ACFI231 - Lecture 11 paying for acquisitions and defences against takeovers

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

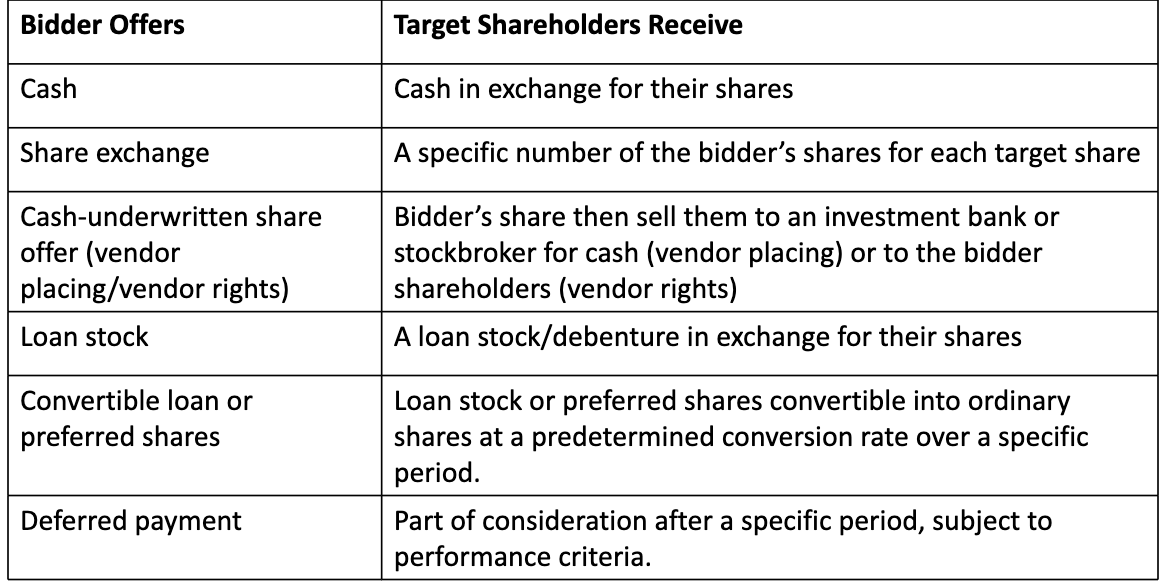

Principal methods of payment for acquisitions

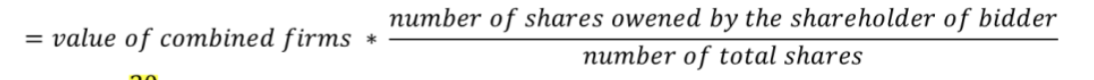

Number of shares post-acquisition

Number of shares post-acquisition = number of existing shares of bidder + number of shares issued to target shareholder

value of combined firms

Factors influencing choice among acquisition financing methods

Risk and valuation considerations

Maximising tax benefits

Corporate control considerations

Deal execution considerations

Capital market conditions

Bid strategy

Bid strategy is a plan to acquire another company in order to achieve the predetermined business and corporate objective

being a first mover in bid strategies

Being a first mover you can:

Cherry pick the best target

buy at a lower price than follow on buyers

prevent competitors from accessing the buying targets resources

being a second mover in bid strategies

• A second mover may have advantages in new and fast-evolving industries, where

the true value of a target is difficult to access in both strategic and financial term.

• The second mover can also take the time to counter the first mover effectively

through strategies other than acquisitions, e.g., a joint venture.

Showstoppers

Firms must look for any potential ‘showstoppers’ or ‘deal-killers’ that can thwart the

bid.

• Antitrust regies: Office of Fair Trading (in the UK); Federal Trade Commission and

Justice Department (in the US); European Commission (in the EU).

• Litigation initiated by the target.

• Contracts between a target and its suppliers or customers.

• Bond covenants.

• Trade unions representing employee or employees themselves

Getting the board on board

A bid strategy must command the wholehearted support of all bidder directors.

Similarly, the strategy must also have the support of the large and influential

shareholders.

Where board is divided, the bidder team will find it very difficult to sell the deal to the

target board and its shareholders, and to other stakeholders.

Bid resistance motives

managers may resist takeovers as they believe remaining independent best serves the interest of shareholders, fear of loss, or waiting for the best time to extract maximum bid premium for shareholders

manager bid acceptance motives

best option available

secures a better deal in the post acquisition dispensation

Pre Bid defences

The best form of defence is being prepared. Pre-bid defences fall into two board

categories. Internal defences are decisions/actions to alter the internal structure or

nature of operations of the firm. External defences are actions taken to influence

outsiders’ perceptions of the firm, and to provide early warning signals about

potential predators.

Post offer defences

First response and pre emption letter

defence doc

profit forecaste

promise higher future dividends

asset revaluation

share support campaign