Influences on financial management

1/100

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

101 Terms

what are internal sources of finance

Refers to finance coming from either the business owners (equity or capital) or from the outcomes of the business activities (retained profits). They are the funds obtained from within the business.

what is owners equity

the funds put into the business by the owners to start or build the business.

Undercapitalisation (not having enough capital to start the business) is a major reason for business failure.

what are retained profits

Retained profits refers to profits made by the business that are kept in the business.

These are the profits that are not paid to the owners as dividends. Retained profits are a cheap and accessible source of finance for future activities, e.g. to fund growth in the future.

what are advantages of retained profits

- Immediate access/use to fund business activities i.e. expansion and growth plans

- Does not increase debt levels

- No interest repayments/debt servicing costs

- Retained profits can be used for expansion activities (achieving growth objective)

- Does not incur interest payments, therefore reducing expenses (achieving profitability objective)

what re disadvantages of retained profits

- Available funds may be limited (based on business performance)

- May take time to accumulate funds (missed business opportunities)

- Could result in decreased dividend payments to shareholders (shareholders dissatisfied)

- Using retained profits reduces the level of equity in the business (impacting

gearing, and solvency objective)

what are external sources pf finance

refer to the funds provided by sources outside the business, e.g. banks.

what are the external sources of finance (by the syllabus)

- debt → short-term borrowing (overdraft, commercial bills, factoring), long-term borrowing (mortgage, debentures, unsecured notes, leasing)

- equity → ordinary shares (new issues, rights issues, placements, share purchase plans), private equity

what is debt

Debt refers to monetary contributions that are externally sourced to fund the business

- Businesses must repay the amount borrowed in addition to interest to remain creditable for liabilities so that reputational damages are not acquired and that future loans will be available.

what are the different types of short-term debt

Bank overdraft, Commercial bills, Factoring

what is bank overdraft

Bank overdraft: A bank allows a business to overdraw its account to an agreed limit.

- An overdraft facility essentially means that a business can continue to make withdrawals when the account is empty.

- Bank overdrafts assist a business with short-term liquidity problems, e.g. seasonal decrease in sales-

a pool builder during a very wet season may take out a short term overdraft as a solution to cash

flow problems.

- They are also flexible and the interest rate is relatively high -11% .

- Banks may be secured over assets, (properties, car fleets) – less risk for the bank, lower interest rate

- Or banks may be unsecure – do not require some security, higher intrest rate

Interest rates are higher as the overdraft is not secured against collateral, meaning there is more risk for the bank than the business

what are advantages of bank overdraft

→ BO allows the business for immediate access to

funds; beneficial when a business is having cash flow

issues/short-term liquidity issues

→ BOs are a flexible source of finance in contrast to

bank loans

→ BO may not need to be secured against company

assets

what are disadvantages of Bank overdraft

→ Have to pay relatively high interest/debt servicing costs compared to other finance options (average interest rate for business overdraft is 10% p.a.) → Fees associated with initial set-up of an overdraw account (link to profitability objective) → Banks require some form of security → Interest repayments must be made regardless of level of profitability |

what are commercial bills

Commercial bills: Are short-term loans issued by institutions i.e. banks.

- They are usually for large amounts (over $100 000) for a period between 30 – 180 days (1 – 6 months).

- They are generally secure for the creditor i.e. secured against the borrower’s assets

- The borrower receives the sum immediately and at the end of the term repays the full amount and

interest that has accrued

- Commercial bills are an asset for a bank as they can be bought and sold on the markets

- Interest is less for commercial bills than an overdraft as the bill is secured against asset, therefore there is less risk for the business

- Generally for larger purchases of inventory and suppliers

- Also known as BANK BILLS!

Promise by a business to pay a certain amount by a certain day. By the end of the term you pay a full amount.

Lump sum is paid in around 180 days. Interest is paid in lump sum. Flexible if the business needs more time, yet

the business then needs to pay interest to the new set date.

what are advantages of bank overdrafts

→ Allows a business to borrow significant funds

>$100,000

→ Borrower generally receives the funds

immediately

→ Flexible source of funds (can adjust the principal

amount borrowed each rollover and interest payment

period in line with business cash flow requirements)

→ Interest rate may be cheaper than other sources

of ST borrowing instruments i.e. interest rate is lower

than bank overdrafts

what are disadvantages of bank overdraft

→ Have to pay interest (increasing business expenses

and impacting profitability objective)

→ Establishment fees need to be paid by borrower to the

financial institution

→ Usually secured against company assets – lose

assets if default on payments

what is factoring

Factoring: enables a business to raise funds immediately by selling accounts receivable at a discount

to a firm that specialises in accounts receivable (a finance or factoring business).

- Factoring allows the business to have immediate access to funds, solving any cash flow problems it may have.

- However, the business does not receive the full amount owed- usually receive 90% of invoice within 48 hours.

The business does not have to worry about the collection of accounts or the cost involved in this

process.

what are advantages of factoring

→ Immediate access to funds (factoring companies

can usually transfer funds within 48 hours to the

business)

→ Saves time and associate costs of following up

unpaid accounts

→ Improves cash flow/cash on hand – business in a

more liquid position

what are disadvantages of factoring

→ Business does not receive full value of accounts

receivable (usually 10% of the value is paid to the

factoring company), compromising’s short term

profitability

→ May impact customer relationships (with involvement

of a 3rd party factoring company receiving debts)

→ Business responsible for unpaid debts with recourse

factoring

→ Detrimental impact on the current ratio i.e. reduced

value of current assets as accounts receivable have

been sold at a discount

what are the different types of long term debt

mortage, debentures, unsecured notes, leasing

what is a mortage

Mortgage: a mortgage is taken over a property as a security for a loan (secured loan).

A mortgage is a long-term loan, such as 25-30 years, which enables a business to raise a significant amount of

funds, and is secured by the property of the borrower (business)

A mortgage is a contractual arrangement where one party (the mortgagor – the business that purchases the property) provides property as a security for a loan provided by the other party (the mortgagee – the

bank).

what are advantages of a mortage

→ Access to significant amount of funds allowing a

business to purchase property; can help with bus

growth and expansion

→ Regular periodic payments i.e. predictability of payments can be matched to business cash flow

→ Interest payments are tax deductible - which

contributes to reducing the business's tax liability

(profit objective)

→ Interest rates tend to be lower on mortgages than

other forms of debt (because the risks to the lender

are lower, i.e. the security - property - provided to the

bank)

what are disadvantages of a mortage

→ The property that is mortgaged cannot be sold or used

as security for further borrowing until the mortgage is

repaid

→ Asset acting as security can be confiscated if default on repayments

→ Interest needs to be paid (regardless of level of

business profitability)

→ Exposed to increases/changes in interest rates (if on

variable loan)

what are debentures

Debentures are long-term debt instruments issued by companies that carry a fixed rate of interest over a specific

term and are backed by the assets of the company. (note: the business borrows funds from investors, not banks)

- issued by a company to raise funds from investors, as opposed to financial institutions.

- They are issued by a company for a fixed rate of interest and for a fixed amount of time. It is a promise made by a company to repay money that has been lent to a business.

- In return for your money, the business (or ‘issuer’ of the debenture) promises to:

➢ Pay you interest over the term

➢ Pay back the money you lend it at a future date

Note that debentures are secured. This means that the company borrowing the money offers security to the lender usually over the company’s assets.

By investing in a debenture or unsecured note, you are lending your money to a business, with all

the risks this involves i.e. interest payments on your money and return of your capital are not

certain.

what are advantages of debentures

→ Access to significant funds/potential to raise a

large pool of capital for expansion activities (growth

objective)

→ Interest paid to investors is tax deductible (profit

objective)

→ Business determines the terms and conditions of

the loan (interest rates and loan periods) - these

terms can be set to suit the financial needs of the

business

→ Fixed interest payments to investors for a fixed

period of time (predictable payments for business -

assists with cash flow management)

→ Issuing of debentures does not dilute the control

of the existing shareholders (i.e. debenture holder

does not have the right to vote and there is no profit

sharing - just the outlined fixed interest)

what are disadvantages of debentures

→ Significant government regulation/must comply with ASIC and APRA regulations (i.e. must issue a prospectus document to lenders/investors - explaining how much looking to raise, how Funds will be used, etc.) note: the contents of the prospectus document could also reveal the business's strategic plans to its competitors, thus compromising its competitive advantage/hindering expansionary plans (link to growth objective) → Issuing a debenture increases the gearing/leverage of the business, thus adversely impacting business solvency (solvency objective) → Interest must be paid to investors → Need to offer security to the lenders (investors), usually in the form of the company's assets → Expensive and timely to establish |

what are unsecured notes

Unsecured notes are long-term debt instruments issued by companies for a fixed, high rate of interest and for a

specified period of time.

- Identical to debentures but not secured against the assets of the company ; risk sits with the investor,

thus why interest rates are higher as return on investment is not ensured

what are advantages of unsecured notes

→ Potential to access significant funds for

growth/expansion activities, e.g. acquisition

→ Interest paid to unsecured noteholders is tax

deductible

→ Business assets are safe from unsecured note

holders/investors (don't need to offer security)

→ Issuing of unsecured notes does not dilute the

control of the existing shareholders (i.e. unsecured

note holder does not have the right to vote and there

is no profit sharing - just the outlined fixed interest)

what are disadvantages of unsecured notes

→ The success of the issue of an unsecured note is

dependent upon the reputation and creditworthiness of

the business

→ Have to pay high interest rate to investors (usually

higher than a secured loan)

→ Have to produce and issue a prospectus document

→ increases business gearing (debt Financing raises the

leverage of the business and thus presenting a risk)

→ have to pay back the principal amount plus interest

back to investors (regardless of level of business

profitability or liquidity at the time

what is leasing

Leasing is an arrangement where the owner (lessor) of an asset grants possession of an asset to the lessee for a specified period of time in return for regular lease payments. Purchase all assets, then leases to you; not

provided with cash, rather assets. After a lease, you do not keep the assets. Two types:

1. Operating leases

- For assets leased for short periods (usually shorter than the life of the asset)

- The lessor carries out maintenance on the asset

- Can often be cancelled without penalty

2. Financial leases

- The lessor purchases the asset on behalf of the lessee

- usually between three and three and five years (the economic life of the assets

- Examples: plant, equipment, Furniture, Fixtures

- Penalties For cancellation of financial leases

- Leasing assets for long periods as financial leases is cheaper than leasing them as operating

leases

what are advantages of leasing

→ Assists in managing cash flow, as lease payments

are spread out over several years, hence saving the

burden of a one-off significant cash payment (liquidity

objective)

→ The lease repayments are tax deductible -

decreasing expenses (link to profit objective)

→ The costs of establishing leases may be lower

than other forms of finance (e.g. compared to cost of

preparing a prospectus for debenture or unsecured

note)

→ The business does not need to pay for

maintenance expenses associated with an operating

lease

→ Lease payments are fixed, therefore predictable

payments make it easier to manage cash flow

what are disadvantages of leasing

→ Public companies are required to reveal significant leases in their published financial statements or in notes to the financial statements (if the stimulus relates to a private - Pty. Ltd. - company then this point is irrelevant) → Business does not own the asset at the conclusion of the lease period → Business is obliged to make repayments for entire lease term (penalties applied if early termination) → Interest charges may be higher than for other forms of borrowing → If a business takes out a financial lease, the business incurs maintenance costs on the asset → don't need a deposit |

what are the different types of equity

ordinary shares and private equity

what is equity

finance refers to funds contributed by the business owners; for example, capital or reinvesting net profit back into the business.

- Equity as an external source of funds refers to the finance raised by a company through inviting new owners. For example, this can be done by issuing shares to the public through the Australian Securities Exchange (ASX). This is used as an alternative to debt funding. Equity as a source of external finance includes:

• ordinary shares (new issue, rights issue, placements, share purchase plan)

• private equity

what are ordinary shares

An ordinary share is part ownership in a business, this entitles the private individual (also known as a shareholder) to receive a proportion of the business’s profits (called dividends) and potentially to vote on matters raised at the AGM

- Large businesses can secure capital (i.e. to facilitate growth and expansion) by issuing ordinary shares to the general public through the Australian securities exchange (ASX)

what are the different types of ordinary shares

New issues, rights issues, placements and share purchase plans

what are new issues

A new issue refers to a security that has been issued and sold for the first time on a public market,

e.g. the Australian Securities Exchange.

- Initial public offerings (IPOs) are the most common new issues.

An IPO, or ‘float’, is when a private company lists on a stock exchange for the first time to

raise funds by selling shares to the public.

why do you issue new shares

so that the business can grow

what are rights issues

A rights issue is an invitation to existing shareholders to purchase additional new shares in the same company.

- This type of issue gives existing shareholders securities called rights. With the rights, the

shareholder can purchase new shares at a discount to the market price on a set future date.

- Rights are considered to be a type of option since it gives shareholders the right, but not the

obligation, to purchase additional shares in the company.

- Usually the current shareholders will have the right to purchase new shares in proportion to the number of shares they currently own.

The shareholder does not have to take up the rights issue. However, if they do not, the value of their

holding is diluted. i.e less ownership

what are placements

A placement involves creating new shares in return for capital and issuing them to selected investors at a discount to the market price of the company’s shares.

- Another way a company can raise additional funds is to do a ‘share placement’.

- In other words, additional shares are offered at a discount (say 15 – 25%) to their current trading

price to special institutions or investors who are able to invest a large sum of money. This discount is

- intended to persuade specific investors to invest in the company.

- Critics contend that emergency equity capital raisings favour institutional investors too much at the

expense of retail investors i.e. mum and dad investors.

Eligible retail shareholders may not be offered the opportunity to take part in the capital raising and the value of their shareholding can be diluted.

whats a share purchase plan

Share purchase plan: Offer existing shareholders in a listed company the opportunity to purchase more shares in that company, without brokerage fees.

- A share purchase plan is an offer to existing shareholders, company employees and managers to buy shares in the company they work for or have invested in.

- As a further enticement to invest, the shares are also usually offered to existing shareholders at a discount to the current market price.

Example: is dividend reinvestment plans e.g. instead of receiving a $200 dividend from BHP, a

shareholder has the option to convert the dividend into shares. E.g. can buy five shares at $40 each

(market price is $42)

what is private equity

Private equity (PE) is ownership or interest in an entity that is not publicly listed or traded on the Australian Securities Exchange (ASX).

- A source of investment capital, private equity (PE) comes from high-net-worth individuals (HNWI) and firms that purchase stakes in private companies or acquire control of public companies with plans to take them private and delist them from stock exchanges.

- Because private equity (PE) entails direct investment—often to gain influence or control over a company's operations—a significant capital outlay is required, which is why funds with deep pockets dominate the industry.

- Buys businesses to make a profit e.g bain bain buys virgin

- Private equity firms target underperforming businesses e,g they have a lot of debt or badly managed

what are advantages of private equity

→ Potential to access significant amount of capital

→ Private equity firms can also provide advice/offer expertise

what are disadvantages of private equity

→ Private equity firm may request board representation

→ Potential for conflict in strategic direction of firm

between private company and private equity firm

→ Dilution of ownership/control/profit distribution

what are the different types of financial institutions

banks, investment banks, finance companies, superannuation funds, life insurance companies, unit trusts and the Australian Securities Exchange

what are financial institutions

Financial institutions collect funds and invest them in financial assets.

While most businesses acquire funds from a bank, finance is also available from a variety of other institutions, such as investment banks, finance companies, superannuation funds, life insurance companies, unit trusts and the Australian Securities Exchange.

Financial institutions assist businesses to meet their financial needs through the provision of financial

services.

how do financial institutions assist businesses

- Collect funds

- Provide financial services-

- Provide debt and equity finance

- Assist with daily operations i.e. bank account transactions

what are banks

A bank is a financial institution that receives savings as deposits from individuals, businesses and governments, and in turn, makes investments and loans to borrowers.

what do banks provide

Banks also provide other typical banking services such as internet banking, automatic teller machines (ATMs) and financial advice.

how do banks make money

- so it accepts money as savings (deposits) at a lower interest rate and lends that money at a higher interest rate.

The difference between these two rates of interest is one of the ways a bank makes a profit i.e.

interest rate differential —> lenders earn 4% interest, Borrowers own 6% interest, bank makes 2%

what are investment banks

Investment banks, also known as merchant banks, are financial institutions that

assist individuals, companies or governments in raising capital.

Investment banks provide services in both borrowing and lending, primarily to the business sector,

for example, Macquarie Bank.

- They do not take deposits

- They provide a wide variety of different types of loans for businesses and can therefore customise loans to suit the business’s specific needs.

- Provide corporate advice (i.e. M&A, forex)

Assist in raising capital through debentures (debt) , new issues (equity)

what are finance companies

Finance companies are non-bank financial intermediaries that specialise in smaller commercial finance.

They provide mainly

- Short-term loans

- Long-term loans

To businesses through consumer hire-purchase loans, personal loans and secured loans

- They are also the major providers of lease finance to businesses.

Some finance companies specialise in factoring or cash flow financing.

what are superannuation funds

Superannuation is a scheme set up by the federal government, which requires all employers to make

a financial contribution to a fund that will provide benefits to an employee when they retire.

- Employers must pay an amount equal to 11.5 % of their employee’s salary into a super fund account.

(increase to 12% on 1st July 2025.) This is on top of the employee’s salary or wages.

- Over the course of their working life, these contributions add up.

- Superannuation funds invest the money received from superannuation contributions in many things,

such as company shares, property and managed funds.

- They do this so that their members will earn investment returns on the money.

Superannuation funds are able to invest in shares (NI, RI, P), property, cash, etc so that the super can grow

what are life insurance companies

Life insurance companies are also non-bank financial intermediaries who provide cover and a lump

sum payment in the event of death.

- Policy holders pay regular premiums and the insurer guarantees to pay the designated beneficiary a sum of money upon death of the insured person or under other circumstances specified in the contract.

Life insurance companies provide both equity and loans to the corporate sector through receipts of

insurance premiums, which provide funds for investment. The funds received in premiums, called

reserves, are invested in financial assets.

what are unit trusts

Unit trusts (also known as mutual funds) take funds from a large number of small investors and

invest them in specific types of financial assets.

- Unit trusts invest in any mixture of cash, Australian or international shares, fixed interest securities (such as government bonds) or property.

- In recent years some unit trusts have also invested in gold, silver, oil and gas. Unit trusts are usually connected to a management firm that manages a diversified investment portfolio for its investors.

what is the Australian Securites Exchange

The Australian Securities Exchange (ASX) is the primary stock exchange group in Australia. The ASX is

a market where shares are bought and sold.

- The ASX offers products and services including shares.

- The biggest stocks traded on the ASX include BHP Billiton, CBA, Rio Tinto, CSL and Westpac.

- Importantly for businesses, the ASX acts as a primary market.

- This primary market enables a company to raise new capital through the issue of shares and through the receipt of proceeds from the sale of securities.

The ASX also operates as a secondary market. The secondary market is where pre-owned or second-hand securities, such as shares, are traded. See equity section on Sources of Finance.

what are the different influences of the government

Australian Securities and Investment Commission AND company tax

what is ASIC

ASIC Australian securities and investment commission (ASIC) is Australia’s corporate, markets and financial services regulator

how does is influence businesses

The Australian Securities and Investments Commission (ASIC) is an independent commission of the Australian Government tasked as the national corporate regulator. ASIC's role is to regulate company and financial services and enforce laws to protect Australian consumers, investors and creditors.

What is a corporate regulator? A corporate regulator is an organization or agency responsible for overseeing, monitoring, and enforcing laws, rules, and regulations related to businesses and the financial sector.

Which laws do they enforce? The Australian securities and investments commission Act 2001, corporation Act 2001

what is company tax

All companies, both public and private (i.e. incorporated businesses) must pay company tax on profits.

Company tax is paid before profits are distributed to shareholders as dividends.

- The tax is levied as a flat rate i.e. unlike personal income taxes that are progressive

Currently, the company tax rate in Australia is: 25% <50mil revenue

what are global market influences

economic outlook, avalibility of funds, intrest rates

what does economic outlook refer to

Refers specifically to the projected changes to the level of economic growth throughout the world.

how does the economic outlook influence businesses

- Economic outlook projections will create or limit business opportunities

- Economic forecasts will affect business decision making i.e. in terms of investment into respective markets

- If the economic outlook and economic growth projections are positive for a respective region, businesses will look to invest into those markets to capitalise on the rising consumer confidence and demand

- If the economic forecasts are negative, the business may limit investment, remove resources and down-scale

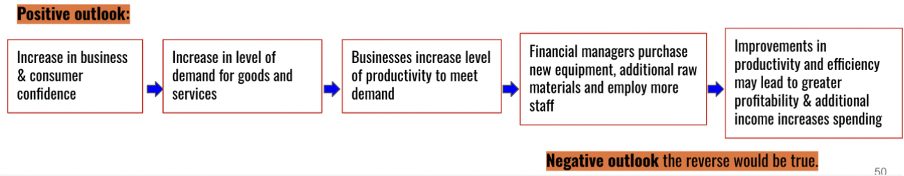

what is a positive economic outlook

what does avalibility of funds refer to

Refers to the ease with which a business can access funds (for borrowing) on the international financial markets

The international financial markets are made up of a range of institutions, companies and governments that are prepared to lend money to individuals, companies or governments who may need to raise capital. There are various conditions and rates that apply and these will be based primarily on:

• Risk

• Demand and supply

• Domestic economic conditions

- The Australian financial system was deregulated in the 1970s and 1980s. Ever since barriers to cross-border financial flows were dismantled, the Australian economy became more

integrated with the global financial system.

- As a result, Australians are free to borrow and invest in financial assets overseas, and foreigners can do likewise in Australian markets.

- These developments have had a lot of benefits for businesses, including increasing the availability

of funds.

- The COVID-19 pandemic, which has had a negative impact on the availability of funds. The

reluctance of banks to lend money has had a greater impact on small businesses. Part of the

reason why banks are hesitant to lend to businesses is the fact that so many businesses have

failed and are experiencing difficulties meeting their current repayments

how does the avalibility of funds influence a business

· If there is high availability of funds, businesses can obtain funds at lower interest rates (due to supply and competition between financial institutions)

· If there is a low availability of duns in a respective country, domestic businesses within that country may look to borrow funds in o/s markets

if funds are difficult to access, businesses may need to rely on internal sources of funds (i.e. retained profits and equity) to enable them to funds business activity

what are intrest rates

Interest rates are the cost of borrowing money (or the return on saving money).

how do intrest rates influence a business

· the level of risk involved in lending to a business, the higher the interest rates.

· Traditionally Australian interest rates tend to be above those of other countries, such as the United States

and Japan, therefore Australian businesses could be tempted to borrow the necessary finance

from an overseas source to gain the advantage of lower interest rates.

· The risk in this is exchange rate movements. Any adverse currency fluctuation could see the

advantage of cheaper overseas interest rates quickly eliminated – the ‘cheap’ interest rates

end up costing more.

i.e. a lower exchange rate will make interest servicing costs higher (and vice versa) “Emergency measures” were in place and interest rates dropped to historically low levels (cash rate was .1% in Australia), and in some cases negative, in response to the COVID-19 pandemic. This is called Monetary Policy and is managed by economies Central Banks i.e. RBA (Australia), The Federal Reserve (USA) etc. The cash rate rose to 4.35% in Australia to decrease inflation post-COVID to reduce inflation. The cash rate is currently at 4.1% and is expected to decrease further as inflation gets under control.

what are the different steps for planning and implementing

– financial needs, budgets, record systems, financial risks, financial controls

what are financial needs

To determine where a business is headed and how it will get there, it is important to know what its current and future financial needs are.

Important financial information needs to be collected before future plans can be made. This financial information includes balance sheets, income statements, cash flow statements, sales and price forecasts, budgets, bank statements, weekly reports from departments, break-even analysis, reports from financial ratio analysis and

interpretation.

The financial needs of a business will be determined by which factors?

1. The size of the business

2. The current phase of the business cycle

3. Future plans for growth and development

4. Capacity to source finance – debt/and/or equity

Management skill for assessing financial needs and planning

what are budgets

A budget is a financial document used to estimate future revenue and expenses over a period of time. A budget should provide an accurate picture of income and expenses and should be used to drive important business decisions such as whether to increase marketing, hire staff, cut expenses or purchase new assets.

Budgets are used in both the planning and the control aspects of a business. As a control measure, planned performance can be measured against actual performance and corrective action taken as needed.

what are the main types of budgets

1. Operating budgets

2. Project budgets

3. Financial budgets

what are factors to consider when preparing a budget

Past trends and financial data – Reviewing past performance for forecasting.

Market conditions – Seasonal demand, competitor strategies, and economic trends.

Business expansion plans – Assessing future investments and operational needs.

External factors – Labour costs, interest rates, and availability of raw materials.

Budgets act as control mechanisms by comparing planned vs. actual financial performance.

what are record systems

Record systems are the mechanisms employed by a business to ensure that data are recorded and the information provided is accurate, reliable, efficient and accessible.

Management bases its decisions on the information when needed and must have guarantees that the information is accurate and reliable.

what are financial risks

Financial risk refers to the possibility of financial loss to businesses.

Every business is subject to a degree of financial risk and not all financial risks are able to be controlled; for example, changes in interest rates.

Financial risks include:

· insufficient funds to pay creditors i.e. meet financial obligations

· debtors unable to pay money owed to the business

· changes to the external business environment

Explain the different types of financial risks.

- Credit risk

- Market risk

- Liquidity risk

- Operational risk

Managing Financial Risk:

- Diversify revenue streams to reduce reliance on one market.

- Monitor financial statements regularly to detect potential issues.

- Develop strong credit policies to ensure customers can meet obligations.

Maintain a financial safety net (e.g., cash reserves).

what are financial controls

Financial controls are the procedures, policies and means by which a business monitors and controls the allocation and usage of its resources.

What are some common policies and procedures that promote control within a business?

- Seperation of duties

- Control of cash

- Protection of assets

Qualification restrictions

what is gearing

the proportion of debt (external finance) and the proportion of equity (internal finance) that is used to finance the activities of a business.

what is gearing measured by

the debt to equity ratio

what is solvency

the ability to meet long-term debts —> the extent to which the business can meet its financial commitments in the longer term (more than 12 months)

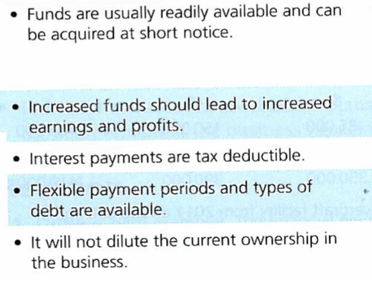

what are advantages of debt finance

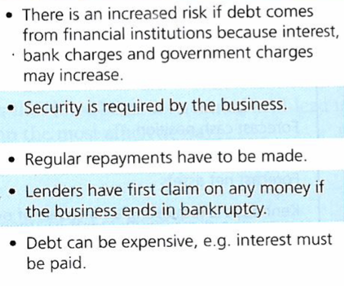

what are disadvantages of debt finance

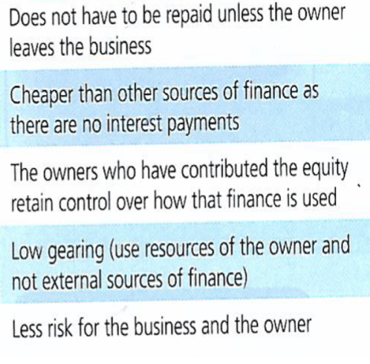

what are advantages of equity finance

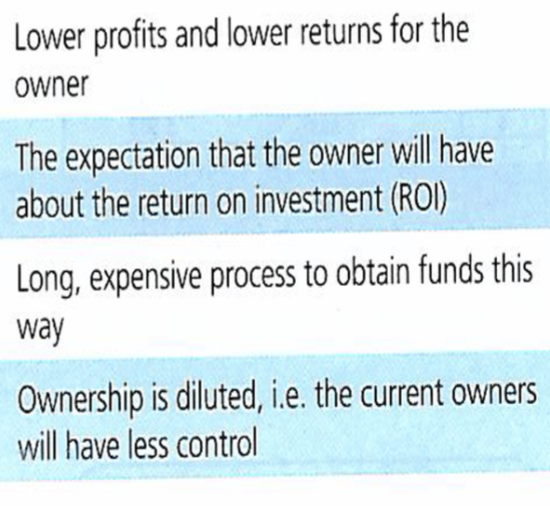

what are disadvantages of equity finance

how do finance managers match sources of finance

should match the length or term of the loan with the economic lifetime of the asset the finance is being used to purchase.

A basic principle of finance is that a business’s long term asset base should be funded by long term sources of finance, while short term assets should be funded by short term finance. This is called the matching principle.

Long term sources of finance (i.e. mortgage) should fund long term assets (i.e. factory)

Short term sources of finance (i.e. accounts payable) should fund short term assets (i.e. stock)

what are key considerations and implications to it

- Cost implications

● Debt involves interest, while equity may dilute ownership and profits.

● Short-term finance may attract higher interest rates.

- Flexibility

· Overdrafts and trade credit provide flexibility for immediate needs.

· Long-term finance supports larger, strategic investments.

- Risk and Control

● Debt increases financial risk but allows the owner to retain control.

● Equity reduces financial risk but involves sharing decision-making and profits.