Market failures and (potential) fixes

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

objectives

Understand the causes and types of market failures and

environmental externalities

• Identify how items such as taxes, subsidies and regulations

influence environmental pollution patterns

• Understand the key principles of effective market-based instrument

Guiding items

-Revisiting supply and demand

• Categorize costs of economic activities

• Types of market failures

• Intervention through taxes and quotas

• Aftermatch: workshop How to assess total costs of production

1. Revisiting Supply and Demand

The traditional Demand-Supply curve:

- Producer willingness to sell (S)

- Consumer willingness to pay (D)

- Equilibrium between private parties

Categorize costs of economic activities

What costs are captured in the supply-demand model for the following goods and services:

• Principal cost (from seller)

• Cost to access market/product/service (from buyer)

What’s missing?

Costs to parties not involved in exchange (i.e. external to the buyer and seller)

- Social and environmental costs of consumptio

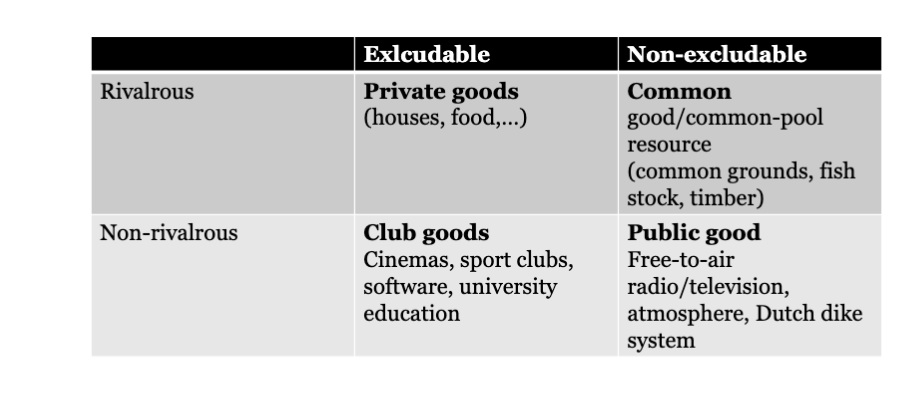

Types of market failures

What is a “market failure”?

• Market failure: a situation in which the market-driven allocation of goods and services is not

efficient (not optimal for human welfare)

• There exists another conceivable outcome where an individual may be made better-off without

making someone else worse-off

• Market failures can be the results of ...

• ... the nature or design of a market (interaction of actors needed)

• ... the nature of a good

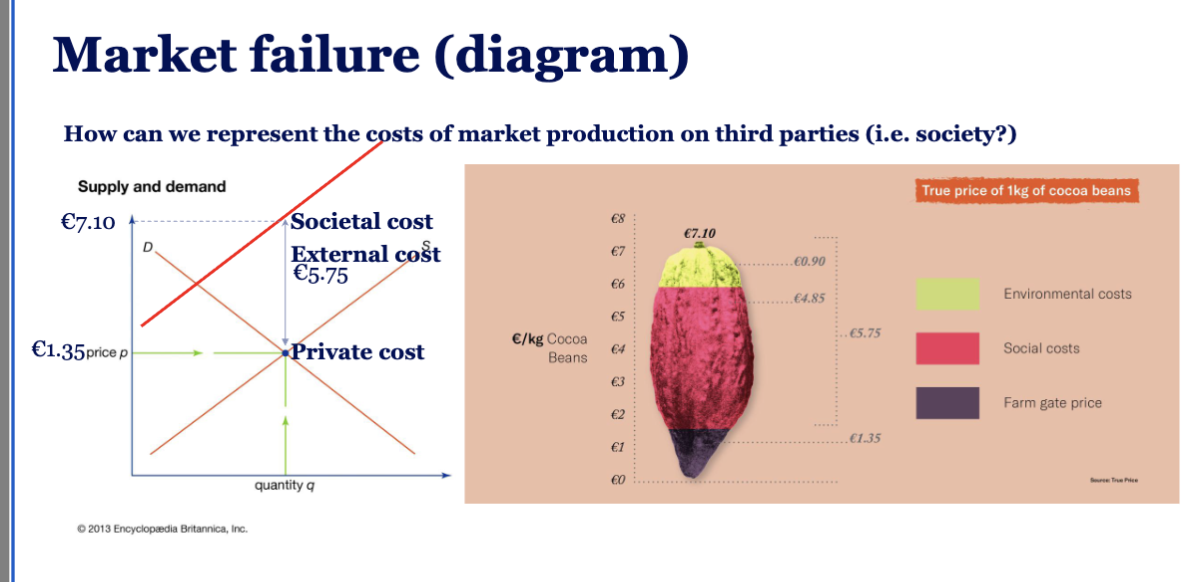

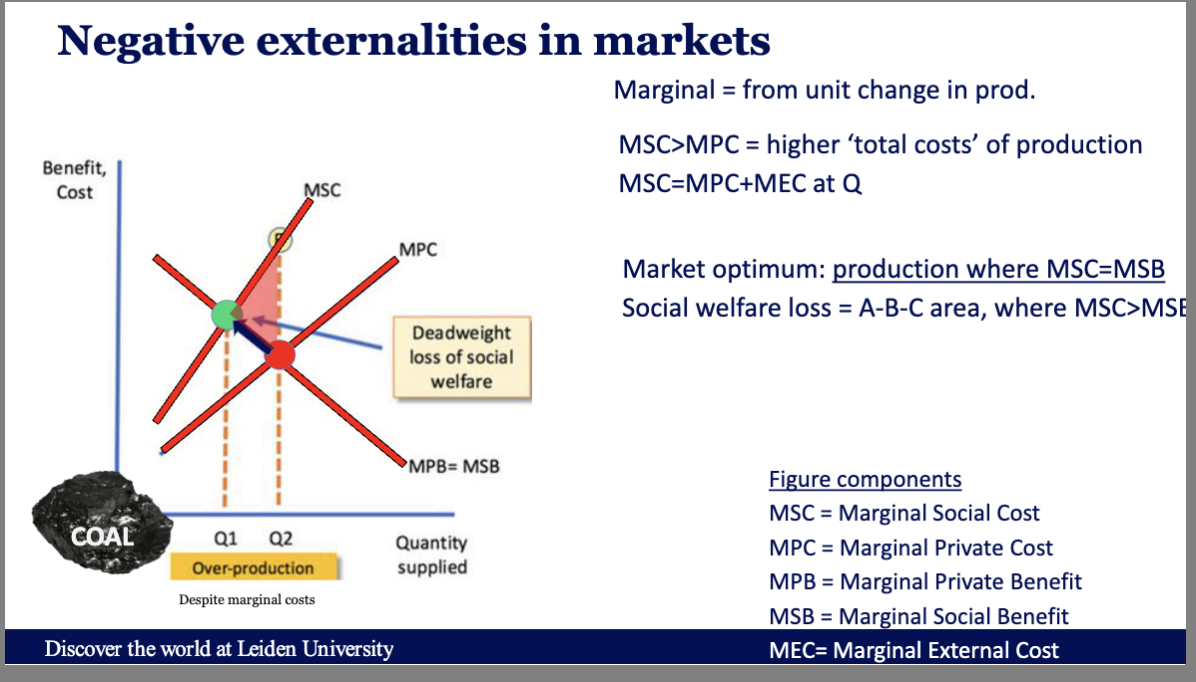

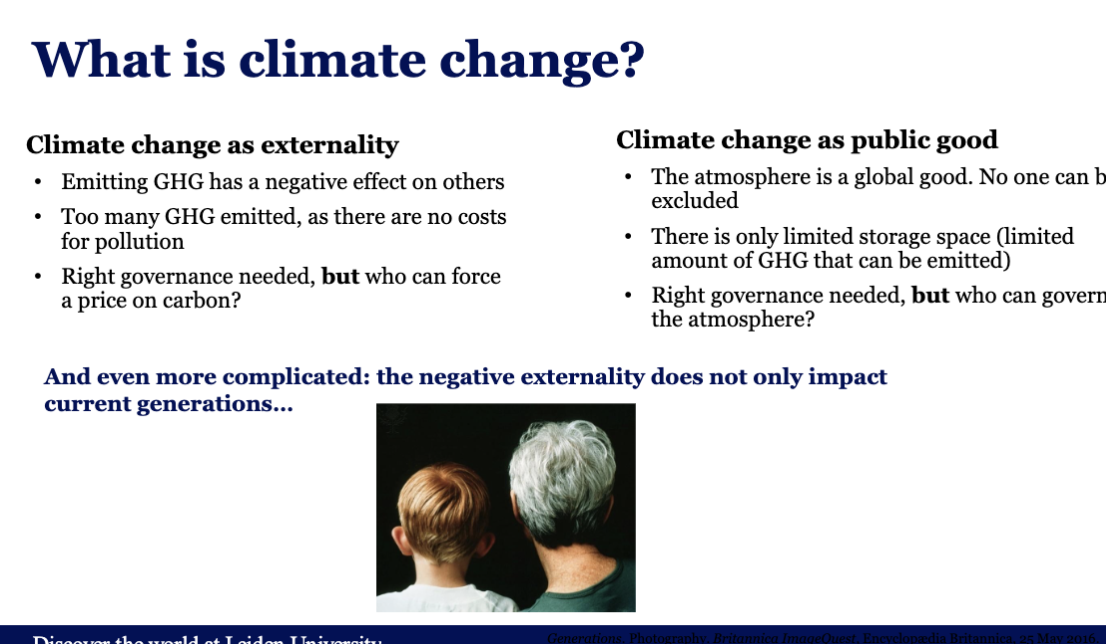

Externality?

Externality:

Markets respond to private costs

Product price does not reflect total, societal costs of production

Societal costs exceed market costs → production exceeds social optimum

Obvious solution: price the externality!!!

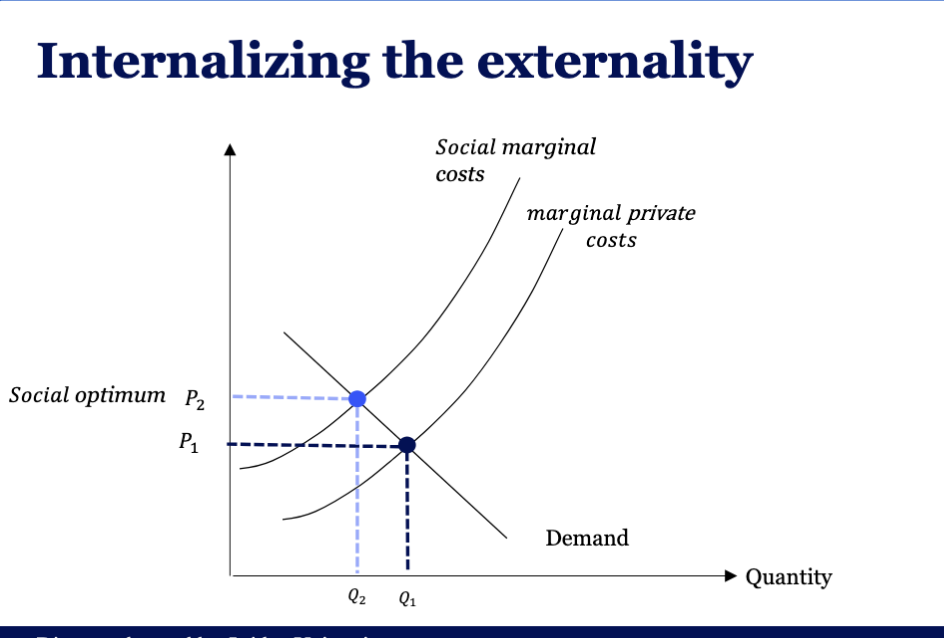

A negative externality implies social cost are above private cost

• Hence: Apply a tax to raise the private marginal cost

• “Internalize the externality” (polluter pays)

• If the tax rate is set at the level equal to the marginal damage, the tax is called a Pigouvian tax

• Vice versa for positive externalities

What is climate change?

Exam practice question:

There can be positive externalities

vaccines help other people not to get the diseases

more green spaces are better

= affects other ppl in a good way

Guiding items

Revisiting supply and demand

• Categorize costs of economic activities

• Types of market failures

• Intervention through taxes and quotas

• Aftermatch: workshop How to assess total costs of productions

Intervention through taxes and quotas

Environmental taxes and quota

Defining a tax

A compulsory contribution to state revenue, levied by the government

on workers' income and business profits, or added to the cost of some

goods, services, and transactions. (Oxford English Dictionary)

Defining a quota

Pollution standards in the form of maximum amounts of emmission of

a particular pollutant in the air or the water. They also cover maximum

harvest quotas or minimum forest and natural area covers. (OUP)

Purpose of taxes (and quotas)

• Raising of revenues & control price

• Compensate for damages

• Frequently used to steer behaviour

Examples

- Beard tax (introduced in Russia 1698) to ‘modernize’ the appearance of the society

- Stamp Act 1712 (UK): Tax on newspaper: initially designed to tax the rich. Increasing the circulation of newspaper /made it less accessible for the poor

- Climbing permits in Nepale for high mountains (15,000$ for Mt Everest spring spring season)

- Functionarities in Gongan county, China, Hubei had been orderd to smoke at least 23,000 packs of

(locally produced) cigarettes a yea

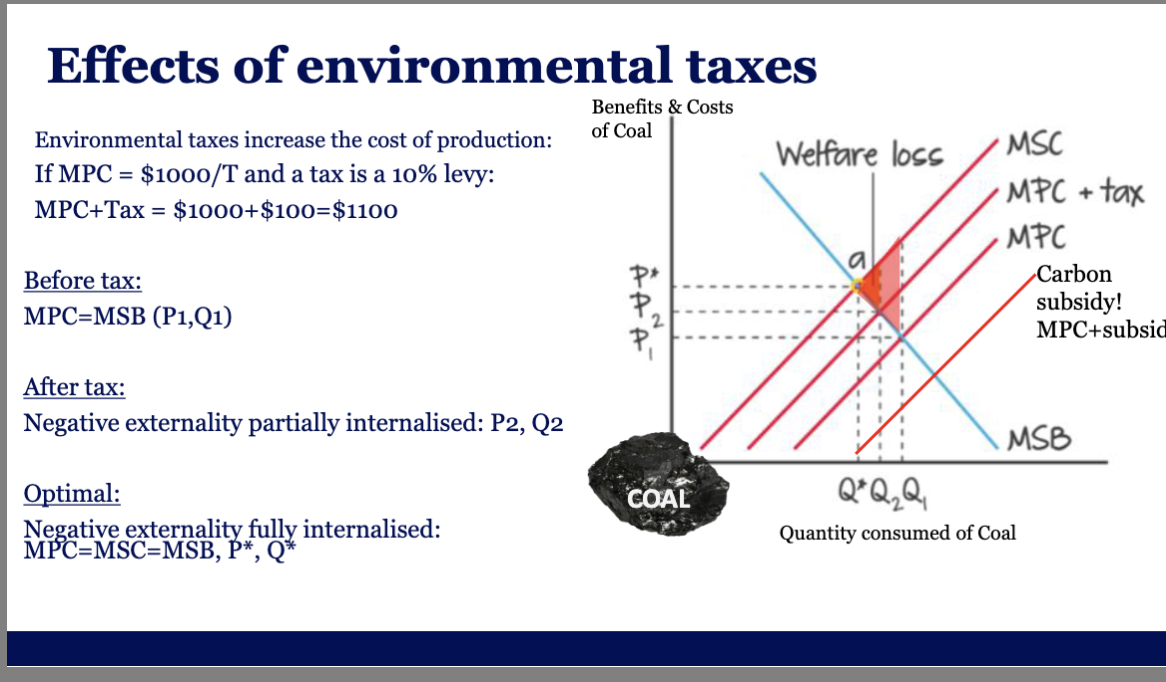

Effects of environmental taxes

optimal is A

Environmental taxes

- A meat tax could be levied on producers, consumers, or both.

- Taxation level = the social cost of health and environmental impacts

linked to meat consumption and production

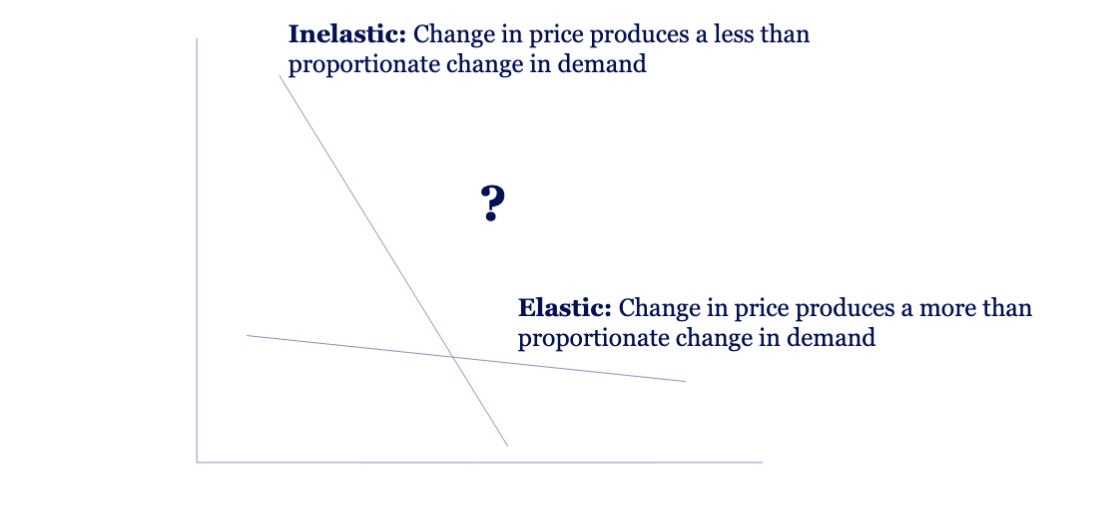

- The demand change of consumers depends on the price elasticity of

meat…

- Carbon tax: Ideally identify the virtual carbon content of goods, then

apply the tax equivalent to all damages

Price elasticity of demand (ped

inelastic—> change in price= not rlly a change

elastic—> change in price= a big change

cant substituted easily

Pros and cons of environmental taxes

Pros of environmental taxes

1. *Generates revenue which can be earmarked for green investment

2. Works on the polluter pays principle

3. Easier to implement than a quota to implement on consumption

4. Gives a clear signal, sets economic incentives to adjust

*Hypothecation: dedicated tax revenue to a particular expenditure does not always occur

Cons of environmental taxes

1. Effects on demand depend on the price elasticity of demand

2. Can be regressive, particularly when applied to staple foods/products

3. Requires iteration to be effective (i.e. guesswork on effects)

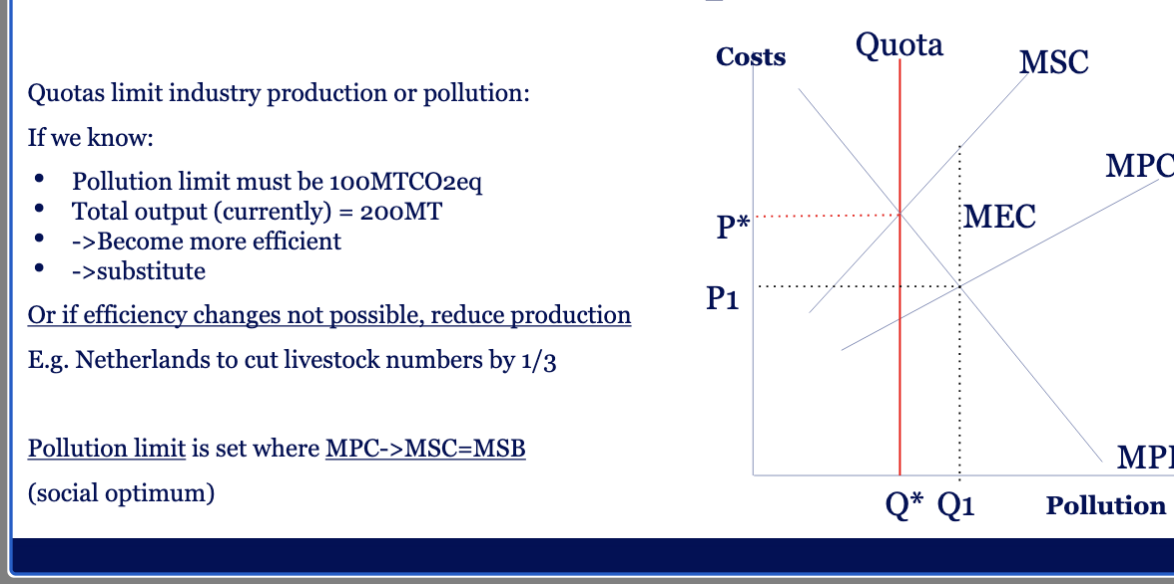

Effects of environmental quotas

Discover the world at Leiden University

Applied originally to industry then to mobile source

• Mainly focused on air pollutants (187 overall): e.g. particulate matter, ozone,

nitrogen dioxide

• Impact: passenger vehicles 98% cleaner, fuels 90% cleaner

• Estimation: $1:$9 multiplier benefits

Pros and cons of environmental quotas

Pros of environmental quotas

• Immediate effect (good in the case of harmful substances and avoiding tipping

points)

• Informed by science based goals

• Outcome largely expected

Cons of environmental quotas

• Quotas do not incentivise further mitigation

• Disadvantages small and older production facilities

• Fines must ≥ cost of abatement to avoid pollution

• Raises little revenue (only from fines)

Exam practice question:

Hybrid solution

Auctioning of quotas

- Limit overall pollution and

- Create a market

- Indicate that quotas will decline over time

• Example: EUETS

Economics in practice!

Market externalities and fixes:

• In addition to negative externalities, positive externalities imply goods which produce a spillover benefit to third parties, such as the pollination service of bees.

• Denmark introduced meat tax

• And a tax on cows (methane taks)

• EU deforestation regulation is a zero quota for traded products linked to overseas deforestation

• Corporate Sustainability Reporting Directive

(CSRD), 2023, requires businesses to report social and environmental impacts

what are the economic costs of the oil spill and design a scheme for compensation of impacted stakeholders

social impacts

economic impacts

env impacts

species die

affects food chain

destroys coastal and marine ecosystems

biodiversity loss

for each impact aim for 2-3 categories

impacted stakeholders

fisherman, consumers, oil producers, companies/ people near the coast

method for monetizing impact

cost of fish

cost to clean up the env impact

loss of business cost

pros and cons limitations of method

loss of business cost

how do we measure it

hard to put monetary value of ecosystem services

pros for price of fish

can the polluter be fully payed or is it also regulated or bailed out by gov

fining the company

pros: maybe they will make more successful equipment that prevents oil spill

con: less economic growth for companies

cost to clean up the env impact

con: only be based on precedent hard to estimate - uncertainty in long term damages

pros: there is an exact cost ; companies invest in an emergency fund

observstions

most costs not formally marketed (demand proxy markets to evaluate)

some are extremely difficult to quantify

costs demand boundary setting (spatially, econ, morally , time horizon)

feedbacks and causality difficult to evaluate

gloal reercussions on energy prices

long term health outcome and intergenerational impacts reputational damage

Cost benefit analysis (CBA)

compares traditional (marketed) costs and benefits of policies

common in early economic policy appraisal

excluded public goods and costs (Externalities)

ex: investing a wind farm involves a large upfront costs (infrastructure , and labor) but reduces long term energy costs

not always counted: carbon saving, effect on local house prices , impacts on nature, shifts jobs

weighted/multi criteria analysis

Economic or non-economic method to compare policy impact(s)

• Impacts given weights in appraisal to reflect their prioritisation

• Reveals trade-offs + helps to achieve desired policy outcomes

CBA = single balance sheet

MCA = multiple balance sheets

Total Economic

Valuation (TEV)

Attempt to capture all costs/benefits into

economic terms

Non-tangible costs are also quantified

Total Economic Valuation (TEV) methods

Contingent Valuation: estimate an economic value for a non-market good/service,

using direct or indirect survey techniques

- Method 1: Willingness to Pay (WTP) survey: How much are you willing to pay for an X

improvement in a good/service (e.g. pandas or rainforests)

- Limitation: no one parts with their money and people want to appear generous

→ overestimated value

- Answer? Indirect questioning: ask what an average person is WTP. People are

more likely to reveal their actual preference

- Method 2: Choice Experiments: elicit the value assigned to an attribute of interest (e.g.

sustainable sourcing or water quality improvement) by surveying consumers on

bundles of attributes and changing them in order to reveal inferred value of the

attribute of interest.

Hedonic pricing: Experimental method for using existing markets to infer price of non-

market goods/services, e.g. green spaces near housing (using house market prices) or

recreation