3 Financial Statements

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

What does the balance sheet show

snapshot of business’s assets, liabilities, equity at single part of time

what should assets equal to

liabilities + equity

What does equity mean

Owner's stake in company (company’s net worth)

What does an income statement show

summarize business revenues + expenses over period of time

What does assets mean

What the company owns

why does profit not equal to cash flow (why businesses need cash flow statement)

Time of payment (e.g. give 30 day window to pay)

Depreciation (e.g. Cars, paid sales price, but profit decrease each year)

inventory & capital spending (e.g. spend 20K to stock warehouse in products: profit no change, cash immediately out)

What does the cash flow statement show

cash inflows + outflows over period of time

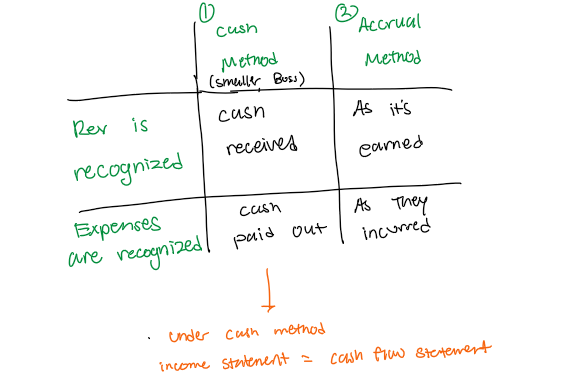

What are the 2 methods of accounting and their attributes

cash method & accrual method

What’s the order in which the 3 financial statements should be read in an interview

Income → cash flow→ Balance sheet

what does retained earnings mean

company's cumulative profit that it keeps (retains) rather than paying out to shareholders as dividends

“savings account” for reinvestment

What does goodwill mean

intangible asset (company’s brand, customer loyalty, '“secrets”)