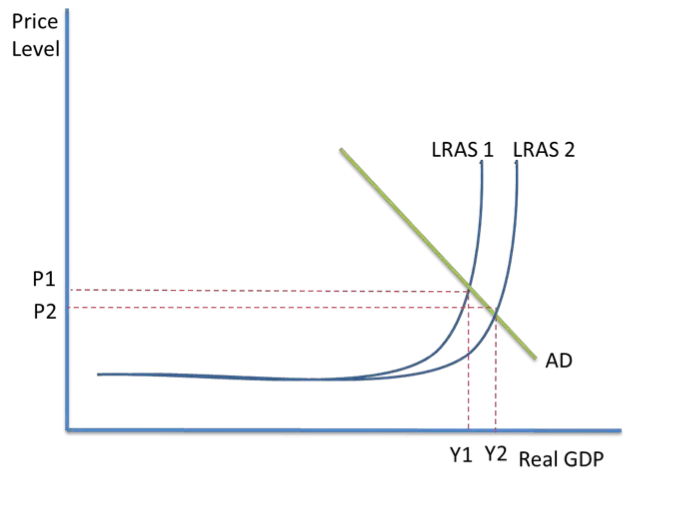

SS POLICY- KEYNESIAN DIAGRAM

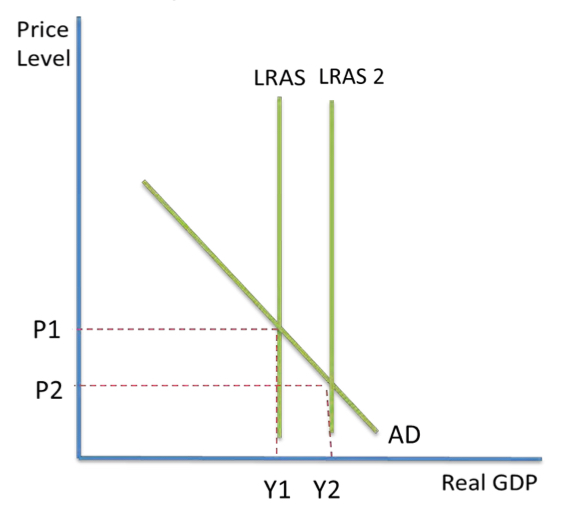

SS POLICY- CLASSICAL DIAGRAM

STRENGTHS

able to both increase output and decrease prices- no inflation

lead to long term economic growth, rather than small changes in economic growth following changes in AD

can be directed at increasing exports which will improve balance of payments

allow 2 diff approaches: market based and interventionist

means that both free market and interventionist economists will accept it

WEAKNESSES

Keynesian LRAS curve shows that they have no impact when LRAS is elastic, so demand-side policies needed to fix problem in short run

not all SS policies increase supply and others cause conflicts- issues vary depending on which policies used

often, gov has to spend more money or decrease taxes- will decrease revenue and lead to budget deficit

actions may also have undesirable impacts on AD and could cause higher inflation

time lag on effect on output