Lecture 11 - Trading Strategies, Portfolio Management

1/59

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

60 Terms

Several issues to trade based on:

performance, catching large trends, diversification

Costs

Time consumption, opportunity costs, trading losses from learning curve

Set-up costs, computer, high speed internet, trading platform order execution, chart service

Commission, slippage, missing orders in fast markets, errors

Unexpected events - order entry going down

Personal risk tolerance

Leverage use, futures vs stocks, going on margin

Suitability

Based on your experience and personality

Choose “slower” or lower risk markets when starting

Volatility

The more volatility, the higher the potential profit but the greater the potential costs

The breakout from low to high volatility is where most profits are made

Liquidity

Ability to transact a large number of shares without bringing about a large price change

Dependent on bid-ask size, as narrow spreads does not always guarantee liquidity

Volume

You want issues with heavy volume that have liquidity

3 types of trading for different time horizons

Scalping

Day Trading

Swing Trading

Scalping

Taking very small profits between bid-ask spreads and accumulating liquidity credits

Requires time, an excellent order entry system, and experience

Extremely short term (minutes) and fast paced

Competition between trader and market makers, specialists

Day Trading

Trading an issue and closing all positions by the end of the day, therefore not taking any overnight risk

“Screen trading” by using intraday technical analysis signals

Very short term minute/hour bars are used

Swing Trading

Catching small trends or counter trends over several days or weeks

Less experience required in comparison to day trading

Entry and exits can be predefined using pivot points, 2 bar patterns, candle patterns, crossovers etc…

Not as short term, less time consuming

2 approaches used to select which issues for investment

Top Down

Bottom Up

Top Down Approach

Selection starting from the type of market (stocks, bonds) → country → industry sector → security

Relative strength analysis, intermarket relationships

Bottom Down Approach

Security → industry sector → country

Security slection first also based relative strength and additional screening criteria

Industry sectors and sector rotation theories

Selecting sectors based on the business cycle

Ratio (relative strength) analysis

Relative Strength

Simple yet effective method of stock screening

Based on the notion that strength just like trend continues

Ratio determined between two investments, sectors, industry groups, indexes, etc… to see which is outperforming the other

Other Measures of Relative Strength

Percentage change

Trend Slope Method

Levy Method

Percentage Change

Uses a 6 month price change to determine relative strength

Stocks are then sorted based on relative strength. Higher decile stocks continued to be stronger for the next 3-10 months

Trend Slope Method

Calculate the slope of each stock’s price curve in percentage terms over a specified period through a linear regression. Stocks are then ranked by their slope

Levy Method

First calculated the ratio of a stock’s current price/131 trading-day moving average, he later changed to using the 6 month moving average

Then ranks this ratio against the same ratio for all other stocks

He concluded that relative strength is a better position process in bull markets

Stock screen selection methods of the Pros

Kirkpatrick

Value line

Wyckoff

O’Shaughnessy

O’Neil - CANSLIM

Kirkpatrick

Calculated all relative price ratios to each other; P/S, 6 month RS

Used a multifactor model of the above relative rankings and outperformed by 4:1 vs S&P 500 over the last 27 years

Value Line

Analysis service that uses a proprietary relative strength ranking of 1 to 5 to rank the “timeliness of stocks”

They also incorporate additional factor such as; earnings trends, recent earnings, earnings surprises

Value line has outperformed S&P 500 16:1 ratio

Wyckoff

80 year method developed by Richard Wyckoff

He believed stock prices were determined solely by supply & demand, and influenced by wealthy individuals and large institutional insiders

Used tools; bar charts, P&F charts, relative strength, volume

He believed markets travelled in waves and calculated % price changes from waves highs and lows

O’Shaughnessy

Relative price strength was the factor that consistently beat the market. Calculated 12 month relative price strength

Also studied factors such as: market cap, P/S, P/B, P/S, dividend yields, earnings, ROE and developed multi-factor investment strategies

O’Neil CANSLIM facts

Stocks are ranked according of 12 month relative price strength, 3 month price strength weighted more heavily in percentiles from 0-99, 99 being the strongest

O’Neil found that the average relative strength percentile by his calculations was 87 before large upward moves

Uses a 7-8% strict stop loss rule

Hold position if stock ries greater than 20% within 1-3 weeks

Buys the pattern breakouts within 5% of breakout price

Patterns used:

Cup and handle/saucer

Flat base

Double bottom

Allow for a minimum of 7 weeks for a pattern to develop

Best time to buy is on a breakout from a pattern with at least a 50% increase in volume

C of CANSLIM - Current Quarterly Earnings

25% or more in recent quarters

Research shows earnings growth is the No. 1 indicator of a stock’s potential to make big gains. That’s why it’s important for look for stocks with strong current results, as well as history of solid earnings growth

A of CANSLIM - Annual Earnings

25% or more in each of the past 3 years

N of CANSLIM - New Product, Management, Highs

Explosive stock growth doesn’t happen by accident. The biggest stock winners had new products, new management or new conditions in an industry that propelled the company to astounding height

Some investors pass over a great stock because it’s already reaching a new price high. But that’s precisely the point where many of the best stocks gain steam and begin their biggest price moves

S of CANSLIM - Supply & Demand

Most basic economic principles is the law of supply & demand and one of the places its power is most sharply demonstrated is the stock market

Strong demand for a limited supply of available shares will push a stock’s price up. On the flip side, an oversupply of shares and weak demand will cause the price to sag

L in CANSLIM - Leaders: Choosing to Win

Steer clear of laggards

When you choose stocks that have solid fundamentals, your prospects are better because you are selecting “institutional quality” stocks that get noticed by the biggest traders - the institutional investors like mutual fund and pension fund managers

I in CANSLIM - Institutional Sponsorship

Big institutional investors, like mutual funds, hedge funds, banks and insurance companies, are the driving force behind much of the trading activity in the stock market

M in CANSLIM - Market Direction

Buying a stock during a market downturn can be like trying to swim against the ocean tide: You might make some progress, but the going will be tough, and a big enough wave of selling could drown you

Technicals of CANSLIM

The Bases:

Before a stock can launch a big price run-up, it must have a solid base pattern to build upon (it’s a base, must be solid)

Institutions can’t hide their tracks

Institutions play defence at the 50-day moving average

When to sell & cash out

Is it acting right?

Big money is in the sitting

Your insurance policy - 7%

1.618 (Phi)

The ratio of any number in the Fibonacci sequence divided by the next lower number approaches this ratio

Elliott Wave Theory

Stock prices are governed by irregular cycles founded upon the Fibonacci series

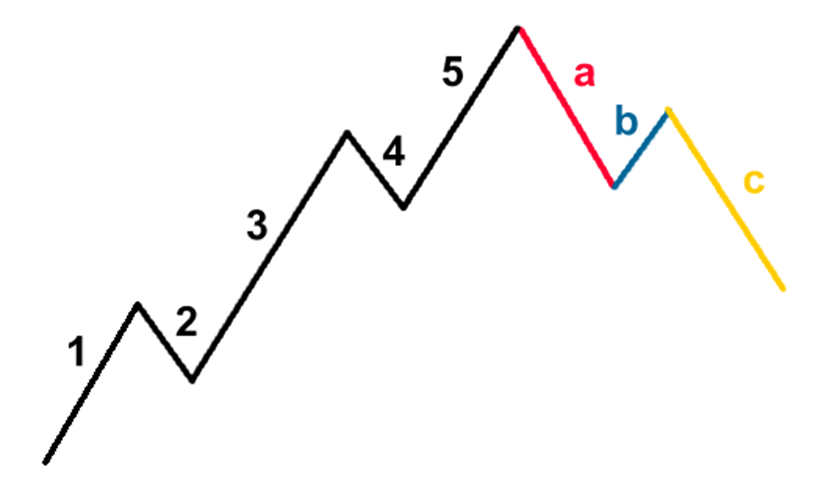

Elliott Wave Theory waves

Impulse Waves move with the trend

Corrective (counter trend) moves against the trend

5 motive waves (waves 1,2,3,4,5)

3 impulse waves (waves 1,3,5)

“3 steps forward, 2 steps back”

EWT in Bull Markets

The 5 wave uptrend is then corrected and reversed by 3 wave counter trends

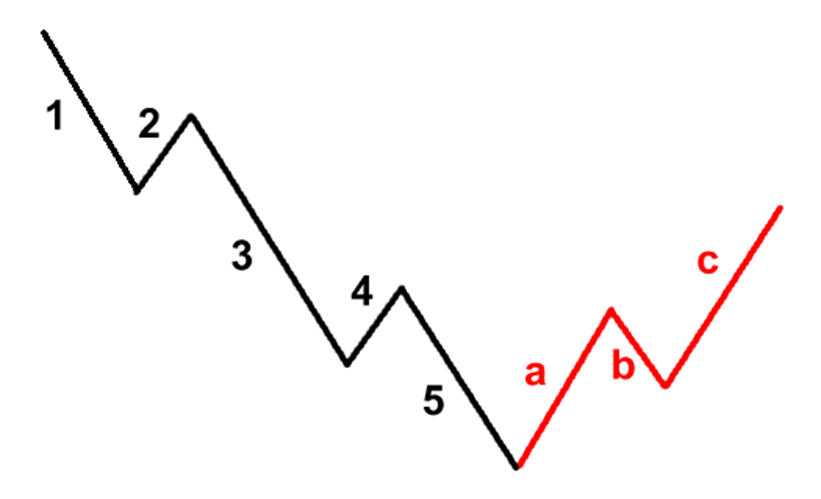

EWT in bear markets

In bear markets, the same 5 - 3 wave patterns can look like this

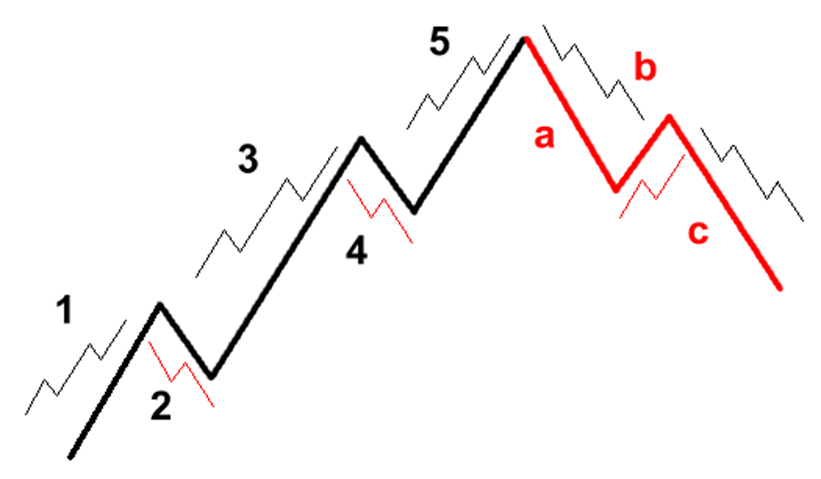

EWT Wave Within Waves

Each wave is comprised of smaller wave patterns

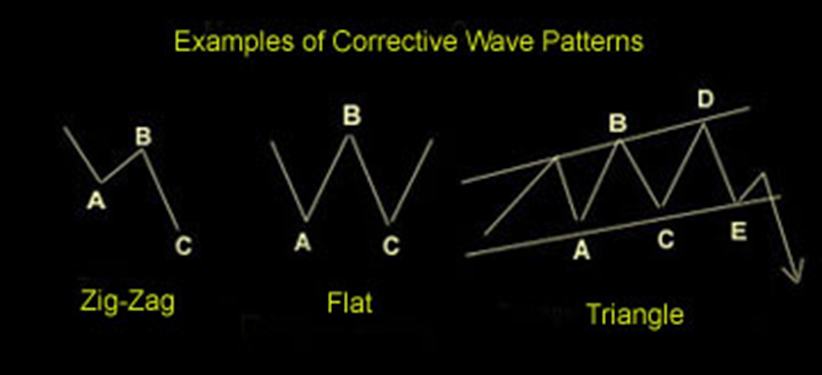

3 types of corrective waves

Zig zags

Flats

Triangles

Corrective wave patterns

Zig Zags

A-B-C, A & C impulse, B corrective

Flats

A-B-C moves sideways with overlapping sub-waves

Triangles

Like triangle patterns with 5 waves A-B-C-D-E

EWT rules that cannot be broken and must be held

Wave 2 may not break below the origin of wave 1

Wave 3 is never shorter than wave 1 and 5, but doesn’t have to be the longest wave

Wave 4 cannot overlap the termination of wave 1

All other suggestions are guidelines

EWT Guidelines

Alternation

Equality

Truncation

Alternation

Types of corrective waves in wave 2 and 4 alternate (a flat is followed by a zig-zag or triangle)

Equality

At least 2 of the 3 impulse sub waves in a 5-sub wave sequence are often equal in length

Truncation

Occasionally the 5th wave fails to exceed the 3rd wave and gets truncated

Gann

Time is more important than price

Fan lines

Price targets according to cycles and degrees of a circle

Time from cycle high/low, to the next cycle high low can be related

Using EWT

Difficult to interpret, especially corrective waves

Much debate as to “which wave we are in”

Tendency to overanalyze

Waves are fractal

Waves known after the fact

Wave movements are related to the Fibonacci ratio

Wave 1

rarely obvious at its inception. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to revise their earnings estimates lower; the economy probably does not look strong. Sentiment surveys are decidedly bearish, put options are in vogue, and implied volatility in the options market is high. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts.

Wave 2

corrects wave one, but can never extend beyond the starting point of wave one. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, and "the crowd" haughtily reminds all that the bear market is still deeply ensconced. Still, some positive signs appear for those who are looking: volume should be lower during wave two than during wave one, prices usually do not retrace more than 61.8% (see Fibonacci section below) of the wave one gains, and prices should fall in a three wave pattern.

Wave A

Corrections are typically harder to identify than impulse moves. In wave A of a bear market, the fundamental news is usually still positive. Most analysts see the drop as a correction in a still-active bull market. Some technical indicators that accompany wave A include increased volume, rising implied volatility in the options markets and possibly a turn higher in open interest in related futures markets.

Wave B

Prices reverse higher, which many see as a resumption of the now long-gone bull market. Those familiar with classical technical analysis may see the peak as the right shoulder of a head and shoulders reversal pattern. The volume during wave B should be lower than in wave A. By this point, fundamentals are probably no longer improving, but they most likely have not yet turned negative.

Wave 3

usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, wave five is the largest). The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to "get in on a pullback" will likely miss the boat. As wave three starts, the news is probably still bearish, and most market players remain negative; but by wave three's midpoint, "the crowd" will often join the new bullish trend. Wave three often extends wave one by a ratio of 1.618:1.

Wave C

Prices move impulsively lower in five waves. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Wave C is typically at least as large as wave A and often extends to 1.618 times wave A or beyond.

Wave 4

Prices may meander sideways for an extended period, and wave four typically retraces less than 38.2% of wave three. Volume is well below than that of wave three. This is a good place to buy a pull back if you understand the potential ahead for wave 5. Still, the most distinguishing feature of fourth waves is that they often prove very difficult to count.

Wave 5

final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high, the indicator does not reach a new peak). At the end of a major bull market, bears may very well be ridiculed (recall how forecasts for a top in the stock market