aggregate demand and aggregate supply (chap 19-21)

1/72

Earn XP

Description and Tags

circular flow of income, aggregate demand, aggregate supply, multiplier and accelerator affect

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

73 Terms

demand

willingness to buy and sell goods and services at a given price point

aggregate

mass/ as a whole

wealth effect/ income effect

when the general price level rises/ falls allowing households to have less/ more wealth as they have more or less purchasing power

aggregate demand

measure for the total level of goods and services demanded in an economy, based on general price level and demand

what is the equation for aggregate demand and what does each component stand for

C+I+G+(X-M) consumption + investment/ inventories + government spending + (exports - imports)

capital labour

machinery making things

recession

two consecutive quaters of negative economic (GDP) growth

recovery

return from negative gdp growth to positive gdp growth

boom

significantly high gdp growth in a given time

slump

sudden fall of rapid economic growth

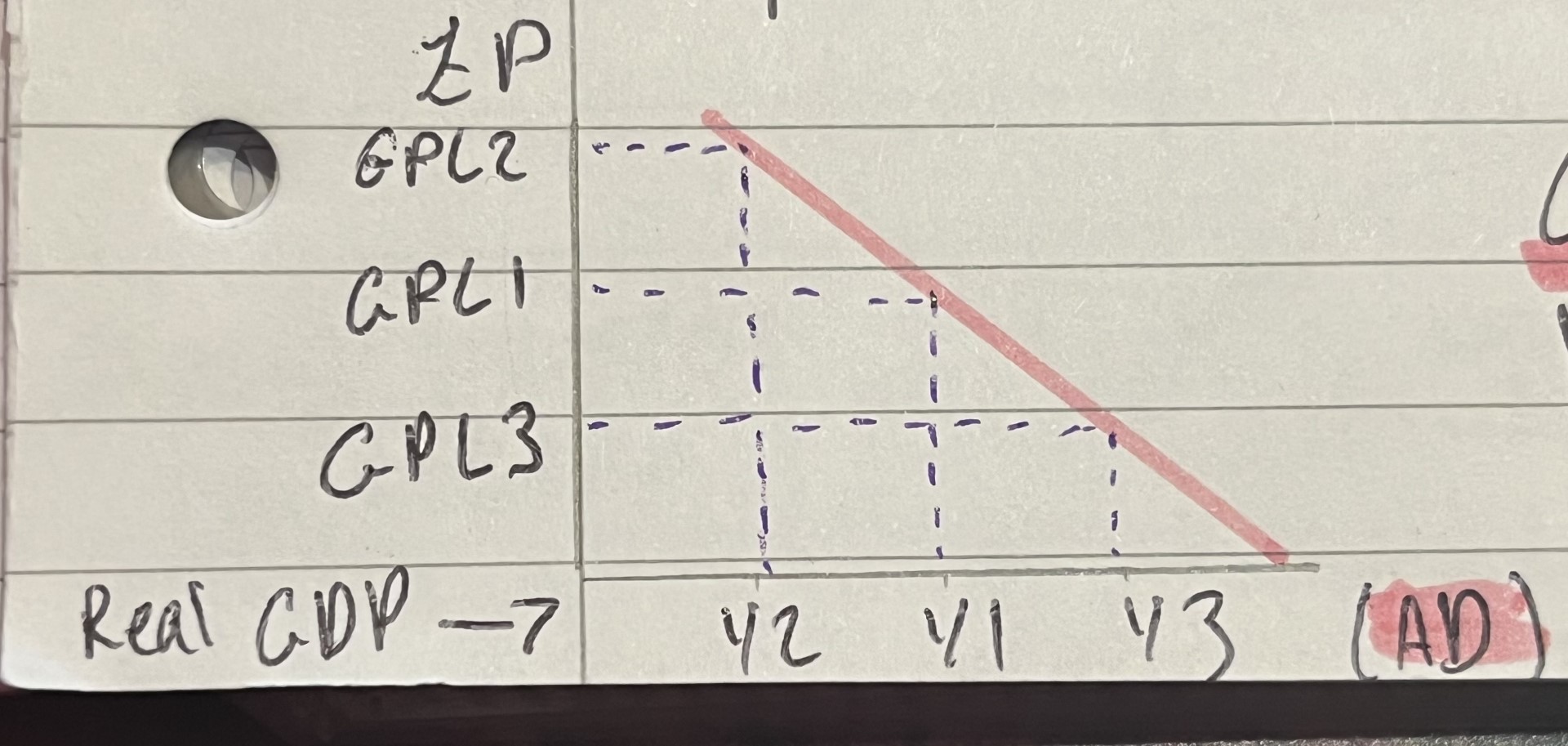

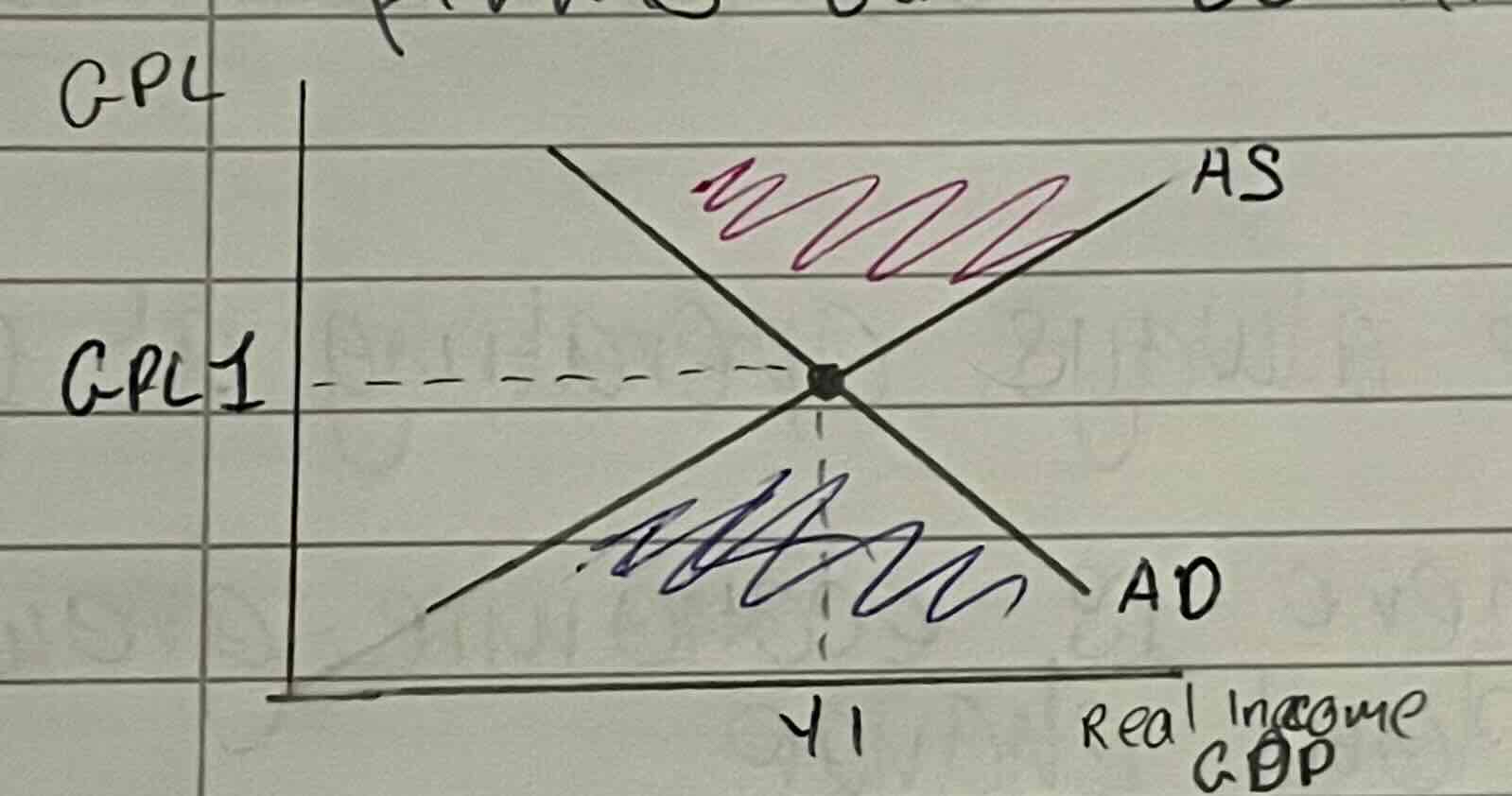

explain the ad graph / curve

when prices levels are too high ad contracts and when general price level decreases ad expands

what does gpl stand for

general price level, shows at what price goods and services are currently at, GPL3 is the highest and GPL1 is the lowest

what does y stand for

income, y1 is the lowest and y3 is the highest

recovery

return from negative gdp growth to positive gdp growth

explain the circular flow model including how each element interacts with each other

the interaction of economic agents exchanging money, households give governments taxes and governments give households welfare benefits

governments give firms money through purchasing, firms give governments taxes

households purchase goods and services from firms, firms provide rent wages dividends and labour to households

the external sector brings in and takes out goods and services

gdp

gross domestic product, shows actual value of expenditure over a given period

examples of injections

exports, capital spending such as investing in machinery, government investment such as hs2

leakages/ withdrawls

money leaving the domestic economy

examples of leakages

savings, imports, payments to the government such as taxation

commodity

product that is bought and sold globally e.g diamonds, flour

dynamic prices

prices that continuously fluctuate such as oil

factors affecting consumption

income, taxes, inflation, wealth, trends, interest rates, consumer confidence, unemployment

balance of trade effect

fall of prices in an economy could cause foreign imports to be more expensive increasing exports and decreasing imports

interest rate effect

if inflation is low, interest rates may reduce which encourages people to spend rather than save which increases exports as other countries can afford our goods and services

shift

a new line on a curve

what does SPICED stand for

strong pound means imports cheaper exports dearer

factors causing shifts in the aggregate demand curve

changed in income and employment, government spending, monetary policy, countries exchange rates, economic partner nations growth (slower, faster), consumer and business confidence

simply, changes in C+I+G+(X-M)

what are the four elements to the circular flow model

households, businesses/firms, government, external sector

domestic circular flow

circular flow diagram only with households, governments and firms

external shock

external events to the domestic economy that impact the local aggregate demand e.g covid

when we study supply, who do we refer to

businesses and firms rather than consumers

aggregate supply

total amount of goods and services available to buy

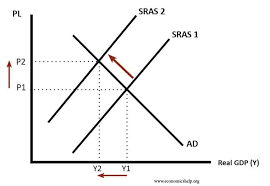

sras

short run aggregate supply, how supply is in the short run and how much the economy can generate in a short term at each price level

what does the sras curve represent

the relationship between planned national output and the general price level

what two things are always assumed to be consistent when drawing the sras curve

state of technology is the same, production costs are the same

when will the sras curve shift

when there is change in finance/ costs to a business

what factors cause the sras shift

unit wage cost e.g higher minimum wage, labour productivity (economies of scale), raw material or component prices, business taxes such as VAT, exchange rate on imports, supply shocks such as war

basically always think of costs to the firm

injection

money coming into the domestic economy

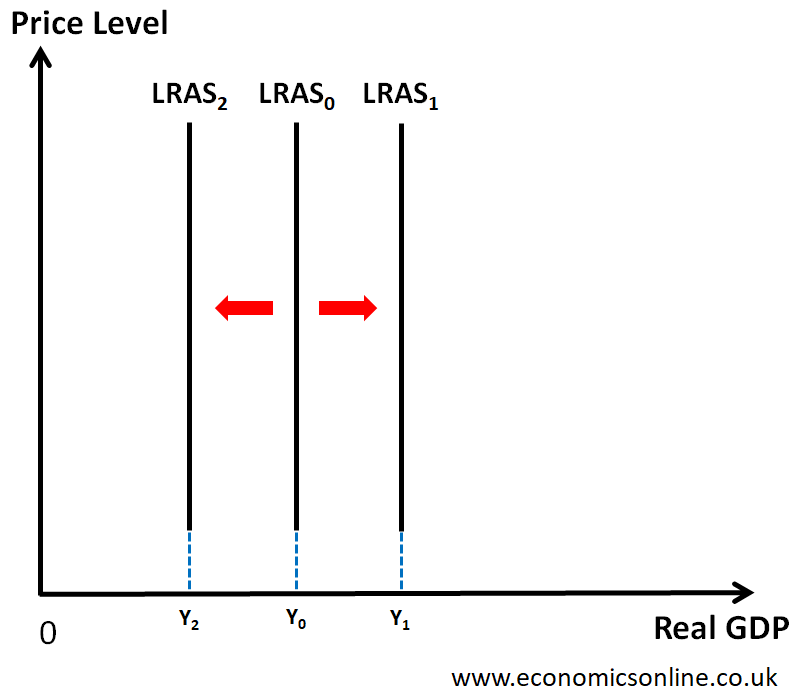

lras

long run aggregate supply, the ability of an economy to produce goods and services based on the state of production, technology and quality of factor inputs

what four factors affect lras

capital land labour enterprise

rise / expansion of ad causes

rise in house prices, depreciation of exchange rates, tax cuts, higher interest rates

what causes a shift in long run aggregate supply

quantity of factor inputs and the effectiveness of the inputs

what does an outward shift of lras show

economic growth

give some examples of what causes a shift in lras

higher productivity of labour, increased efficiency of technology, growing population for a larger workforce, higher competitiveness in international markets due to more entrepreneurship, capital investment such as fdi

stock of natural environmental resources

the ability of an economy to find and harness their natural resources in a sustainable way

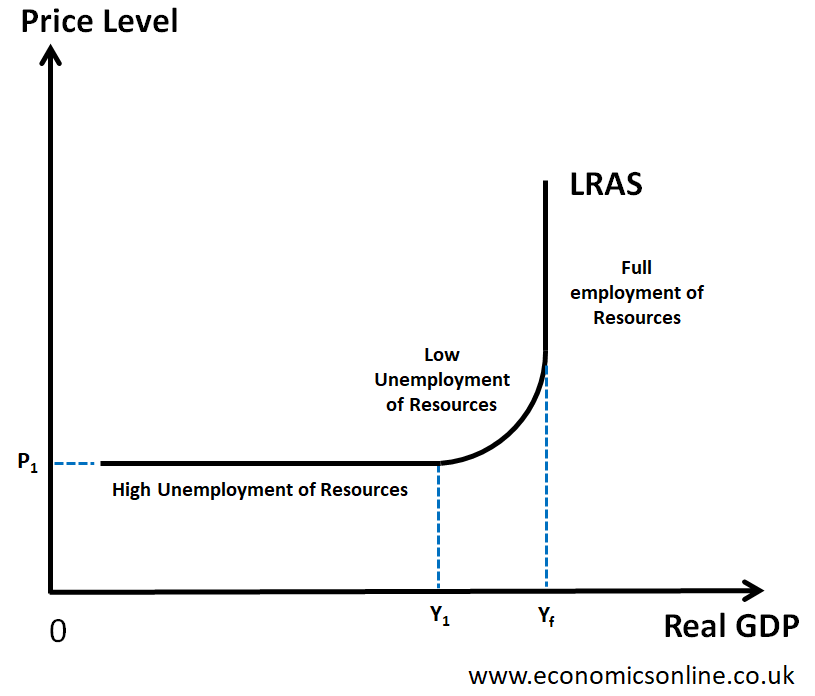

explain the classical lras curve including reasons for shifts

vertical line that assumes the economy is always operating at full employment, change in price level does not affect the curves position, shifts outwards when quantity or quality of goods increases or when costs decrease, shifts inwards when decrease in amount of resources or quality or when costs increase

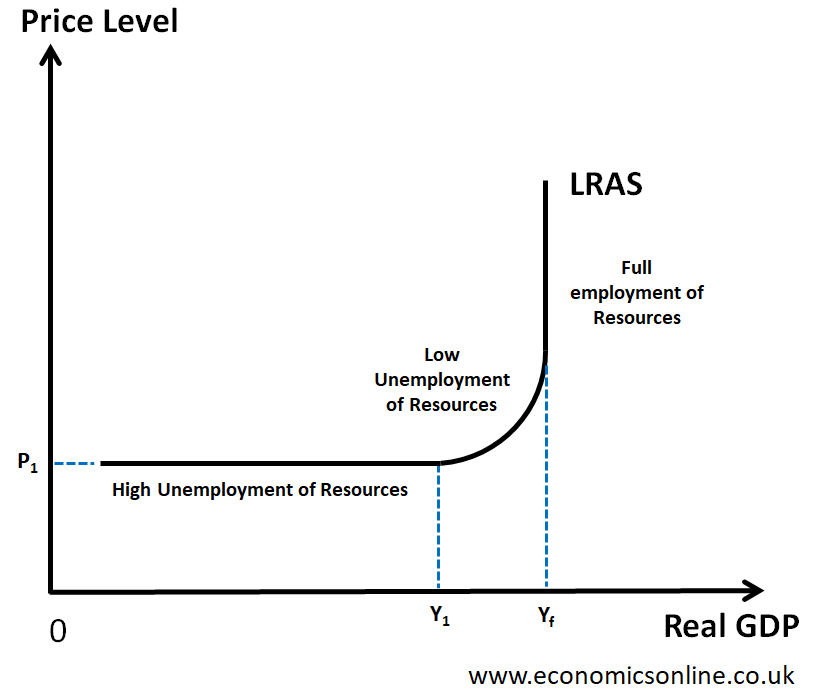

explain the keynesian lras curve

a non linear supply curve that shows how firms are able to supply based on levels of employment, demand can change with or without changes in the general price level

spare productive capacity in relation to keynesian lras

when businesses are able to produce more as they are not operating at full capacity, shown at any point on the curve before it moves vertically (full capacity)

what is price elasticity of demand, when are prices elastic during keynesian lras and why

where the change in gpl of a good or service causes the supplyor demand to change such as in food or luxury goods, shown in the horizontal portion of the keynesian lras curve, price elasticity reduces when the curve slopes upwards

where on a curve would non inflationary economic growth occur

ad lines movement along the horizontal portion of the curve

demand pull inflation

demand rises higher than supply causing the rise in prices as supply is scarce

when can and cant businesses react on a keynesian lras curve

during price elasticity they can react, during price inelasticity they cannot react

negative output gap

when the economy is operating below full employment so their maximum output is not fulfilled

macroeconomic equilibrium

where aggregate demand = aggregate supply as consumers are willing to pay the price firms are willing to charge

real gdp

gross domestic product adjusted for inflation

diminishing marginal returns

as each new unit of production is increased, returns begin to reduce and the ratio of returns to factor inputs decreases

what is the multiplier

ratio of change of equilibrium income to the actual change that is brought about

who thought of the multiplier

keynes

what is the formula for the multiplier

1/ MPW which includes mps mpt and mpm

what is an example of the positive multiplier effect

a gigafactory being builts as the revenue generates jobs which generates incomes which get used in the local and wider economy

MPW

marginal propensity to withdraw, consists of MPS MPT and MPM, measure of tendency to take money out of the circular flow of income

MPS

marginal propensity to save, measure of how much additional income that is earned is saved

MPT

marginal propensity to tax, measure of how much additional income that is earned is spent on taxes

MPM

marginal propensity to import, measure of how much additional income that is earned is spent on imports

MPC

marginal propensity to consume, measure of how much additional income that is earned is spent

what/who should the government focus on to increase ad

those with a high marginal propensity to consume as they will spend a larger proportion of their income, usually those on low incomes as they have minimal marginal propensity to save

multiplier affect

the ratio of change in national income following a change in government spending

what are some variables impacted by the multiplier

unemployment, economic growth, spare capacity in the economy (AD increase may not be able to be met by firms), exchange rates, inflation

spare capacity

where a business doesnt make full use of its supplies such as capital and labour which means they are producing below full capacity

negative multiplier effect

initial withdraw or leakage in CFI results in a bigger final drop in GDP

accelerator

effect where firms see increased demand so will turn to more investment to expand their output

what does the accelerator do to supply

shifts it outwards

how do the accelerator and multiplier interact

multiplier results in more income being spent and going round the economy which increases demand which tells firms to expound their output and invest resulting in the accelerator