fiscal federalism

1/56

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

57 Terms

fiscal federalism

addresses the division of revenue collection and expenditure between levels of government

which levels of gov should spending and revenue decisions be made at

these concepts also apply to allocation within an economic union

typical levels of government

– Central (or federal)

– State or Devolved Nations in UK

– Town councils

– Parish councils

taxation across different levels of government

each level employs taxes

Central government faces no restrictions on the choice of

taxes

Local governments face restrictions imposed by central

government

expenditure across different levels of government

Central government usually takes responsibility for

defence, law and order, and transfers

Lower levels responsible for education, health care, and

refuge collection

subsidiarity

is a principle in fiscal federalism that dictates decisions should be made at the lowest possible level of government, ensuring efficiency and responsiveness to local needs.

fiscal federalism in the European Union

Closer economic integration raises issues about

subsidiarity (which is the freedom of individual

member states to choose policy)

Fiscal federalism guides the design of the

institutional structure for an economic union

arguments for multi level government

justified if it raises efficiency or enhances equity when compared to

single-level government

can increase amount of info

tiebout model

People will move to communities that provide the mix of taxes and public services that best matches their preferences. Over time, this leads to an efficient allocation of resources across jurisdictions and promotes competition among local governments.

e.g if u want higher spending u accept higher taxes

consumers reveal preferences through their choice of community

theres no impediments to movement so efficiency is ensured

Why does the market do so well for private

goods but not public goods?

no shopping and competition if we have a centralsied government thay deicdes everyhting people cant shop around and compete

what happens when public goods are provided at the local level

by cities and towns

competition arises because individuals can vote with their feet.

if you dont like the tax and spending bundle in the jusrdsiiton in which youre living, you can move to another one

maybe you think the things provided are fine but provided inefficnietly, so you move and this forces them to become more efficient

This threat of exit can induce efficiency in local public

goods production

why is competition good across towns

People move freely across towns, picking their

preferred locality.

• People with similar tastes end up together, paying

the same amount in taxes and receiving the same

public goods.

• There is no free riding because everyone pays the

same amount in each town

major benefits of tie bout model

its the main benefit off decentrlisaon

taste matching: people with similar benefits will be together

people are at higher level of utility, can vote with ur feet

more efficient outcomes, government competiton kind of mimics market competition

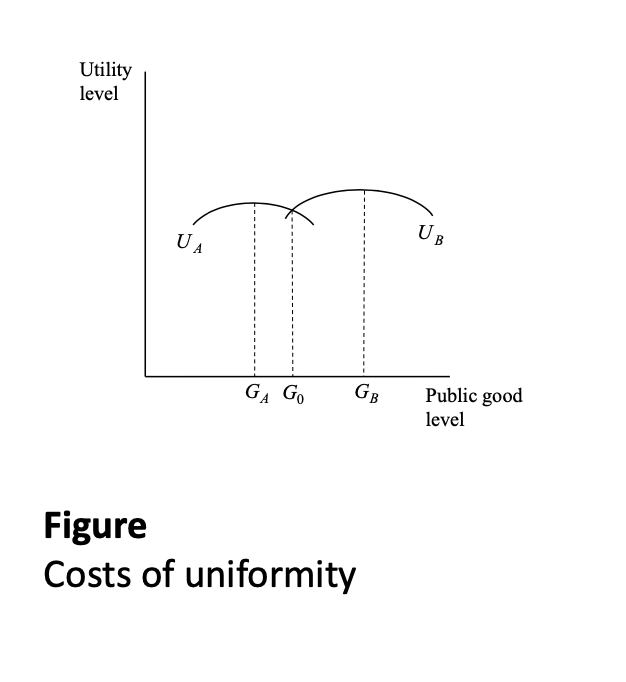

tiebout diagram

Assume two groups of consumers A and B and a single public good financed by a uniform income tax

G = public good provision

publci provison is likely to be a copromise, so somewhere like g0 where a and b have to compropmise

Group B have a stronger preference for the public good than group A

In the figure the optimal public good levels are GA and GB

The uniform level G0 involves a utility loss for both groups

if you break it up into jurisdictions, you can let everyne who belived A live and be giverned by 1 thing and B in another, whih ismore efficent

assumptions of the tie bout model

People are actually able to move

not everyone can free pf charge

People have full information on taxes and benefits

most people dont know or understand them

People must be able to choose among a range of towns that might match my taste for public goods.

is there variety or enough variety

The provision of some public goods requires sufficient scale or size.

assume scale ecoomies dont really exist, but this is a big problem

There must be enough towns so that individuals can sort

themselves into groups with similar preferences for public goods.

problems with tiebout model

its assumptions make it extremely unrealistic and so it doesnt work irl

gooods we’d be concerned about leaving this model:

spillovers/externalities

education, policing, environmental projects etc - if one area spends more on education/policing, theres an externality effect bc free riding can happen e.g one place might not spend mihc on it and then just hire peope from a state tjaty does spend lots on it

second issue is financing: under tiebout you get what youb pay for regardless of incmoe, which ignores equity issues. if you want nore spent on educstion e.g, you go to another place that spends more on it

but this isnt very equitable. e.g if you tax the rich high and poor low, the rich can just leave to other places that have lower taxes and you might end up attracting all the low income people

to avoid this ioncome taxes etc are done by central government

average costs can come down with centralised decisions e.g national defence

financing problems with the tiebout model

The Tiebout model requires equal financing of the

public good among all residents, requires a lump sum tax

• Lump sum taxes are often infeasible/unfair, so

taxes are income or wealth based.

• But then the rich pay more than the poor, so the

poor chase the rich, may 3ant to come into rich communities and free ride

lump sum tax

A fixed taxation amount

independent of a person’s income, consumption

of goods and services, or wealth.

no redistributiin with lump sum taxes so if youre poor and you really like the goods, if you cant afford the lump sum tax then the rich will all gather in one community and the poor in another - so itll end up being communties based off income not tastes

externality problems with the tiebout model

The Tiebout model assumes that public goods

have effects only in a given town and that the

effects do not spill over to neighboring towns.

• Many local public goods have similar externality

or spillover features: police, public works,

education.

• If there are spillovers, then low-tax, low-benefit

municipalities can free-ride off of high-tax, high-

benefit ones.

if theres spillovers the low spending community can be free riding off the high spending community which means its underoprovided and the high spending might try and free ride back which creates prorblems

summary of tiebout model

Tiebout model implies that three factors determine local

public good provision:

1. Tax-benefit linkages: The relationship between the taxes

people pay and the government goods and services they

get in return (so redistribution of income at federal level)

2. Cross-municipality spillovers in public goods.

3. Economy of scale in public good provision.

• If taxes and benefits are linked, and there are no spillovers or

economies of scale, then local public good provision is close

to optimal.

its better than federal even if people arent well infomred

local communties can respond better to what they want cmpared to central govenremnts

what does the tiebout argument ignore

the scale of government and the costs of having multiple layers

Each public good has a level of government at which it

is best delivered

Defence is best delivered nationally

Trash collection is best organized locally

If there were no costs it would be optimal to have the number of levels of government matching the requirements of the public good

but irl theres costs like staff, building, equipment etc

optimal government structure

trades the costs against the benefits

the more local you go the better the prpvisoon is but theres costs to going this local

Public good provision can be centralised or decentralised

optimal structure drawn

A federation is represented

by the line segment [0, 1]

0 = not interested at all, 1 = very interested

The population is uniformly

distributed

• Centralized provision

locates the public good at ½ (where median voter is)

• Region L is the interval [0,

½] and region R the interval

[½, 1]

• Decentralisation locates the

public good at ¼ and ¾

2 median voters, one in both sections, then we see whats chosen here

![<ul><li><p>A federation is represented</p></li></ul><ul><li><p>by the line segment [0, 1]</p><ul><li><p>0 = not interested at all, 1 = very interested </p></li></ul></li><li><p>The population is uniformly</p><p>distributed</p><p>• Centralized provision</p><p>locates the public good at ½ (where median voter is)</p><p>• Region L is the interval [0,</p><p>½] and region R the interval</p><p>[½, 1]</p><p>• Decentralisation locates the</p><p>public good at ¼ and ¾ </p><ul><li><p>2 median voters, one in both sections, then we see whats chosen here</p></li></ul></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/07578429-cca0-40f5-bed7-5c4c2f17c773.png)

costs of public good with and without centralisation

The cost of the public good is C per person with

centralisation and 2C with decentralisation

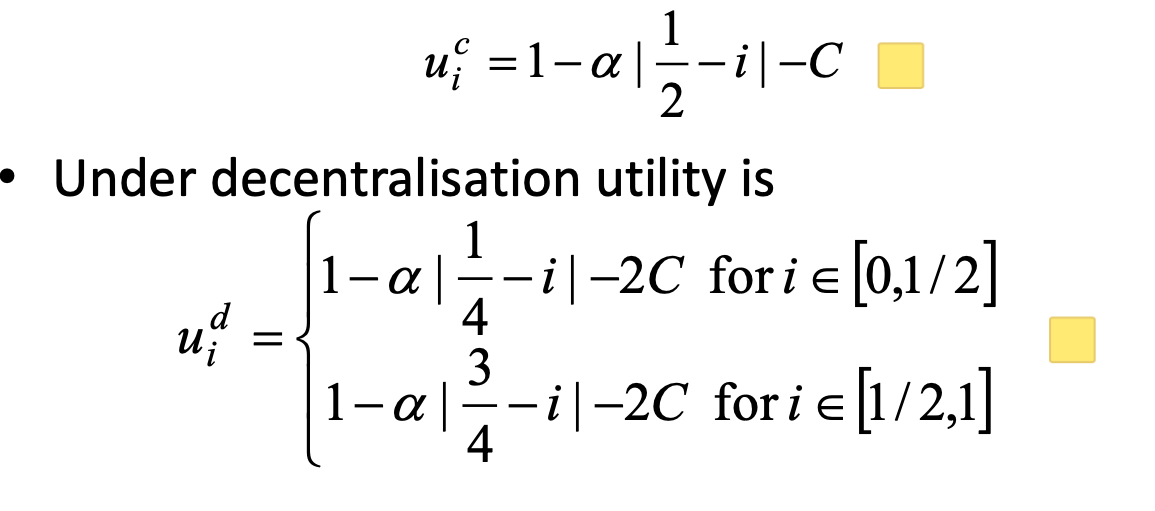

utility wiyh centralisation equation

alpha tells us how much u care about the issue

if alpha was 1 and i was 1/2, utulity is 1-c which is the max level you can get, best outcome

the further you get away from 1/2 the worse off you will be

With centralisation the average distance is 1/4

utility with decentralisation

change the 1/2 from above to 1/4 and 3/4, so ideals would be when i is 1/4 and 3/4 respectivly

Decentralisation is chosen if it leads to higher total

utility than centralisation

With decentralisation the average distance is 1/8

Hence decentralisation is optimal if

1 −α[1/8]-2C > 1 −α[1/4]-C

C ≤ α[1/4 - 1/8]

hold when c ≤ α/8

if costs less than alpha/8, and alpha is how much u care about matching ur preferences, then you’ll do it

![<ul><li><p>change the 1/2 from above to 1/4 and 3/4, so ideals would be when i is 1/4 and 3/4 respectivly</p></li></ul><ul><li><p>Decentralisation is chosen if it leads to higher total</p><p>utility than centralisation</p></li><li><p>With decentralisation the average distance is 1/8</p><ul><li><p>Hence decentralisation is optimal if</p><p>1 −α[1/8]-2C > 1 −α[1/4]-C</p><p>C ≤ α[1/4 - 1/8]</p></li><li><p>hold when c ≤ <em>α</em>/8</p></li><li><p>if costs less than alpha/8, and alpha is how much u care about matching ur preferences, then you’ll do it</p></li></ul></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/3807e0eb-876c-475e-ab39-2c764e45c5c4.png)

how you might end up with excessive decentralisation

the averahe citizen will either be 1/4 or 18, away, but the median voter will be at 1/4, so clearly im more infavour of decentralisation than the average citizen

so i’d allow decentralsaition to go through at higher cost

median voter theorem: if u assume theres some parties competing to set a policy, and if all our policies are set from 0-1/2, then the policy thats chosen wil be 1/4

this captuires tiebout, problem with scale economics and politics

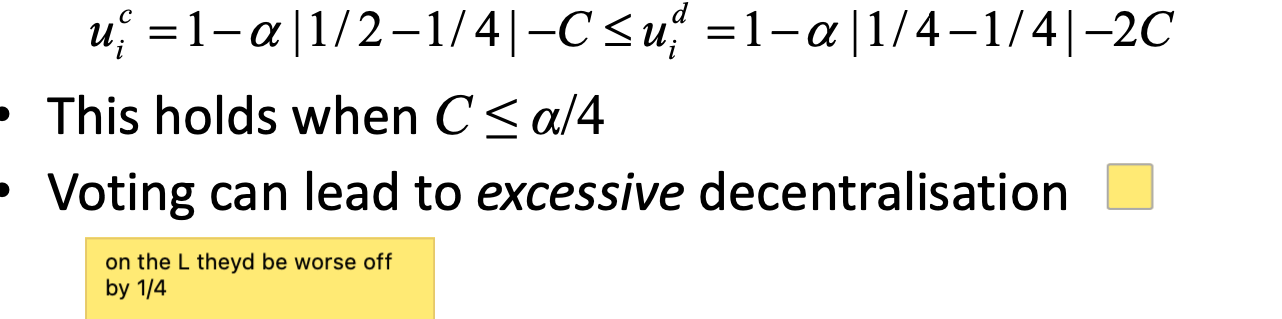

choice between centralisation and decentralisation by voting

The Median Voter Theorem makes the central voter in each region decisive

• Decentralisation will win a vote against centralisation if: photo

voting can lead to excessive decdentrlisaiton

economic argument for politics

Govs have to produce policies efficiently or we will kick them out for someone else

if we knew exactly if the government was behaving at its very best and be able to kick them out if they werent, it would be fine but we cant

when is a government accountable

if voters can Discern the behavior of the government

Sanction the government if it is not acting correctly

Accountability ensures incumbents will be brought to account for past actions

The need to seek re-election produces a trade- off between diverting rents and losing office

agency problem

voters have no real reaosn to be well infomred because you cant decide whose going to win solely, you shouldnt expect to be pivotal

this leads to an agency prpbkem - governmetn is the agent and the voter is the badly informed principal

voters may be Poorly informed about politician type, Observe politician behavior imperfectly, and lectoral sanction is a blunt instrument bc politicans might be able to get away with things, be corrupt and still get re elected

how’s can decentralisation assist with the control of politicians

Breaks the monopoly of a single government

Allows comparison of performance across jurisdictions

arguemnt here is i might not really know if ur good or not and if youd work in my interest, but i can see whats hapopening in other jurisdictions and what works well there

i can learn from other soruces which can inform me aboit whats happening here

Circumstances are good in state a, but bad in state b

• Policy A (B) is best for citizens in state a (b)

• The ranking is reversed for the government

• V is the value of re-election and r the rent from choosing incorrect policy

• The government knows the state, citizens observe only

their welfare level

we dont know if theyre doing policy a or polocy b

how does decentralisaiton help with solving the problem that no matter what voting you have theres incenitive for rent seeking from the government

- theres competition, so if a voter sees other states. have it better then when they go to vote, theyll vote for someone else. if politicanas antiticpte this, they dont rent seek because they want to be re elected

big bonsu of decentralsied governments: experiments

e.g in us theres 50 states and when something succeeds, it can spread across all states

why would we not want full decentralisaiton and risk sahring?

some states just wouldnt help each other out, wouldnt bail out so union can be lost

if u centralise it wont people know that the taxes they pay helpo other states anyway? yes but its not as explicit, builds a semse of amntional identitiy

interregional insurance

shares risks between regions

Interregional insurance is organized through federal taxes and transfers

this is how it works in the us

when is mutual inseuancwe possible

if theres some independence of risk, so some regions suffer losses but others dont

independence is unlikely for regions, and with an asymmetric distribution of risk (there are

regions which suffer adverse shocks more frequently)

some regions will typically subsidize others

– This is redistribution not insurance

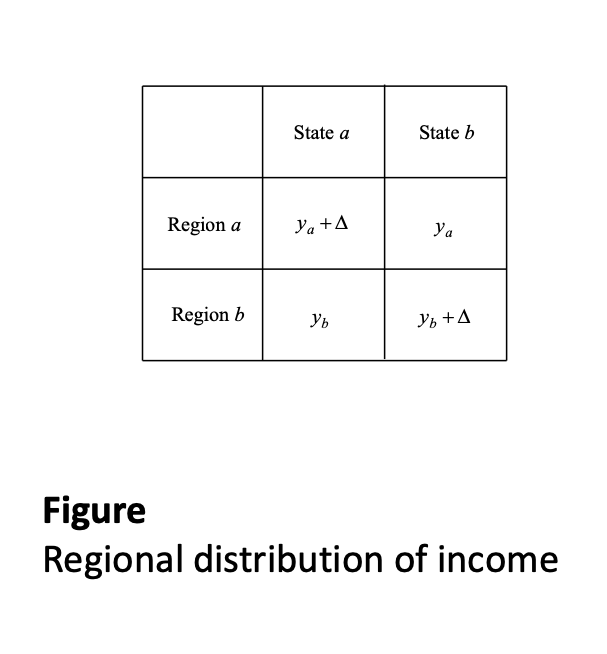

risk sharing with regions

Two regions a, b and two

states a, b

• Probability 1/2 of a gain

• Total income constant at Y =

ya + yb +

• Optimal risk-sharing is to

transfer t* = /2 from region

that gains

• Regional incomes are constant after the transfer

what choice does a region that gains from risk sharing face

a choice between:

Making the transfer and enjoying future insurance

Keeping the gain and losing future insurance

The choice made is dependent on the discount rate

• When future payoffs are highly discounted only

partial insurance is possible

should we are about inequalities across municipalities

If Tiebout is right, then this reflects optimal sorting and

financing.

– But if not, redistribution might be called for.

– The main tool of redistribution is intergovernmental grants,

cash transfers from one level of government to another.

different forms of grants

Block grant: A grant of some amount with no

mandate as to how it is spent. (like this in the UK)

Conditional block grant: A grant of some amount

with a mandate as to how it is spent.

Matching grant: A grant, the amount of which is

tied to the amount of spending by the local

community.

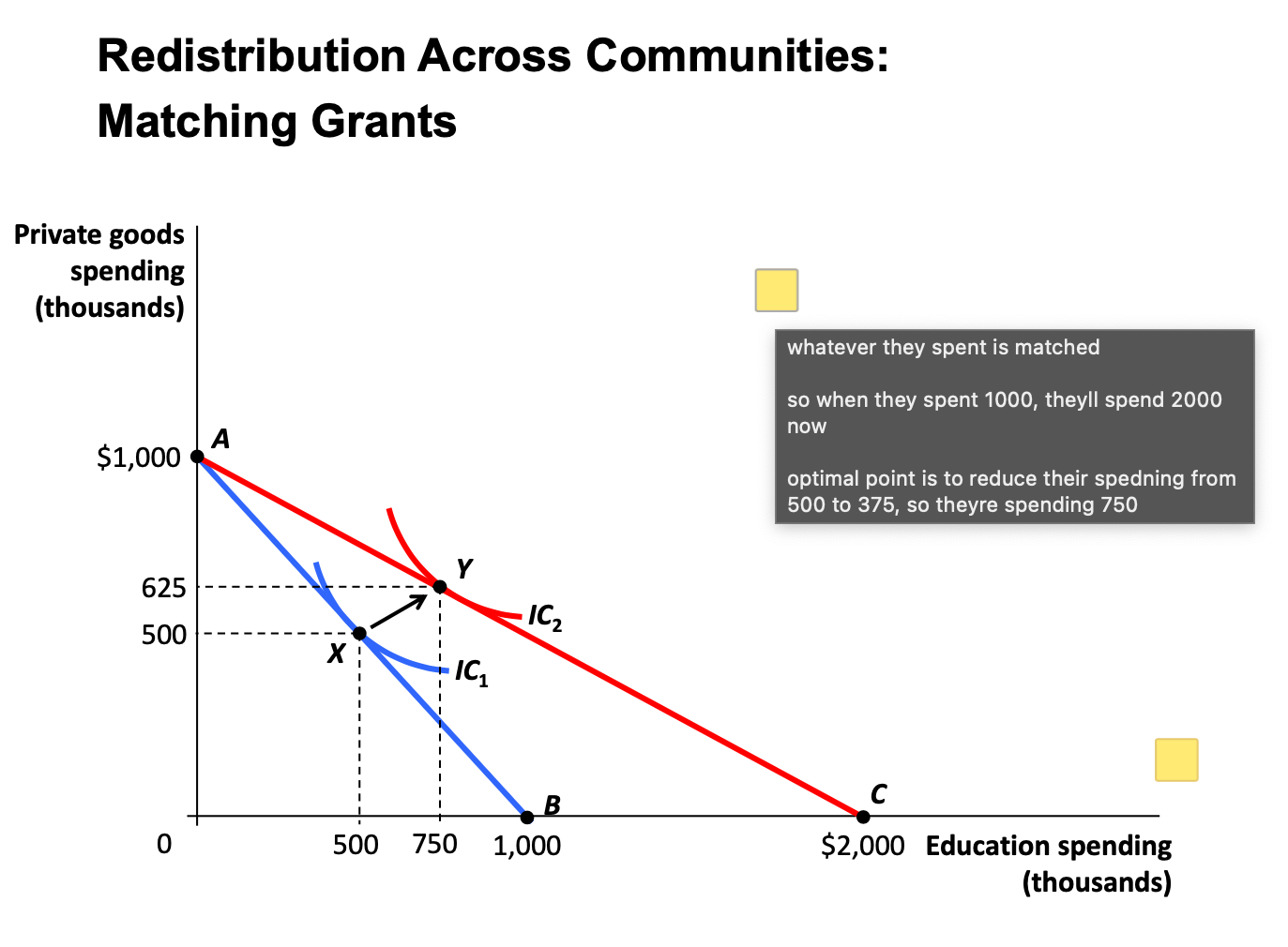

matching grant diagram

• Matching grant: A grant, the amount of which is

tied to the amount of spending by the local

community.

a lumo sumo transfer may be better

use matching grants with education as it has positive externalities

a matchng grant makes esne bc theres already a dsitoriton, so its ok to intorduce another.

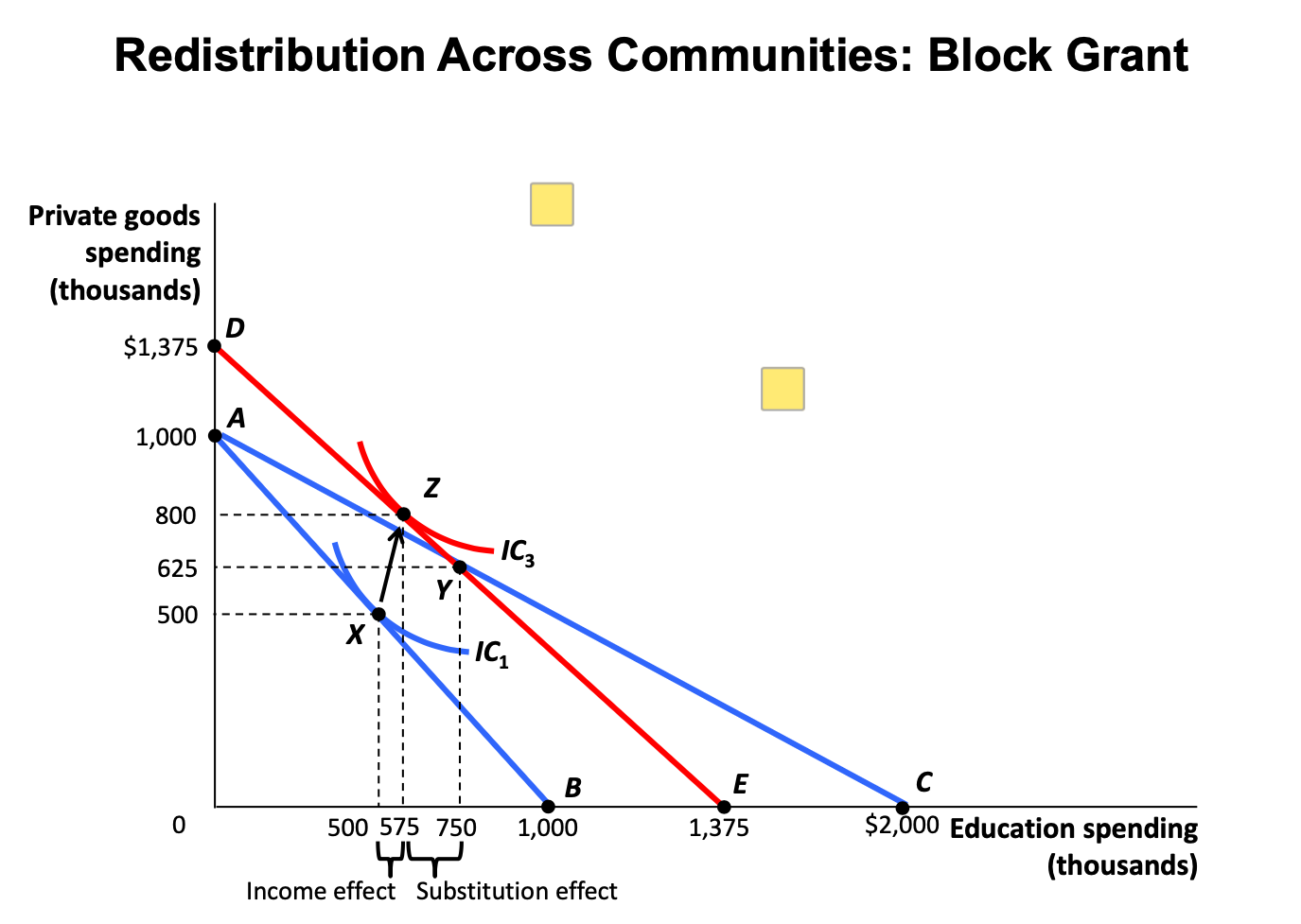

block grant diagram

they couldve given them 375, which would be better bc indivduals dont face dsitortionary effect on budget constraint and it would purely be an incme effect

theyre not commiteed to having to spend 375 on education, and actually only spend 75 so they can put the rest of the 300 int tax cuts which can now be 800

matching grant vs block grant

Welfare is higher with block grants

• But if there are positive externalities, a

matching grant internalises these and thus is

better for welfare.

• If externalities are large, perhaps spending

decision should be centralised.

• Use block grants for redistribution, but block grant could be made equivalent

by a cut in taxation

the flypaper effect

money sticks where it hits, even tho in theory block grant saysd it should be sahred between tax cuts and public spending, in reality poublci spending gets most of it

hard budget constraint

A hard budget constraint must be met which

requires a credible commitment from the centre

soft budget constraint

A soft budget constraint can be manipulated by the

local government

• Soft budget constraints lead to inefficiency because

they encourage strategic behavior

leads to moral hazard

Local governments may borrow excessively knowing

they will receive a bailout

how can fiscal decentralisation be measured

Share of total revenue collected by centre

– Share of centre in all public expenditure

– Share of centre in consumption expenditure

Share of total revenue collected by centre

fails to account for levels from differnt regions, doesnt hlpe with decerntralisation

Share of centre in all public expenditure

inlcudes redsitributin, which is almost always an activity of the centre and so exaggerates the level

Share of centre in consumption expenditure

this is the best

measure of decentralisation

data on decentralisation

developed countries are

more decentralised

Latin American countries

decentralized between 1980

and 1985

African countries are the

most centralized

World level shows a trend

of decentralisation

political aspects of decenraliasiton

Larger and richer countries decentralise more

• Urbanisation increases decentralisation

• Decentralisation increases with the level of

democracy and ethnolinguistic fractionalization

• The threat of secession is also a force for

decentralisation