3.05 Profitability and Liquidity Ratio Analysis

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

Ratio Analysis

A quantitative management tool for analysing and judging the financial performance of a business. This is done by making calculations from the final accounts.

Ratio

A number expressed in terms of another number.

Purpose of Ratio Analysis

Examine financial position

Assess financial performance

Compare actual with projected or budgeted

Aid decision-making

Two ways ratio are compared

Historical comparison (your past performance)

Intra-firm comparisons – same industry, similar size (benchmarking)

Gross profit margin

The value of gross profit as a percentage of sales revenue.

Profit Margin

The percentage of sales revenue that is turned into net profit.

Return on capital employed (ROCE)

Measures the financial performance of a firm compared with the amount of capital invested. The higher the percentage, the better it is for the business. A 20% ROCE figure shows that for every $100 invested in the business, $20 profit is generated.

Capital Employed

Capital used/invested in the company

Profitability

Examining profit in relation to other figures, like sales revenue

Liquidity Ratios

Liquidity ratios look at the ability of a firm to pay its short-term liabilities (debt)

Creditors and financial lenders are interested in liquidity ratios as they help to assess the likelihood of getting back the money owed.

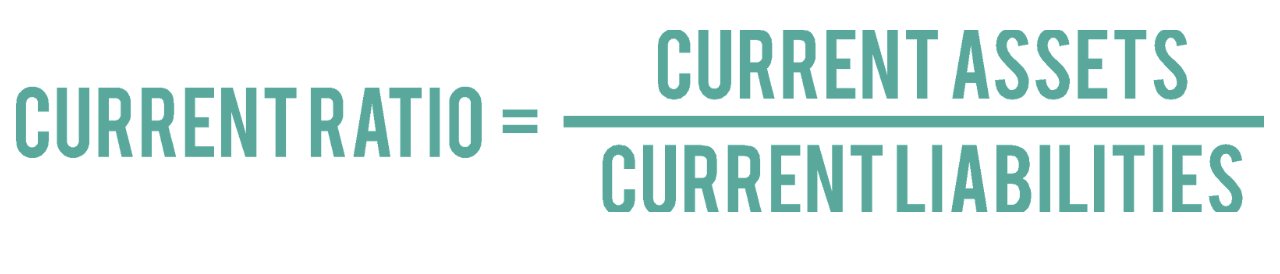

Current Ratio

Reveals whether a firm can use its liquid assets to cover its short-term debts. Generally accepted that a current ratio of 1.5:1 to 2:1 is desirable. This allows for a margin of safety.

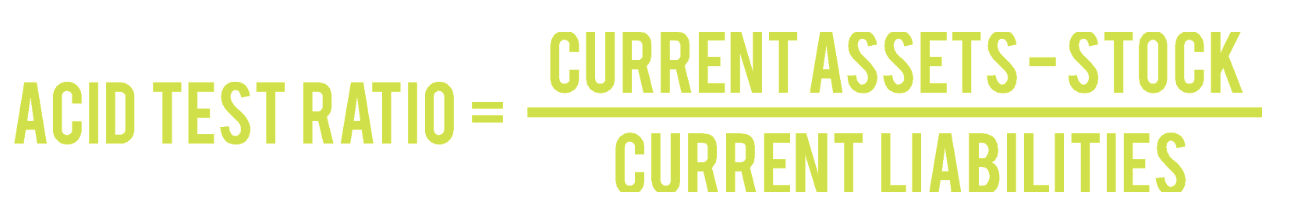

Acid Test Ratio (quick ratio)

Similar to the current ratio, except it ignores stock when measuring the short-term liquidity of a business. It can be more meaningful as stock is not always easy to convert to cash.