Ch 4: Balance Sheet and Statement of Cash Flows Notes

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

62 Terms

Balance Sheet/Statement of Financial Position

- reports the assets, liabilities, and SE of a business enterprise at a specific date

Why is the BS useful

- provides info abt the nature and amounts of investments in enterprise resources

- helps in predicting the amounts, timing, and uncertainty of future cash flows

- basis for computing rates of return and evaluating the capital structure of the company

- assess a company's risk and future cash flows

- assess a company's liquidity, solvency, and financial flexibility

Liquidity

reflects an asset's or liability's nearness to cash

- stockholders assess liquidity to evaluate the possibility of future cash dividends or the buyback of shares

- the greater the company's liquidity, the lower its risk of failure

Solvency

- the ability of a company to pay its debts as they mature

- companies with higher debt are relatively more risky because they will need more of their assets to meet their fixed obligations (interest and principle payments)

Financial Flexibility

- Liquidity and solvency affect a company's financial flexibility, which measures the ability of an enterprise to take effective actions to alter the amounts and timing of cash flows so it can respond to unexpected needs and opportunities

- the greater a company's financial flexibility, the lower its risk of failure

Three Limitations of the BS

1. Most assets and liab are reported at historical cost. As a result, the info provided in the BS is often criticized for not reporting a more relevant fair value

2. Companies use judgements and estimates to determine many of the items reported in the BS

3. The BS necessarily omits many items that are of financial value but that a company cannot record objectively (knowledge and skill)

Classification in the BS

- BS accounts are classified. Balance sheets group together similar items to arrive at significant subtotals. The material is a arranged so that important relationships are shown

- FASB doesn't want you to report the summary accounts alone. They should classify with sufficient detail to permit users to assess the amounts, timing and uncertainty of future cash flows

Elements of the BS: Assets

- Present rights of an entity to economic benefits

Elements of the BS: Liabilities

Present obligations of an entity to transfer economic benefits

Elements of the BS: Equity or Net Assets

Residual interest in the assets of an entity that remains after deducting its liabilities. In a business enterprise, the equity is the ownership interest

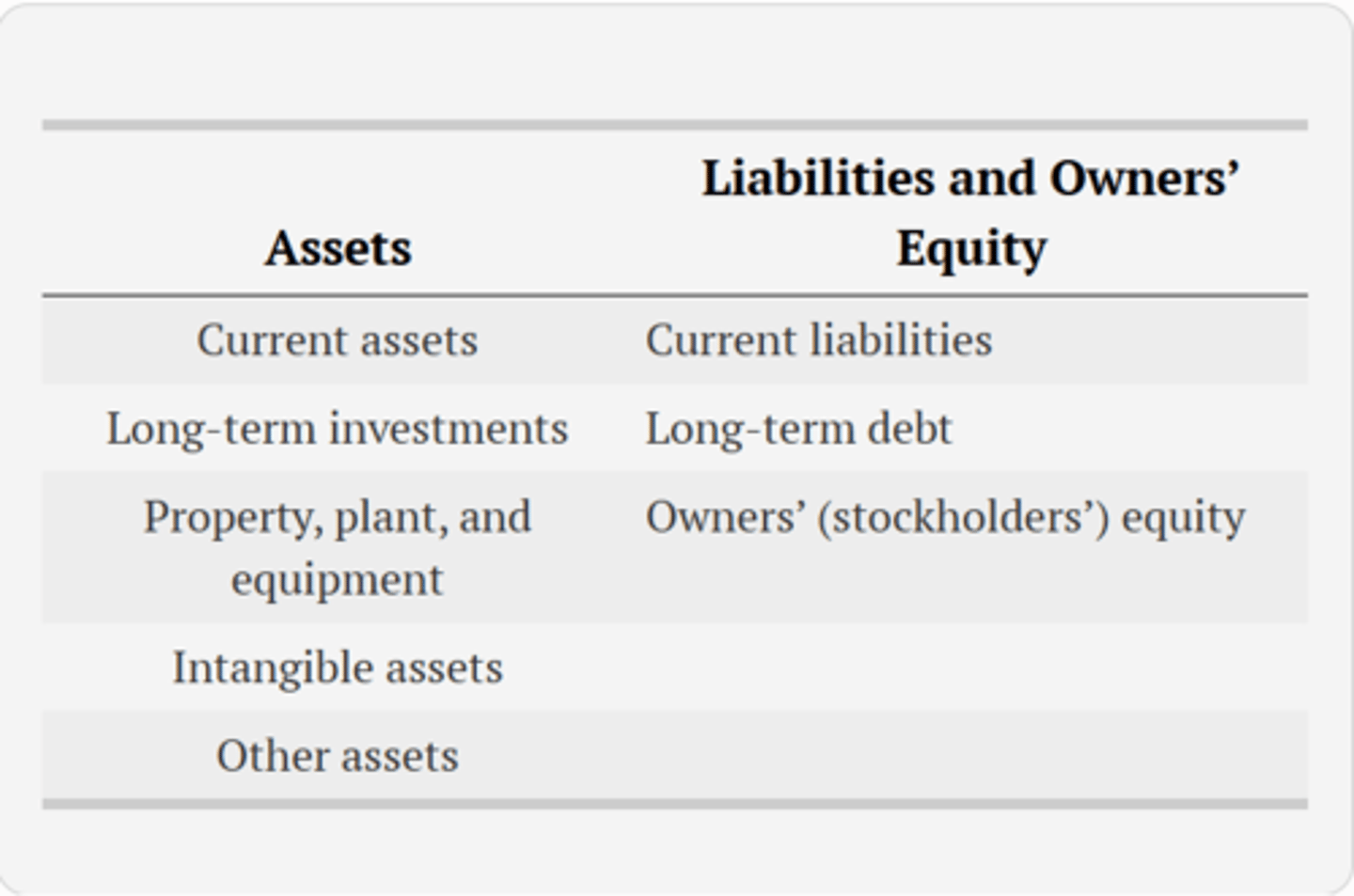

Balance Sheet Classifications

Current Assets

Cash and other assets a company expects to convert into cash, sell, or consume either in one or in the operating cycle, whichever is longer

- presented in the BS in order of liquidity

- if a company expects to convert an asset into cash or to use it to pay a current liability within a year or the operating cycle, which ever is longer, it classifies the asset as current

Current Assets: Operating Cycles

- the operating cycle is the avg time btwn when a company acquires materials and supplies and when it receives cash for sales of the product (for which it acquired the materials and supplies)

- the cycle operates from cash thru inventory, production, receivables, and back to cash

- when several operating cycles occur within one year (service and merch companies), company uses the one-year period. Uses a longer one if more

Current Assets and Basis of Valuation

1. Cash and cash equivalents: Fair Value

2. Short-term investments: Generally, Fair Value

3. Receivables: Estimated Amount Collectible

4. Inventories: Lower-of-Cost-or-Net Realizable Value/Market

5. Prepaid Expenses: Cost

- a company does not report these five items as current assets if it does not expect to realize them in one year or in the operating cycle, whichever is longer

Cash and Cash Equivalents

- Cash: currency and demand deposits at a financial institution. Examples of demand deposits: checking, saving, and money market accounts

- Cash Equivalents: short-term, highly liquid investments that will mature within three months or less. (CDs)

- both reported at approximate fair value on the BS

Short-term investments

- company has excess cash on hand and chooses to invest it in stocks or bonds of other companies

- Equity Securities or Debt Securities

Equity Securities

- investments in preferred and common stock of other companies. A company can buy the stock and sell it quickly if the stock price increases, or it can be held for many years.

- If the entity intends to sell the stock in a short period of time (less then a year), it is classifies as a short term investment

- recorded at fair value

Debt Securities

- investments in bonds or notes of other companies or governmental entities. Debt investments are further separated into three portfolios:

-- Held to Maturity

-- Trading

-- Available for sale

Debt Securities: Held to Maturity

- debt securities that a company intends to hold until maturity. These are reported as current or noncurrent assets depending on the time left until maturity.

- held to maturity debt investments are reported on the BS at amortized cost

Debt Securities: Trading

- debt securities bought and held primarily for sale in the near future to generate a return. Reported as current assets at their fair value

Debt Securities: Available-for-sale

- debt securities not classifies as held to maturity of trading securities

- reported at fair value as current or noncurrent assets depending on the length of time management intends to hold the investment

Receivables

- may be grouped as one item on the BS and shown "net" of any expected loss due to uncollectable amounts (allowance for credit losses)

- for receivables arising from unusual transactions, such as sale of property or a loan to employees, companies should separately classify these as long-term unless collection is expected within one year

Inventories

- assets that a company holds for sale in the ordinary course of business, or goods that will be used in the production of goods to be sold

- the inventory amnt on the BS represents the inventory on hand at the BS date

- notes disclose the basis of valuation and the cost flow assumption used

Prepaid Expenses

- advance prepayments

- only included if it will receive benefits within one year or the operating cycle

- they are current assets bc if they had not already been paid, they would require the use of cash during the next year or the operating cycle

- a company reports prepaid exp at the amount of the unexpired or unconsumed cost

Noncurrent Assets

long-term investments, PPE, intangible assets

Long-term investments

4 types:

1. investments in debt and equity securities

2. investments in tangible fixed assets not currently used in operations, such as land held for sale or as an investment (aka speculation)

3. investments set aside to be used for specific purpose, such as a bond sinking fund, pension fund, or plant expansion fund. Includes the cash surrender value of a life insurance policy

4. investments in nonconsolidated subsidiaries or or affiliated companies

- companies usually present long-term investments on the BS just below "current assets" in a separate section called "investments"

Property, Plant, and Equipment

- tangible long-lived assets used in the regular operations of the business

- consist of physical property cash as land, buildings, machinery, furniture, tools, right-of-use assets (leased assets), and wasting resources (timberland, minerals)

- with the exception of land, a company depreciates tangible long-lived assets such as buildings and equipment. Depletion is used for natural resources such as oil or timberland

Intangible Assets

- lack physical substance and are not financial instruments

- includes patents, copyrights, franchises, goodwill, trademarks, trade names, and customer lists

- a company writes off (amortizes) limited-life intangible assets over their useful lives

- periodically assesses indefinite-life intangibles (such as goodwill) for impairment

Other Assets

- unusual items sufficiently different from assets included in specific categories

Current Liabilities

- obligations that a company reasonably expects to settle, or pay off, within a year of the balance sheet date

- current liabilities are settled through the use of current liabilities

1. payables resulting from the acquisition of goods and services, such as accounts payable, wages payable, taxes payable, and short-term notes payable

2. Cash received in advance from customers for the delivery of goods or performance of services, such as unearned rent revenue or unearned subscriptions revenue

3. Current maturities of long term debt, which represents the portion of a long-term debt that is due within the coming year

Working capital

current assets - current liabilities

- represents the net amount of a company's relatively liquid resources

Long-term liabilities

obligations that a company does not reasonably expect to settle within the normal operating cycle

- ex: bonds payable, notes payable, deferred income tax liabilities, lease obligations, and pension obligations

- companies classify long-term liabilities that mature within the current operating cycle as current liabilities if payment of the obligation requires the use of current assets

Three types of long-term liabilities

1. obligations arising from specific financing situations, such as the issuance of bonds, long term lease obligations, and long-term notes payable

2. obligations arising from the ordinary operations of the company, such as pension obligations and deferred income tax liabilities

3. obligations that depend on the occurrence or nonoccurrence of one or more future events to confirm the amount payable, the payee, or the date payable, such as service or product warranties

Contra account

an account that reduces a related account on a financial statement

- When a bond is issued at less than face value, it is issued at a discount. The amount of the discount is recorded in the Discount on Bonds Payable account and is subtracted from the Bonds Payable account.

adjunct account

- increases either an asset, liability, or owners' equity account

- When a bond is issued at greater than face value, it is issued at a premium. The amount of the premium is recorded in the Premium on Bonds Payable account and is added to the Bonds Payable account.

Owner's Equity (SE) five parts

1. Capital Stock

2. Additional paid in capital

3. retained earnings

4. accumulated other comprehensive income

5. treasury stock

Capital Stock

The total par or stated value of the shares issued. Companies must disclose the par value per share and the authorized, issued, and outstanding share amounts for common and preferred stock.

Additional Paid-in capital

the excess of amounts paid in over the par or stated value

Retained Earnings

- the corporation's accumulated, undistributed earnings

a. Unappropriated: the amount usually available for dividend distribution

b. Restricted: the amount restricted by bond indentures or other loan agreements

Accumulated other comprehensive income

- the aggregate amount of the OCI items such as unrealized gains and losses on certain investments

Treasury Stock

generally, the cost of shares repurchased by the company. This amount is recorded in a contra account and is a reduction of stockholders' equity. Dividends are not paid on treasury stock shares since they are owned by the company. TS is considered issued, but it is not outstanding

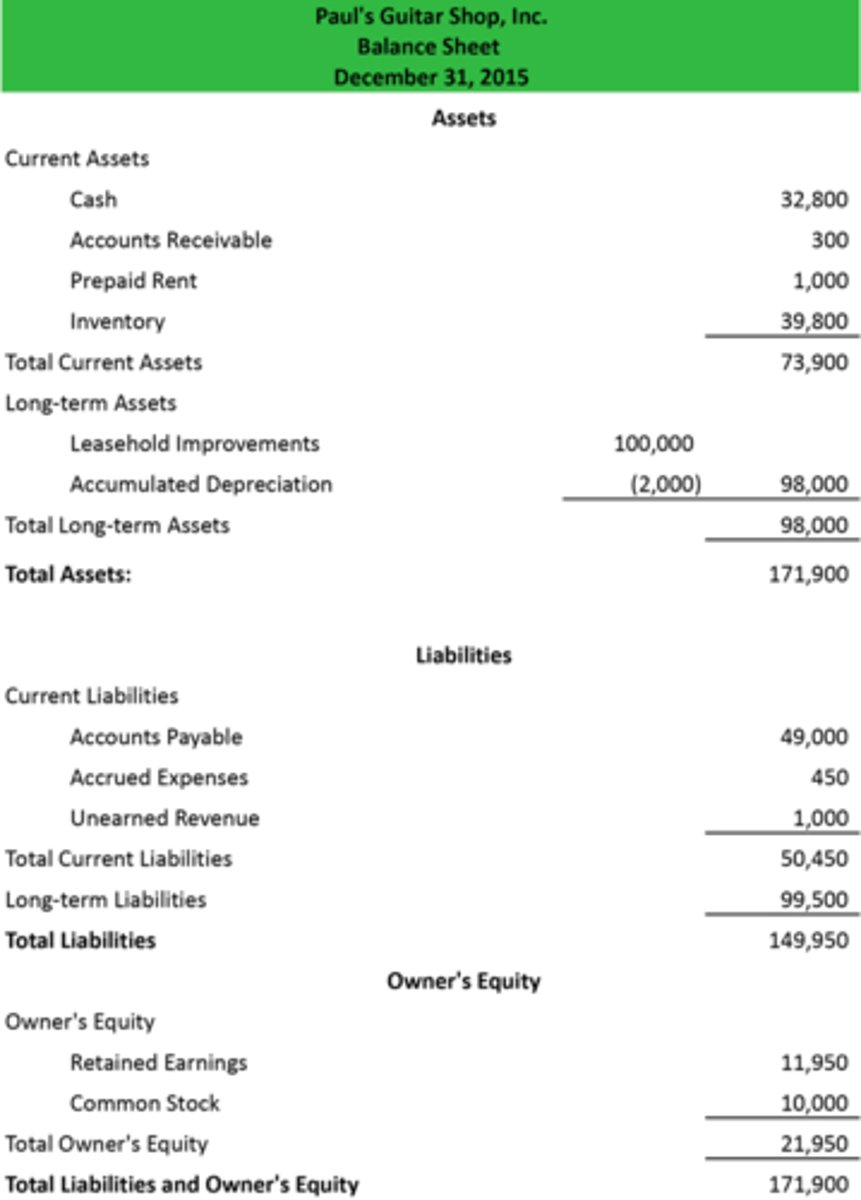

Format of the Balance Sheet

- the most common form of the BS is the report form, lists the BS sections above the other, on the same page

Limitations of IS, SoSE, and BS

- The income statement provides information about resources provided by operations but not exactly cash.

- The statement of stockholders' equity shows the amount of cash provided by issuing more capital stock and used to pay dividends or purchase treasury stock.

- Comparative balance sheets might show what assets the company has acquired or disposed of, and what liabilities it has incurred or liquidated.

Statement of Cash Flows

- provided relevant info abt the cash receipts and cash payments of an enterprise during a period

- reports: the cash effects of operations during a period, investing transactions, financing transactions, and the net increase or decrease in cash during the period

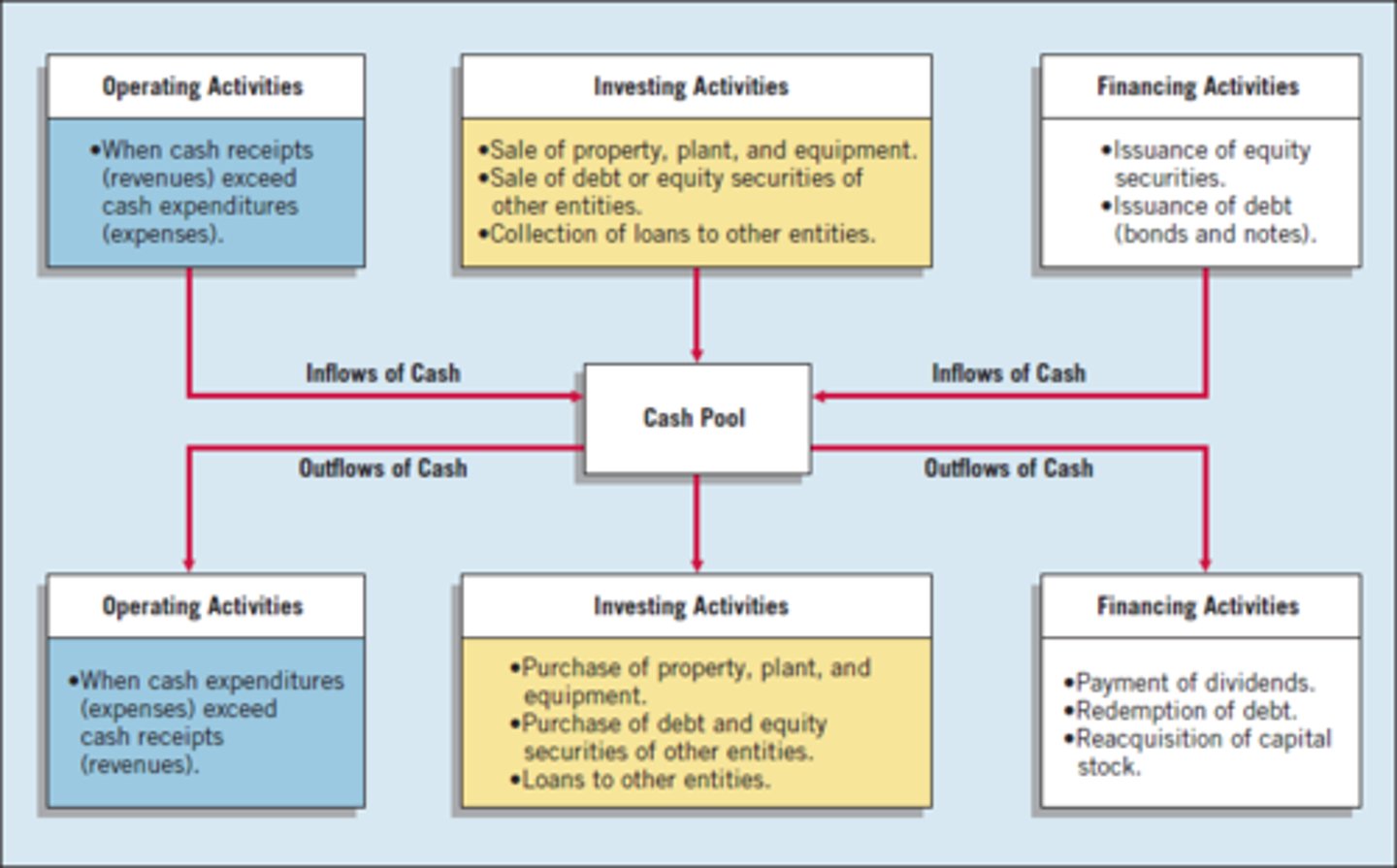

Companies classify cash receipts and cash payments during a period into three different activities

1. operating activities

2. investing activities

3. financing activities

Operating Activities

involve the cash effects of transactions that enter into the determination of net income

Day-to-day transactions that make up net income.

Think: "Normal business operations" (cash generated or spent in running the business).

Examples:

Cash received from customers

Cash paid to suppliers/employees

Interest received and dividends received (GAAP)

Interest paid and taxes paid

Adjustments for non-cash expenses (depreciation, amortization)

Changes in working capital (A/R, Inventory, A/P, etc.)

Rule of Thumb: If it affects net income, it usually belongs in Operating Activities.

Investing Activities

includes making and collecting loans and acquiring and disposing or investments (both debt and equity) and property, plant, and equipment

Cash flows from buying or selling long-term assets or investments.

Think: "Where are we putting our money for growth?"

Examples:

Purchase or sale of property, plant, and equipment (PPE)

Purchase or sale of land or buildings

Purchase or sale of investments (stocks, bonds, other businesses)

Collection of loan principal (giving or receiving long-term notes receivable)

Rule of Thumb: Long-term assets being bought or sold = Investing Activity.

Financing Activities

involve liability and owners or SE items. They include obtaining resources from owners and providing them with a return on their investment, and borrowing money from creditors and repaying the amounts borrowed

Cash flows from transactions with owners and creditors (except interest, which is operating under GAAP).

Think: "How do we finance the business?"

Examples:

Issuance of common stock (inflow)

Purchase of treasury stock (outflow)

Issuance of bonds or long-term debt (inflow)

Redemption/repayment of bonds or debt (outflow)

Payment of dividends (outflow)

Rule of Thumb: Raising or returning money to owners/creditors = Financing Activity.

Cash Inflows and Outflows

Template of SoCF Direct vs Indirect Methods

Direct:

- shows actual cash receipts and cash payments from operating activities. Starts with exact cash inflows and outflows and is easy to understand. But it is less commonly used bc it requires detailed cash records

Indirect: Starts with NI and adjusts for non-cash items and changes in working capital to get cash from operating activities. Most widely used bc FASB prefers it. It is easier to prepare from existing accounting records. But it doesn't show actual cash receipts/payments directly

Template of SoCF Direct Method

1. Direct Method Template

Company NameStatement of Cash Flows (Direct Method)For the Year Ended [Date]

Cash Flows from Operating Activities

Cash received from customers: $________

Cash paid to suppliers: $(_______)

Cash paid to employees: $(_______)

Cash paid for interest: $(_______)

Cash paid for income taxes: $(_______)

Net Cash Provided (Used) by Operating Activities: $________

Cash Flows from Investing Activities

Cash received from sale of equipment: $________

Cash paid for purchase of land/building: $(_______)

Cash paid for purchase of investments: $(_______)

Net Cash Provided (Used) by Investing Activities: $________

Cash Flows from Financing Activities

Cash received from issuance of common stock: $________

Cash received from issuance of bonds: $________

Cash paid for redemption of bonds: $(_______)

Cash paid for dividends: $(_______)

Cash paid to purchase treasury stock: $(_______)

Net Cash Provided (Used) by Financing Activities: $________

Net Increase (Decrease) in Cash: $________

Cash at Beginning of Year: $________

Cash at End of Year: $________

Significant Noncash Investing & Financing Activities

[For example: Issuance of bonds for plant assets, Exchange of furniture for equipment]

Template of SoCF Indirect Method

Company Name

Statement of Cash Flows (Indirect Method)

For the Year Ended [Date]

Cash Flows from Operating Activities

Net Income: $________

Adjustments to reconcile net income to cash:

Depreciation: $________

Amortization of intangibles: $________

Loss on sale of equipment: $________

Gain on sale of equipment: $(_______)

Changes in working capital:

Increase in Accounts Receivable: $(_______)

Decrease in Accounts Receivable: $________

Increase in Inventory: $(_______)

Decrease in Inventory: $________

Increase in Accounts Payable: $________

Decrease in Accounts Payable: $(_______)

[Other changes in current assets/liabilities]

Net Cash Provided (Used) by Operating Activities: $________

Cash Flows from Investing Activities

Cash received from sale of equipment: $________

Cash paid for purchase of land/building: $(_______)

Cash paid for purchase of investments: $(_______)

Net Cash Provided (Used) by Investing Activities: $________

Cash Flows from Financing Activities

Cash received from issuance of common stock: $________

Cash received from issuance of bonds: $________

Cash paid for redemption of bonds: $(_______)

Cash paid for dividends: $(_______)

Cash paid to purchase treasury stock: $(_______)

Net Cash Provided (Used) by Financing Activities: $________

Net Increase (Decrease) in Cash: $________

Cash at Beginning of Year: $________

Cash at End of Year: $________

Significant Noncash Investing & Financing Activities

[For example: Issuance of bonds for plant assets, Exchange of furniture for equipment]

Preparation of the Statement of Cash Flows: Sources of Information

- companies obtain the info to prepare the statement of cash flows from several sources: comparative balance sheets, the current income statement, and selected transaction data

Preparing the Statement of Cash Flows: Step 1: Determine Net Cash Provided by Operating Activities

- this steps calculates the excess of cash receipts over cash payments from operating activities. determined by converting net income on an accrual basis to a cash basis

- they adjust NI for items that do not affect cash (indirect method). It requires that a company analyze not onlt the current years IS, but also the comparative BS and selected transaction data

Preparing the Statement of Cash Flows: Step 2. Determine the Net Cash Provided by (or Used in) Investing and Financing Activities

- next the company determines its investing and financing activities

Preparing the Statement of Cash Flow: Step 3. Determine the Change (Increase or Decrease) in Cash During the Period

knowing the amounts provided/used by operating, investing, and financing activities, the company determines the net change in cash

Preparing the Statement of Cash Flow: Step 4. Reconcile the Change in Cash with the Beginning and the Ending Cash Balances

The increase in cash reported in the statement of cash flows agrees with the increase of cash calculated from the comparative balance sheets

Significant Noncash Activities

Not all of a company's significant activities involve cash

examples: Issuance of CS to purchase assets, conversion of bonds into CS, issuance of debt to purchase assets, exchange of long-lived assets

- significant financing and investing activities that do not affect cash are not reported in the body of the statement of cash flows. These activities are reported in either a separate schedule at the bottom of the SoCF or in separate notes to the financial statements

Usefulness of the SoCF

- cash flow is the single most important element for survival

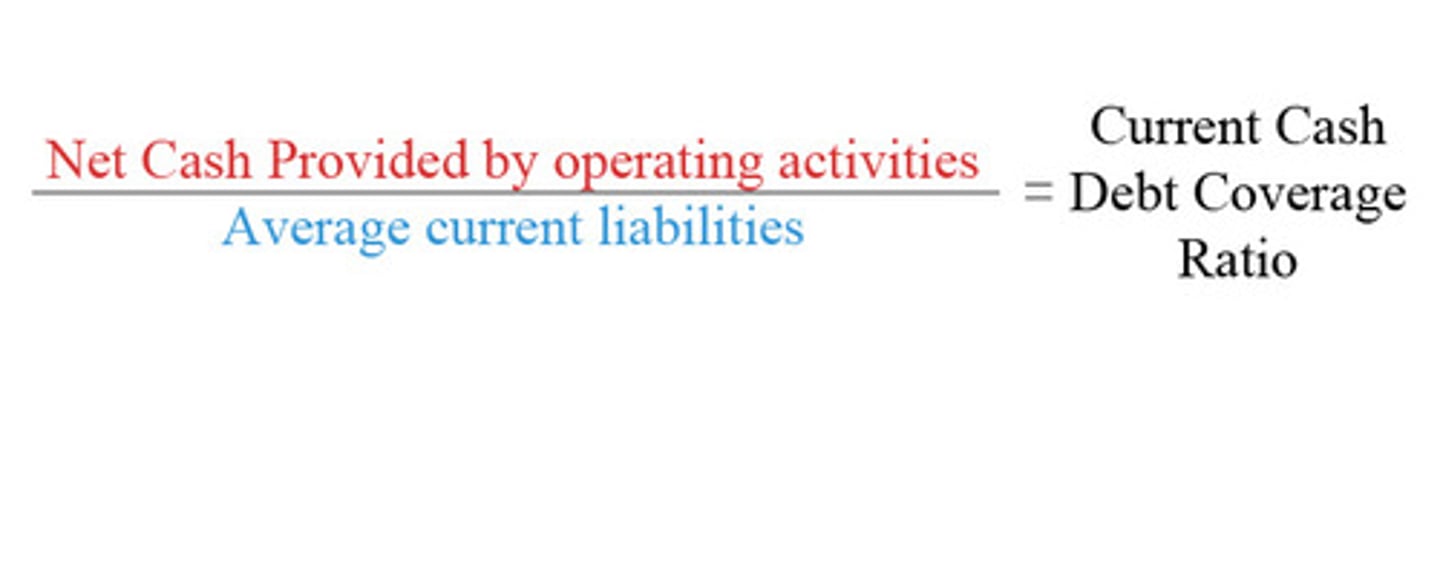

Liquidity: Current Cash Debt Coverage

- indicates whether the company can pay off its current liabilities from its operations in a given year

- the higher the current cash debt coverage, the less likely a company will have liquidity problems

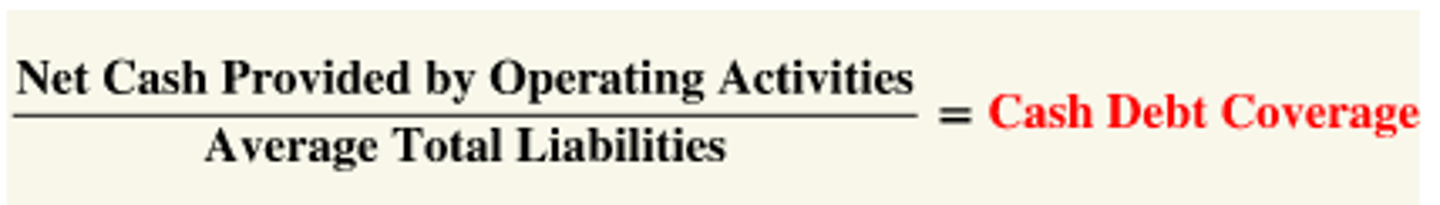

Financial Flexibility: Cash Debt Coverage

- provides information on financial flexibility. It indicates a company's ability to repay its liabilities from net cash provided by operating activities without having to liquidate the assets employed in its operations

- takes a longer range view bc it uses a longer-range view

- the higher this debt ratio, the less likely the company will experience difficulty in meeting its obligations as they come due. It signals whether the company can pay its debts and survive if external sources of funds become limited or too expensive

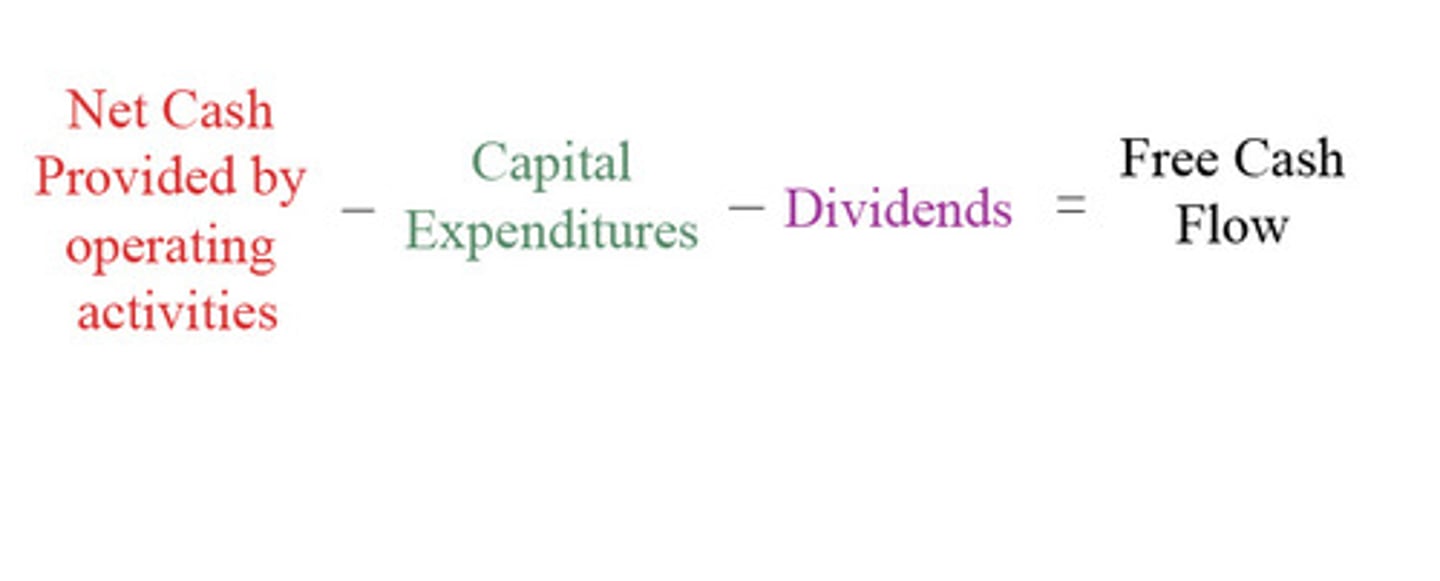

Free Cash Flow

- more sophisticated way to examine a company's financial flexibility is to develop a free cash flow analysis

- its the amnt of discretionary cash flow a company has

- it can use this cash flow to purchase additional investments, retire its debt, and purchase treasury stock, or simply add to its liquidity

- subtract capital spending to indicate it is the least discretionary expenditure a company generally makes

- then deduct dividends

- examples of capital expenditure: A cash outflow for purchasing or improving long-term assets (Property, Plant, and Equipment - PPE).

Found in the Investing section of the Statement of Cash Flows.

It represents money spent to maintain or expand the company's operations.

(Purchase of land, Purchase of buildings, Purchase of equipment, Major improvements or upgrades to existing assets)