Business Law - Exam 2

1/310

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

311 Terms

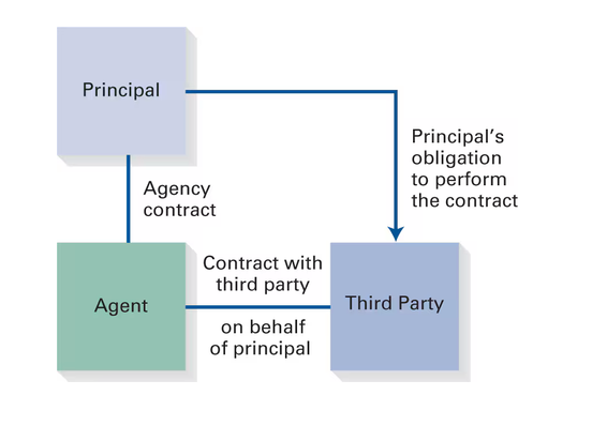

Agency

a fiduciary relationship which results from the manifestation of consent by one person to another that the other shall act in his behalf and subject to his control, and consent by the other so to act

Persons Who Can Initiate an Agency Relationship

Any person who has the capacity to contract

Can only be created to accomplish a lawful purpose

Principal-Agent Relationship vs. Employer-Employee Relationship

Ex. A welder on General Motors Corporation’s automobile assembly line is employed to perform a physical task but is not given authority to enter contracts

Independent Contractor

a non-employee retained to perform certain tasks on a principal’s behalf

An independent contractor operates its own business or profession

A principal can authorize a ____ to enter into contracts on its behalf

Ex. If a client authorizes an attorney to settle a case within a certain dollar amount and the attorney does so, the settlement agreement is binding.

Formation of an Agency - Express Agency

Agent has authority to contract or otherwise act on the principal’s behalf as stated in an agency agreement

Power of Attorney (general vs. special)

Ex. A person who has her house listed for sale but who is going on a trip givers her sister a special power of attorney to make decisions regarding the selling of her house while she is gone, including accepting offers to sell the house and signing documents and deeds necessary to sell the house.

Formation of an Agency - Implied Agency

Implied from the conduct of the parties

Formation of an Agency - Agency by Ratification

Occurs when (1) a person misrepresents themselves as another’s agent, and (2) the purported principal ratifies the unauthorized act

Apparent Agency

Arises when a principal creates the appearance of an agency that does not exist

Principal is estopped from denying the agency relationship and is bound to contracts entered intoby the apparent agent

Principal’s Duties - Duty to Compensate

If no agreement, the principal must pay a customary fee paid in the industry. If no custom, a reasonable value for the agent’s services

Principal’s Duties - Duty to Reimburse

Must reimburse expenses if they were (1) authorized by the principal, (2) within the scope of agency, and (3) necessary to discharge the agent’s duties in carrying out the agency

Principal’s Duties - Duty to Indemnify

Must indemnify the agent for any losses the agent suffers because of the principal’s conduct

Principal’s Duties - Duty to Cooperate

Must cooperate with and assist the agent in the performance of the agent’s duties and the accomplishment of the agency

Agent’s Duties - Duty to Perform

Must (1) perform the lawful duties expressed in the contract, and (2) meet the standards of reasonable care, skill, and diligence implicit in all contracts

Standard of care is based on an agent in the same occupation in the same locality under the same circumstances

Agent’s Duties - Duty to Notify

Must notify the principal of important information learned concerning the agency

Information learned by the agent in the course of the agency is imputed to the principal, even if the agent does not tell the principal

Agent’s Duties - Duty to Account

Must maintain an accurate accounting of all transactions

Must (1) maintain a separate account for principal, and (2) use the principal’s property in an authorized manner

Termination of an Agency - Termination by an Act of the Parties

Mutual assent of the parties

A stated time has lapsed

If a specified purpose is achieved

The occurrence of a stated event

(examples for all 4 on class 11 slides)

Termination of an Agency - Notice of Termination

Direct notice to all persons who the agent has dealt with

Constructive notice to any party that has knowledge of the agency but has not dealt with the agent

Termination of an Agency - Termination by an Unusual Change of Circumstances

There must be a change in circumstances that would lead the agent to believe that the principal’s original instructions should no longer be valid

Termination of an Agency - Termination by Impossibility of Performance

A situation arises that makes the fulfillment of the agency impossible

Loss or destruction of the subject matter

Loss of a required qualification

A change in law

Termination of an Agency - Termination by Operation of Law

Occurs in the following circumstances:

The death of the principal or the agent

The insanity of either the principal or the agent

The bankruptcy of the principal

The outbreak of a war between the principal’s country and the agent’s country

Termination of an Agency - Wrongful Termination

If the principal’s or agent’s termination of an agency contract breaches the contract, the other party can sue for damages

Agent’s Duty of Loyalty

Agent owes principal a duty of loyalty in all agency-related matters

Agent owes a duty not to act adversely to the interests of the principal

Agent’s Duty of Loyalty - Self-Dealing

Remedy: Principal has the ability to rescind the purchase and recover the money paid to agent

Agent’s Duty of Loyalty - Usurping an Opportunity

Occurs when an agent is offered a business opportunity or another opportunity that is meant for the principal or that the principal is entitled to be informed about and takes it for themselves

A third-party offer must be conveyed to the principal

Agent can only take the opportunity for itself if the principal rejects the opportunity

Remedy: Principal has the ability to recover the opportunity from the agent

Agent’s Duty of Loyalty - Competing with the Principal

Remedy: Principal may recover the profits made by the agent as well as damages caused by the agent

Agent’s Duty of Loyalty - Dual Agency

Occurs when an agent acts for two or more different principals in the same transaction

All parties must consent to a dual agency

Remedy: Agent must forfeit all compensation received in the transaction

Agent’s Duty of Loyalty - Misuse of Confidential Information

Duty applies during and after the course of the agency

Duty does not prohibit using general information, knowledge, or experience acquired during an agency in later employment

Remedy: Principal can recover damages, lost profits, and any remuneration the agent received from another party to obtain the confidential information. Principal can also obtain an injunction.

Tort Liability of Principals and Agents

Generally

Principal and agent are each personally liable for their own tortious conduct

Principals are liable for tortious conduct committed by agents while they are acting within the scope of the authority given to them by the principal

Agent is only liable for tortious conduct of the principal if they directly or indirectly participate in or aid and abet the principal’s conduct

Employment context – “scope of employment”

Tort Liability of Principals and Agents - Negligence

Principals are liable for the negligent conduct of agents acting within their scope of employment

Tort Liability of Principals and Agents - Frolic and Detour

An agent my run a personal errand while on assignment for the principal

Principals are generally relieved of liability if the agent’s frolic and detour is substantial.

Tort Liability of Principals and Agents - Coming and Going

Principal is generally not liable for injuries caused by agents while they are on their way to and from work

Tort Liability of Principals and Agents - Dual-Purpose Mission

Principal is generally liable for agent’s act if the principal requests that the agent run errands or conduct other acts while the agent is on personal business

Liability for Intentional Torts

Include acts such as assault, battery, false imprisonment, and other intentional conduct that causes injury to another person

Principal is not liable for the intentional torts of agents and employees that are committed outside of the principal’s scope of business

Principal may be liable for intentional torts of agents and employees committed within the agent’s scope of employment

Motivation test

- if the agent’s motivation for committing the intentional tort is to promote the principal’s business

- if the agent’s motivation is personal, the principal is not liable, even if the tort takes place during business hours or at work

Work-Related Test

- if the agent commits an intentional tort within a work-related time or space, the principal is liable

Liability for Intentional Torts - Misrepresentation

A principal is liable for the intentional and innocent misrepresentations made by an agent acting within the scope of employment

Remedy: Third party can either (1) rescind the contract with the principal and recover any consideration paid, or (2) affirm the contract and recover damages

Contract Liability of Principals and Agents to Third Parties - Fully Disclosed Agency

Occurs if a third party entering into a contract knows (1) that the agent is acting as an agent for a principal, and (2) the actual identity of the principal

The principal is liable on the contract

The agent is not liable on the contract

Contract Liability of Principals and Agents to Third Parties - Partially Disclosed Agency

Occurs if an agent discloses his or her agency status but does not reveal the principal’s identity (and the third party doesn’t otherwise know the principal’s identity)

Both the principal and agent are liable on the contract

If the agent is made to pay the contract, though, it can sue the principal for indemnification

Contract Liability of Principals and Agents to Third Parties - Undisclosed Agency

Occurs when a third party is unaware of the existence of an agency

Both the principal and agent are liable on the contract

If the agent is made to pay the contract, though, it can sue the principal for indemnification

Contract Liability of Principals and Agents to Third Parties - Agent Exceeding the Scope of Authority

If the agent exceeds the scope of his or her authority, the principal is not liable on the contract

The agent is liable to the third party for breaching the implied warranty of authority

Third party must show (1) reliance on the agent’s representation, and (2) ignorance of the agent’s lack of status

Factors for Determining Independent Contractor Status

“a person who contracts with another to do something for him who is not controlled by the other nor subject to the other’s right to control with respect to his physical conduct in the performance of the undertaking”

The crucial factor is the degree of control that the principal has over that party

Other critical factors

Whether the principal supplies the tools and equipment used in the work

The method of payment

The degree of skill necessary to complete the task

Whether the employer has the right to control the manner and means of accomplishing the desired result

Liability for an Independent Contractor’s Torts

Generally, a principal is not liable for the torts of its independent contractors

Principals cannot avoid liability for an inherently dangerous activity that they assign to an independent contractor (i.e., use of explosives, clearing land by fire, crop dusting, and other inherently dangerous activities that involve special risks)

Liability for an Independent Contractor’s Contracts

A principal can authorize an independent contractor to enter into contracts

If the principal does not authorize the independent contractor, it will not be liable under the contract

Principals are bound by the authorized contracts of their independent contractors

U.S. Constitution - Functions

(1) creates 3 branches of federal government

(2) protects individual rights by limiting the government’s ability to restrict those rights

U.S. Constitution - Federalism and Delegated Powers

Federalism – the federal government and the 50 state governments share powers

Enumerated powers (Article I, Section 8)

Necessary and Proper Clause

Any powers not specifically delegated to the federal government are reserved to the states

U.S. Constitution - Separation of Powers

(1) Legislative Branch (Article I)

(2) Executive Branch (Article II)

(3) Judicial Branch (Article III)

U.S. Constitution - Checks and Balances

built in to ensure that no one branch becomes too powerful

Commerce Clause

Grants Congress the power to regulate commerce with foreign nations, among the several states, and with Indian tribes

Intended to foster the development of a national market and free trade among the states

Commerce Clause - Foreign Commerce

A clause of the U.S. Constitution that vests Congress with the power “to regulate commerce with foreign nations.”

Commerce Clause - Interstate Commerce

Federal government may regulate activities that affect interstate commerce

The regulated activity does not itself have to be in interstate commerce

Wickard v. Filburn

State Police Power

States retained the power to regulate intrastate commerce and much of interstate commerce occurring within their borders

Permits states to enact laws to protect or promote the public health, safety, morals, and general welfare

Dormant Commerce Clause

A situation where the federal government has the power to regulate an area of commerce but has chosen not to

Prohibits a state from unduly burdening interstate commerce

Due Process

5th and 14th Amendments contain a Due Process Clause

No person shall be deprived of “life, liberty, or property” without due process of law

Substantive Due Process

Procedural Due Process

Equal Protection

14th Amendment

Equal Protection Clause - provides that a state cannot “deny to any person within its jurisdiction the equal protection of the laws”

Prohibits state, local, and federal governments from enacting laws that classify and treat “similarly situated” persons differently

Designed to prohibit invidious discrimination – it does not make the classification of individuals unlawful per se

Standards of Review

Strict Scrutiny – if based on a suspect class or involves fundamental rights

Intermediate Scrutiny – if based on a protected class other than a suspect class or fundamental right

Rational Basis

Equal Employment Opportunity Commission

Equal Employment Opportunity Commission (EEOC)

Federal agency responsible for enforcing most federal antidiscrimination laws

Has jurisdiction to investigate charges of discrimination based on race, color, national origin, gender, religion, age, disability and genetic information

Complaint Process

A person who thinks they have been discriminated against in the workplace must first file a complaint with the EEOC

If EEOC finds a violation, it will decide whether to sue the employer

If EEOC chooses to sue the employer, the employee cannot bring the suit.

If EEOC chooses not to bring a suit or doesn’t find a violation, it will issue a right to sue letter to employee

Lilly Ledbetter Fair Pay Act of 2009

Each discriminatory pay decision restarts the statutory 180-day clock contained in The Civil Rights Act

Provides that a court can award back pay for up to 2 years preceding the filing of the claim if similar violations occurred during the prior 2-year period

Title VII of the Civil Rights Act of 1964

Civil Rights Act of 1964

Prohibits discrimination based on race, color, national origin, sex, and religion in public accommodations (e.g., motels, hotels, restaurants, theaters) by state and municipal government public facilities, by government agencies that receive federal funds, and by employers

Scope of Coverage of Title VII

Applies to (1) employers with 15 or more employees, (2) all employment agencies, (3) labor unions with 15 or more members, (4) state and local governments and their agencies, and (5) most federal government employers

Prohibits employment discrimination

Disparate-Treatment Discrimination vs. Disparate-Impact Discrimination (Remedies for Violation: Back pay and reasonable attorneys’ fees, Equitable remedies, and Punitive damages)

Disparate- Treatment Discrimination

Occurs when an employer treats a specific individual less favorably than others because of that person’s race, color, national origin, sex, or religion

Complainants must prove: (1) they are a member of a Title VII protected class, (2) they applied for and were qualified for the employment position, (3) they were rejected despite this, and (4) the employer kept the position open and sought applications from persons with the complainant’s qualifications

Disparate- Impact Discrimination

• Disparate-Impact Discrimination

Occurs when an employer discriminates against an entire protected class

Often proven through statistical data about an employer’s employment practices

Plaintiff must demonstrate a causal link between the challenged practice and the statistical imbalance; a statistical disparity is not enough

Can occur when an employer adopts a work rule that is neutral on its face but shown to cause an adverse impact on a protected class

Race and Color Discrimination

Title VII was enacted primarily to prohibit employment discrimination based on a person’s race and color

Title VII provides equal opportunity in employment for minority job applicants and minority employees seeking promotion

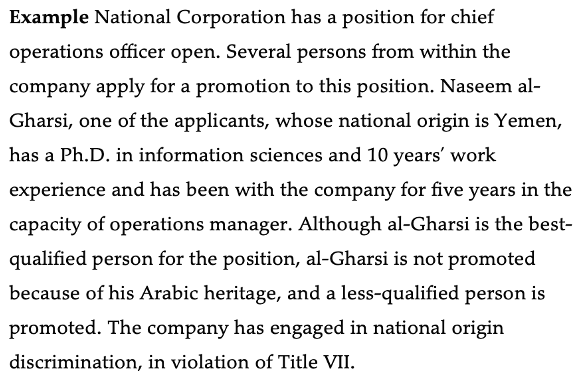

National Origin Discrimination

Title VII prohibits employment discrimination based on national origin

National origin refers to the place of origin of a person’s ancestors; physical, linguistic, or cultural characteristics; or heritage

An employer may not base an employment decision on an employee’s foreign accent unless the accent seriously interferes with the employee’s job performance

Gender Discrimination

Title VII prohibits employment discrimination based on gender

Gender discrimination occurs when an employer treats a job applicant or employee unfavorably because of that person’s sex

Examples

Direct sex discrimination (ex. An employer refuses to hire a qualified job applicant or to promote a qualified employee becaouse of his or her gender)

Quid pro quo sex discrimination (ex. A manager refuses to promote a woman unless she engages in sexual activities with him)

Sex-plus discrimination (An employer does not discriminate against women in general but does discriminate against married women or women with children)

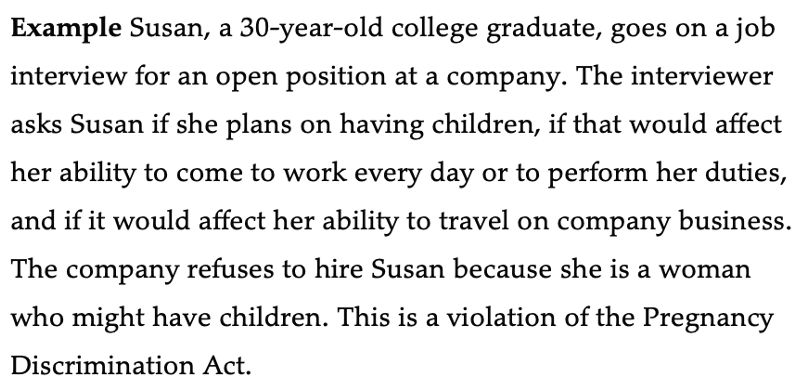

Pregnancy Discrimination - Forbids employment discrimination against a female job applicant or employee because of her pregnancy, childbirth, or a medical condition related to pregnancy or childbirth (ex. in image)

Sexual Orientation and Gender Identity Discrimination

Bostock v. Clayton County, Georgia

EEOC interprets the prohibition in Title VII against sex discrimination to include members of the LGBTQ+ community

EEOC rules prohibit employment discrimination against LGBTQ+ job applicants and employees

Harassment

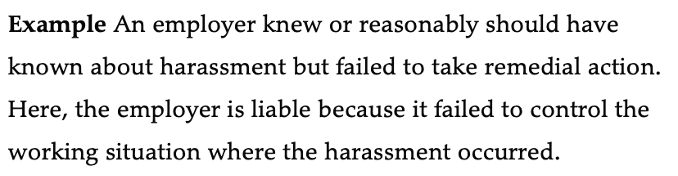

Harassment that is so severe or frequent that it creates a hostile work environment violates Title VII

Affirmative Defense

Must meet the following:

(1) employer exercised reasonable care to prevent, and promptly correct, any sexual harassing behavior, AND

(2) plaintiff-employee unreasonably failed to take advantage of any preventative or corrective opportunities provided by the employer or to otherwise avoid harm

Employer has the burden of proving the affirmative defense

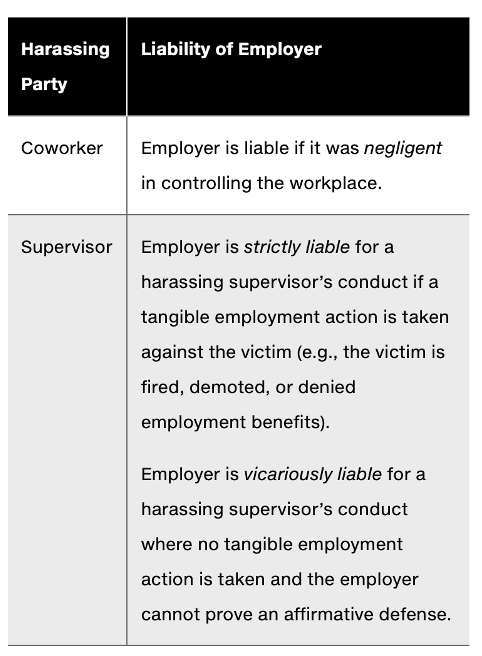

Harrassment - Classification of Harasser

Ex. A supervisor harrasses an employee because she is African American and then demotes her without cause. The employer is strictly liable for this conduct and cannot raise a defense against the imposition of strict liability.

Harrassment - Racial and National Origin Harassment

Examples in images

Harrassment - Sexual Harrassment

EEOC defines sexual harassment as follows: Images

In determining whether a woman has been sexually harassed, the EEOC and courts apply a reasonable woman standard (ex. If a female employee alleges that she has been sexually harrassed by a man, the court will determine the lawfulness of the conduct based on what a reasonable woman would have believed was unlawful conduct and not on what the defendant man believed was lawful conduct)

Other Types of Harassment

Age, pregnancy, disability, sexual preference, and genetic information

Religious Discrimination

Title VII prohibits employment discrimination based on a person’s religion

Employer is under a duty to make a reasonable accommodation for an employee’s religious observances, practices, or beliefs if doing so does not cause an undue hardship on the employer

“undue hardship” may occur if the requested accommodation would be costly, compromise workplace safety, decrease workplace efficiency, infringe on the rights of other employees, or require other employees to do more than their share of potentially hazardous or burdensome work

Title VII prohibits workplace or job segregation based on religion

Harassment because of religion violates Title VII if it creates a hostile work environment

Defenses to a Title VII Action

Merit

Merit decisions are often based on work, educational experience, and professionally developed ability tests. To be lawful under Title VII, such a requirement must be job related

Seniority

Bona Fide Occupational Qualification

Discrimination based on protected class OTHER than race or color is permitted if it is shown to be a bona fide occupational qualification (BFOQ)

A BFOQ must be job related and a business necessity

Equal Pay Act

Protects both sexes from pay discrimination based on sex

Prohibits disparity in pay for jobs that require equal skill, equal effort, equal responsibility, or similar working conditions

Criteria That Justify a Differential in Wages

Seniority

Merit

Quantity or quality of product

“Any factor other than sex”

Age Discrimination in Employment Act (ADEA)

Protects employees who are 40 and older from job discrimination based on their age

Prohibits age discrimination in all employment decisions

Discrimination Against Individuals with Disabilities

Americans with Disabilities Act (ADA)

Title I requires that employers make reasonable accommodations for individuals with disabilities that do not cause undue hardship to the employer

Qualified Individual with a Disability

A physical or mental impairment that substantially limits one or more major life activities, such as walking, talking, seeing, hearing, or learning

A history of such impairment

Regarded as having such impairment even if they do not have the impairment

The person with the disability must, with or without reasonable accommodation, be able to perform the essential functions of the job that person desires or holds

Limits on Employer Questions

Title I limits an employer’s ability to inquire into or test for an applicant’s disabilities

Employer may inquire about the applicant’s ability to perform job-related functions

Undue Hardship

Actions that would require significant difficulty or expense

Considerations include nature and cost of accommodation, the overall financial resources of the employer, and the employer’s type of operation

Uncovered Conditions

Temporary or nonchronic impairments of short duration with few or no residual effects usually are not considered disabilities

Genetic Information Discrimination

Discrimination based on information from which it is possible to determine a person’s propensity to be stricken by diseases

Genetic Information Nondiscrimination Act

Makes it illegal for an employer to discriminate against job applicants and employees based on genetic information

Inadvertent discovery of genetic information and voluntary submission of genetic information to an employer do not violate the act

Protection from Retaliation

Federal antidiscrimination laws prohibit employers from engaging in retaliation against an employee for filing a charge of discrimination or participating in a discrimination proceeding concerning race, color, national origin, gender, religion, age, disability, genetic information, and other forms of discrimination

Veterans and Military Personnel

Uniformed Services Employment and Reemployment Rights Act of 1994

Law protects and grants employment benefits to persons who serve or have served in the US military services or who is or has been a member of the Reserves or National Guard

Prohibits employers from engaging in employment and wage discrimination against persons because of their past military service or their current or future military obligations

Requires employers to rehire returning service members who had previously been its employee at a job that the person would have retained had he or she not been absent for military service

Requires employers to rehire persons with service-connected disabilities if the disability can be reasonably accommodated

Affirmative Action

Affirmative Action Plan

Employers often adopt an affirmative action plan that provides that certain job preferences will be given to members of minority racial and ethnic groups, women, and other protected-class applicants when making employment decisions

Narrowly tailored to achieve some compelling interest

Reverse Discrimination

Title VII also protects members of majority classes from discrimination

If an affirmative action plan is based on pre-established numbers or percentage quotas for hiring or promoting minority applications, then it causes reverse discrimination

Term Employment

Occurs when an employer and an employee enter a contract for a specified time

If an employer terminates the employee without cause during the stated period, the employer is liable for wrongful discharge

At-Will Employment

Employee can be terminated without cause at any time by employer

Employer does not need to show cause to terminate

Certain exceptions where at-will employees cannot be legally terminated

- Labor union exception

- Public policy exception

- Statutory exception

Workers’ Compensation

compensation paid to workers and their families when workers are injured in connection with their jobs

Worker must file a claim with the appropriate state government agency

The agency determines the legitimacy of the claim

Benefits are paid according to preset limits established by statute or regulation

Workers’ Compensation Insurance

States typically require employers to purchase workers’ compensation insurance or contribute to state funds

Worker’s Compensation - Employment-Related Injury

In order to receive compensation, the employee must prove they were harmed by an employment-related injury

Covers physical injuries as well as stress and mental illness

Worker’s Compensation - Exclusive Remedy

Workers cannot receive workers’ compensation and sue their employers unless the employer intentionally injures the worker

Employees not barred from suing third parties

Occupational Safety and Health Act

Promotes safety in the workplace

Imposes record-keeping and reporting requirements on employers

Requires employers to post notices in the workplace to inform employees of their rights under the act

Occupational Safety and Health Administration (OSHA)

Empowered to inspect places of employment for health hazards and safety violations

Occupational Safety - Specific Duty Standards

Rules that are developed for and apply to specific equipment, procedures, types of work, individual industries, and unique work conditions

Occupational Safety - General Duty Standard

Occupational Safety and Health Act contains a general duty standard that imposes a duty to provide employees with a work environment that is free from recognized hazards that have caused or are likely to cause death or serious physical harm to its employees

Fair Labor Standards Act (FLSA)

Applies to private employers and employees engaged in the production of goods for interstate commerce

U.S Department of Labor is empowered to enforce FLSA; private civil actions are permitted

Fair Labor Standards Act - Child Labor

FLSA restricts the types of occupations and jobs that children under the age of 18 may engage in

Other regulations based on whether the job is hazardous or nonhazardous

Fair Labor Standards Act - Minimum Wage

Requires employors to pay all employees a minimum hourly wage

Employer may pay less than the minimum wage to students and apprentices and may reduce the minimum wage by an amount equal to the reasonable cost of food and lodging provided to employees

Tipped employees can be paid less if the amount paid plus tips received equals at least the minimum wage

Fair Labor Standards Act - Overtime Pay

Certain employees who work more than 40 hours per week must be paid overtime pay for each hour worked beyond 40 hours

Overtime pay must be at least 1.5X

Exempt vs. nonexempt employees

Fair Labor Standards Act - Blue-Collar Workers

Workers who perform work involving repetitive operations with their hands, physical skill, and energy are nonexempt employees

Required to be paid overtime no matter how highly paid they might be

Fair Labor Standards Act - First Responders

Required to be paid overtime pay regardless of rank or pay level

Fair Labor Standards Act - White-Collar Workers

Required to be paid overtime unless exempt

SALARIED DOES NOT MEAN EXEMPT

Executive, administrative, and professional exemptions (Executive employees, Administrative employees, Learned professionals, Creative professionals, Highly compensated employees, Computer employees, Outside sales representatives, Teachers)

Fair Labor Standards Act - Job Titles and Employee Duties

Job titles do not establish exempt status

Employees who are designated by their employers to be in an exempt class must actually be performing the duties required for an exemption

Family and Medical Leave Act (FMLA)

Guarantees workers unpaid time off from work for family and medical emergencies and other specified situations

Applies to companies with 50 or more workers

Employee must have worked for the employer for at least 1 year and must have performed more than 1,250 hours of service during the previous 12-month period

Covered employers are required to provide up to 12 weeks of unpaid leave during any 12-month period due to the following

The birth of and care for a child

The placement of a child with an employee for adoption or foster care

A serious health condition that makes the employee unable to perform their duties

Care for a spouse, child, or parent with a serious health problem

Consolidated Omnibus Reconciliation Act (COBRA)

An employee of a private employer or the employee’s beneficiaries must be offered the opportunity to continue group health insurance after the voluntary or involuntary termination of a worker’s employment or the loss of coverage due to certain qualifying events

Typically available for 18 months after employment has ended

Employee Retirement Income Security Act (ERISA)

If employers establish pension plans for their employees, they are subject to certain record-keeping, disclosure, fiduciary duty, and other requirements

Requires pension plans to be in writing and to name a pension fund manager who owes a fiduciary duty to the fund

Vesting – a nonforfeitable right to receive pension benefits

Immediate vesting of employee’s own contribution

Employer’s contributions must either (1) totally vest after 5 years, or (2) gradually vest over a 7-year period

Unemployment Compensation

Employers pay unemployment contributions

State governments administer unemployment compensation programs under guidelines set by the federal government

Each state establishes its own eligibility requirements and benefits

Applicants must be able to work and available for work and seeking employment

Workers who have been let go because of bad conduct or who voluntarily quit work without just cause are not eligible

Social Security

Provides limited retirement and death benefits to certain employees and their dependents

Benefits include: (1) retirement benefits, (2) survivors’ benefits to family members of deceased workers, (3) disability benefits, and (4) medical and hospitalization benefits

Employees must make contributions into the Social Security fund. Employers pay a matching amount.

Current contributions used to fund current claims

Negotiable Instruments - Drafts

An unconditional written order by one party (drawer) that orders a second party (drawee) to pay money to a third party (payee)

For drawee to be liable, it must accept the drawer’s written order to pay

Time draft (paid at a particular time) vs. sight draft (payable on demand)

Negotiable Instruments - Check

An order to pay drawn on a financial institution

Negotiable Instruments - Promissory Note

An unconditional written promise by one party to pay money to another party

Typically arises when one party borrows money from another

The note is evidence of (1) the extension of credit, and (2) the borrower’s promise to repay the debt

Parties are free to design the terms of the note to fit their needs

Negotiable Instruments - Certificate of Deposit

A special form of note that is created when a depositor deposits money at a financial institution in exchange for the institution’s promise to pay back the amount of the deposit plus an agreed-on rate of interest on the expiration of a set time period agreed by the parties

Requirements for Creating a Negotiable Instrument - Be in Writing

Must be (a) in writing and (b) permanent and portable

Can be combinations of different types of writing