3.9 not finished

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Cost centre

These are departments of a business that incur costs but are not involved in generating any profit.

Profit centre

These are departments of a business that incur both costs and revenues.

Adv and dis

Adv :

Accountability of managers

Identifies areas of weakness

Promotes team spirit

Eliminates cost classifications into fixed/variable and direct/indirect costs

Allows for benefits from benchmarking

Improves motivation from delegation of responsibility

Dis :

Subjective allocation of indirect costs

Departmental profits can be misleading due to apportionment of fixed costs across centres

Time consuming data collection for accurate cost and profit allocations

Added pressure on staff to manage centres

ignores social and ethical responsibilities

Tension and conflict arising from unnecessary internal competition

Budgets

•A budget is a financial plan of expected revenue and expenditure for an organization, or a department within an organization, for a given time period.

Budgets have to be continuously monitored to ensure a company is spending its finances wisely.

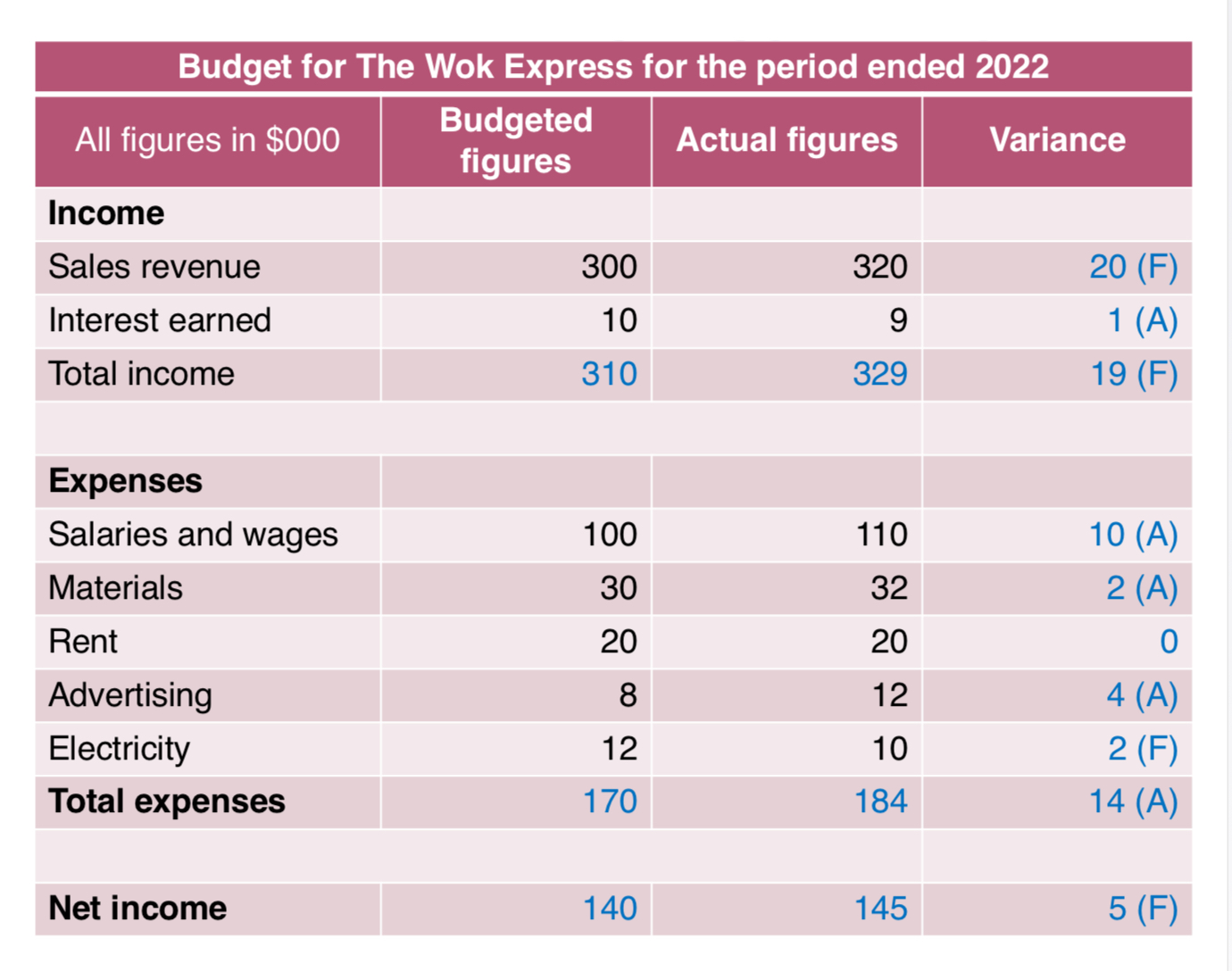

Variance

•Variance analysis is looking at the difference between the budgeted figure and the actual expenditure figure.

•There are two types of variance:

•Favourable: a difference that is of benefit to the business.

Adverse: a difference that is harmful to the business.

Reasons for setting budget

Financial planning

monitoring

Planning

Controlling

Setting

Planning and guidance

Helps plan for future

Anticipating financial problems before they actually happen

Consider:

How much money to spend

Workforce planning and costs

How cut to set aside for contingency fund (plan B)

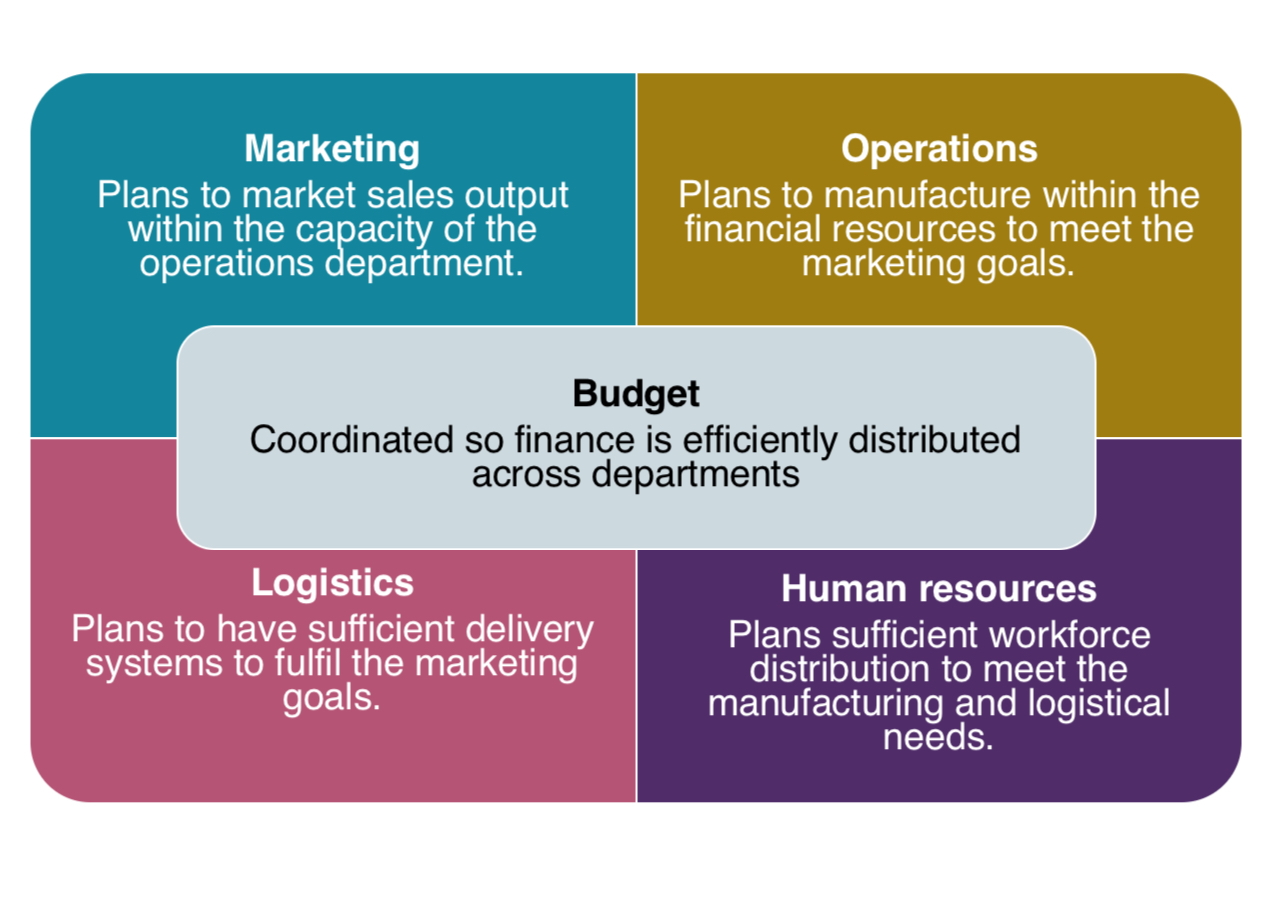

Coordination

•Budgets help different departments to coordinate objectives and expenditures with each other.

Control

Budgets offer financial control to prevent overspending.

Budget holders are held accountable for variances between planned and actual expenditure.

Motivation

Employee motivation

Considering when setting budgets

Available finance

Historical data

Organisational objectives

Bench marking

Negotiations

Limitations of budgeting

•Unrealistic/ unachievable budgets can occur.

•Wasteful use of resources due to overbudgeting and/or no carrying over budget surpluses to following year.

•Less useful for businesses with fluctuating sales revenues.

Quality may be harmed if budgets are excessively limited and rigid.

Budget sheet