FINS 2618 All Weeks

1/76

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

77 Terms

Pre-1980 Banks (Before Deregulation)

Banks were very regulated in their activities and mostly followed an asset management business model. Their loans portfolio had to match with their deposit base therefore they were limited by deposit funding. Further more the rate at which loans were set were fixed.

Post-1980 Banks (After Deregulation)

Banks gained greater flexibility to set variable rates and diversify lending portfolios. This allowed banks to pursue higher-return, riskier lending, including large-scale commercial loans, foreign currency lending, and exposure to new sectors. They were also allowed to use debt as a source of capital to lend out more loans. This also encouraged banks to take on off-balance-sheet activities (e.g., guarantees, derivatives) to generate fee income and manage risks more efficiently.

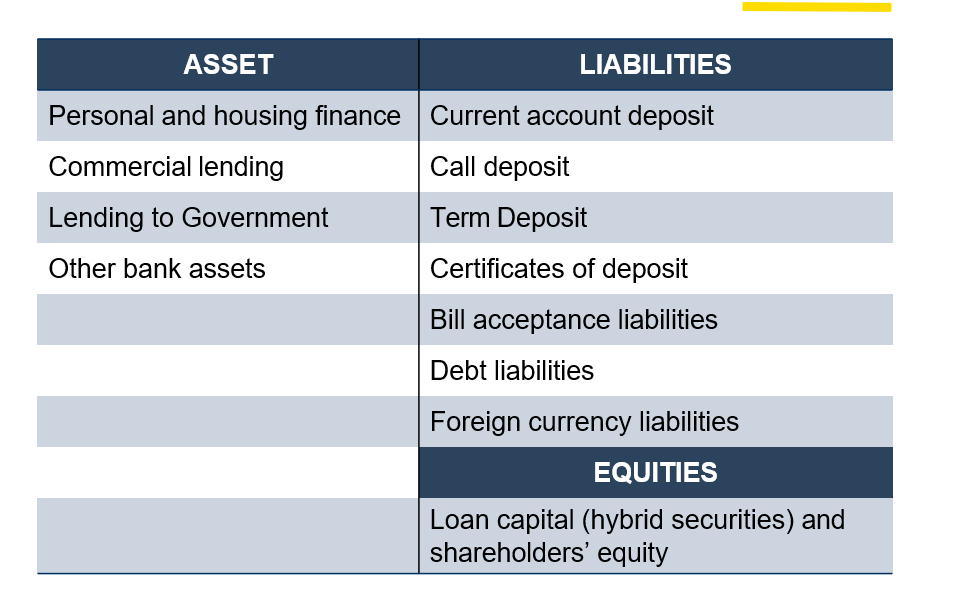

On balance sheet activities

Current account deposit

daily transaction account

no interest or investment return at all

very liquid

Call Deposit

small interest liquid account

for short-medium term savings

Term Deposit

fixed set period where interest is paid periodically

higher return than a call deposit

less liquid as there is typically a minimum time horizon

Certificates of Deposit (CD)

Short term security in the money market

Extremely liquid

Interest may be similar or lower than a call deposit

Typically has a minimum period and has withdrawal fees charged if withdrawn earlier

Bill acceptance liabilities

is a form of short term funding (30-180 days)

bank guarantees payment even if drawer (original payee) cannot pay

bank may sell this on the secondary market or the drawer discounts the bill to allow banks to make profit from interest by holding to maturity.

Debt Liabilities

may be short-long term in nature

usually in the form of bonds

Foreign Currency Liabilities

banks may raise funds overseas

individuals or corporations may hold foreign currencies for trading, hedging, international trade, etc

Personal and housing finance

Provide accessibility to credit for individuals, helping them purchase large items for personal use (house, cars, etc)

Generates interest income for the bank

Stable income for the bank as long as the customer base is well diversified

Secured by assets being financed

Commercial lending

Banks extend credit to businesses that need capital for daily operations, investment, and expansion.

These loans tend to carry higher interest rates due to the risk associated with business activities.

They are a significant portion of a bank’s revenue-generating activities as the interest income is higher.

Lending to government

Banks are large purchasers of government securities due to their relatively safe investment-grade status. These securities are then used in the bank’s liquidity management and diversification strategy. It could also provide another form of reliable income for the bank.

Other bank assets

These include interbank loans (short-term loans made to other banks to ensure liquidity), investments in financial instruments (excluding government securities, which could be foreign currency reserves), and holdings in subsidiaries

Allows for further diversification

Off balance sheet activities

Off-balance sheet business are tranasctions that represent a contingent liability (dependent on future outcomes). Therefore, they are not recorded on the balance sheets. They also generate fee income from the banks advisory services for example.

Direct Credit Substitutes

Provided by banks to support financial obligations of the client

E.g.: letters of credit (facilitates trade by guaranteeing payment for goods and services, essentially relies on the bank to pay for the goods, risk of the counterparty refusing to pay)

SBLC (Backup payment that is performed by the bank, performance based)

Trade and performance related items

Provided by the bank to a third party promising payment under the terms of a specified contract. E.G.: bid bonds (paid if a counterparty withdraws a bid by the bank to a third party)

Commitments

Bank has contractual obligations that are not yet fulfilled

E.G:, if the bank underwrites an undersubscribed IPO, they might buy a stake to fill the gap, or loan commitments starting at a later date.

FX, interest rates nad other market rate related contracts

Banks may provide derivative products to allow hedging and speculation to clients.

E.G. CDS (transfers the risk of bonds or assets to another party which is paid premiums for holding the risk).

Reserve Bank of Australia (RBA)

Ensures the stability of the financial and payments systems

E.G: controlling inflation and interest rates

Australian Prudential Regulatory Authority (APRA)

Regulation and supervision of authorised deposit taking institutions

E.G: Ensures ADIs follow Basel 3 requirements

Australian Security and Investments Commission (ASIC)

Ensures market integrity and consumer protection

E.G: regulates ASX and publicly listed firms in the ASX, prevents insider trading and market manipulation among others

Australian Competition and Consumer Commission (ACCC)

Competition policy (trade practices act)

Ensures fair pricing, breaking of monopolies, upholds the rights of the consumer

Bank regulation

Constraints on banking activities through prescriptive legislation and prudential supervision

Prudential supervision

Imposition and monitoring of standards designed to ensure the soundness and stability of the financial system

Use of Capital for banks

Source of equity for the bank

Indicates shareholder interest and commitment to the corporation

Growth of the business and source of future profits

Allows the bank to write off periodic business losses

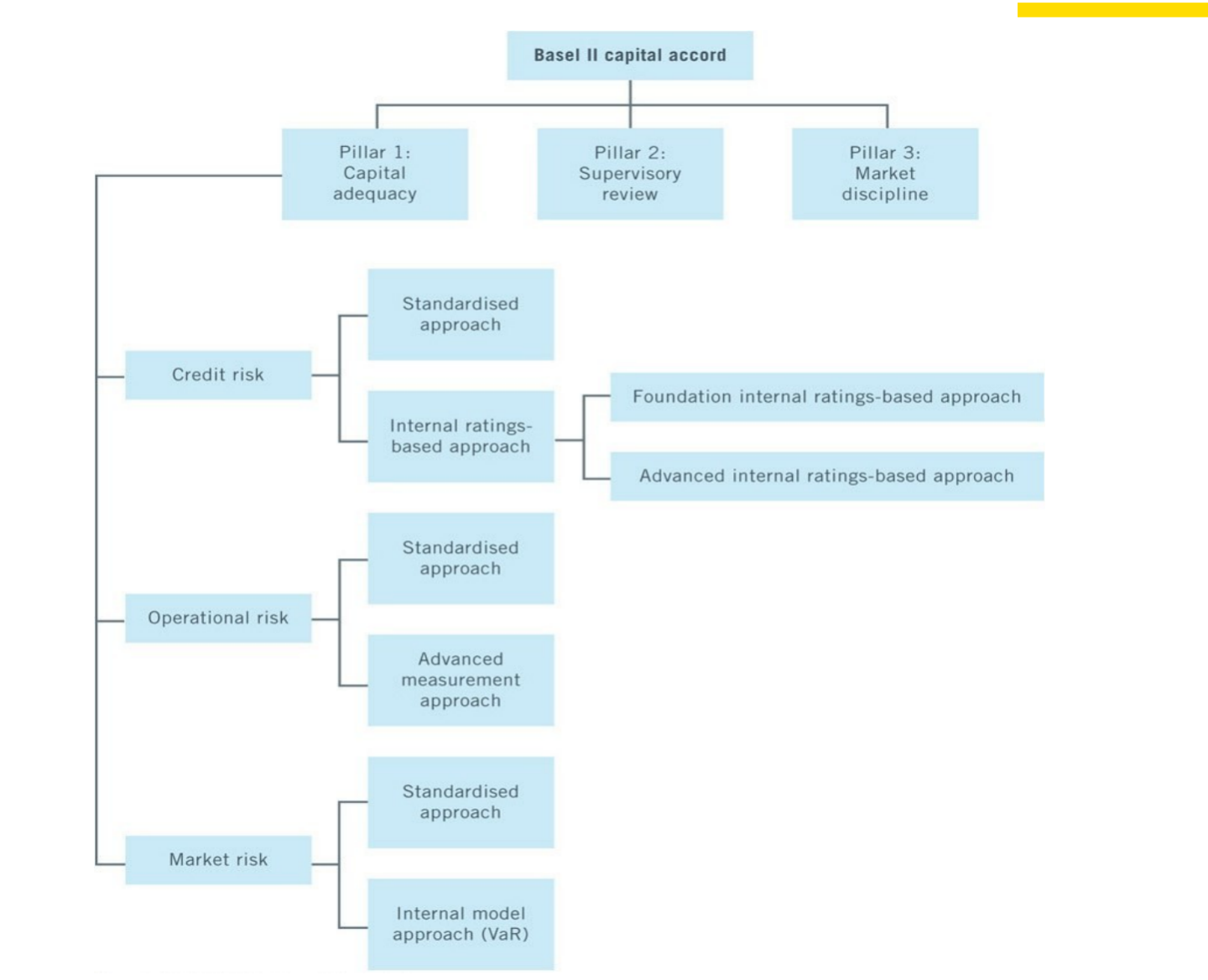

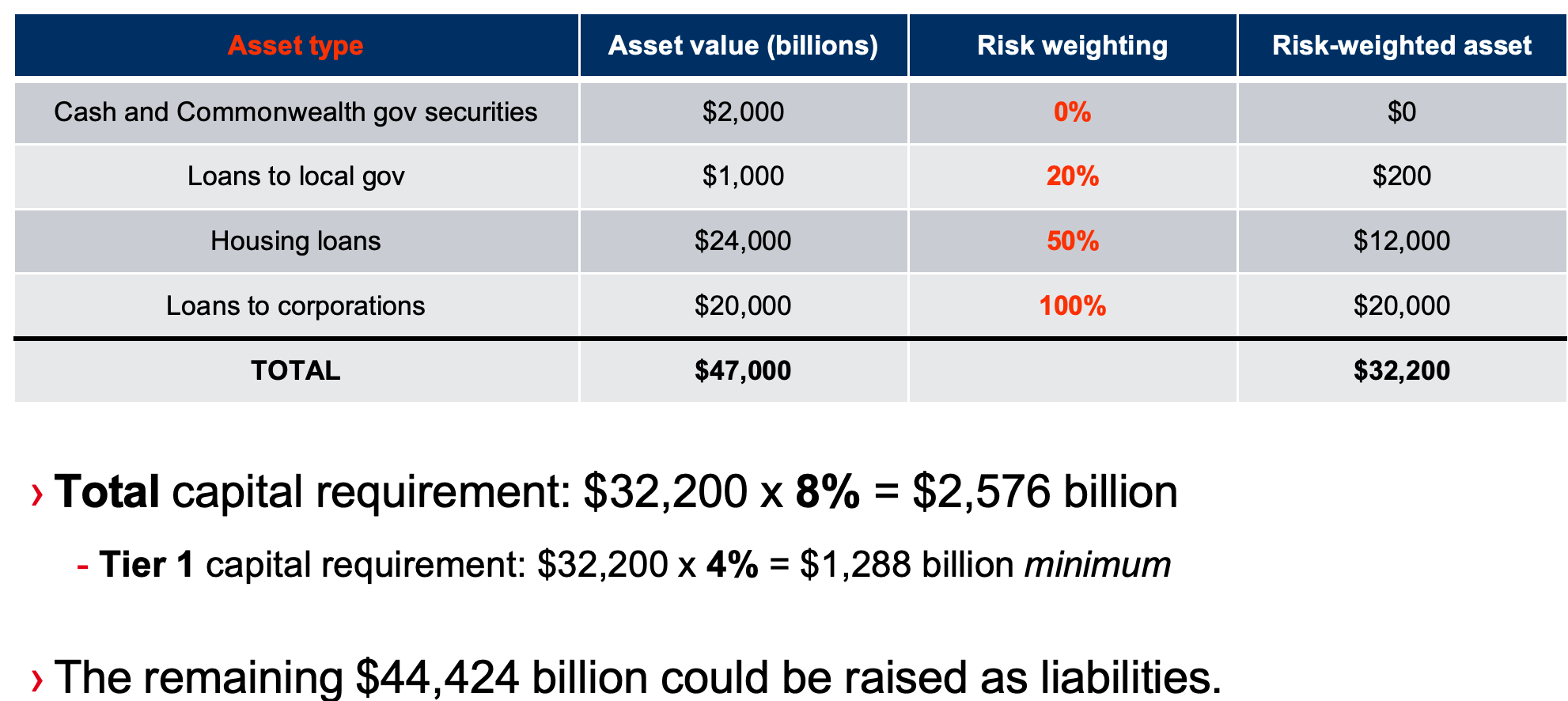

Basel 2 Structural Framework

Pillar 1

Minimum risk based capital ratio of 8%

4% held as Tier 1 Capital

Highest quality core capital

Remainder can be held as Tier 2 Capital

Upper Tier 2 - Specified Permanent instruments

Lower Tier 2 - Specified Non-Permanent instruments

Standardised Approach

Relies on external ratings by credit agencies (moodies, S&P, Fitch)

Some other predefined classes are set by the regulatory authorities

Operational Risk

Risk of loss from failed or inadequate internal process, people and systems or external events

E.G. hacking, fraud, workplace safety

Market Risk

Risk of losses resulting from changes in market rates in FX, interest rates, equities and commodities

Divided into:

General market risk which is the changes in the overall market

Specific market risk which is the change in the value of a security owing to issuer specific factors

Pillar 2

Supervisory review of capital adequacy

Ensure banks have sufficient capital to support all risks and encourage improved risk management to identify, measure and manage risk exposures

Pillar 3

Market discipline

Aims to develop disclosure requirements to access information on the capital adequacy of an institution

Increase the transparency of an institution risk exposure, risk management and capital adequacy

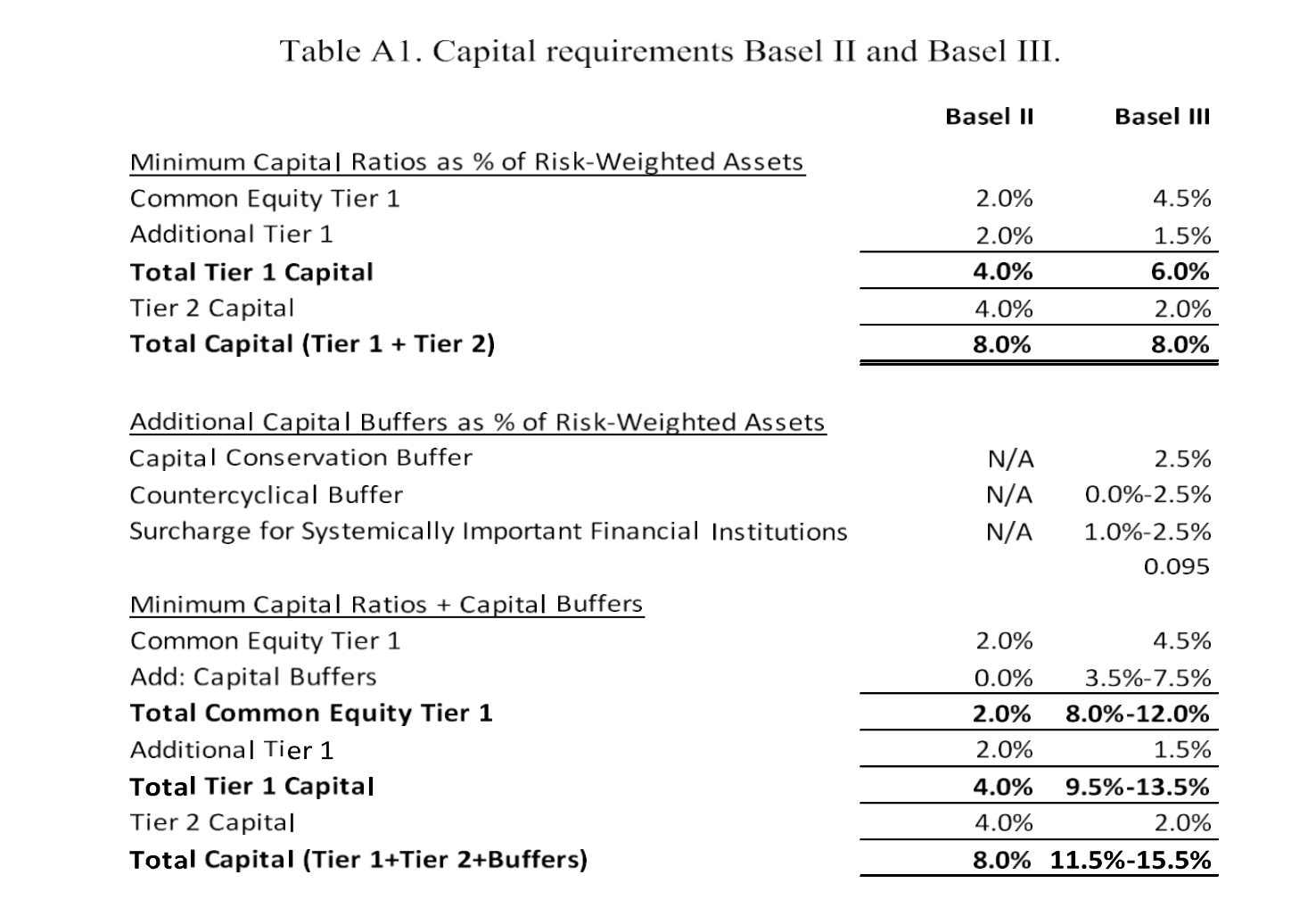

Basel 3

Developed in 2010

aims to enhance the risk coverage of Basel 2 framework by enhancing capital adequacy requirements

Boost the banking sector’s ability to absorb shocks

Improve risk management and governance

Strengthen banks transparency and disclosures

Basel 3 Tier 1 Capital

Tier 1 Capital: Common Equity Tier 1 (CET1) + Additional Tier 1 (AT1)

CET1: Common shares + retained earnings

AT 1: meant to absorb losses during stress

Must be perpetual (equity like features, unsecured, subordinated, last behind common equity in the event of liquidation)

Can be written down or converted to equity

Cannot have incentive to redeem

E.G: contigent convertible bonds, perpetual preferred stock

Basel 3 Tier 2 Capital

less permanent and have lower absorbing capacity than tier 1 capital

Must have minimum original maturity of at least 5 years

Supporting the solvency of a bank is a gone concern (i.e its everything the bank can muster and its cooked)

Must be subordinated to depositors and senior creditors

Basel 3 Capital Base

Increase minimum tier 1 capital to 6% from 4% of RWA

Increase minimum CET1 capital to 4.5% from 2% of RWA

Improve the quality of capital (tighter definition of CET1 capital)

Create conservation buffer for use during a financial crisis or economic distress starting from 0.625% of RWA now at 2.5%

Overall View of Basel 3

Liquidity

access to source of funds to meet day to day expenses and commitments

Special liquidity problems

Mismatch in maturity structure of balance sheet assets and liabilities and associated cash flows

Role of banks in the payments system

Liquidity coverage ratio (LCR)

HQLA (High Quality Liquid Assets) / Total net cash outflows over a 30 day stressed period

Net stable funding ratio (NSFR)

NSFR = ASF (Long term deposits, all the banks long term assets)/RSF (outflows in the long term)

Financial System

System designed to transfer funds from surplus units (providers) to deficit units (lenders)

Examples of Lenders

Households, Companies, Governments

Examples of Borrowers

Households, Companies, Government

Financial Institutions

Organisations that permit the flow of funds between lenders and borrowers through facilitating transactions

5 Types of FIs

Depository financial institutions, Investment banks, Unit trust, Contractual savings institutions, finance companies

Role of Depository Institutions

Obtains deposits and uses them to provide loans to individuals and businesses.

Role of Investment banks

Assist in complex financial products such as underwriting securities, and providing advisory services for mergers and acquisitions. May provide loans to clients.

Role of Contractual Savings Institutions

Receive periodic payments from clients to provide specified payouts to the holder of the contract if and when an event specified in the contract occurs. The periodic cash flow is invested.

Role of Finance Companies

Provide loans to consumers and businesses, often specializing in high-risk lending and financing. (i.e: People will lower credit scores)

Role of Unit Trusts

Pool funds from multiple investors to invest in various assets, offering diversification and professional management. It also allows more accessibility to the public for high capital assets (property)

Types of assets

Real assets, Financial assets

Real Assets

Assets that can be put to productive use to generate a return

Financial Assets

Assets that represent a claim to a series of cash flows against an economic unit, has an entitlement to future cash flows

Financial security

A financial asset that can be traded in secondary market

Attributes of financial assets

Return, Risk, Liquidity, Time pattern of cash flow

Return or Yield

Total compensation received from an investment, typically expressed as a percentage

Risk

Probability that actual return on an investment will vary from expected return

Liquidity

Ability to easily convert an asset into cash without significant loss of value.

Time pattern of cash flows

Frequency of expected cash flows from a financial assets to be received

Types of Financial Instruments

Equity, Debt, Hybrids, Derivatives

Equity

Provides an ownership interest in an asset, has a residual claim on earnings and assets

Debt

Contractual claim to interest payments and principal, has a finite life but senior to equity

Hybrids

Characteristics of both debt and equity instruments

Derivatives

Synthetic security providing specific future rights that derives its price from another asset, used mainly to hedge and speculate

Wholesale Markets

Direct financing flow transactions between institutional investors and borrowers, typically involves larger scale transactions

Money markets

Wholesale markets in which short-term securities are issued (CDs, Commercial Paper)

Capital Markets

Wholesale markets in which longer term securities are issued (ETFs,Bonds, Stocks)

Matching Principle

Assets should be funded with the appropriate time period liabilities

Primary market transactions

Issue of a new financial instrument to raise funds, occurs when a new financial instrument is issued in the money/capital markets. (IPO)

Secondary market transactions

Serves to provide liquidity to existing instruments (NYSE)

Direct Financing

Users of funds obtain finance through primary market via direct relationship with providers, is obtained directly from the money and capital markets. (raising of corporate bonds, share issuance)

Advantages of Direct Financing

Save costs of intermediation, Increases access to diverse range of markets, Greater flexibility in range of securities to be issued

Disadvantages of Direct Financing

Needs to be matching of preferences and maturity structure, liquidity and marketability of securities, higher search and transaction costs, default risk

Intermediated Financing

Arrangement involving two separate contractual agreements where the saver provides funds to an intermediary (banks) which provides funding to the ultimate user of the funds

Retail markets

Transactions conducted primarily with intermediaries by the household and small to medium business, typically smaller scale transactions and are price takers