Personal Financial Literacy

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Deposit

To put money inside

a bank account.

Allowance

Money given for personal spending, based on different factors, such as doing chores.

Balance

The amount of money you have in your account, after deposits and withdrawals.

Bank

an institution for receiving, keeping, and lending money

Savings Account

A bank account that helps keep money safe for a long time and allows people to earn interest.

Bond

Certificates sold by companies or governments in order

to raise money. Bonds are issued for a specific amount

of time. The government or company that sold the bond

must pay interest to the buyer during that time.

Credit Union

Is a not-for-profit financial

cooperative where every

member is also an owner

or shareholder of the

financial institution.

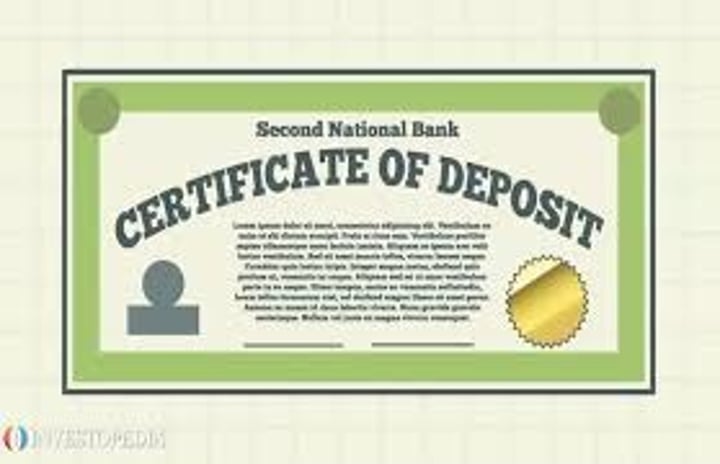

Certificate of Deposit

Also known as a CD, it is a savings

account at the bank that if you

withdraw it early, it has a penalty.

Cost

The amount a

person pays for a

product.

Expenses

Payment for goods or

services.

Financial Institution

A bank or credit union

that offers services to

help people with their

money.

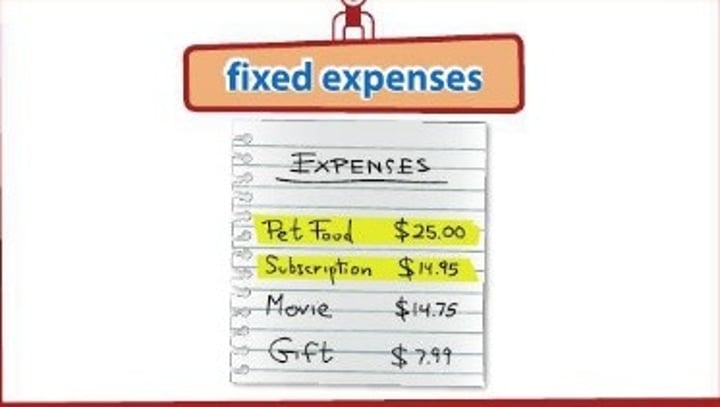

Fixed Expenses

Expenses that stay the same

from month to month.

Interest

Extra money paid back when money

is borrowed.

Money Market Account

This is a kind of savings account offered by a

bank or brokerage company. Because you

must deposit a required amount in the

account, money market accounts usually pay

more interest than a regular savings account.

Profit

The financial gain made in a transaction

Revenue

incoming money

Saving

Putting money aside to

save to pay for something

in the future.

Spend

To pay for a product or

service using money.

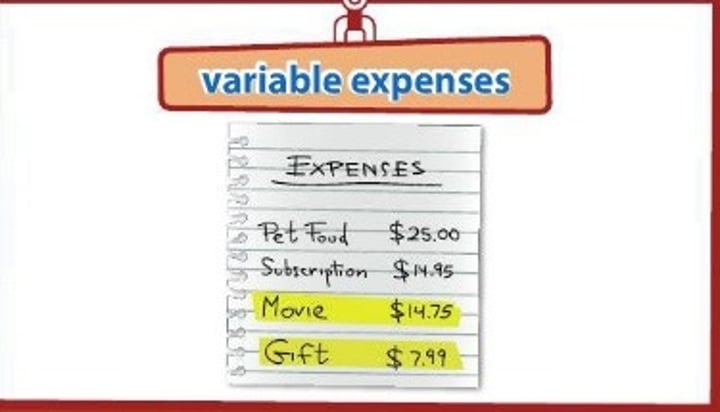

Variable Expenses

Expenses that change from

month to month.

Withdrawal

To take money out

of a bank account.