Lecture 8: historical returns, expected return, variance, standard deviation

1/13

Earn XP

Description and Tags

Chapter 7

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

14 Terms

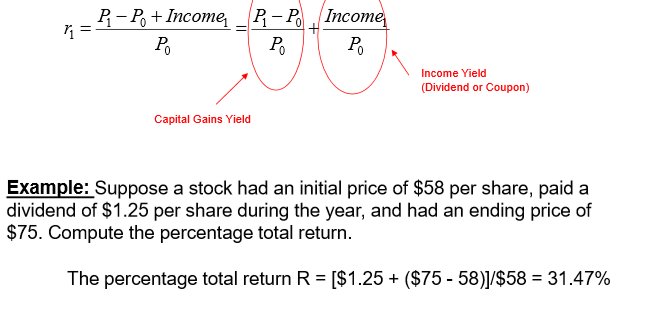

What is a historical return (HPR)?

The formula used to calculate the percentage return for a single period

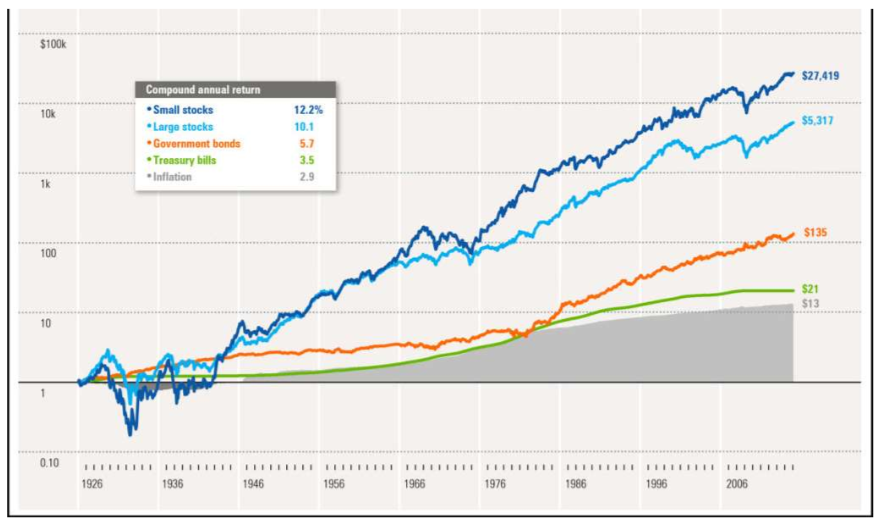

What are the 4 types of assets?

Cash → short term, risk-free, liquid

Bonds → risk of interest rate, not default, longer maturity than cash

Large stocks → risk of default, debtholders paid first then equity holders

Small stocks → ownership of shares in publicly held small corporations

What is the market cap?

Market cap = number of shares x price

What kind of treasuries are more riskier than others?

Small stocks most risky → more returns

Large stocks

Government bonds

treasury bills

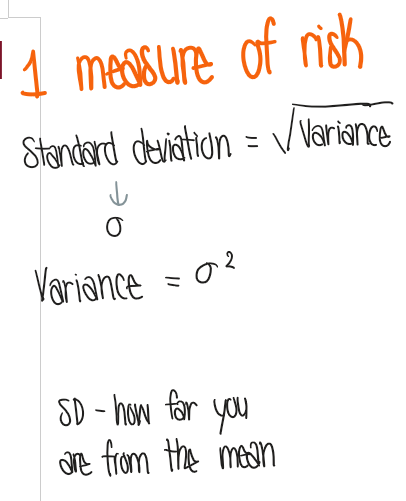

What is variance and standard deviation?

The spread of a return → measure of how the return may deviate from its average (mean) value

standard deviation represents the spread of a normal distribution

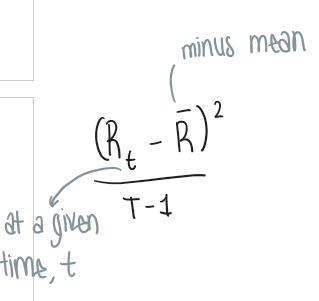

What is the formula for variance?

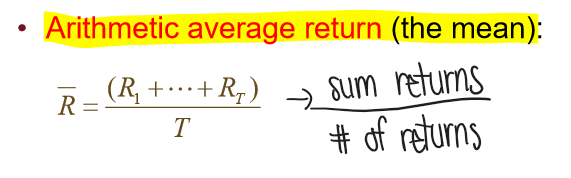

What is the formula for the average return (the mean)?

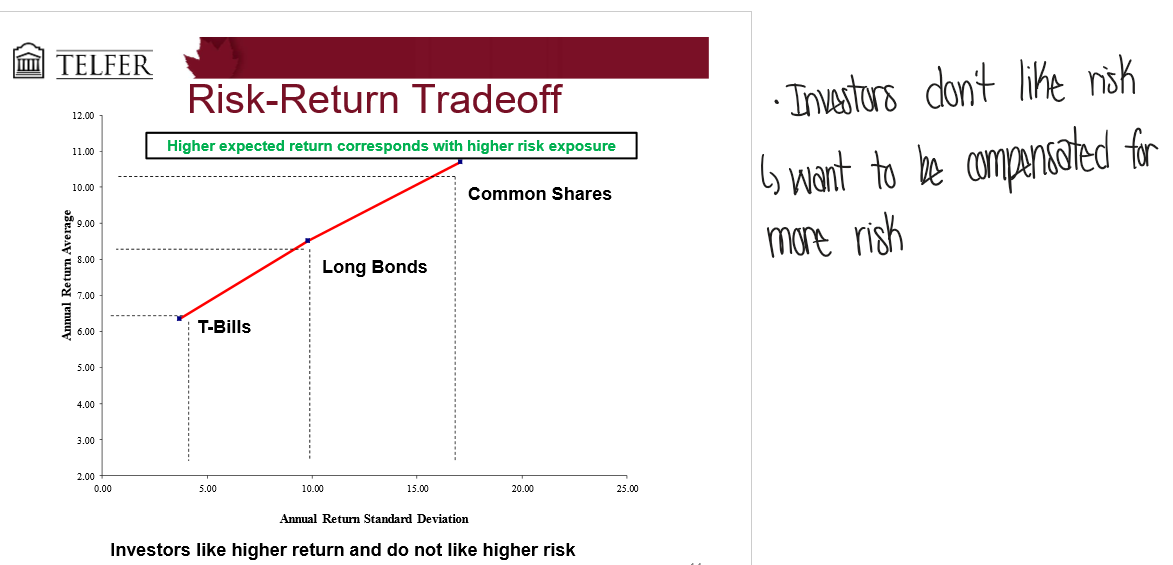

Why would investors buy more risky securities?

Investors don’t like risk

want to be compensated for risk

more compensation in exchange for higher risk (risk premium)

Risk premium = average (return - risk free rate)

What is the coefficient of variation (CV)?

Standard deviation / expected return

measure risk/unit of return

Why do we care about historical returns?

Historical data is a good predictor of future returns

past data to forecast the future

historical average return to estimate expected future return

historical standard deviation to estimate future standard deviation

What are some issues with historical data?

Issues with the sample → you can get different mean, standard deviation, variance depending on the period of sample used

need a lot of data (long sample period)

single stocks can be biased

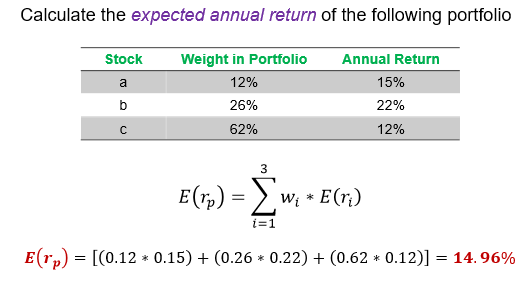

What is the formula for expected returns and risk?

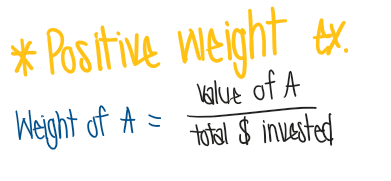

What are portfolio measures? (positive & negative weights)

Portfolio: combination of securities

Positive weight: buy security

Negative weight: sell security

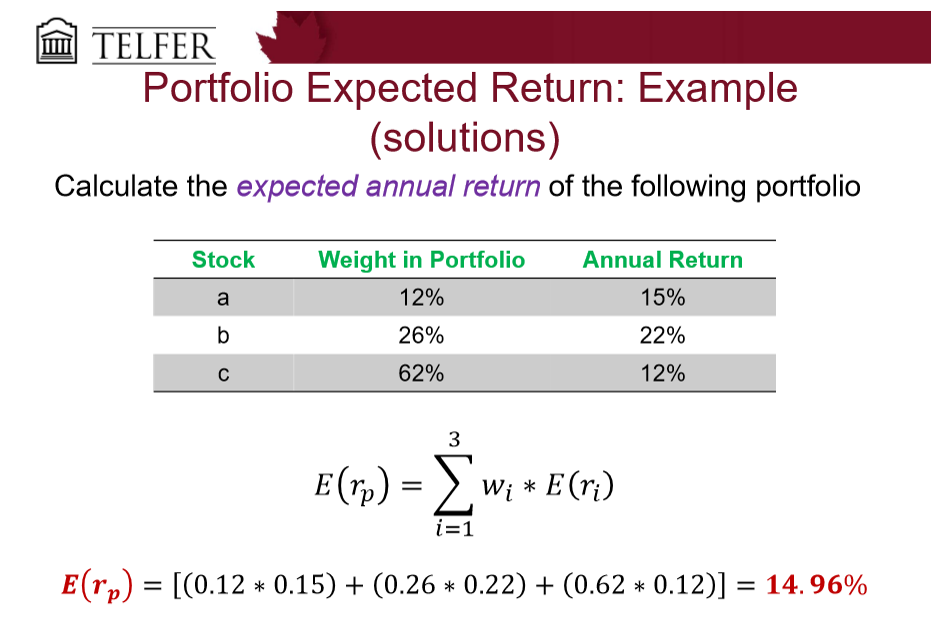

What is the portfolio expected return?

portfolio weight 1 x annual return 1 + portfolio weight 2 x annual return 2