ACCCOB3 Module 3 Reviewer

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

Cost system

A framework used by firms to collect cost information and maintain an accounting record of cost incurred during business operations.

Purpose of Cost system

To estimate product cost by which companies make informed management decisions

2 type of cost accumulation systems

Job Order Costing

Process Costing

Job Order Costing

Many different products are produced each period.

Products are manufactured to order.

The unique nature of each order requires tracing or allocating costs to each job, and maintaining cost records for each job.

Customization, customer specifications

In job-order costing more specifications = More Costs

Example:

Boeing (aircraft manufacturing)

Bechtel International (large scale construction)

Walt Disney Studios (movie production)

Process Costing

Best used for companies that:

A company produces many units of a single product.

One unit of product is indistinguishable from other units of product.

The identical nature of each unit of product enables assigning the same average cost per unit.

Their product maintains a certain kind of formula.

Example:

Asia Pulp & Paper (paper manufacturing)

Kang-shi-fu (Instant Noodle Producer)

Coca-Cola (mixing and bottling beverages)

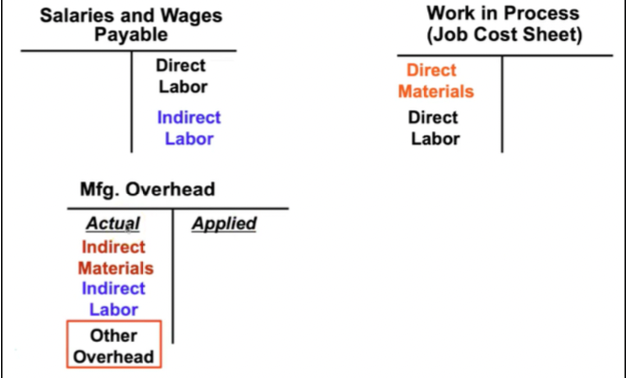

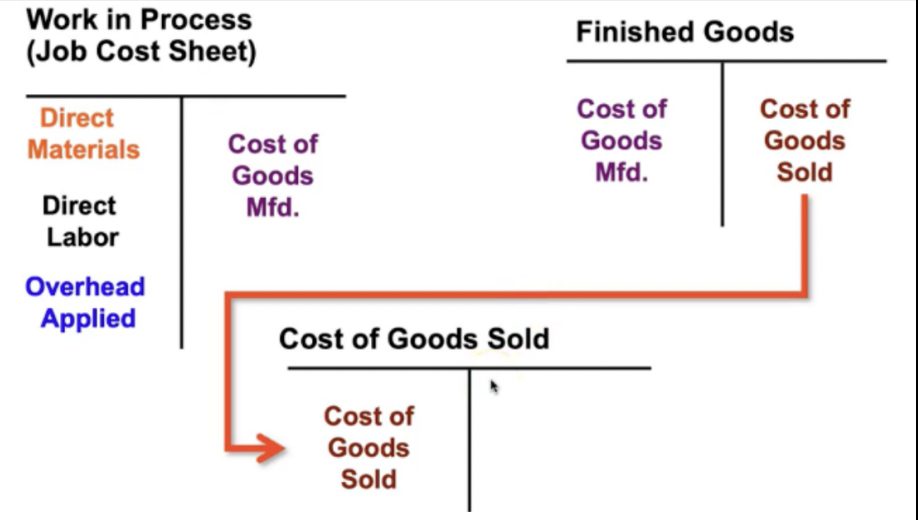

Job-order costing system cost flow

Cost Flow 1

Charge direct material and direct labor costs to each job as work is performed.

Cost Flow 2

Manufacturing overhead, including indirect materials and indirect labor, are allocated to all jobs rather than directly traced to each job.

Job Cost Sheet

Contains Direct materials, Direct Labor, Manufacturing Overhead

Must have a unique identifier such as a job number

Contains job information, date initiated, date completed, units completed, and product or item.

All company’s Job Costing Sheet form a subsidiary ledger

Summary of info needed

DM info come from material requisition form

DL info from labor time ticket

Provide an underlying set of financial records that explain what specific jobs comprise the amounts reported in WIP and FG.

Provide an underlying set of financial records that explain what specific jobs comprise the amounts reported in COGS and Income Statement.

Materials requisition form

Unclassified in the storeroom

Classification will follow whoever is requesting (direct/indirect)

The production acquisition team prepares a materials requisition form to specify the type, quantity, and the total cost of materials.

The document must have a unique identifier such as a requisition number

We deduct indirect from RM

Best used by companies producing many units of a single product

Summarized in Job Cost Sheet

Labor Time Ticket

Contains info of DL

Contains info about employee’s starting & end time, hours worked completed, hourly rate and amount.

Manufacturing Overhead

Basis for getting the manufacturing overhead cost is computing the predetermined overhead rates (POHR)

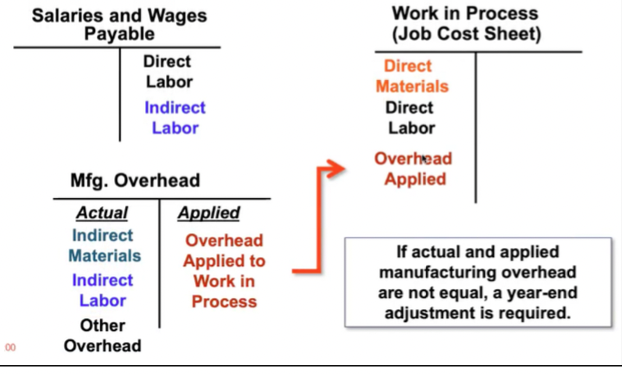

When we say overhead is allocated, it is the same as manufacturing overhead is applied.

When an overhead is applied, we use an allocation base.

We applied overhead using a base we believe causes the overhead cause to

Allocation Base

An allocation base, such as direct labor hours, or machine hours, is used to assign manufacturing overhead to individual jobs.

Why we use Allocation Base because?

It is impossible or difficult to trace overhead costs to particular jobs.

Manufacturing overhead consists of many different items ranging from the grease used in machines to the production manager’s salary.

Many types of manufacturing overhead costs are fixed even though output fluctuates during the period.

Predetermined Overhead

Predetermined overhead rate (POHR) used to apply overhead to jobs is determined before the period begins.

The allocation base is the cost driver that causes the overhead

Divide estimated total manufacturing overhead by the estimated direct labor hours (DLH)

POHR Formula

Estimated total manufacturing overhead cost for the coming period / Estimated total units in the allocation base for the coming period

Why do we need POHR?

Actual overhead for the period is not known until the end of the period, thus inhibiting the ability to estimate job costs during the period.

Actual overhead costs can fluctuate seasonally, thus misleading decision makers.

4 Steps of computing POHR

Estimate the total amount of the allocation base (the denominator) that will be required for next period’s estimated level of production.

Estimate the total fixed manufacturing overhead cost for the coming period and the variable manufacturing overhead cost per unit of the allocation base/

Use the following equation to estimate the total amount of manufacturing overhead: Y = a + bX

Where,

Y = The estimated total manufacturing overhead cost

a = The estimated total fixed manufacturing overhead cost

b = The estimated variable manufacturing overhead cost per unit of the allocation base

X = The estimated total amount of the allocation base

Compute the predetermined overhead rate.

Y = a + bX

Where,

Y = The estimated total manufacturing overhead cost

a = The estimated total fixed manufacturing overhead cost

b = The estimated variable manufacturing overhead cost per unit of the allocation base

X = The estimated total amount of the allocation base

Total Cost Formula

Direct Material + Direct Labor + Manufacturing Overhead

Why is accurately assigning MOH costs to jobs important?

Inaccurately assigning MOH costs to jobs can adversely affect the planning and decision made by managers.

Job order costing can accurately trace DM and DL costs to jobs. However, the job order costing system fail to accurately allocate MOH costs during the production process to their respective jobs.

Usage of a single predetermined plantwide overhead rate

Many companies use a single predetermined plantwide overhead rate to allocate all manufacturing overhead costs to jobs based on their usage of direct-labor hours.

It is an issue because:

It is often overly-simplistic and incorrect to assume that direct-labor hours is a company’s only manufacturing overhead cost driver.

If more than one overhead cost driver can be identified, job cost accuracy is improved by using multiple predetermined overhead rates.

How to compute for multiple predetermined overhead rates?

Calculate the Predetermined Overhead Cost for Each Department

Y = a + bX

Calculate the Predetermined Overhead Rate for Each Department

= Estimated manufacturing overhead / Estimated direct labor

Calculate the Amount of Overhead Applied from Both Departments to a Job

Calculate the Total Job Cost

Total Cost = DM + DL + MOH

Calculate the Selling Price for the Job

Markup = Total Cost + mark up %

Selling Price = Total cost + Markup

Multiple Predetermined Overhead Rates – An Activity-Based Approach

Activity-based costing

This is when a company creates overhead rates based on the activities that it performs.

An alternative approach to developing multiple predetermined overhead rates.

Managers use activity-based costing systems to more accurately measure the demands that jobs, products, customers, and other cost objects make on overhead resources.

Job-Order Costing for financial Statements for External Parties

The amount of overhead applied to all jobs during a period will differ from the actual amount of overhead costs incurred during the period.

Underapplied Overhead

When a company mapplies less overhead to production than it actually incurs.

Increases cost of goods sold and decreases net operating income

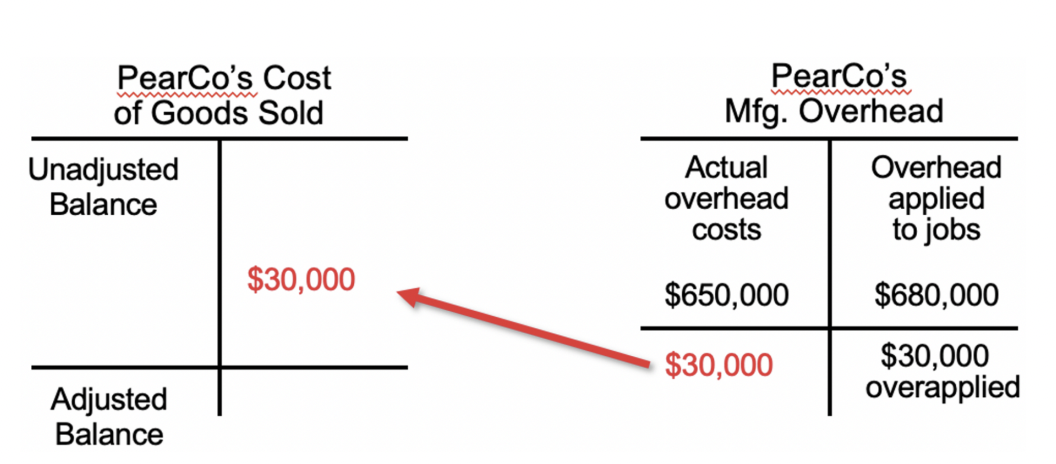

Overapplied Overhead

When it applies more overhead to production than it actually incurs

Decreases cost of goods sold and increases net operating income

Predetermined Overhead Rate and Capacity Methods

Absorption Approach: Costing based on External Reporting Purposes

Capacity Approach: Internal Management Purposes

Absorption Approach: Costing based on External Reporting Purposes

Bases the denominator on volume for overhead rates on the estimated, or budgeted, amount of the allocation base for the upcoming period.

Capacity Approach: Internal Management Purposes

Bases the denominator volume for overhead rates on the estimated total amount of the allocation base at capacity.

Limitation of Absorption and Capacity Costing

Traditional Absorption Costing

If predetermined overhead rates are based on budgeted activity and overhead includes significant fixed costs, then the unit product costs will fluctuate depending on the budgeted level of activity for the period.

it charges products for resources that they don’t use.

Capacity Based Approach

This approach overcomes the limitations of absorption based approach by using “estimated total amount of the allocation base at capacity” in the denominator of the predetermined overhead rate calculation (rather than the “estimated total units in the allocation base” in the denominator).

POHR = Estimated total manufacturing overhead cost at capacity / Estimated total amount of the allocation base at capacity

Capacity Based Approach POHR Formula

POHR = Estimated total manufacturing overhead cost at capacity / Estimated total amount of the allocation base at capacity

Formula for Cost of Unused Capacity

Cost of unused = (Amount of the allocation base at capacity - Actual amount of the allocation base) x Predetermined overhead rate

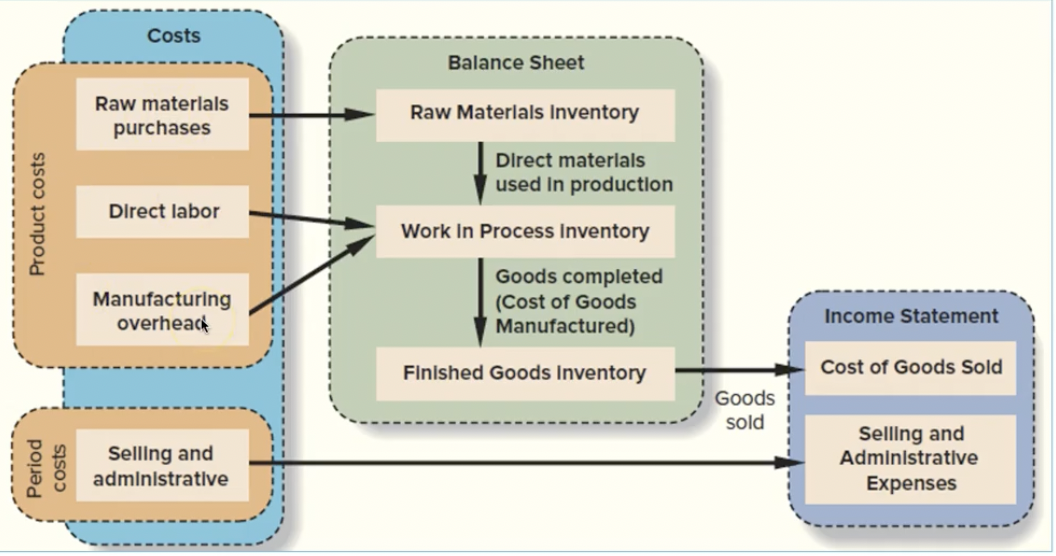

Conceptual Overview of Flow of Costs

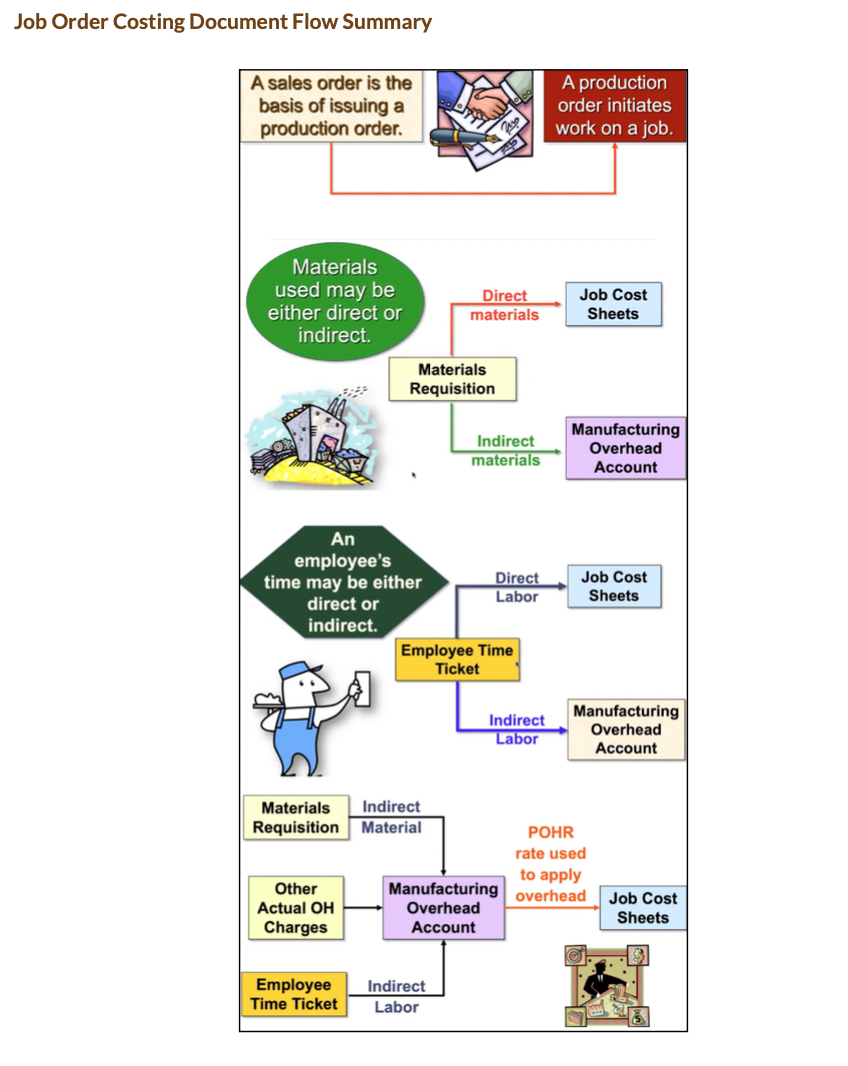

Job Order Costing Documents Summary

A sales order is the basis of issuing a production order.

A production order initiates work on a job.

Through materials requisition, we are able to determined wether materials are direct or indirect.

Through employee time ticket, we may be able to determined whether the employee’s time may be either direct or indirect.

Indirect material, Other actual OH charges, and indirect labor are charged to manufacturing overhead.

MOH Account uses POHR rate to apply overhead to Job Cost Sheet.

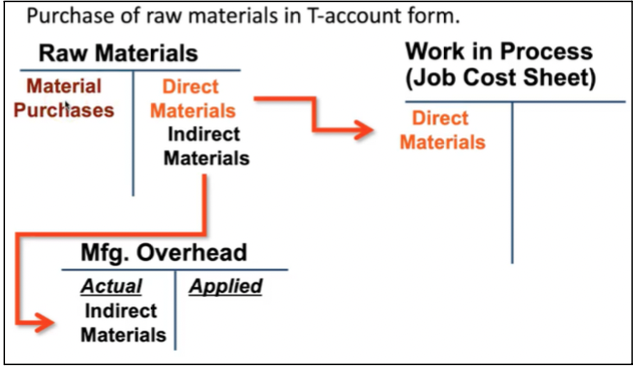

The flow of costs on T-accounts — Purchasing of raw materials in T-account form

The flow of costs on T-accounts — Purchasing of raw materials in Journal entry form

On April 1, Ruger Corporation had $7,000 in raw materials on hand. During the month, the company purchased on account an additional $60,000 in raw materials.

Raw Materials | 60,000 | |

Accounts Payable | 60,000 |

The flow of costs on T-accounts — Issuing of Direct and Indirect Material

During April, materials requisition forms were prepared to authorize the withdrawal of $52,000 in raw materials from the storeroom for use in production. These raw materials included $50,000 of direct and $2,000 of indirect materials. Entry (2) records issuing the materials to the production departments

Work in Process | 50,000 | |

Manufacturing Overhead | 2,000 | |

Accounts Payable | 52,000 |

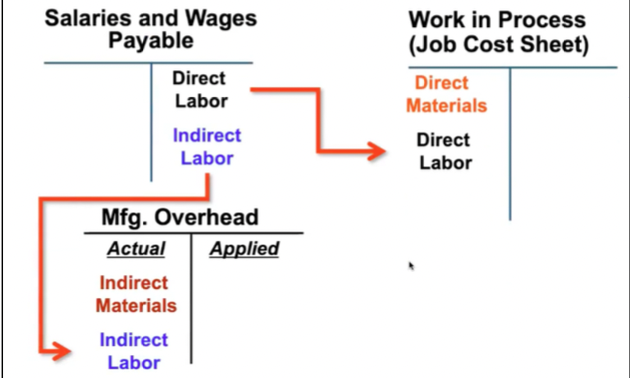

Recording Labor Cost in T-accounts

Recording Labor Cost — Purchasing of raw materials in journal entry form

In April, the employee time tickets (which provide hourly summaries of each employee's activities throughout the day) included $60,000 recorded for direct labor & $15,000 for indirect labor.

Work in Process | 60,000 | |

Manufacturing Overhead | 15,000 | |

Accounts Payable | 75,000 |

Recording Actual Manufacturing Overhead Costs in T-accounts

Recording Actual Manufacturing Overhead Costs in Journal Entry

Assume that Ruger Corporation incurred the following general factory costs during April:

Utilities (heat, water, and power), $21,000.

Rent on factory equipment, $16,000.

Miscellaneous factory overhead costs, $3,000.

Manufacturing Overhead | 40,000 | |

Accounts Payable* | 40,000 |

*Accounts such as Cash may also be credited.

Applying Manufacturing Overhead costs to WIP in T-accounts

Applying Manufacturing Overhead costs to WIP in Journal entry form

Assume that Ruger Corporation's predetermined overhead rate is $6 per machine-hour. Also assume that during April, 10,000 machine-hours were worked on Job A and 5,000 machine-hours were worked on Job B (a total of 15,000 machine-hours). Thus, $90,000 in overhead cost (56 per machine-hour × 15,000 machine-hours = $90,000) would be applied to Work in Process. The following entry records the application of manufacturing overhead to Work in Process:

Work in Process | 90,000 | |

Manufacturing Overhead | 90,000 |

Accounting for Nonmanufacturing costs

Nonmanufacturing costs are not assigned to individual jobs, rather they are expensed in the period incurred.

To Illustrate

The salary expense of employees who work in a marketing, selling, or administrative capacity is expensed in the period incurred.

Advertising expenses are expensed in the period incurred

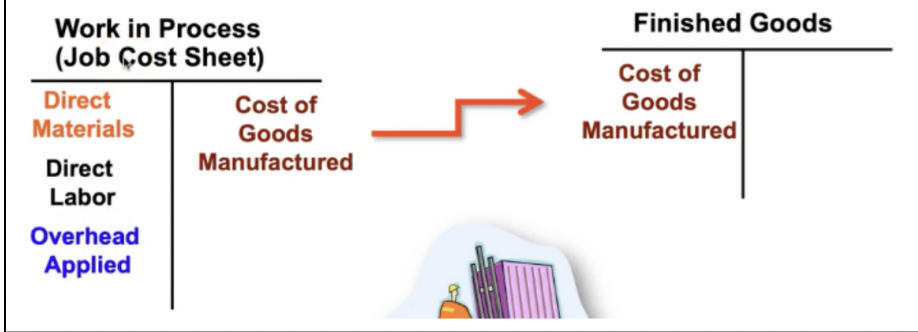

Transferring Completed Jobs From Work in Process to Finished Goods in T-accounts

Transferring Completed Jobs From Work in Process to Finished Goods in journal entry form

Job A was completed during April, and Job B was incomplete at the end of the month. Thus, the following entry transfers the cost of Job A from Work in Process to Finished Goods:

Transferring Finished Goods to Cost of Goods Sold in T-accounts

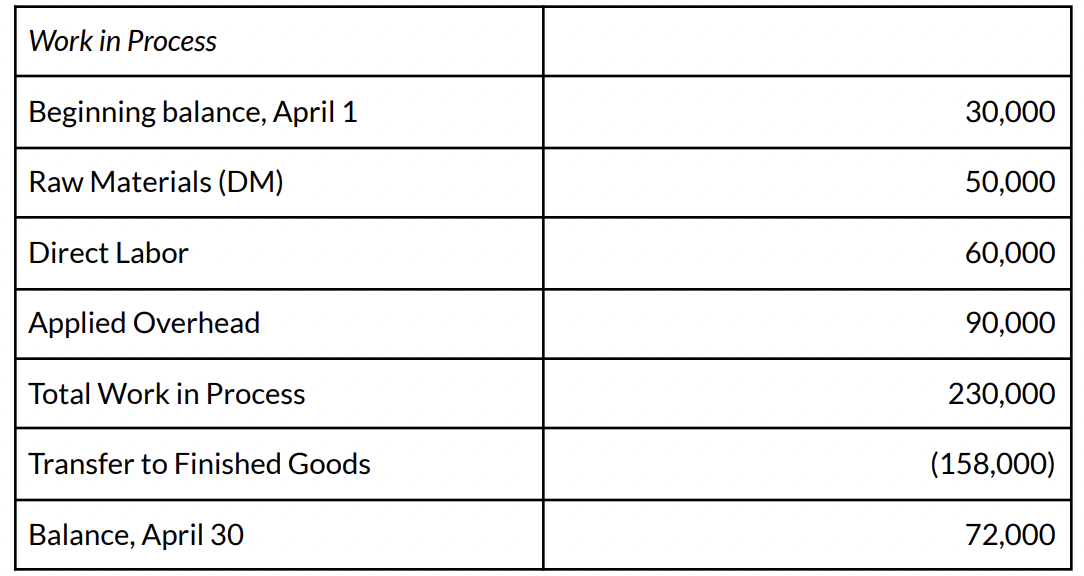

Schedules of Cost of Goods Manufactured and Cost of Goods Sold

The schedules contains three types of costs:

Direct Materials

Direct Labor

Manufacturing Overhead

The schedules calculate:

The cost of raw material and direct labor used in production and the amount of manufacturing overhead applied to production.

The manufacturing costs associated with goods that were finished during the period.

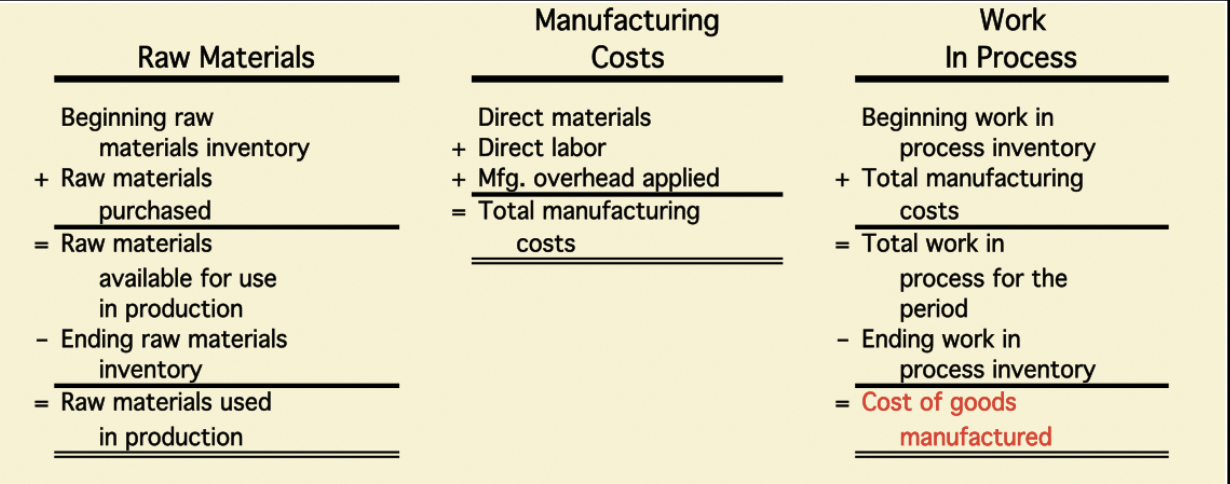

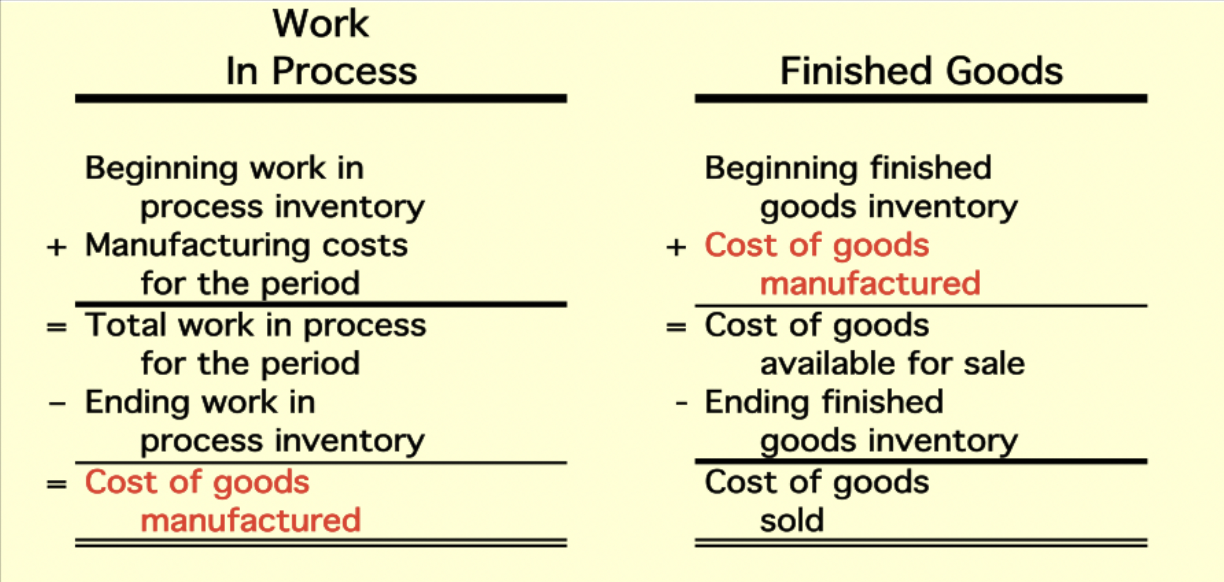

Product Cost Flows Pt. 1

Raw material purchases made during the period are added to beginning raw materials inventory. The ending raw materials inventory is deducted to arrive at the raw materials used in production.

As items are removed from raw materials inventory and placed into the production process, they are called direct materials.

Direct labor used in production and manufacturing overhead applied to production are added to direct materials to arrive at total manufacturing costs.

Total manufacturing costs are added to the beginning work in process to arrive at total work in process.

The ending Work in process inventory is deducted from the total work in process for the period to arrive at the cost of goods manufactured.

The cost of goods manufactured is added to the beginning finished goods inventory to arrive at the cost of goods available for sale. The ending finished goods inventory is deducted from this figure to arrive at the cost of goods sold.

Product Cost Flows Pt. 2 after COGM

The cost of goods manufactured is added to the beginning finished goods inventory to arrive at the cost of goods available for sale. The ending finished goods inventory is deducted from this figure to arrive at the cost of goods sold.

What is the difference between the overhead cost applied to Work in Process and the actual overhead costs of a period is?

the difference is referred to as either under-applied or over-applied overhead.

Under-applied overhead

when the amount of overhead applied to jobs during the period using the predetermined overhead rate is less than the total amount of overhead actually incurred during the period.

Over-applied overhead

when the amount of overhead applied to jobs during the period using the predetermined overhead rate is greater than the total amount of overhead actually incurred during the period.

Disposition of Overapplied and Under-applied Overhead

Any remaining balance in the Manufacturing Overhead account of over-applied overhead, is disposed of in one of two ways:

It can be closed to the Cost of Goods Sold.

It can be Closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold.

Applied Overhead formula

= POHR x Actual Direct Labor Hours