macro chapter 10

1/17

Earn XP

Description and Tags

intro to the problem of macroeconomic fluctuations

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

long-term equilibrium vs short-term fluctuations

graph

long-term models

long-term models could not explain any fluctuations in production

production was predetermined by input factors & technology determine fixed output

Solow model explains long-term growth, but no short-term fluctuations

Principle: every supply creates its own demand (classical economy)

Demand has not yet played a central role in production

long-run equilibrium

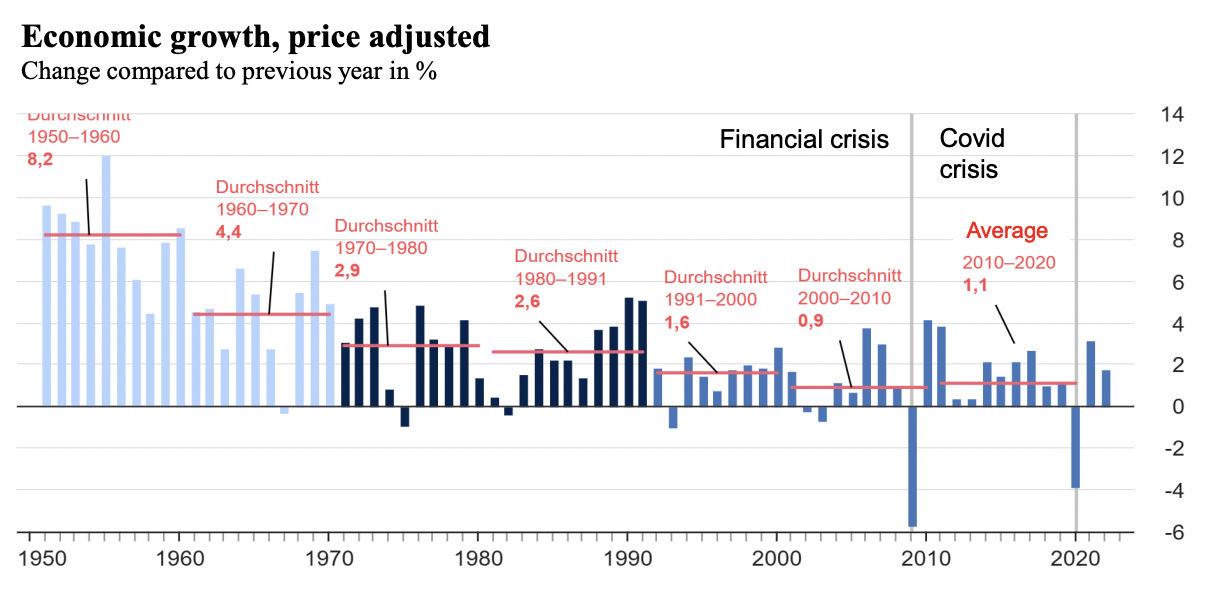

GDP development fluctuates around the long-term equilibrium

economic cycles with periods of recession

economic cycles have different and unpredictable lengths

recession: usually 2 successive quarters of -ve GDP growth

unemployment, consumption and investment also fluctuate with GDP

okun's law: -ve relationship between unemployment & GDP

short vs long term view

assumption: difference lies in the price adjustment

long-term: prices are flexible & adapt to changes

short-term: prices are fixed at given level

consequence

economic policy measures have different effects in both

intuition of content

if prices fail to adjust to changes, real variables of production must take over part of adjustment in short-term

price rigidity is common → companies only adjust prices 1-2 times per year

aggregated demand (AD)

relationship between demand & the macroeconomic price level

determines shape of AD cuve

3 ways to drive the AD curve

from the quantity theory

from the IS-LM model

ad-hoc or intuitive

AD according to quantity theory

quantity equation: M x V = P x Y

M = money supply

V = volume of money

demand for money: M/P = kY

is proportional to production volume

there is -ve relationship between price level P and output Y

intuition: if price level rises, a higher euro amount must be spent on each transaction, so production must fall

change in money supply or interest rate, shifts AD curve

ad hoc derivation of aggregated demand

as prices rise, consumption is postponed in favour of savings

when prices fall, consumption pays off, & aggregate demand increases

investments resulting from savings also increase total demand with Y = C + I + G → unclear if banks always pass on savings directly to investors

if total demand changes irrespective of price, AD curve shifts

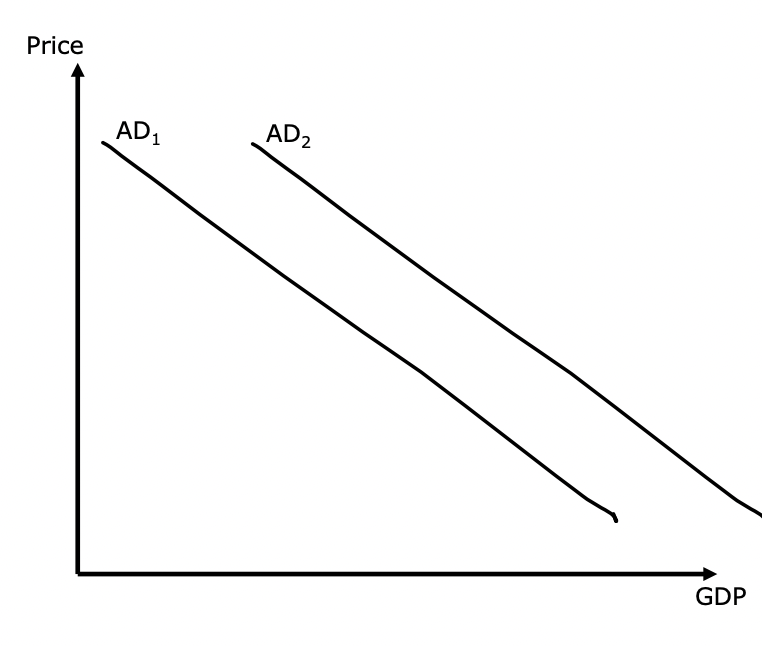

aggregated demand graph

AD curve: -ve relationship between GDP + price

right shift due to additional shift spending (G) and expansion of money supply (M)

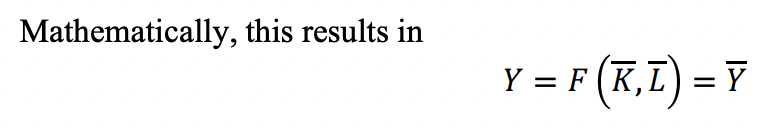

total supply in long-term

quantity of goods produced depends on given quantity of input factors & production technology → fixed

formula corresponds to long-term offer that is independent of price

graph: vertical curve or line

line above K,L,Y = fixed amount of that variable

total offer in the short-term

assumption of fixed prices defined the short-term

great simplification: all prices are fixed in the short term

if price level is fixed → horizontal curve or line

consequence → in short-term, only changes in supply can influence output level

supply shocks are cost shocks that lift the curve

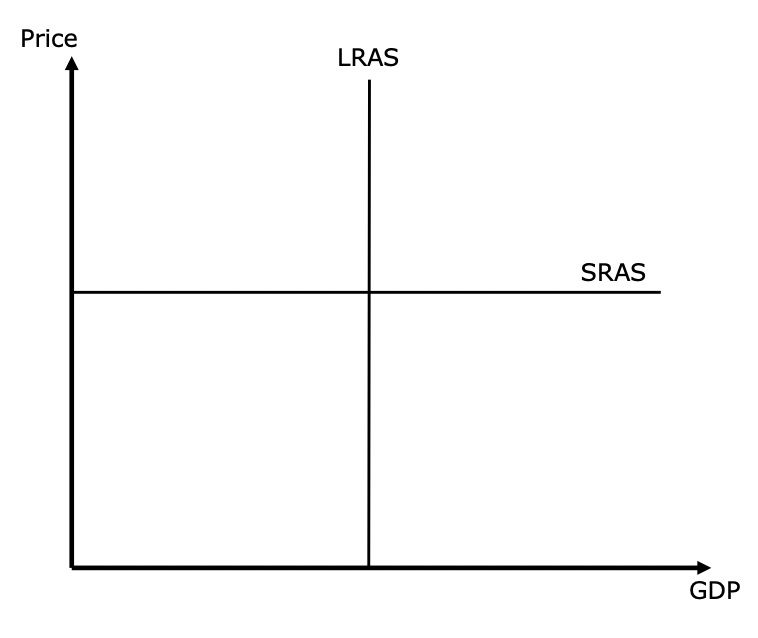

aggregated supply: 2 curves

aggregated supply in long-term: LRAS

long-run aggregated supply

vertical curve

aggregated offer in short-term: SRAS

short-run aggregated supply

horizontal curve

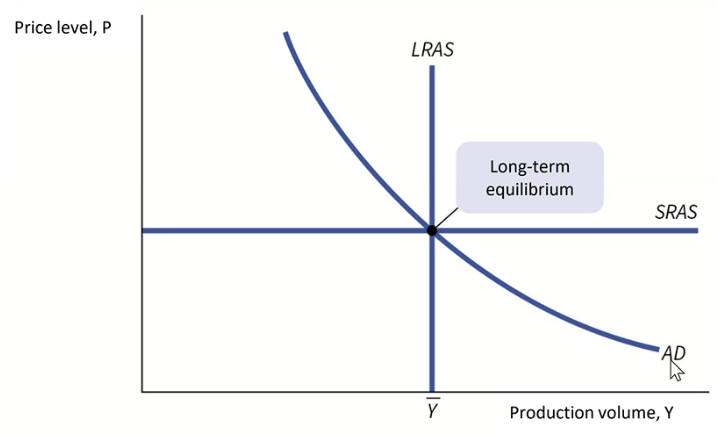

long-term equilibrium in AD-AS model

in long-term, economy is at the intersection of long-term AS and AD curves

as prices have adjusted to this level, the short-term aggregate supply curve also runs through this point

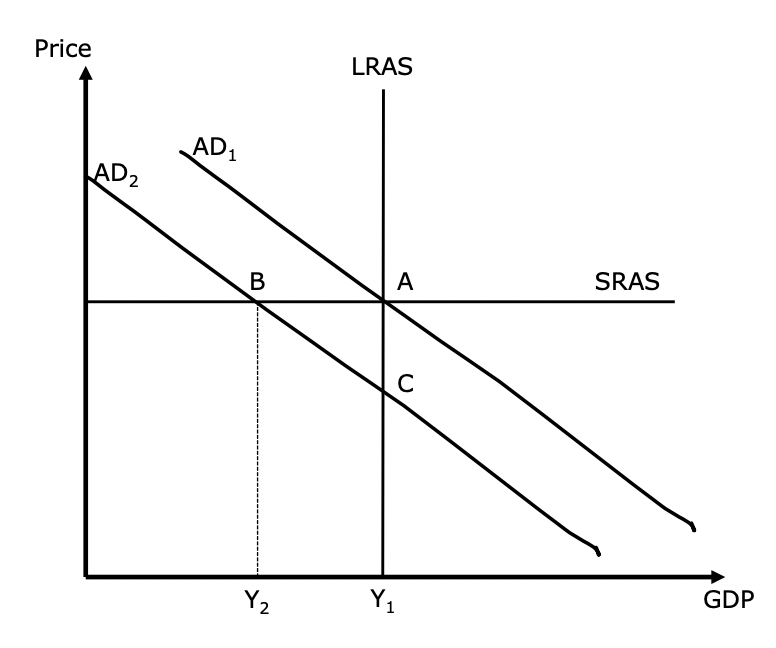

recession in AD-AS model

demand shock shifts AD curve to the left

in short term, the economy moves from equilibrium at point A to the new intersection point B of AD2 and SRAS

if shock is permanent, economy will move from point B to long-term equilibrium at point C in long term

if demand recovers in long-term, economy would move from point B back to the long-term equilibrium at point A

fiscal policy

increase in government spending allows a rightward shift of the AD curve

states can pay out ‘windfall money’ to the population to boost private consumption → AD curve shifts to the right

has a stabilising effect because population suffering from a drop in income is directly benefited

monetary policy

by expanding the money supply, the central bank stimulates economy → right shift in AD curve

reduction in money supply by central bank → left shift in AD curve

counteracts a +ve demand shock, but at the expense of the upswing

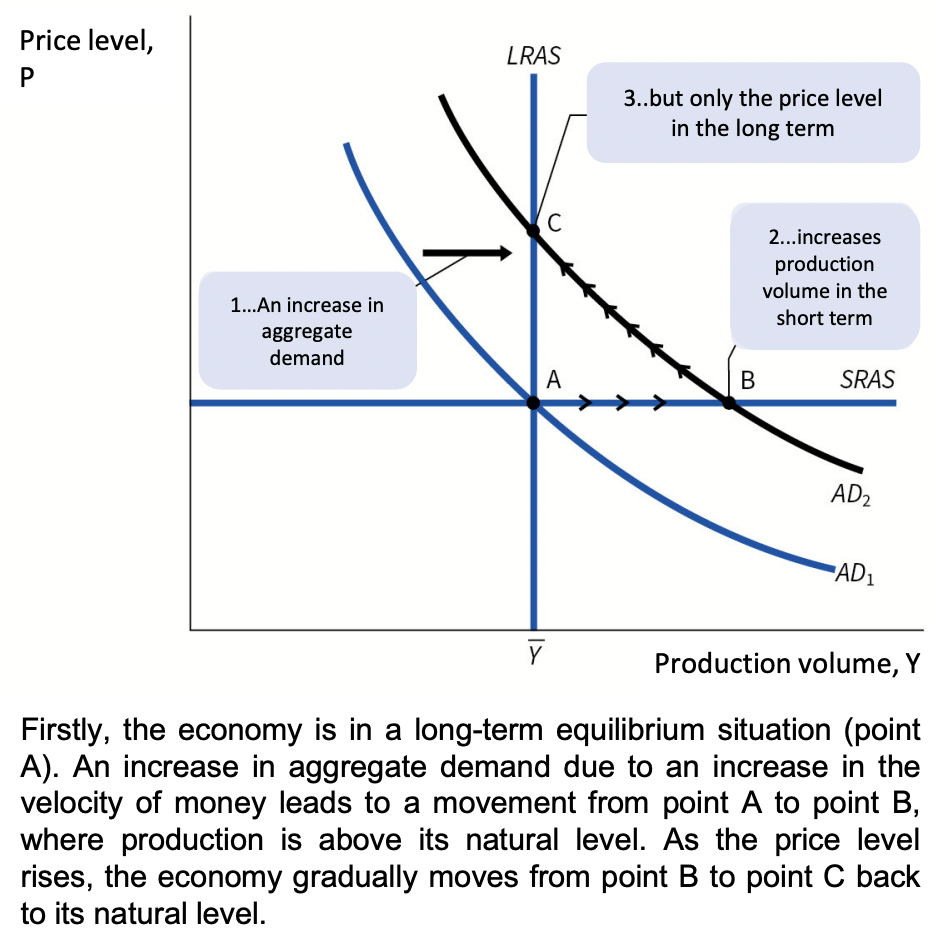

reaction of +ve demand shock

+ve demand shock → AD curve shift right

short-term upswing → slow down in long → prices rise

if price stability is primary goal, the central bank should intervene and put brakes on the upswing

central bank could reduce money supply & try to bring the AD curve back to the initial situation

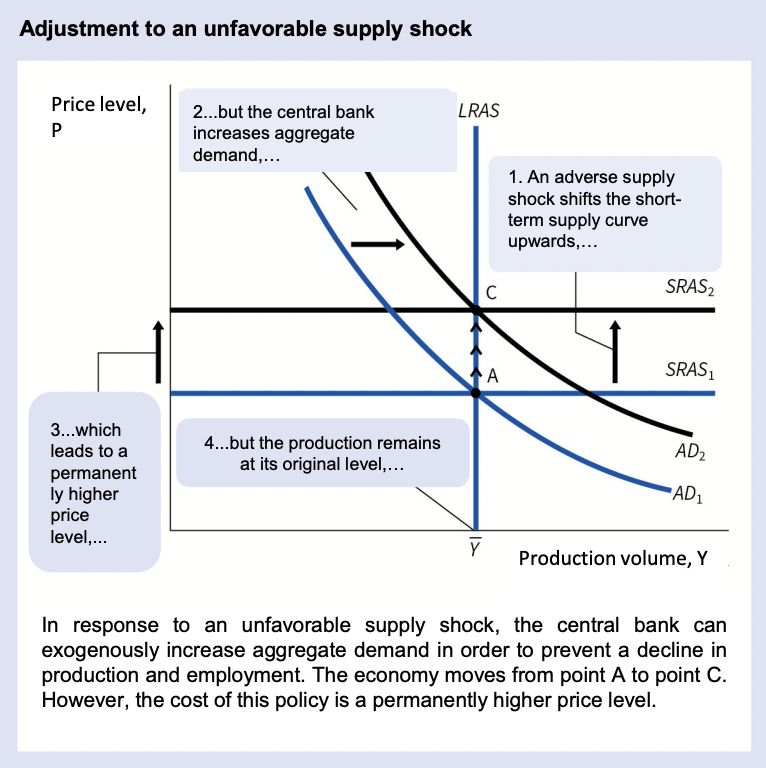

reaction to adverse supply shock

cost shock increases production costs

oil price, delivery failures, gas crisis

SRAS curve shifts upwards

to prevent a recession with a simultaneous rise in prices (stagflation), AD curve can be shifted to right through monetary or fiscal policy

decline in income can be prevented at the expense of a long-term rise in prices